Click image to open full size in new tab

Article Text

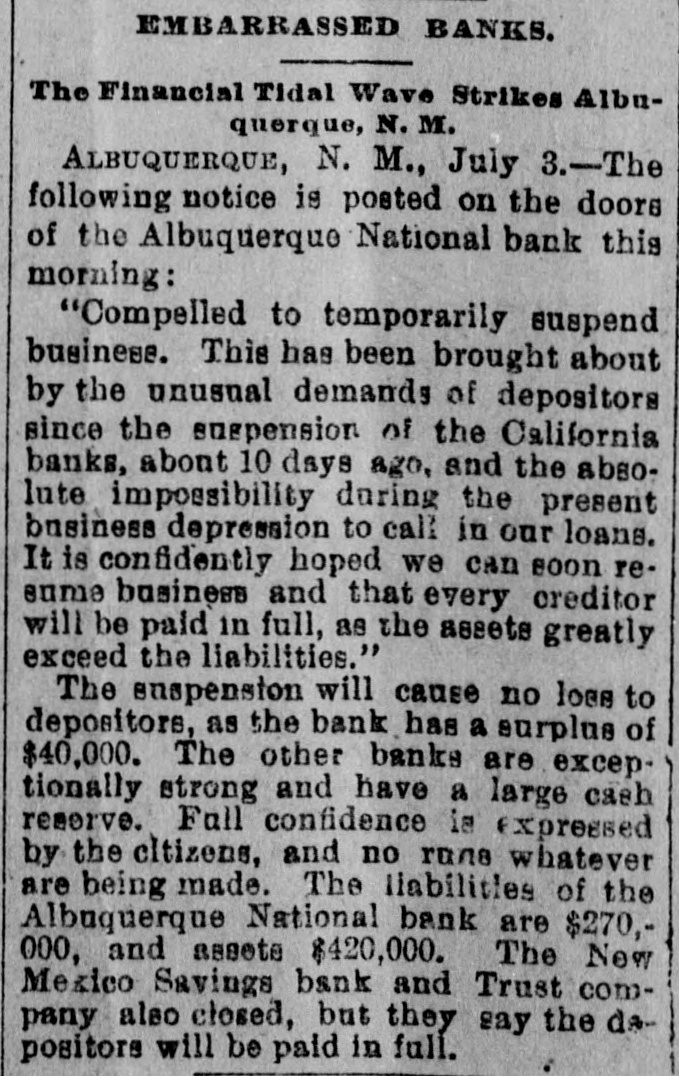

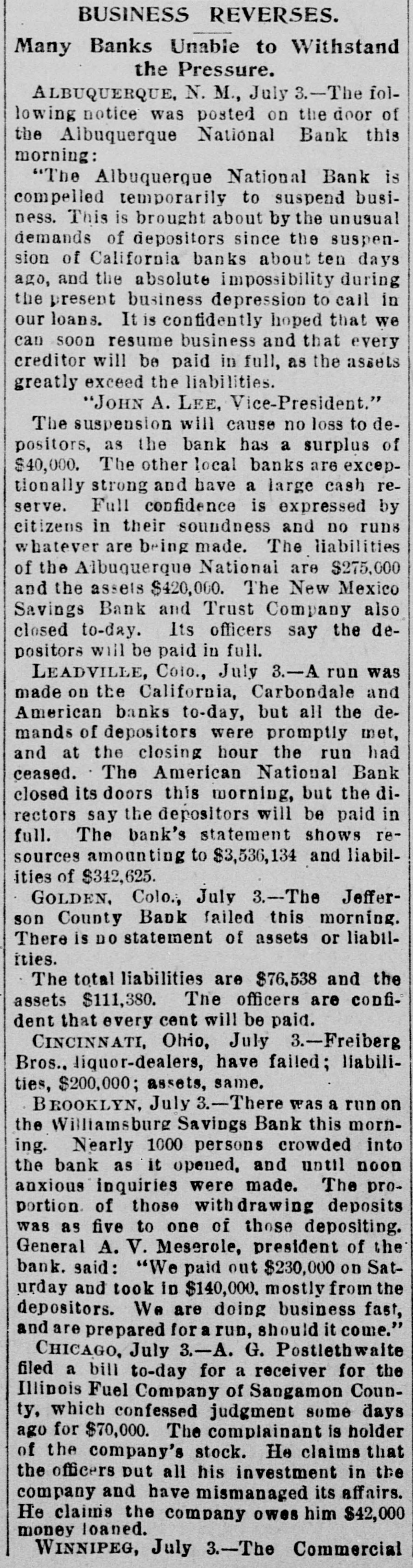

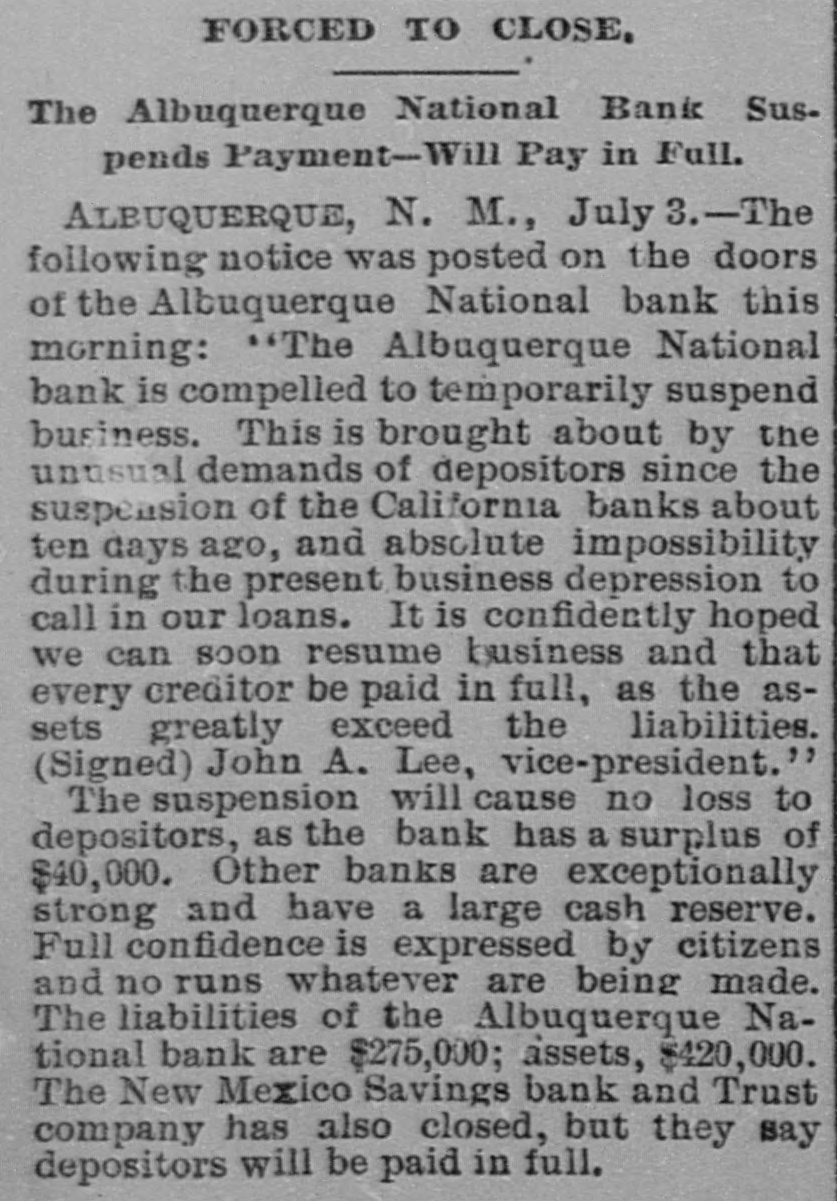

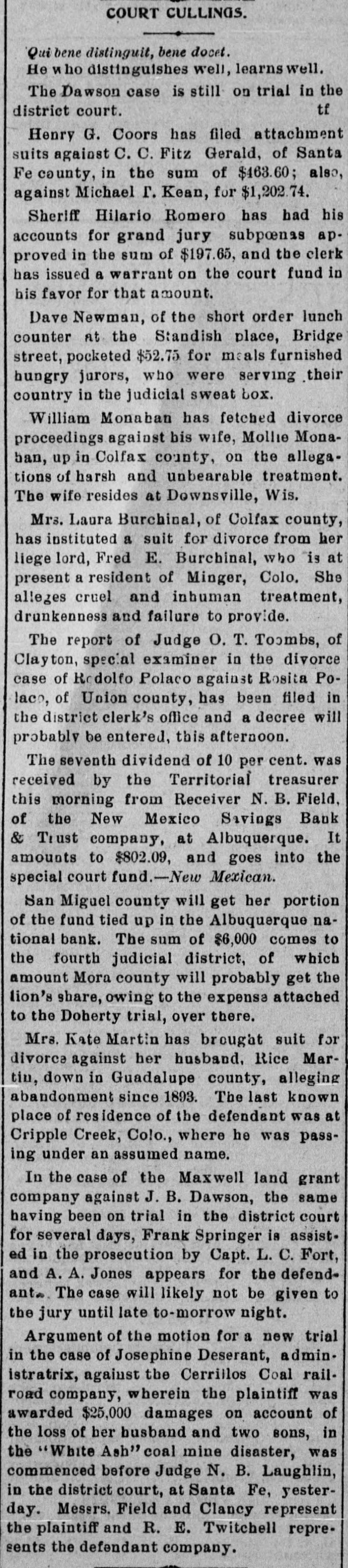

COURT CULLINGS. Qui bene distinguit, bene docet. He ho distinguishes well, learns well. The Dawson case is still on trial in the tf district court. Henry G. Coors has filed attachment suits against C. C. Fitz Gerald, of Santa Fe county, in the sum of $463.60; also, against Michael Γ. Kean, for $1,202.74. Sheriff Hilario Romero has had his accounts for grand jury subpœnas approved in the sum of $197.65, and the clerk has issued a warrant on the court fund in his favor for that amount. Dave Newman, of the short order lunch counter at the Standish place, Bridge street, pocketed $52.75 for meals furnished hungry jurors, who were serving their country in the judicial sweat box. William Monahan has fetched divorce proceedings against bis wife, Mollie Monaban, up in Colfax county, on the allegations of harsh and unbearable treatment. The wife resides at Downsville, Wis. Mrs. Laura Burchinal, of Colfax county, has instituted a suit for divorce from her liege lord, Fred E. Burchinal, who is at present a resident of Minger, Colo. She alleges cruel and inhuman treatment, drunkenness and failure to provide. The report of Judge O. T. Toombs, of Clayton, special examiner in the divorce case of Rodolfo Polaco against Rosita Polaco, of Union county, has been filed in the district clerk's office and a decree will probably be entered, this afternoon. The seventh dividend of 10 per cent. was received by the Territorial treasurer this morning from Receiver N. B. Field, of the New Mexico Savings Bank & Trust company, at Albuquerque. It amounts to $802.09, and goes into the special court fund.-New Mexican. San Miguel county will get her portion of the fund tied up in the Albuquerque national bank. The sum of $6,000 comes to the fourth judicial district, of which amount Mora county will probably get the lion's share, owing to the expense attached to the Doherty trial, over there. Mrs. Kate Martin has brought suit for divorce against her husband, Rice Martin, down in Guadalupe county, alleging abandonment since 1893. The last known place of residence of the defendant was at Cripple Creek, Colo., where he was passing under an assumed name. In the case of the Maxwell land grant company against J. B. Dawson, the same having been on trial in the district court for several days, Frank Springer is assisted in the prosecution by Capt. L. C. Fort, and A. A. Jones appears for the defendant. The case will likely not be given to the jury until late to-morrow night. Argument of the motion for a new trial in the case of Josephine Deserant, administratrix, against the Cerrillos Coal railroad company, wherein the plaintiff was awarded $25,000 damages on account of the loss of her busband and two sons, in the "White Ash" coal mine disaster, was commenced before Judge N. B. Laughlin, in the district court, at Santa Fe, yesterday. Messrs. Field and Clancy represent the plaintiff and R. E. Twitchell represents the defendant company.