Article Text

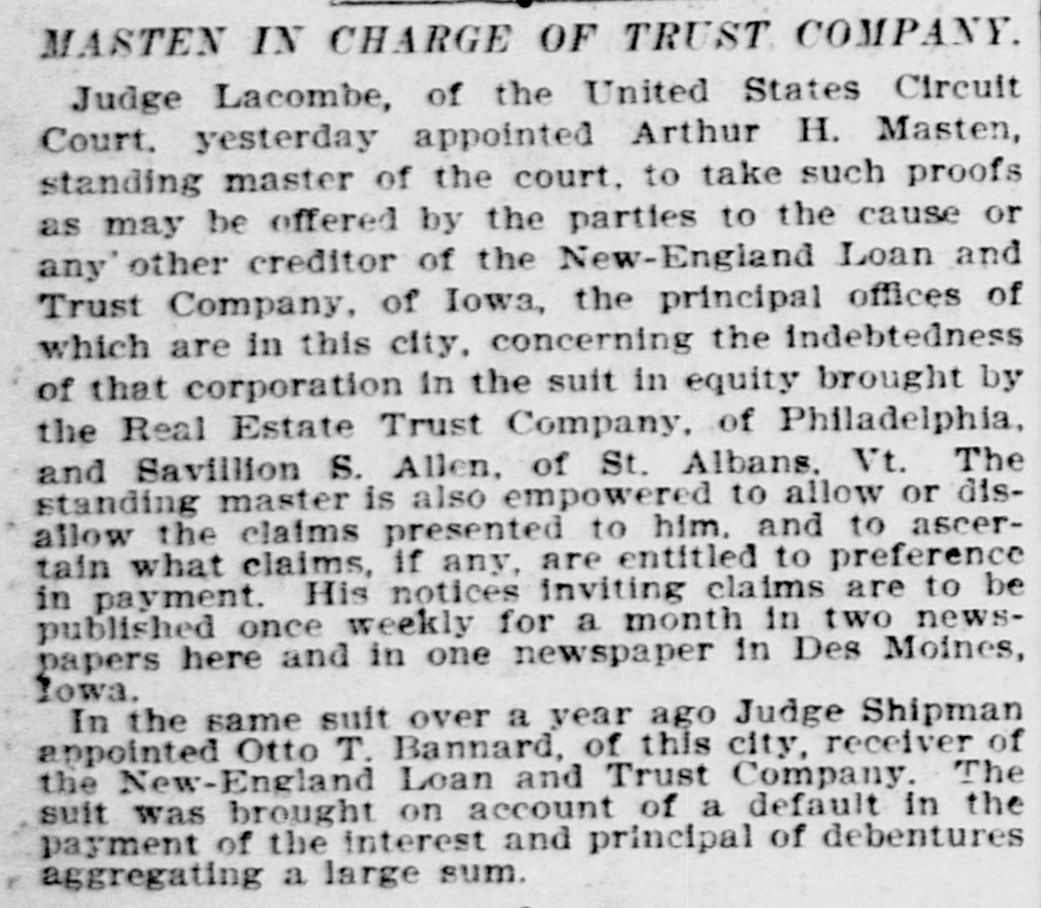

MASTEN IN CHARGE OF TRUST COMPANY. Judge Lacombe, of the United States Circuit Court. yesterday appointed Arthur H. Masten, standing master of the court. to take such proofs as may be offered by the parties to the cause or any' other creditor of the New-England Loan and Trust Company, of Iowa, the principal offices of which are in this city, concerning the indebtedness of that corporation in the suit in equity brought by the Real Estate Trust Company, of Philadelphia, and Savillion S. Allen, of St. Albans, Vt. The standing master is also empowered to allow or disallow the claims presented to him. and to ascertain what claims, if any, are entitled to preference in payment. His notices inviting claims are to be published once weekly for a month in two newspapers here and in one newspaper in Des Moines, Iowa. In the same suit over a year ago Judge Shipman appointed Otto T. Bannard, of this city, receiver of the New-England Loan and Trust Company. The suit was brought on account of a default in the payment of the interest and principal of debentures aggregating a large sum.