Click image to open full size in new tab

Article Text

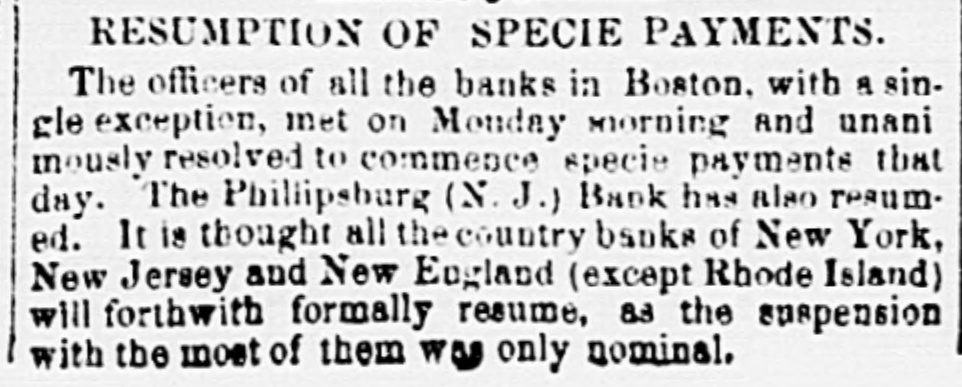

shows that the road earned net just about enough to pay operating expenses and keep up construction account. This is just what we have always said about this company. The road just about takes care of itself, and every dollar of dividend paid is borrowed. All the balance sheets, all the income accounts, all the items of future earnings, all the mode of surplus accounts, all the art of bookkeeping and doctoring figures, cannot overcome nor do anything with these facts. This brings the company's finances from the consolidation down to the 30th of Sep tember, 1856. The last annual report for the year ending Sept. 30, 1857, is just out. We shall one of these days analyze it and incorporate the results with those for the previous three years. The whole matter, financially, is contained in a outshell. The New York Central Railroad Company ways has borrowed its dividends, and it always must. This is clear enough to our mind, and the public begin to think SO too. There are reports from the other side that large subscriptions have been made to the new loan of the Erie Railroad Company. This wants confirmation; but if the account stated is correct, it will not suffice to relieve the company for any length of time. The inflation in Michigan Southern, old or preferred stock, is one of the most speculative movements of the day. It is all artificial-all fictitious. Holders of the preferred stock of the Michigan Southern Railroad Company say that the ten per cent dividend is guarantied, and that all arrears become a floating debt of the company. This question will proba. bly be left for adjustment by some legal tribunal. There are many strong arguments in favor of such a claim. The ten per cent dividend is guarantied, and 80 the certincates read. Reading continues active, without much itaprovement. At the second board the market was weak for some stocks. Erie fell off 1/4 per cent; La Crosse and Milwaukie, ½; Pacific Steamship Company, ½; Cumberland Coal, ½. Speculation is confined to a very few brokers. Outsiders look on with indifference, and cannot be induced to touch railroad stock at any price. In this they are wise. Leave railroad stocks to Wall street specu lators. The Assistant Treasurer reports to-day as follows:$50,002 00 Total receipts Total payments 35,592 47 Total balance 4,250,706 76 The receipts include $50,000 from customs. The Star of the West, it appears, brought no treasury drafts-at all events, none have yet been presented. This accounts for the increase in the specie remittance from San Francisco. The steamers usually bring drafts on the Assistant Trea surer of this port to the amount of two and three hundred thousand dollars. The paragraph in this morning's paper relative to the suspension of operations on the part of the Honduras Railroad Company, was simply a misconception on the part of the individual from whom the statement emanated. The company have never been engaged in any other operations than in surveying, and they are going on 88 usual. It is expected that the engineers will complete their report by the 1st of February next, when the company will go on, if deemed advisable and feasible. The Union Bank has declared a semi-annual dividend of four per cent, leaving S surplus of $260,000. The Fulton Bank has declared a semi-annual dividend of five per cent, payable on the 2d of January. The PhMlipsburg Bank at Phillipsburg, N.J., having resumed specie payments, its bills of all denominations are now redeemed, as heretofore, at the Bank of the Commonwealth. The Honesdale Bank has resumed specie payments. The exchanges at the Bank Clearing House to day were $12,099,990,94, and the balances paid amounted to $743,239,20. The Boston and Lowell Railroad Company have declared a semi-annual dividend of three per cent, payable on the 1st of January. Messrs. Moller & Riera will pay at their office, No. 26 South street, on the 28th inst., the interest due that day on $31,500 of the bonds of the Spanish Gas Light Company of Havana. The Cunard steamer, from Boston to Liverpool to morrow (Wednesday), will take out upwards of half a million in specie. There has been an active business in sterling exchange for this packet. The best drawers are asking 9½ a 9½ per cent on London, and on Paris 5f. 25 a 5f. 17½ Cabal navigation in the State of New York closes to morrow. Nearly or quite all the boats have got through The weather is so mild that lake navigation still continues. The value of merchandise warehoused in Boston for the Week ending Dec. 11 was as follows:$108,506 Dry goods All other merchandise 393,469 Total $496,974 Warehoused for CanadaDry goods, none. All other merchandise 1,427 Total value $498,401 The report of the President and directors of the Central Railroad and Banking Company of Georgia, for the past year, states that the earnings of the road for the year have been $1,126,303 16; the ordinary current roa expenses have been $580,334 63; leaving a net revenue of $545,974.52. Messrs. Gwynne & Day, of Wall street, furnish the following quotations for currency, certificates of deposit, checks, specie, &c.:Checks and Certificates of Bank Notes.