Click image to open full size in new tab

Article Text

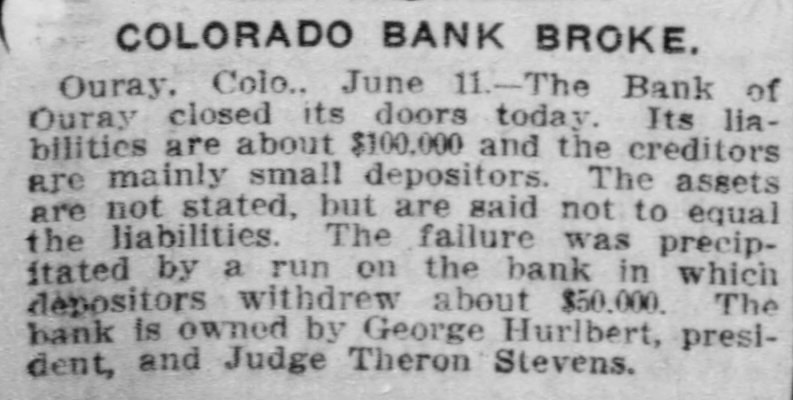

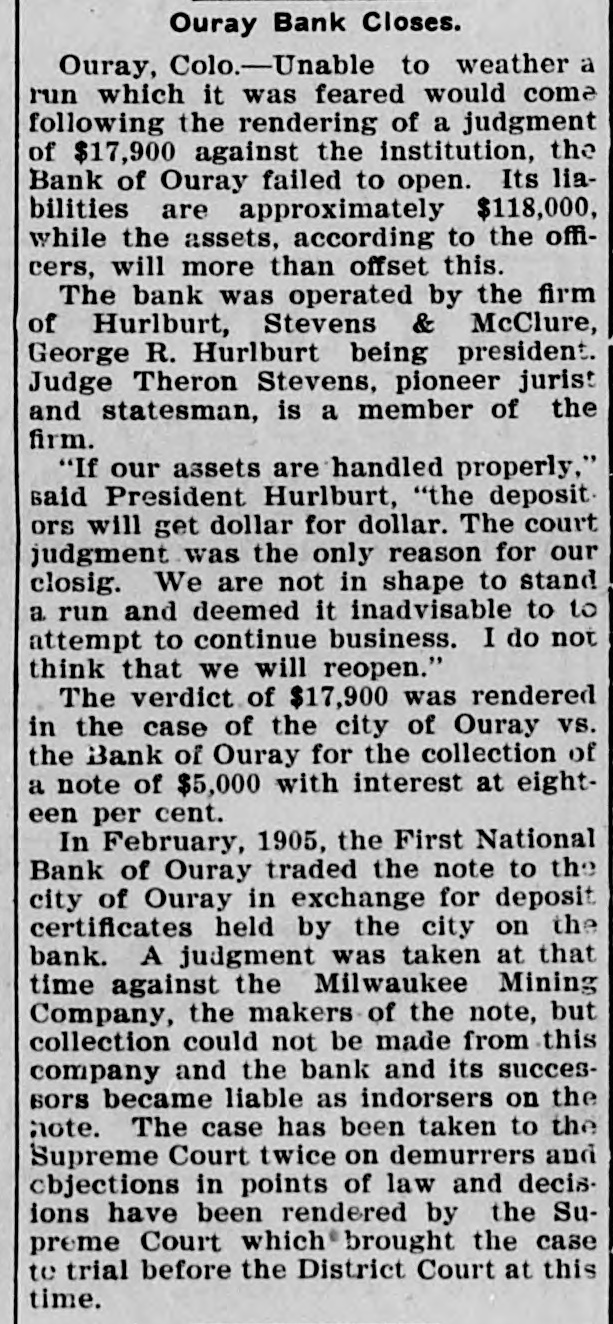

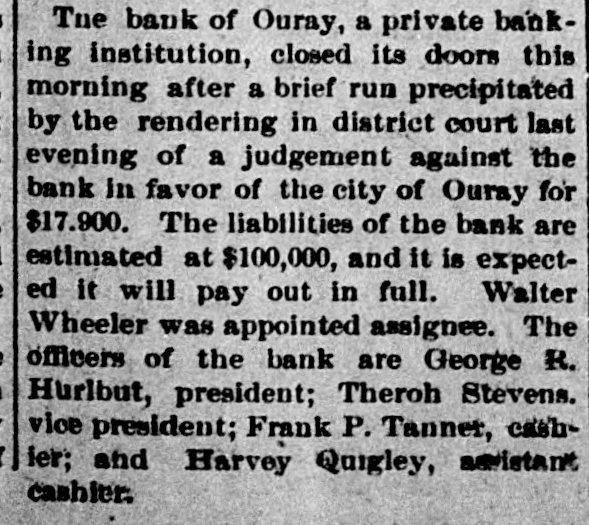

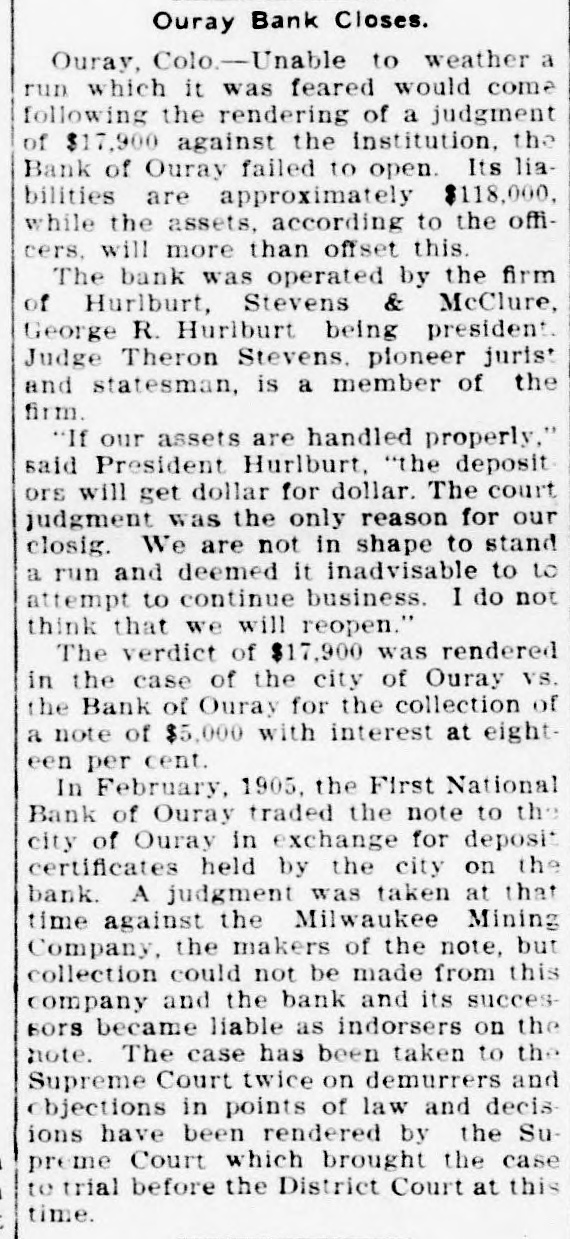

Patrick Gibbons, supposed 10 DO Insane, brutally assaulted Mrs. Chris Jorgensen, aged 87, at Anaconda, Mont. A crowd of women attempted to lynch Gibbons and would have succeeded ,but for the officers. Wells Morton, a prominent broker and promoter, has been found by the Goldfield mining stock exchange to be insolvent. The failure was caused by short interests in Jumbo Extension and other rising securities. J. Ross Clark of the Salt Lake Route states that trains should be running into Goldfield by Sept. 1, and that rights-of-way are being secured through Columbia, Diamondfield and other towns on the way to Tonopah. While pursuing two Montana horse thieves, Sheriff Guy and a posse from Johnson county, Wyoming, shot and killed one of the robbers that held up a Northern Pacific passenger train at Welch Spur recently. The other man escaped. For the first time in the history of the Wells-Fargo Express company anywhere, it has made a shipment of structural steel in carload lots by express. Two carloads of iron and steel to be used in the completion of the new Goldfield News building was shipped from Reno to Goldfield by express. The Bank of Ouray, Colo., nas closed its doors. Its liabilities are about $100,000 the creditors are mainly small depositors. The assets are not stated, but are said not to equal the liabilities. The failure was precipitated by a run on the bank in which depositors withdrew about $50,000. The train dispatchers of Sparks, Verdi and Reno complain that the Southern Pacific company is not obeying the eight-hour law in regard to operators and dispatchers passed by the last legislature, and have asked District Attorney Moran to take action against the company to enforce the law.