Article Text

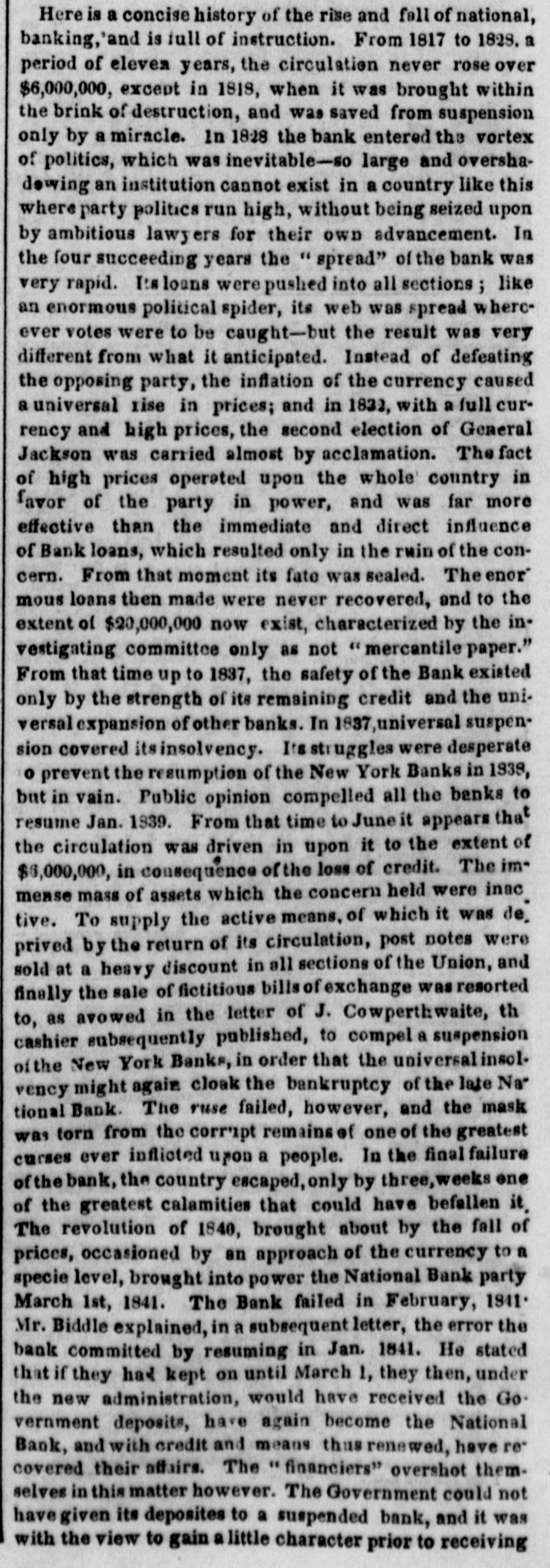

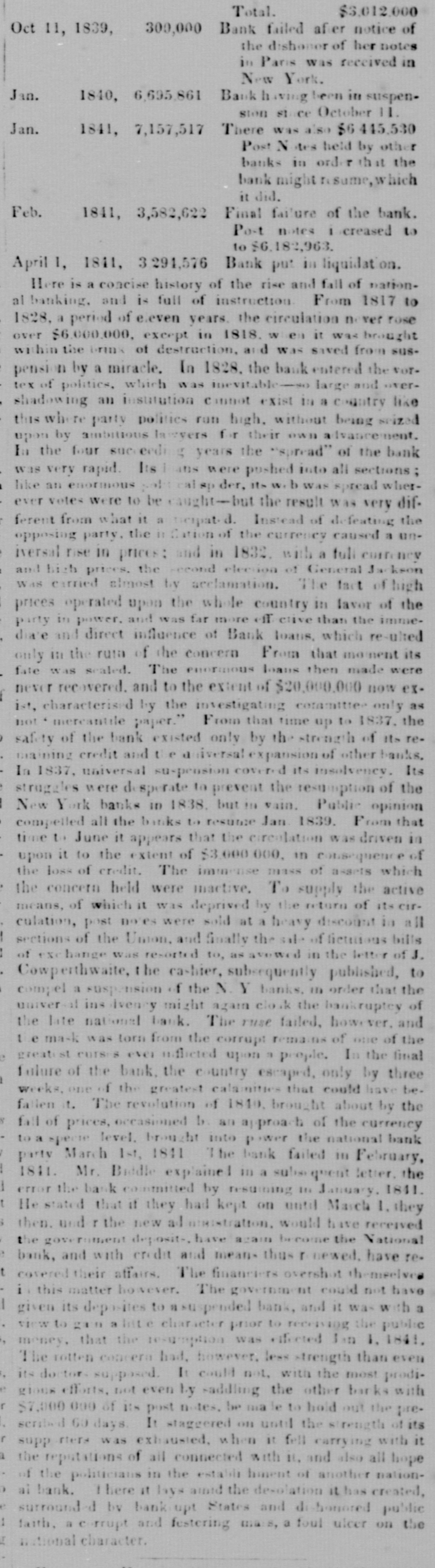

Here is a concise history of the rise and fall of national, banking, and is full of instruction. From 1817 to 1828. a period of eleven years, the circulation never rose over $6,000,000, except in 1818, when it was brought within the brink of destruction, and was saved from suspension only by a miracle. In 1828 the bank entered the vortex of politics, which was inevitable-so large and overshadowing an institution cannot exist in a country like this where party politics run high, without being seized upon by ambitious lawyers for their OWD advancement. In the four succeeding years the "spread" of the bank was very rapid. Itsloans were pushed into all sections like an enormous political spider, its web was spread where ever votes were to be caught-but the result was very different from what it anticipated. Instead of defeating the opposing party, the inflation of the currency caused a universal rise in prices; and in 1832, with a full currency and high prices, the second election of General Jackson was carried almost by acclamation. The fact of high prices operated upon the whole country in favor of the party in power, and was far more effective than the immediate and direct influence of Bank loans, which resulted only in the ruin of the concern. From that moment its fate was sealed. The enor mous loans then made were never recovered, and to the extent of $20,000,000 now exist, characterized by the investigating committee only as not "mercantile paper." From that time up to 1837, the safety of the Bank existed only by the strength of its remaining credit and the universal expansion of other banks. In 1837, universal suspension covered its insolvency. Its struggles were desperate o prevent the resumption of the New York Banks in 1939, but in vain. Public opinion compelled all the banks to resume Jan. 1939. From that time to June it appears that the circulation was driven in upon it to the extent of $6,000,000, in consequence of the loss of credit. The immease mass of assets which the concern held were inac tive. To supply the active means. of which it was de. prived by the return of its circulation, post notes were sold at a heavy discount in all sections of the Union, and sale of fictitious bills of exchange was resorted avowed in the letter to, finally as the of J. Cowperthwaite, th cashier subsequently published, to compel a suspension of the New York Banks, in order that the universal insolvency might again cloak the bankruptcy of the late Na tional Bank. The ruse failed, however, and the mask was torn from the corrupt remains of one of the greatest curses ever inflicted upon a people. In the final failure of the bank, the country escaped, only by three, weeks one of the greatest calamities that could have befallen it The revolution of 1840, brought about by the fall of prices, occasioned by an approach of the currency to a specie level, brought into power the National Bank party March 1st, 1841. The Bank failed in February, 1941 Mr. Biddle explained, in a subsequent letter, the error the bank committed by resuming in Jan. 1841. He stated that if they had kept on until March 1, they then, under the new administration, would have received the Go. vernment deposits, have again become the National Bank, and with credit and means thus renewed, have re covered their affairs. The "financiers" overshot them. selves in this matter however. The Government could not have given its deposites to a suspended bank, and it was with the view to gain a little character prior to receiving