Article Text

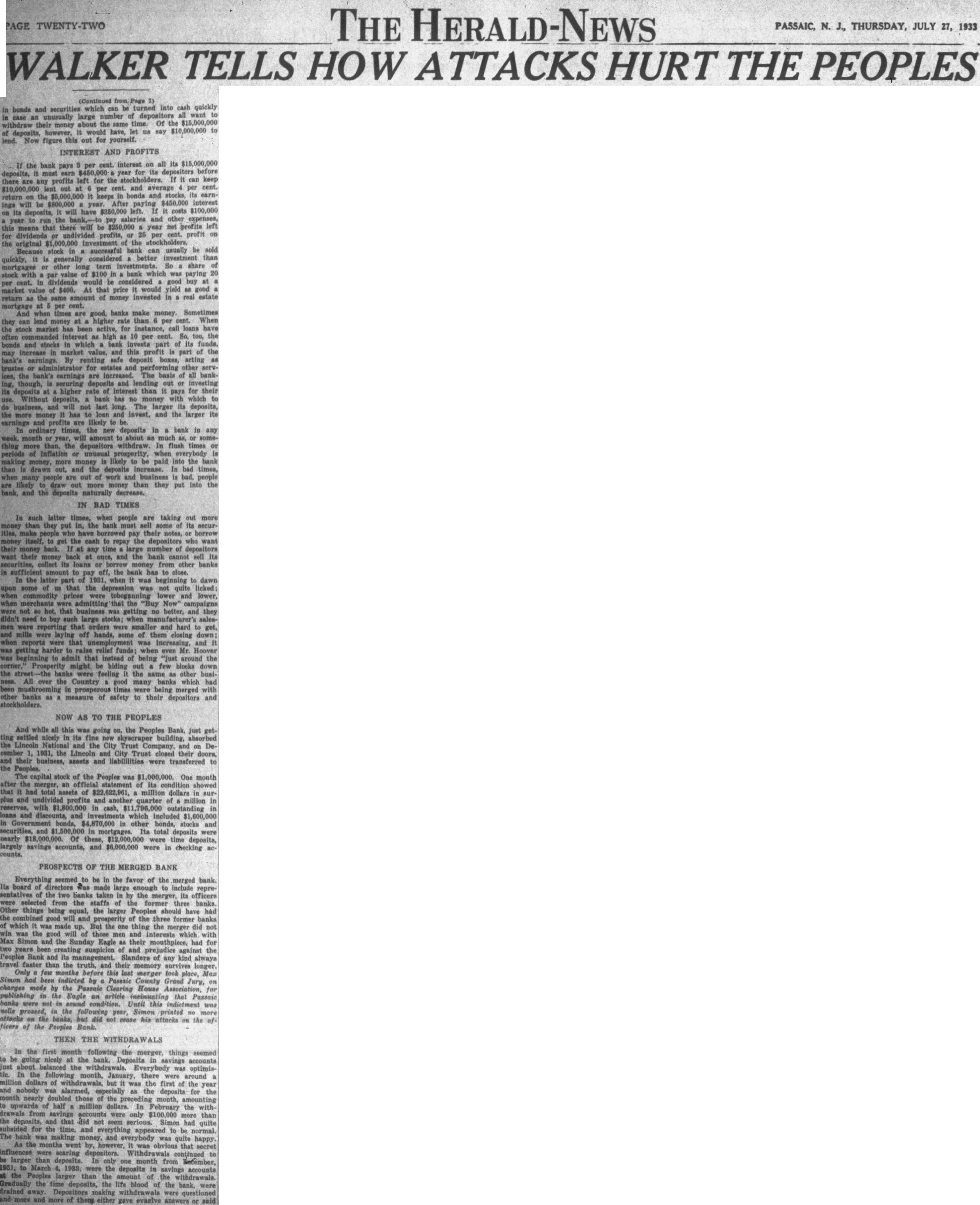

TWENTY-TWO THE HERALD-NEWS PASSAIC, N. THURSDAY, JULY 27, 1933 WALKER TELLS HOW HURT THE PEOPLES (Continued from Page bonds and securities which can be turned into cash quickly of all want to unusually large number depositors case an the time. Of the $15,000,000 withdraw their money about same deposits, however, would have, let us say $10,000,000 to lend. Now figure this out for yourself. INTEREST AND PROFITS If the bank pays per cent. interest on all its $15,000,000 deposits, it must earn $450,000 year for its depositors before there are any profits left for the stockholders. If it can keep $10,000,000 lent out at per cent. and average per cent. return the $5,000,000 It keeps in bonds and stocks, its earninterest will be $800,000 year. After paying ings its deposits, it will have $350,000 left. If it costs $100,000 year to run the pay salaries and other expenses, this means that there will be $250,000 year net profits left for dividends or undivided profits, or 25 per cent. profit on the original $1,000,000 investment of the stockholders. Because stock in successful bank can usually be sold quickly, it is generally considered better investment than mortgages or other long term investments. So share of with par value of $100 in bank which was paying 20 per cent. in dividends would be considered good buy at market value of $400. At that price It would yield as good return as the same amount of money invested in real estate mortgage at per cent. And when times are good, banks make money. Sometimes they can lend money at higher rate than per cent. When the stock market has been active, for Instance, call loans have interest as 10 So, too, the often commanded as high per bonds and stocks in which bank part of its funds, may increase in market value, and this profit is part of the bank's earnings. By renting safe deposit boxes, acting as trustee or administrator for estates and performing other services, the bank's earnings are increased. The basis of all bankthough, is securing deposits and lending out or investing its deposits at higher rate of Interest than it pays for their Without deposits, bank has no money with which to do business, and will not last long. The larger its deposits, the more money it has to loan and invest, and the larger its earnings and profits are likely to be. In ordinary times, the new deposits in bank in any week, month or year, will amount to about as much as, or something more than, the depositors withdraw. In flush times or periods of inflation or unusual prosperity, when everybody is making money, more money is likely to be paid into the bank than is drawn out, and the deposits increase. In bad times, when many people are out of work and business is bad, people are likely to draw out more money than they put into the bank, and the deposits naturally decrease. IN BAD TIMES In such latter times, when people are taking out more money than they put in, the bank must sell some of its securities, make people who have borrowed pay their notes, or borrow money itself, to get the cash to repay the depositors who want their money back. at any time large number of depositors want their money back at once, and the bank cannot sell its securities, collect its loans or borrow money from other banks sufficient amount to pay off, the bank has to close. In the latter part of 1931, when it was beginning to dawn upon some of us that the depression was not quite licked: when commodity prices were toboganning lower and lower, when merchants were admitting that the "Buy Now" campaigns were not so hot, that business was getting no better, and they didn't need to buy such large stocks; when manufacturer's salesmen were reporting that orders were smaller and hard to get, and mills were laying off hands, some of them closing down: when reports were that unemployment was increasing, and was getting harder to raise relief funds; when even Mr. Hoover beginning to admit that instead of being around the corner," Prosperity might be hiding out few blocks down the banks were feeling the same as other busiAll over the Country a good many banks which had been mushrooming in prosperous times were being merged with other banks as measure of safety to their depositors and stockholders. NOW AS TO THE PEOPLES And while all this was going on, the Peoples Bank, just getting settled nicely in its fine new skyscraper building, absorbed the Lineoln National and the City Trust Company, and on December 1931, the Lincoln and City Trust closed their doors, and their business, assets and liabililities were transferred to the Peoples. The capital stock of the Peoples was $1,000,000. One month after the merger, an official statement of its condition showed that It had total assets of $22,622,961, million dollars in surplus and undivided profits and another quarter of million in reserves, with $1,800,000 in cash, outstanding loans and discounts, and investments which included Government bonds, $4,870,000 in other bonds, stocks and securities, and in mortgages. Its total deposits were nearly $18,000,000. Of these, $12,000,000 were time deposits, largely savings accounts, and $6,000,000 were in checking counts. PROSPECTS OF THE MERGED BANK Everything seemed to be in the favor of the merged bank. Its board of directors was made large enough to include representatives of the two banks taken in by the merger, its officers were selected from the staffs of the former three banks. Other things being equal, the larger Peoples should have had the combined good will and prosperity of the three former banks of which it was made up. But the one thing the merger did not was the good will of those men and interests which with Max Simon and the Sunday Eagle as their mouthpiece, had for two years been creating suspicion of and prejudice against the Peoples Bank and its management. Slanders of any kind always travel faster than the truth, and their memory survives longer. Only few months before this last merger took place, Max Simon had been indicted by Passaic County Grand Jury, charges made by the Passaic Clearing House Association, for publishing in the Eagle an article insinuating that Passaic banks were not in sound condition. Until this indictment was nolle prossed, in the following year, Simon printed no more attacks on the banks, but did not cease his attacks on the ficers of the Peoples Bank. THEN THE WITHDRAWALS In the first month the following merger, things seemed be going nicely at the bank. Deposits in savings accounts just about balanced the withdrawals. Everybody was optimisIn the following month, January, there were around million dollars of withdrawals, but it was the first of the year and nobody was slarmed, especially as the deposits for the month nearly doubled those the preceding month, amounting to upwards of half million dollars. In February the withdrawals from savings accounts were only $100,000 more than the deposits, and that did not seem serious. Simon had quite subsided for the time, and everything appeared to be normal. The bank was making money, and everybody was quite happy. As the months went by, however, it was obvious that secret influences were scaring depositors. Withdrawals continued be larger than deposits. In only one month from December, 1931, to March 1933, were the deposits in savings accounts the Peoples larger than the amount of the withdrawals. Gradually the time the life blood of the deposits, bank, were drained away. Depositors making withdrawals were questioned and more and more of them either gave evasive answers said