Click image to open full size in new tab

Article Text

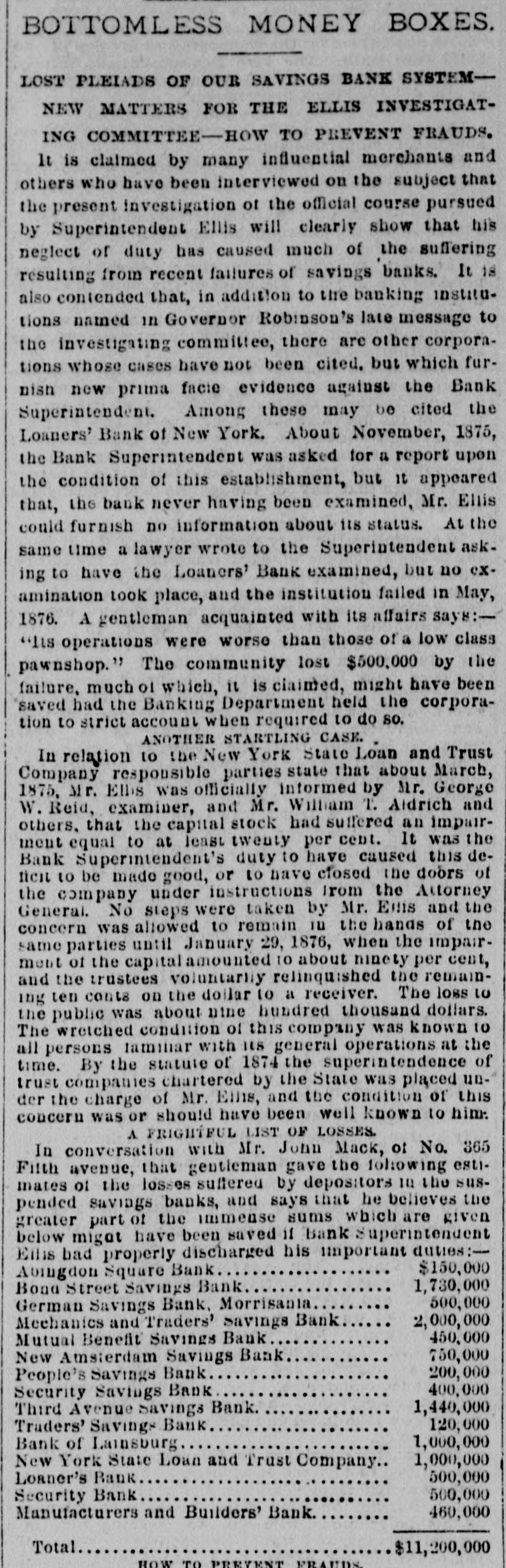

LOCAL MISCELLANY. THE SAVINGS BANKS. NO MORK BANKS TO BE CLOSED-THE TROUBLES BELIEVED TO BE OVER-RECEIVERS FOR THE GERMAN UP-TOWN AND MUTUAL BENEFIT INSTITUTIONS. Since the failure of the German Up-town Savings Bank on Monday there has been little excitement among savings bank depositors, and no runs on any of the stronger banks have taken place. It has been remarked that the excitement from the first has been almost contined to the banks on Third-ave. Nearly all of the recent failures have been in some way ascribed to that of the Third Avenue Savings Bank. Bank Superintendent Eills said yesterday to a TRIBUNE reporter that he thought the trouble was now over* There were no other banks in difficulty, but one or two small banks might have to make their standing good by giving trustees' bonds. Mr. Ellis thought that no other bank would be closed unless some unexpected disclosures should be made. He had sent Bank Examiner Reed to the German Up-town Bank, and Mr. Read had reported that he found, according to the accounts he had examined, a surplus, instead of a deficiency, of several thousand dollars. Based on this report Mr. Ellis's opinion was that the bank might be able to pay dollar for dollar. The President, Mr. Clausen, had however told him that he did not think the bank wouldbe able to pay more than 90 cents on a dollar. Mr. Clausen believed until recently that the bank had a surplus of $25,000. He had taken the report of the Finance Committee as correct, but on making an examination himself he discovered a deficiency of $40,000. Mr. Ellis said that some of the mortgages held by this bank might be of doubtful value, and might cause the deficiency. The Mutual Benefit Bank, he said, never would have resumed, notwithstanding the reports to that effect. He thought it might pay 90 cents on a dollar to its depositors. The Security Bank would go on and be a strong, sound bank again. Judge Davis yesterday, in Supreme Court, Chambers, appointed Herman Uhi, receiver of the German Uptown Savings Bank. The order is made in the suit of John Martin Maut-a depositor to the extent of $2,300against the bank. and the plaintiff's complaint sets out that while the deposits are $838,000, the assets, as stated to him by the bank officers, will not exceed $800,000. and this statement is probably subject to a considerable depreciation below the value of the assets as fixed by the bank officers. He, therefore, charges that the bank is insolvent, and asks an injunction and receiver, in the ordinary form. The answer of the bank is a simple ad mission of the truth of the complaint. Judge Davis, in his order appointing Mr. UM receiver, fixes his bonds at $150,000. and gives him the ordinary powers of receivers, but adds several special restrictions, the chief being that the receiver shall at once make an inventory, and file it with the County Clerk, and thereafter file monthly reports of the funds in his hands; that he shall turn over all the funds in his bands in excess at any time of $25,000, to the New-York Life Insurance and Trust Company, and that every 40 days he shall make a dividend out of the funds in his hands, or show cause to the Court for his failure to do so. Edward M. Shepard appeared for the plaintiff; Man & Parsons for the defendant. Mr. Uhl 18 a member of Gov. Tilden's staff. An order made by Judge Donohue in Supreme Court, Special Term, wasentered yesterday, reducing the bonds of the receiver of the Mutual Benefit Savings Bank from $200,000 to $75,000. W. F. Aidrich, a lawyer, of No. 84 Broadway, has been appointed receiver of this bank. 8. H. Hurd, the new receiver of the Third Avenue Bavings Bank, was at that Institution yesterday, but did not begin his examination of its accounts. A slight run has taken place on the Harlem Savings Bank without, it is said, producing any serious effect. A large number of anxious depositora called at the German Up-town Bank yesterday, but no money was paid out to them. The Security Bank paid out a few hundred dollars in sums of $5 and $10 to each applicant. To-day the officers expect to pay 121g per cent on all deposits withdrawn. There was no excitement, and the larger depositors express entire confidence in the bank, and refuse to touch their money.