Article Text

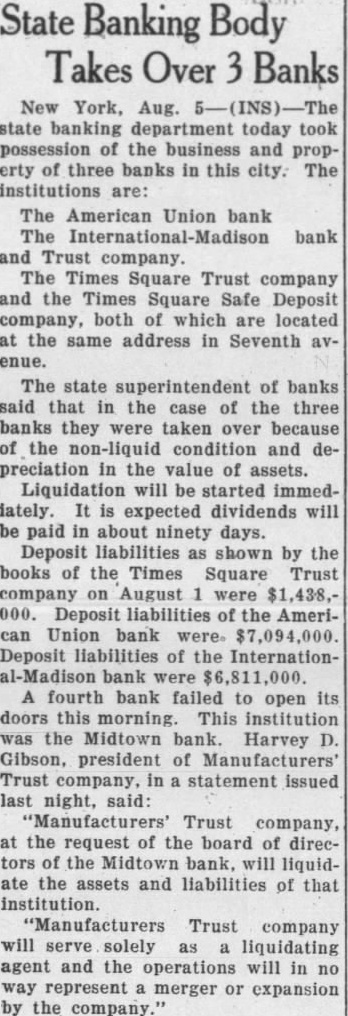

State Banking Body Takes Over 3 Banks New York, Aug. 5-(INS)-The state banking department today took possession of the business and property of three banks in this city. The institutions are: The American Union bank The International-Madison bank and Trust company. The Times Square Trust company and the Times Square Safe Deposit company, both of which are located at the same address in Seventh avenue. The state superintendent of banks said that in the case of the three banks they were taken over because of the non-liquid condition and depreciation in the value of assets. Liquidation will be started immeddately. It is expected dividends will be paid in about ninety days. Deposit liabilities as shown by the books of the Times Square Trust company on August 1 were $1,438,000. Deposit liabilities of the American Union bank were. $7,094,000. Deposit liabilities of the International-Madison bank were $6,811,000. A fourth bank failed to open its doors this morning. This institution was the Midtown bank. Harvey D. Gibson, president of Manufacturers' Trust company, in a statement issued last night, said: "Manufacturers' Trust company, at the request of the board of directors of the Midtown bank, will liquidate the assets and liabilities of that institution. "Manufacturers Trust company will serve solely as a liquidating agent and the operations will in no way represent a merger or expansion by the company."