Article Text

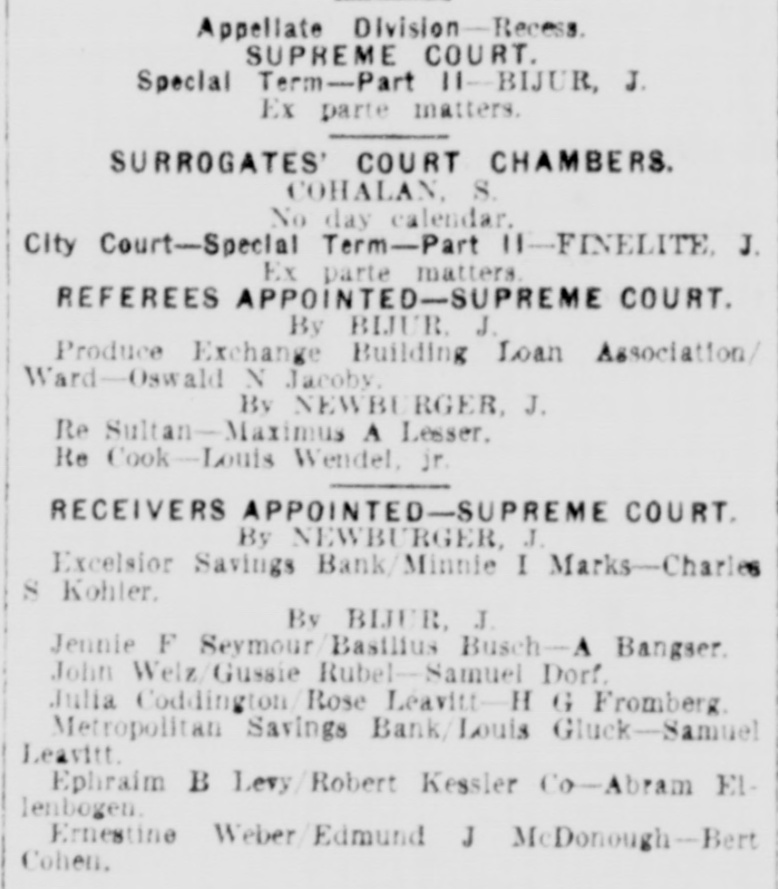

Appellate Division-Recess SUPREME COURT. Special Term-Part II-BIJUR, J. Ex parte matters. SURROGATES COURT CHAMBERS. COHALAN S. No day calendar. City Court-Special Term-Part II-FINELITE J. Ex parte matters REFEREES APPOINTED-SUPREME COURT. By BLJUR J. Produce Exchange Building Loan Association/ Ward-Oswald N Jacoby By NEWBURGER, J. Re Sultan-Maximus A Lesser. Re Cook-Louis Wendel, jr. RECEIVERS APPOINTED-SUPREME COURT By NEWBURGER J. Excelsior Savings Bank/Minnie I Marks-Charles S Kohler. By BIJUR, J. Jennie F Seymour Basilius Busch-A Bangser. John Welz/Gussie Rubel-Samuel Dorf. Julia Coddington/Rose Leavitt-H G Fromberg Metropolitan Savings Bank/Louis Gluck-Samuel Leavitt. Ephraim B Levy/Robert Kessler Co-Abram Ellenbogen Ernestine Weber Edmund J McDonough-Bert Cohen,