Article Text

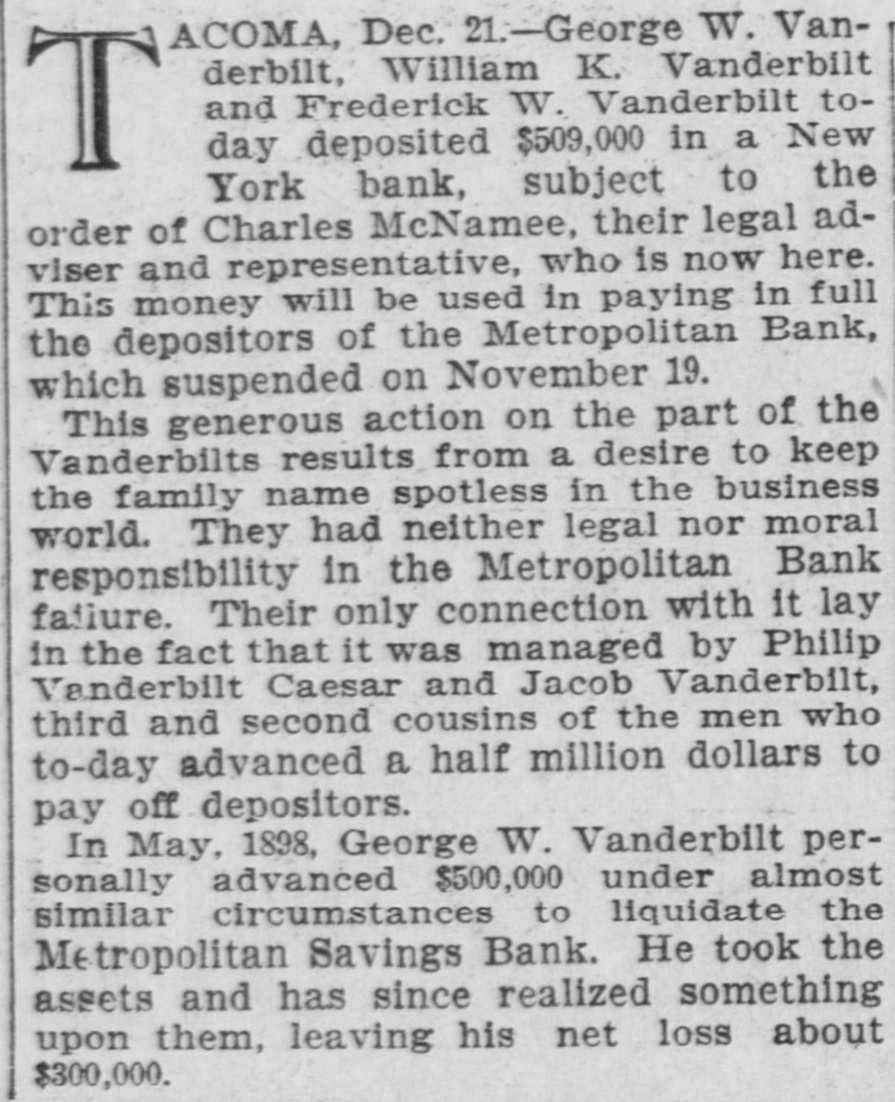

ACOMA, Dec. 21:-George W. Vanderbilt, William K. Vanderbilt and Frederick W. Vanderbilt today deposited $509,000 in a New T York bank, subject to the order of Charles McNamee, their legal adviser and representative, who is now here. This money will be used in paying in full the depositors of the Metropolitan Bank, which suspended on November 19. This generous action on the part of the Vanderbilts results from a desire to keep the family name spotless in the business world. They had neither legal nor moral responsibility in the Metropolitan Bank failure. Their only connection with it lay in the fact that it was managed by Philip Vanderbilt Caesar and Jacob Vanderbilt, third and second cousins of the men who to-day advanced a half million dollars to pay off depositors. In May, 1898, George W. Vanderbilt personally advanced $500,000 under almost similar circumstances to liquidate the Metropolitan Savings Bank. He took the assets and has since realized something upon them, leaving his net loss about $300,000.