Click image to open full size in new tab

Article Text

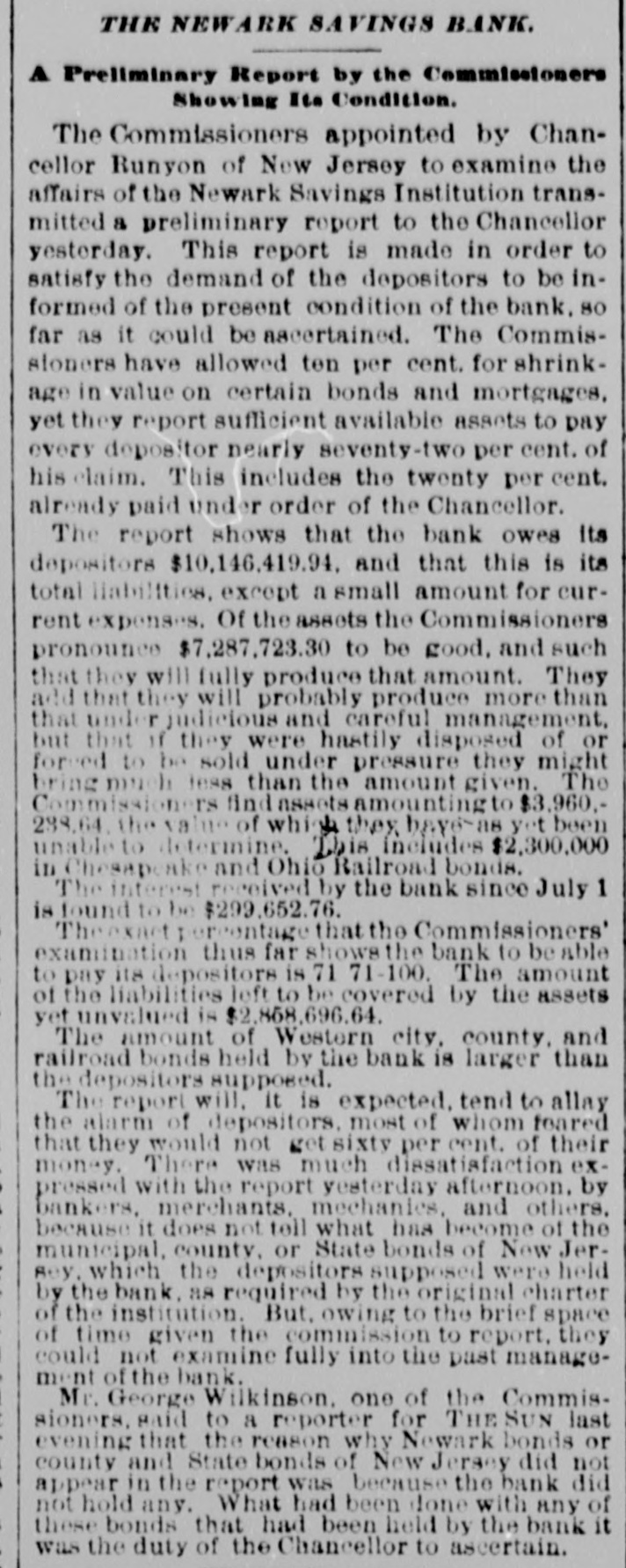

News and Other Items. Blondin has traveled nearly 2500 miles on the tight rope. Lydia Thompson's burlesque troupe has broken up and Lydia is going to Europe. The gas company of Richmond, Va., has cut off the gas from the custom house there on account of the non-payment of the gas bill. The Newark Savings Institution has been taken charge of by the Chancellor. Assets, $12,000,000; deposits $11,000,000. Geo. N. Jennott, aged 21, was killed Tuesday by an engine, while walking on the track at Nashua, N. H. A Catholic priest named Bloomer is in jail at Elmira, N. Y., for refasing to answer a query of the court. He stands OD professional privilege, and not on church discipline. Peter B. Sweeney sailed from New York for Europa yesterday, having settled with the city to the amount of $450,000 for his ring thieving. He expects to return soon on a lecturing tour. The canal system of the Khedive of Egypt has reclaimed 500,000 acres of desert land within 15 years and 300,000 acres more are being op' erated upon. A cancan troupe traveling,West has got into limbo at South Bend, Ind., the proprietors having been arrested under a law prohibiting immoral exhibitions. About two-thirds of the Southern cotton crop has been gathered, and the yield falls about 10 per cent. bebind that of last year. Nearly half of it has already been sold. Qneen Isabella of Spain is expected to visit Rome this winter with the intention and hope, it is thought, of effecting a reconciliation between the Pope and the King of Italy. Toronto Savings Bank has suspended payments. It is represented as solvent and has $125.000 of real estate. There is said to be no doubt but that the depositors will be paid in full. Among the delegates elected to the Republican general committee of New York, Tuesday night, are Naval Officer Cornell, U. S. Marshal Mike Cregan. U. S. Bankrupt Register Dayton and customs officer o' Brion. The City Hotel, two stores and four small buildings in Beringher City, Pa., have been burned. Loss about $10,000. A. B. McCartney of Mercer, Pa., was burned to death in the hotel. William and Mary College at Williamsburg, Va., wants Congress to pay her for the destruction of some of the college buildings by federal soldiers in 1862. This claim has been presented before and the House voted to pay it, but the Senate failed to concur. By recent decisions of the New York courts, a man is held responsible for his wife's funeral expenses, the same as for her living, no matter how much she may leave. But he may charge her estate with extra expenses on account of religious forms, it she was not of his denomination. Mr. Eliha Barritt of New Britain, Conn., "the learned blacksmith," had a severe hemorrhage of the lungs last Friday, and is considered by his physicians to be in a very critical condition. He has been in feeble health for some months, and as he is sixty-seven years old, it is not probable that he will again be restored to health. There lives in Tolland county, Conn., an old man named Bernard Covert, whom some of the elderly men of our day will recollect as a famous singer at political meetings in aid of the Whig and Republican cause. He took part in successive Presidential canvasses from the famous "log cabin and hard cider" canvass of 1840 up to that of 1868. Horace Greeley used often to agree to take the stump only on condition that Mr. Covert accompanied him. The death of Bishop Marvin of the Methodist Episcopal church South, will require the election of three bishops by the General Conference which meets at Atlanta, Ga., next May. It is probable that the Rev. Dr. Lynus Parker, editor of the New Orleans Christian Advocate, will be urged for one of the places. Had the Rev. Dr. Dancan, who died a few months ago lived, he would undoubtedly been elected to a bishopric. Mrs. Chisholm, whose husband was murderf ed in Kemper county, Miss., says that the persons who attacked him in jail were all old resi1 dents, and, what seemed most strange, all religions were represented. "There were," she says, "Catholics, Presbyterian elders, and, most of all, I noticed two Methodist class-leaders that were very active all through the matter. One of these men was a great exhorter, and had often labored with us for the good of our souls. At the last camp-meeting I attended this man got so "happy" he shouted at a great rateand ca ne up to Mr. Chisholm and took him around the neck and begged him to go forward, and said, It is all you lack, Judge, to be a first rate man-all you lack is religion.' And that man helped kill my husband."