Article Text

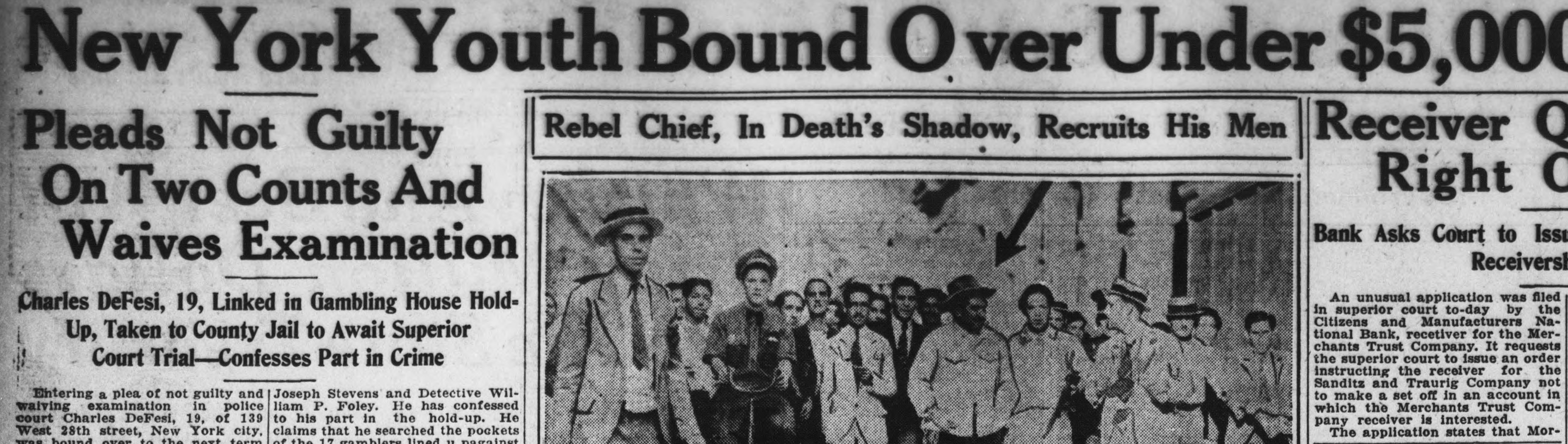

New York Youth Bound O ver Under $5, 000 Rebel Chief, In Death's Shadow, Recruits His Men Receiver Q Pleads Not Guilty a Right On Two Counts And Bank Asks Court to Issu Waives Examination Receiversh An unusual application was filed Charles DeFesi, 19, Linked in Gambling House Holdin superior court to-day by the Citizens and Manufacturers National Bank, recetiver for the MerUp, Taken to County Jail to Await Superior chants Trust Company. It requests the superior court to issue an order Court Trial-Confesses Part in Crime instructing the receiver for the Sanditz and Traurig Company not to make a set off in an account in Joseph Stevens and Detective WilEntering a plea of not guilty and liam P. Foley. He has confessed which the Merchants Trust Comwaiving examination in police court Charles DeFesi, 19, of 139 to his part in the hold-up. He pany receiver is interested. claims that he searched the pockets West 28th street, New York city, The application states that Mornovt of the 17 lined " nagainat form bound