Click image to open full size in new tab

Article Text

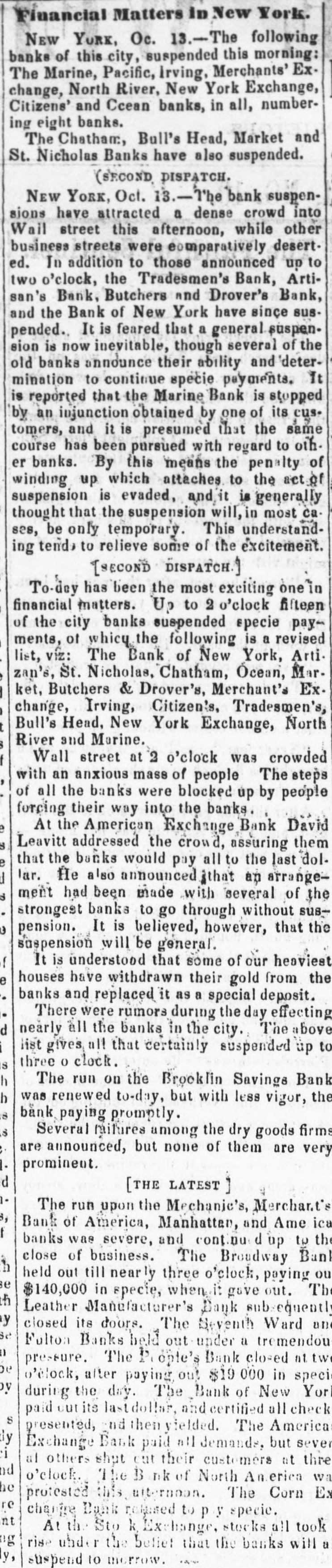

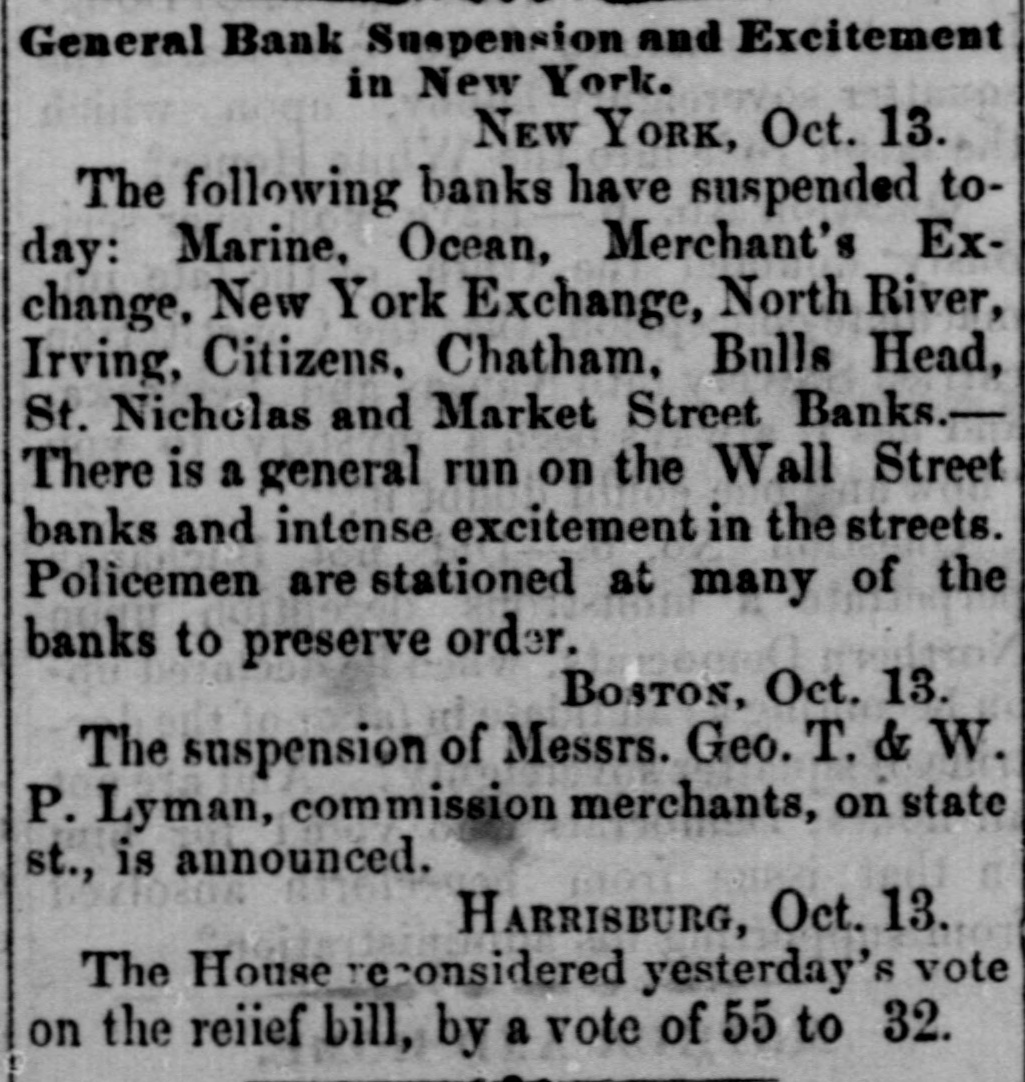

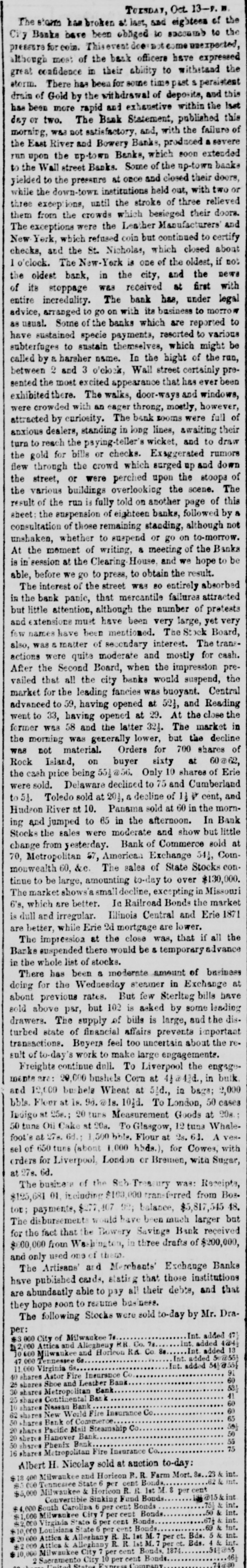

TUESDAY, Oct. The storm has broken at last, and eighteen of the City Banks have been obAged to secomb to the pressure for Thisevent although most of the bank officers have expressed great confidence in their ability to withstand the storm. There has been for some time past & persistent drain of Gold by the withdrawal of deposits, and this has been more rapid and exhaustive within the 1sst day or two. The Bank Statement, published this morning, w&s not satisfactory, and, with the failure of the East River and Bowery Banks, produced a severe run upon the up-town Banks, which soon extended to the Wall street Banks. Some of the np-town banks yielded to the pressure at once and closed their doors, while the down-town institutions held out, with two or three exceptions, until the stroke of three relieved them from the crowds which besieged their doors. The exceptions were the Leather Manufacturers' and New York, which refused coin but continued to certify checks, and the St. Nicholas, which closed about 1 o'clock. The New-York is one of the oldest, if not the oldest bank, in the city, and the news of its stoppage was received at first with entire incredulity. The bank has, under legal advice, arranged to go on with its business to morrow as usual. Some of the banks which are reported to have sustained specie payments, resorted to various subterfuges to sustain themselves, which might be called by & harsher name. In the hight of the run, between 2 and 3 o'clock, Wall street certainly presented the most excited appearance that has ever been exhibited there. The walks, door-ways and windows, were crowded with an eager throng, mostly, however, attracted by curiosity. The bank rooms were full of anxious dealers, standing in long lines, awaiting their turn to reach the paying-teller's wicket, and to draw the gold for bills or checks. Exaggerated rumors flew through the crowd which surged up and down the street, or were perched upon the stoops of the various buildings overlooking the scene. The result of the run is fully told on another page of this sheet: the suspension of eighteen banks, followed by & consultation of those remaining standing, although not unshaken, whether to suspend or go on to-morrow. At the moment of writing, & meeting of the Banks is in session at the Clearing House, and we hope to be able, before we go to press, to obtain the result. The interest of the street was 80 entirely absorbed in the bank panic, that mercantile failures attracted but little attention, although the number of protests and extensions must have been very large, yet very few names have been mentioned. The Stock Board, also, was & matter of secondary interest. The transactions were quite moderate and mostly for cash. After the Second Board, when the impression prevailed that all the city banks would suspend, the market for the leading fancies was buoyant. Central advanced to 59, having opened at 521, and Reading went to 33, having opened at 29. At the close the former was 58 and the latter 321. The market in the morning was generally lower, but the decline was not material. Orders for 700 shares of Rock Island, on buyer sixty at 60@62, the cash price being 551 @56. Only 10 shares of Erie were sold. Delaware declined to 75 and Cumberland to 51. Toledo sold at 201, a decline of 11 P cent, and Hudson River at 10. Panama sold at 60 in the morning and jumped to 65 in the afternoon. In Bank Stocks the sales were moderate and show but little change from yesterday. Bank of Commerce sold at 70, Metropolitan 57, American Exchange 541, Commonwealth 60, &c. The sales of State Stocks con. tinue to be large, amounting to-day to over $130,000. The market shows'a smalldecline, excepting in Missouri 6's, which are better. In Railroad Bonds the market is dull and irregular. Illinois Central and Erie 1871 are better, while Erie 2d mortgage are lower. The impression at the close was, that if all the Banks suspended there would be & temporary advance in the whole list of stocks. There has been a moderate amount of business doing for the Wednesday steamer in Exchange at about previous rates. But few Sterltng bills have sold above par, but 102 is asked by some leading drawers. The supply of bills is large, and the disturbed state of financial affairs prevents important transactions. Buyers feel too uncertain about the result of to-day's work to make large engagements. Freights continue dull. To Liverpool the engagements are: 20,000 bushels Corn at 41@42d., in bulk. and 12,000 bushels Wheat at 51d., in bags; 2,000 bbls. Flour at 1s. 9d. @1s. 10ld. To London, 50 cases Indigo at 25e.; 20 tuns Measurement Goods at 20a. 50 tuns Oil Cake at 20a. To Glasgow, 12 tuns Whalefoot's at 27a. 6d.; ,500 bbls. Flour at 2s. 6d. A vessel of 650 tuns (abont 000 hhds.), for Cowes, with orders for Liverpool, London or Breinen, with Sugar, at 27s. 6d. The business of the Sub Treasury was: Receipts, $125,681 01, including $100,000 transferred from Bos. tor; payments, $277,407 92; balance, $5,817,545 48. The disbursements W and have been much larger but for the fact that the Bowery Savings Bank received $600,000 from Washington, in three drafts of $200,000, and only used one of them. The Artisans' and Merchants' Exchange Banks have published cards, stating that those institutions are abundantly able to pay all their debts, and that they hope soon to resume business. The following Stocks were sold to-day by Mr. Draper: Int. added 17) $3,000 City of Milwaukee To Int. added 4@4 12,000 Attica and Allegheuy RR Co. 7a. 10000 Milwaukee and Horicon RA Co. 8a Int. added 13 Int. added 50@55} 47 000 Tennessee 6a Int. added 541@554 11. 000 Virginia 91 40 shares Astor Fire Insurance Co 60 25 shares Shoe and Leather Bank 531 41 30 shares Metropolitan Bar Bank & 25 shares Continental 60 10 shares Nassan Bank 60 62 shares New World Fire Insurance Co 65 50 shares Bank of Commerce 50/20 shares Pacific Mail Steamship Co 50 20 shares Hanover Bank 55 50 shares Phenix Bank 75 16 shares Metropolitan Fire Insurance Co., Albert H. Nicolay sold at auction to-day: $18 400 Milwaukee and Horieon R.R. Farm Mort. & int. 000 Tennessee State 6 per cent Bonds, $5,000 Milwaukee & Horieon R. R. let M.8 percent @15 & int Convertible Sinking Fund Bonds 75 & int. South Carolina 6 per cent Bonds int. $1,000 Milwaukee City percent Bonds 67 $2,000 Virginia State per cent Bonds int. $10,000 Louisiana State 6 per cent Bonds. $20000 Attica & Alleghany R. let Bds. int. Attica Alleghany per Bds. 511055 int. $10,000 Milwaukee City per Bonds, 1874 Sacramento City 10 per cent Bonds. 74&80