Article Text

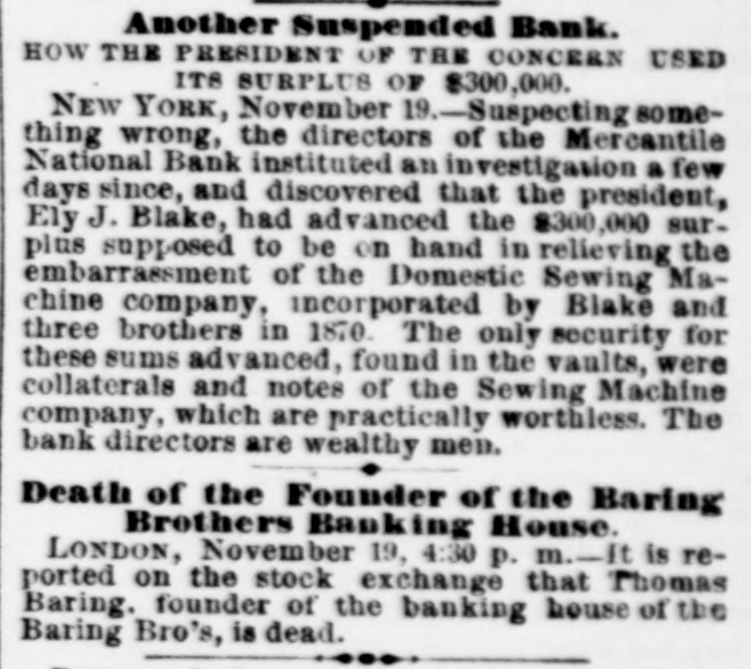

Another Suspended Bank. HOW THE PRESIDENT OF THE CONCERN USED ITS SURPLUS OF $300,000. NEW YORK, November 9.-Suspecting something wrong, the directors of the Mercantile National Bank instituted an investigation a few days since, and discovered that the president, Ely J. Blake, had advanced the $300,000 surplus supposed to be on hand in relieving the embarrassment of the Domestic Sewing Machine company, incorporated by Blake and three brothers in 1870. The only security for these sums advanced, found in the vaults, were collaterals and notes of the Sewing Machine company, which are practically worthless. The bank directors are wealthy men. Death of the Founder of the Baring Brothers Banking House. LONDON, November 19, 4:30 p. m.-It is reported on the stock exchange that Thomas Baring. founder of the banking house of the Baring Bro's, is dead. ....