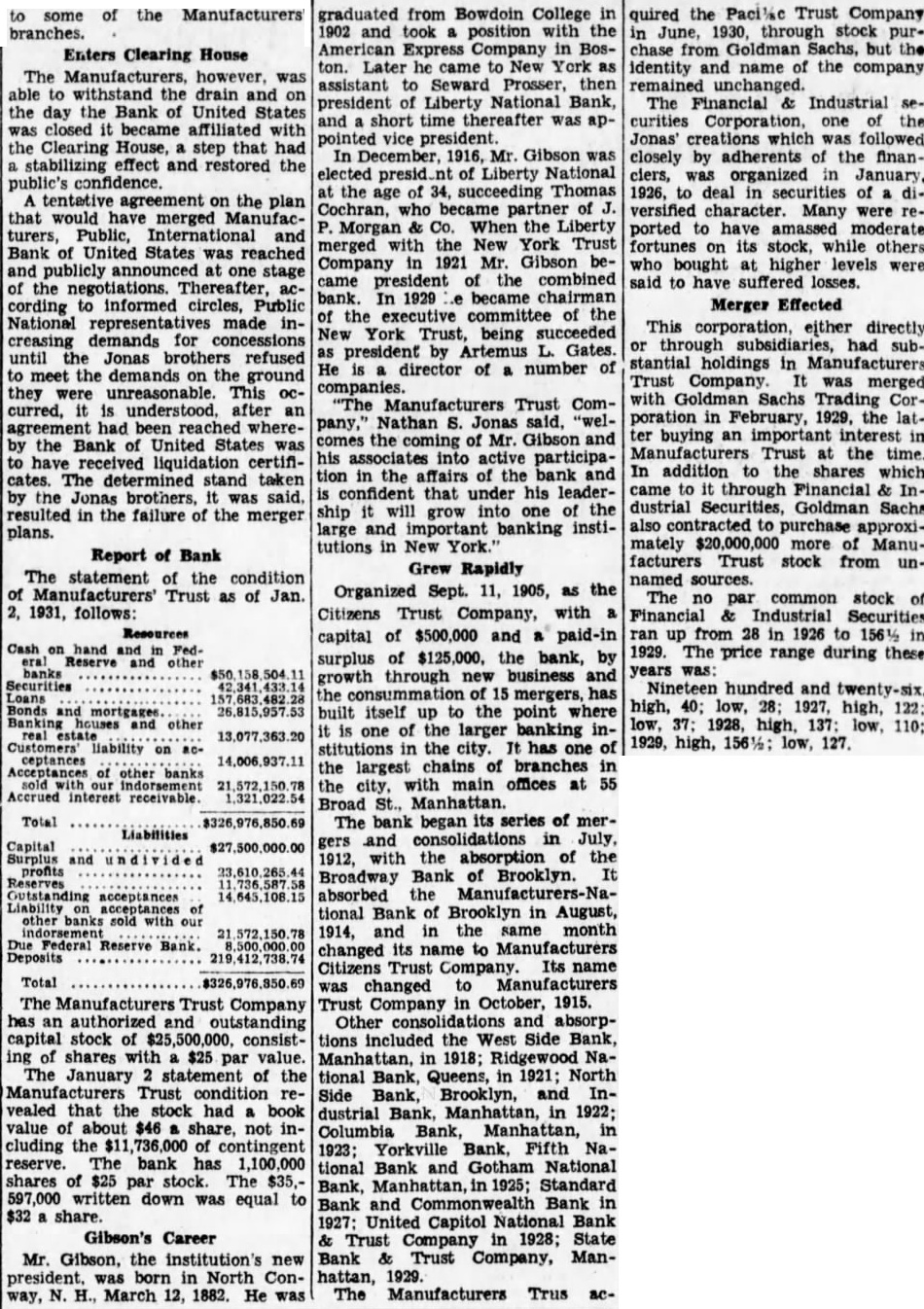

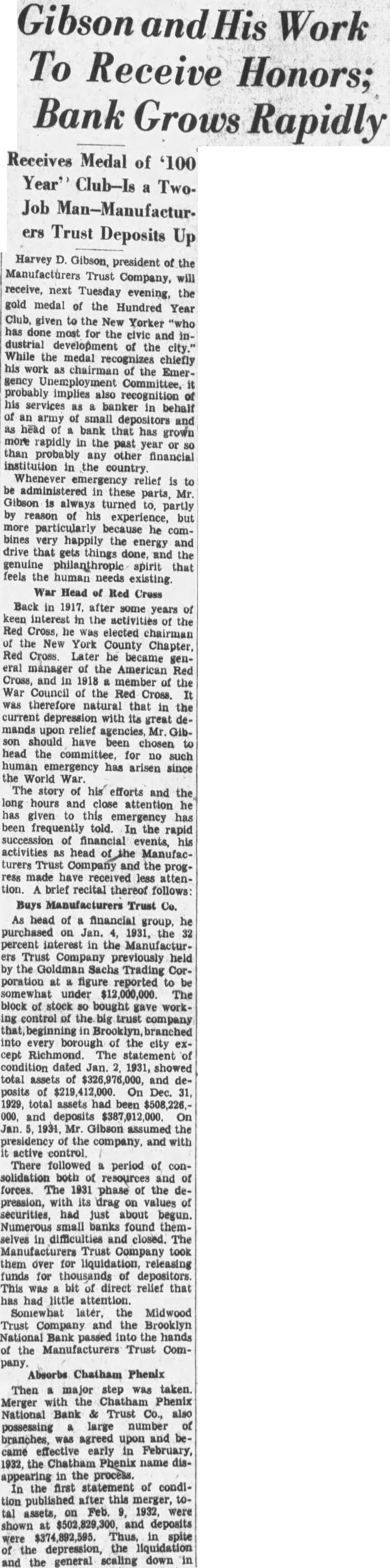

Article Text

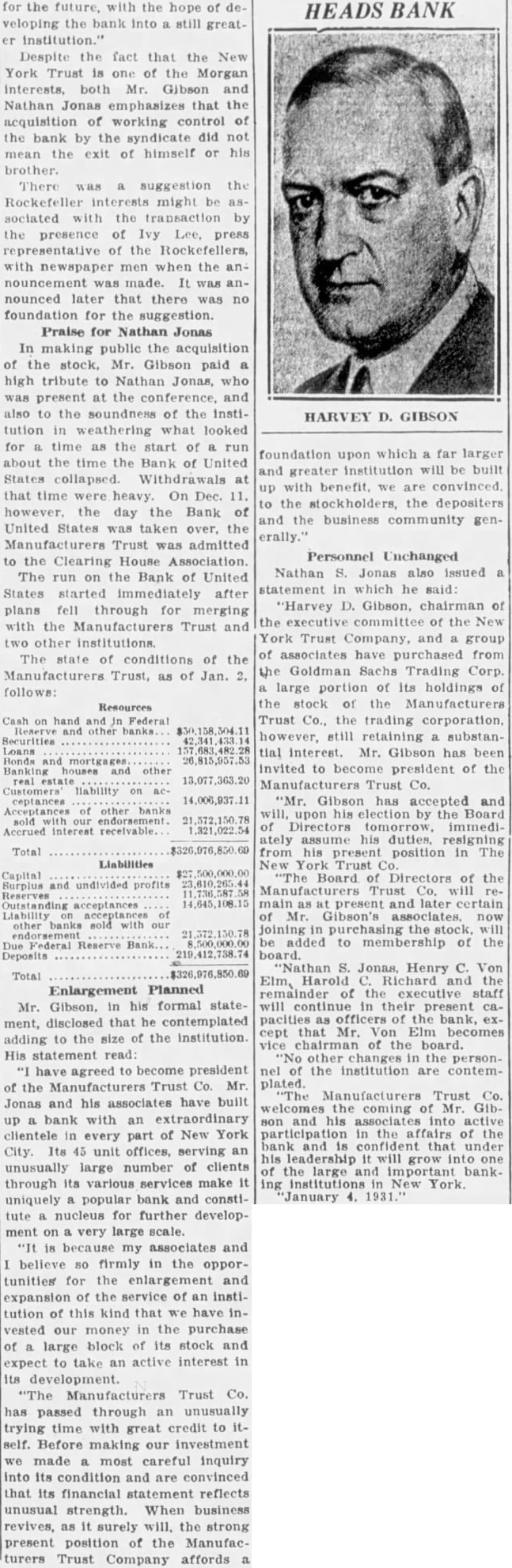

HARD CASH ENDS RUNS AT ELEVEN BANK BRANCHES (Continued from page 2) of the eleven branch offices affected by the rush of withdrawals kept an orderly line and there was no disorder. The throng at the Bronx office grew rapidly as a report spread through the neighborhood that the institution's stock faced a decline. Police. tracing the report. ascribed it to a small neighborhood merchant who offered his stock for sale at the branch and was advised not to dispose of it. His desire to liquidate the stock, police say, came as a result of failure of the proposed billion dollar merger in which the Bank of United States was mentioned. The other banks were the Manufacturers Trust company. Public National Bank and Trust company, and the International Trust company. Negotiations were dropped Tuesday following an all-night conference. Stock Warning Misunderstood. With nothing more substantial than this, police say. the small merchant advised his patrons and friends to get rid of their stock, but they interpreted this to mean to draw their money As soon as the lines began to appear at the branch bank and it became apparent that there would be no let-up, $3,000,000 was rushed out to the office in armored trucks. Sight of the bales of money was sufficient to satisfy many of the depositors that their accounts were secure and they departed. As these left, their places were quickly filled by new arrivals who were not acquainted with the situation. Mounted Cops Clear Streets. At 7 o'clock police passed along the lines advising the depositors to go home and wait until the bank opened in the morning. Their efforts met with little success, however, and when traffic became jammed twelve mounted police were ordered to clear the streets. At a branch at 170th st. and Wythe pl., Bronx, police protection was called at 7:30 p. m. when the crowds blocked traffic. Crowd of 500 persons gathered in front of the branches at Madison ave. and 116th st., Manhattan, and New Lots and Georgia aves., Brooklyn. Those wishing to draw money were told to return this morning when police reserves ordered onlookers away. An order to all precinets was issued at 10:30 last night by Deputy Chief Inspector John Hennessey directing commanding officers to station two patrolmen at branch bank doors at 8 o'clock this morning. Representatives of the bank. which has headquarters at 5th ave. and 44th st., were still in conference at 3 o'clock this morning with officers of the Federal Reserve bank of New York and members of the banks which had figured in the proposed merger. (Picture on page 28)