Click image to open full size in new tab

Article Text

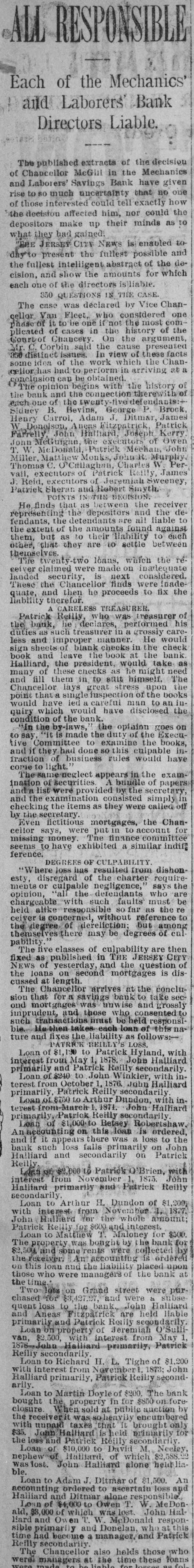

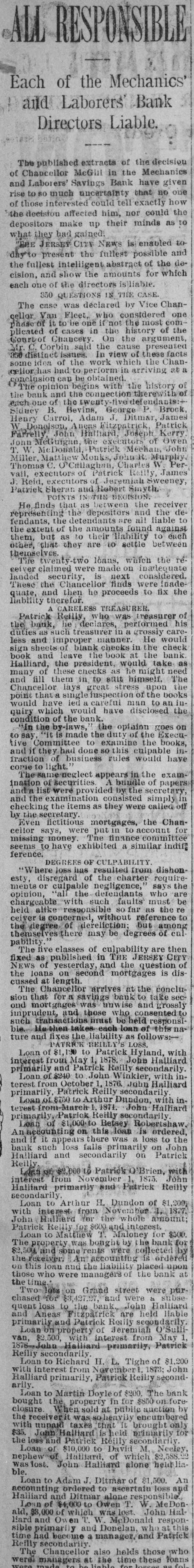

# ALL RESPONSIBLE

Each of the Mechanics'

and Laborers' Bank

Directors Liable.

The published extracts of the decision of Chancellor McGill in the Mechanics and Laborers' Savings Bank have given rise to so much uncertainty that no one of those interested could tell exactly how the decision affected him, nor could the depositors make up their minds as to what they had gained.

"THE JERSEY CITY NEWS is enabled to-day to present the fullest possible and the fullest intelligent abstract of the decision, and show the amounts for which each one of the directors is liable.

350 QUESTIONS IN THE CASE.

The case was declared by Vice Chancellor Van Fleet, who considered one phase of it to be one if not the most complicated of cases in the history of the Court of Chancery. On the argument, Mr. C. Corbin said the cause presented 350 distinct issues. In view of these facts some idea of the work which the Chancellor has had to perform in arriving at a conclusion can be obtained.

The opinion begins with the history of the bank and the connection therewith of each one of the twenty-five defendants: Sidney B. Bevins, George P. Brock, Henry Carrol, Adam J. Ditmar, James W. Donglson, Aneas Fitzpatrick, Patrick Farrelly, John Hallhard, Joseph Kerry. Jonn MeGuigan, the executors of Owen T. W. McDonald, Patrick Mechan, John Miller, Matthew Monks, John R. Murphy, Thomas C. O'Callaghan, Charles W. Pervail, executors of Patrick Reilly, James J. Reid, executors of Jeremiah Sweeney, Patrick Sheran and Robert Smyth

POINTS IN THE BECISION

He finds that as between the receiver representing the depositors and the defendants, the detendants are all liable to the extent of the amounts found against them, but as to their liability to each other, that they are to settle between themselves.

Tire twenty-two loans, which the receiver claimed were made on inadequate landed security, is next considered. These the Chancellor finds were inadequate, and then he proceeds to fix the liability therefor.

A CARELESS TREASURER.

Patrick Reilly, who was treasurer of the bank, he declares, performed his duties as such treasurer in a grossiy careless and improper manner. He would sign sheets of blank checks in the check book and leave the book at the bank. Halliard, the president, would take as many of these checks as he might need and fill them in to stit himself, The Chancellor lays great stress upon the point that a single inspection of the books would have led a careful man to an inquiry which would have disclosed the condition of the bank.

"In the by-laws," the opinion goes on to say, "it is made the duty of the Executive Committee to examine the books, and if they had done so this culpable infraction of business rules would have come to light."

The same neglect appears in the examination of securities. A bundle of papers and a list were provided by the secretary, and the examination consisted simply in checking the items as they were called off by the secretary.

Even fictitious mortgages, the Chancellor says, were put in to account for missing money. The finance committee seems to have exhibited a similar indifference.

DEGREES OF CULPABILITY.

"Where loss has resulted from dishonesty, disregard of the charter requirements or culpable negligence," says the opinion, "all the defendants who are chargeable with such faults must be held alike responsible so far as the receiver is concerned, without reference to the degree of dereliction; but among themselves there may be degrees of culpability."

The five classes of culpability are then fixed as published in THE JERSEY CITY NEWS of yesterday, and the question of the loans on second mortgages is discussed at length.

The Chancellor arrives at the conclusion that for a savings bank to take second mortgages was unwise and grossly imprudent, and those who consented to such transactions imust be held responsibie. He then takes each loan of this nature and fixes the liability as follows:

PATRICK REILLY'S LOSS.

Loan of $1,130 to Patrick Hyland, with interest from May 1, 1878. John Halliard primarily and Patrick Reilly secondarily.

Loan of $240 to John Winkler, with interest from October 1, 1876. John Halliard primarily, Patrick Reilly secondarily.

Loan of $100 to Arthur Dundon, with interest front March 1, 1871. John Halliard primarily, Patrick Reilly secondarily.

Loan of $1,000 to Betsey Robertshaw. An accounting on this loan is ordered, and if it appears there was a loss to the bank such loss falls primarily on John Halliard and secondarily on Patrick Reilly.

Loan of 69,000 to Patrick O'Brien, with interest from November 1, 1875. John Halliard primarily and Patrick Reilly secondarily,

Loan to Arthur H. Dundon of $1,200, with interest from November 1, 1877. John Hallard for the whole amount; Patrick Reilly for $600 and interest.

Loan to Matthew T. Maloney for $500. The property was bonght by the bank for $2,500, and some rents were collected by the receiver. An accounting is ordered on this loan and the liability placed upon those who were managers of the bank at the time

Two lots on Grand street were purchased for $3,427.27, and were a subsequent loss to the bank. John Halliard and Aneas Fitzpatrick are held liable primarily and Patrick Reily secondarily.

Loan on property of Jeremiah O'Sullivan, $2.500, with interest from May 1, 1878 John Halliard primarily, Patrick Reilly secondarily.

Loan to Richard H. L. Tighe of $1,200 with interest from November 1, 1873; John Halliard primarily, Patrick Reilly secondarily.

Loan to Martin Doyle of $200. The bank bought the property in for $850 on foreclosure. When sold at public auction by the receiver it was so heavily encumbered with unpaid taxes that it brought only $35. John Halliard is held primarily for the loss and Patrick Reilly secondarily.

Loan of $10,000 to David M. Neeley, nephew of Halliard, of which $2,588.22 was lost. John Halliard alone heid liable.

Loan to Adam J. Ditmar of $1,500. An accounting ordered to ascertain loss and Halliard and Ditmar alone responsible..

Loan of $4,000 to Owen T. W. MeDonald, $8,000 of which was lost. John Hal-Hard and Owen T. W. McDonald responsible primarily and Donelan, who at this time had become a manager, and Patrick Reilly secondarity.

The Chancellor also holds those who were managers at the time these loans