Article Text

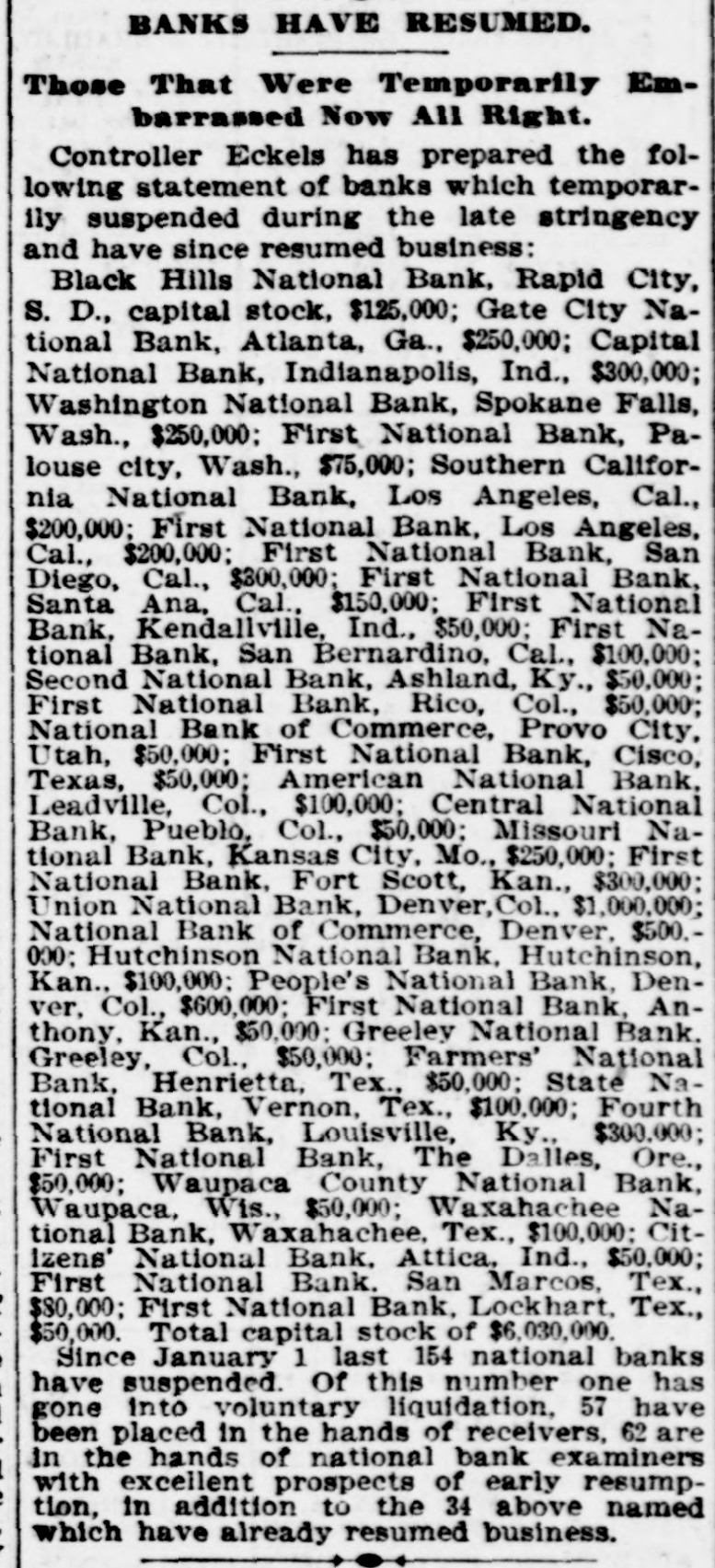

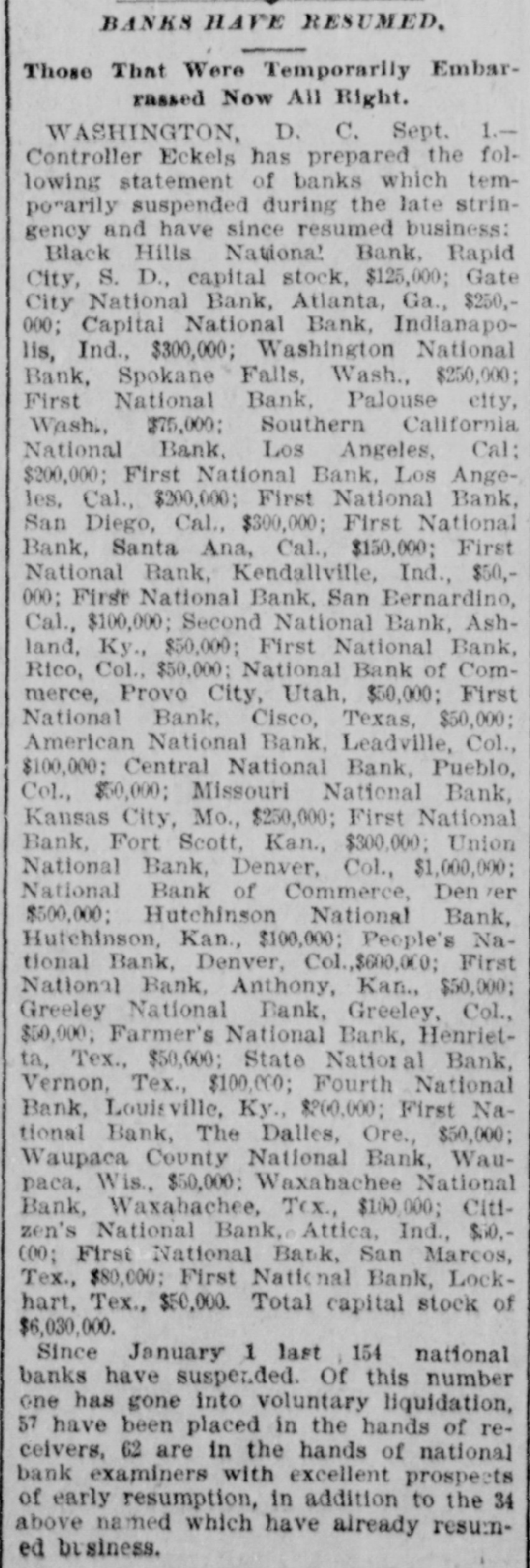

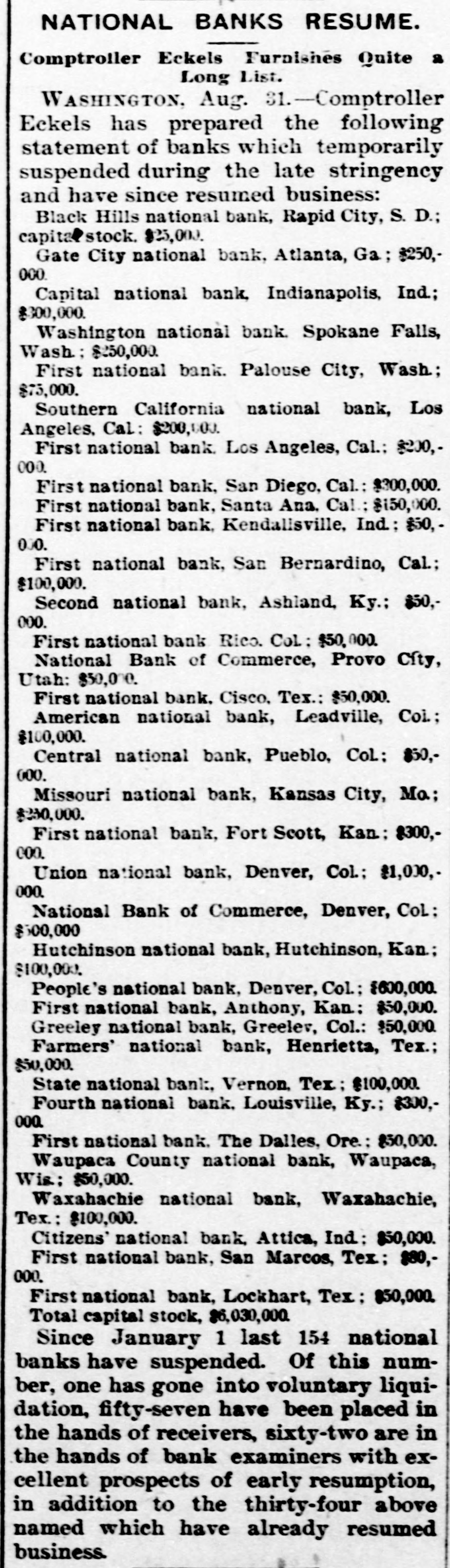

BANK FAILURE. The Albuquerqne National Temporarily Suspends Business. ALBUQUERQUE (N. M.), July 3.-The following note was posted on the door of the Albuquerque National Bank this morning: The Albuquerque National Bank is compelled temporarily to suspend business. This is brought about by the unusual demands of depositors since the suspension of the California banks about ten days ago, and the absolute impossibility during the present business depression to call in our loans. It is confidently hoped that we can soon resuine business and that every creditor will be paid in full, as the assets greatly exceed the liabilities. JOHN A. LEE, Vice-President. The suspension will cause no loss to depositors, as the bank has a surplus of $40,000. Other banks are exceptionally strong, and have large cash reserves. Full confidence is expressed by citizens, and no runs whatever are being made. The liabilities of the Albuquerque National Bank are $270,000, and the assets $420,000. The New Mexico Savings Bank and Trust Company is also closed, but they say the depositors will be paid in full. RESUMING BUSINESS. WASHINGTON, July 3. - Comptroller Eckels is advised that the First National Bank at San Diego, Cal., which failed one month ago, will resume business Wednesday, having complied with the conditions imposed by the Comptroller. It is probable, also, that the failed Washington National Bank of Spokane, Wash., will resume business in ten days. A RUN AT LEADVILLE. LEADVILLE (Col.), July 3.-A run was made on the California, Carbondale and American Banks to-day, but all demands of depositors were promptly met with cash, and at the closing hour the run had ceased. The American National Bank closed its doors this morning, but the directors say the depositors will be paid in full. The statement shows the resources to be $536,134 and the liabilities $347,625. RUN ON A BROOKLYN BANK. BROOKLYN, July 3.-There was a slight run on the Williamsburg Savings Bank this morning. Nearly 1,000 persons crowded into the bank as it opened, and until noon, anxious inquiries made show the proportion of those withdrawing deposits as to five to one of those depositing. General A. V. Meserole, President of the bank, said: "We paid out $230,000 on Saturday and took in $140,000, mostly from new depositors. We are doing business fast, and preparing for a run should it come." HAS PLENTY OF FUNDS. Cisco (Tex.), July 3.-The doors of the National Bank of Cisco were closed by the Inspector to-day, while the inspections of the bank's condition are being made, to prevent a run. The Cashier stated that the bank had two and a half dollars for every dollar of liabilities. DECLARED INSOLVENT. WINNIPEG (Man.), July 3.-The Commercial Bank of Manitoba has been declared insolvent and liquidators appointed to wind up its business. Bills of the bank are as good as gold under the Dominion law.