Article Text

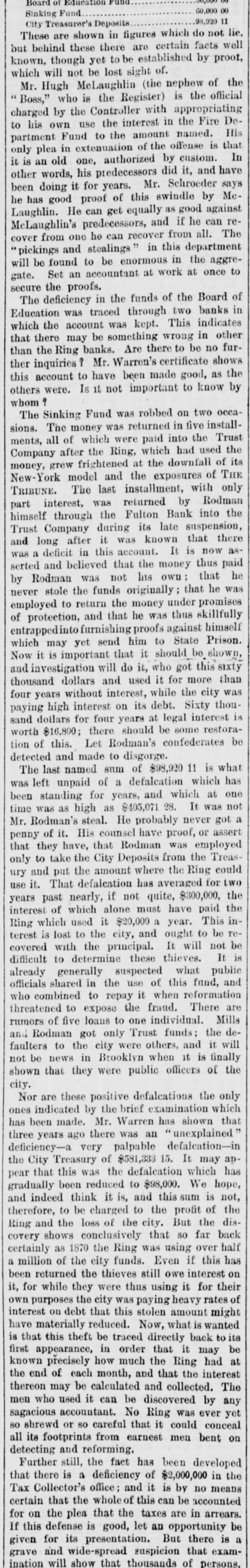

1.00,000.00 Board of Education Fund 60,000 00 Sinking Fund 198,920 1 Treasurer's Deposits These City are shown in figures which do not well lie, behind these there are certain facts known, but though yet to be established by proof, which will not be lost sight of. Mr. Hugh McLaughlin (the nephew of official the who is the Register) is the the Controller with use the interest in charged Boss," his own by appropriating named. the Fire De- His to Fund to the amount is that partment plea in extenuation of the offense In only is old one, authorized by custom. and it other an words, his predecessors did it, have says doing it for years. Mr. Schroeder Mebeen good proof of this swindle by he has He can get equally as good he can against reMcLaughlin's Laughlin. predecessors, and from if all. The cover from and one stealings he can recover in this department the "pickings found to be enormous in aggre- to will gate. be Set an accountant at work at once secure the proofs. deficiency in the funds of the Board banks of in The was traced through two indicates Education the account was kept. This in other which there may be something wrong furthat the Ring banks. Are there to be no shows than inquiries Mr. Warren's certificate as the ther account to have been made good, know by others this were. Is it not important to whom Sinking Fund was robbed on two install- occaThe The money was returned in five the Trust sions. all of which were paid into used the ments, after the Ring, which downfall had of its Company grew frightened at the of THE money, model and the exposures only New-York The last installment, with TRIBUNE. returned by Rodman part interest, through was the Fulton Bank suspension, into the himself Company during its late that there Trust long after it was known It is now asand deficit in this account. thus paid was a and believed that the money that he serted Rodman was not his own that he was by stole the funds originally ; promises never to return the money under skillfully employed and that he was thus himself of protection, furnishing proofs against Prison. entrappedinto yet send him to State shown, which may is important that it should be this sixty Now investigation it will do it, who got than and dollars and used it for more was thousand without interest, while the Sixty city thoupaying four years high interest on its at debt. legal interest sand dollars for there four years should be some restora- be worth of $16,800; this. Let Rodman's confederates detected tion and made to disgorge. what The last named sum of $98,920 11 which is has was left unpaid of years, a defalcation and which at one been standing high for as $405,071 28. It was got not a time was as steal. He probably never assert Mr. Rodman's of it. His counsel have proof, employed or penny they have, that Rodman was the Treasthat the City Deposits from could only to take the amount where the Ring for two ury and That put defalcation has averaged $300,000, the use it. nearly, if not quite, have paid the years past of which alone must This ininterest used it $20,000 a year. to be reRing which to the city, and ought not be terest is lost with the principal. thieves. It will It is difficult covered to determine these what public already shared generally in the suspected use of this reformation fund, and officials who combined to expose to repay the it fraud. when There Mills are threatened of five loans to one individual. funds; the derumors got only Trust and it will and Rodman the city were others, is finally faulters to in Brooklyn when it of the not shown be that news they were public officers city. these positive defalcations the which only Nor are by the brief examination shown that ones indicated made. Mr. Warren has " unexplained has been ago there was an defalcation-in three years very palpable may apdeficiency-a of $581,333 15. It which has the City Treasury this was the defalcation We hope, and gradually pear indeed that been think reduced it is, to to and $98,000. the this profit sum of is not, the therefore, the to be loss charged of the city. But far the back disRing and shows conclusively that using so over half covery 1870 the Ring was if this has certainly as of the city funds. Even owe interest on a million returned the thieves still it for their been while they were thus using rates of it, for the city was paying amount heavy might own purposes debt that this stolen is wanted interest materially on reduced. Now, directly what back to its have is that this theft be traced order that it may be first appearance, precisely how in much the Ring the interest had at known each month, and that The the end may of be calculated discovered and collected. by any thereon used it can be ever yet men who accountant. No Ring could was conceal sagacious careful that it bent on all so shrewd its footprints or so from earnest men and reforming. developed that detecting still, the fact has $2,000,000 been in the and Further there is a deficiency of it is by no means Tax Collector's office; whole of this can be accounted arrears. that the taxes are for on the plea let an is this defense is But there certain If that the presentation. good, opportunity in exam- be a given for its guspicion that grave and will wide-spread show that thousands of persons. ination