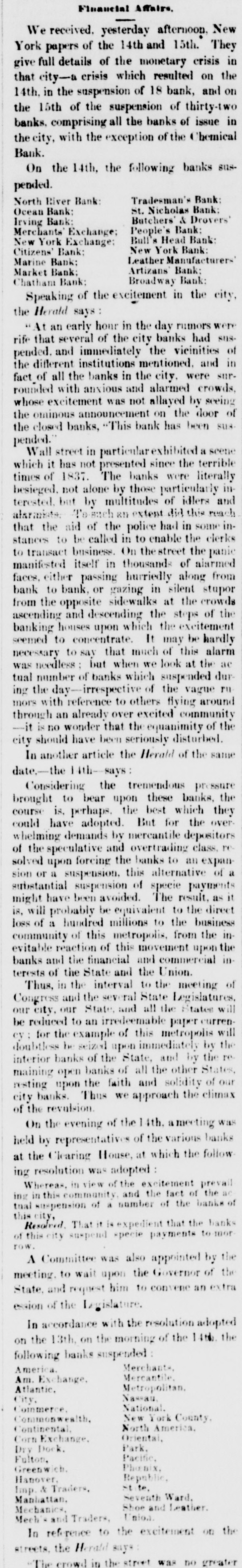

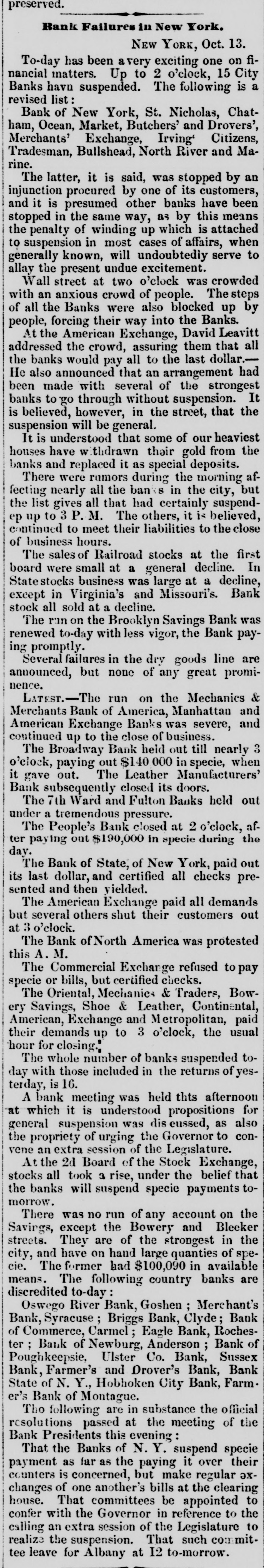

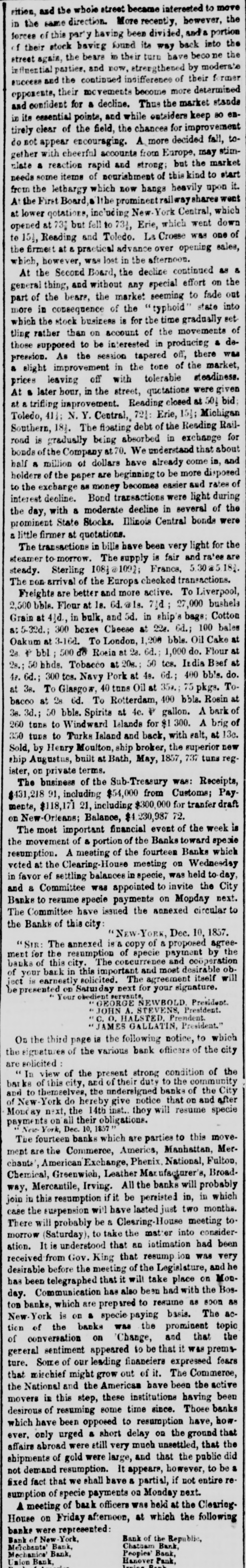

Article Text

From the Associated Press Agent. The Pennsylvania Election. PHILADELPHIA, Oct. 13.-The general elect for State officers -Governor, members of the L islature, Canal Commissioner, Judges, &c his State-came off to-day. In this city it pas off very quietly, and with no disturbances of peace. Only a small vote appears to have b polled Williamsport, Lycoming county, gives Pack Dem., for Governor, 469; Wilmot, Rep., 278; Hazlehurst, Amer., 139 Columbia, Lancas county, gives Packer 319; Hazlehurst 211, Wilmot 85. Phoenizville, Chester county. gi Packer 295, W ilmot 237, and Hazlehurst 12. PITTSBURG, Oct. 12 -Returns from three I cinets in and two in Alleghany city sh a falling off in the Republican majority of m than half, and it is believed that their major in the entire county will bereduced still more LANCASTER, Oct. 13th.-The returns from city, complete, give Packer a majority of 730 large Democratic gain Northumberland-Packer's majority in t borough is 110. Harrisburg -Thiscitygives Packer a major of 419-a Democratic gain of 370. Dauphin cou gives 79 majority for Packer-a heavygain Danville gives 92 maj. for Packer; Tama 215 do and Mount Joy, Lancaster county, gi Wilmot a majority of 119. Honesdale, Wayne county, gives Wilmot majority. Scranton gives Packer 107 majority York county-This county is reported at 2 majority for Packer. It gave Buchanan over 2 majority last fall Lycoming county gives ,000 majority for Pa er. It gave Buchanan about the same. Carawissa, Columbia county, gives Wilm majority. West Chester, Chester county, gives Will 198 majority Luzerne county 1,500 majority for Packer, ag of some 400 on the last Presidential election Berks county gives 6,000 Democratic major Reading alone gives 1,000 majority for Packer gave Buchanan about the same majority Montour county gives Packer 450 majorit about the same it gave Mr Buchanan Northampton county gives Packer about 3 majority-a gain. PHILADEDPHIA, Oct. 13, midnight. From character of the returns received here there is question of Mr Packer's election. Be has m SO far considerable gains on Mr. Buchanan's when he carried the State over the Republi candidate by 83,200 plurality and over all by I majority The Democrats are now parading the str contident of victory. They have elected their Legislative ticket. and also their county tic The entire ticket for Democratic State and cou officers is elected in this city and county by largest majority ever known PHILADELPHIA, Oct. 14, 1.15 m-Paeker majorities in the following wards: Fifth WE 750 majority; Eighth Ward, 588. The city le lative ticket. for Senate and Assembly, has Democratic majority. Carbon county gives Packer600, and Montg ery county 2,000 majority. PITTSBURG, Oct. 13, midnight.-Wilmot lost in this and Allegheny county 1,400 vo The Democratic county ticket is partly elec here. YORK, Oct. 13, 10 m -Packer's majority o Wilmot, in this borough, is 303, and over I candidates 77. Buchanan's majority last fall only one. The election passed off very quietly [SECOND DISPATCH.] PHILADELPHIA, Oct. 13-The complete turns of this city foot -Packer, 27,749; Hat hurst. 13,817; Wilmot, 9,609. The Democratic candidates for Canal Comi sioner and Supreme Judge have about the si majority All the Democratic candidates have been elec to the Legislature and county offices. Ludlow (Dem ) has 5,300 majority over Con (Rep.) for Judge of the Court of Common Pl In Northampton county, 18 districts show 3 majority for Packer In Lehigh county Packer's present majorit over 1,000 In Cambridge county the Democratic gai twelve hundred Indiana county gives a thousand majority Wilmot. The Financial Crisis, &c. NEW YORK, Oct. 13-To-day has been a \ exciting one in financial matters. Up to2 fifteen of our city banks had suspended, of wh the following is a revised list, namely:-Banl New York, Artizans, St. Nicholas. Chath Ocean, Market. Butchers and Drovers', M chants' Exchange, Irving, Citizens', Trad men's. Buil's Head. New York Exchange No River, and Marine Bank. Wall street, at two o'clock, was crowded w an anxious mass of people. The steps of all banks were also blocked upby the people fore their way into the banks There were rumors during the morning aff ing nearly all the banks in the city, but the ab list gives all that had certainly suspended up 3 o'clock. The sales of railroad stocks at the first bo were small, at a general decline. In State sto the business done was quite large at a decl excepting Virginia and Missouri stocks. B stocks were all sold at a decline The run on the Brooklyn Savings Bank was newed to-day, but with less vigor and the be paying promptly There have been several failures in the goods line announced to-day, but none V prominent. LATER. The run upon the Mechanics', Bank of Ameri Manhattan and American Banks was very seve and continued up to the close of business The Broadway Bank held out till nearly th o'clock and paid out $140,000 in specie, when gave out. The Leather Manufacturers' Bank subsequer closed its doors The Seventh Ward and Fulton Banks held under a tremendous pressure The People's Bank closed at 2 o'clock. al paying out $19,000 in specie during the day The Bank of the State of New York paid out last dollar and certified all checks presented, then yielded. The American Exchange Bank paid all mands upon it. but several others shut out tb customers at o'clock The Bank of North America suffered prot this afternoon The Corn Exchange Bank refused to pay spe or bills, but certified checks. The Oriental. Mechanics and Traders', Bow Savings, Shoe and Leather, Continental, America Exchange and Metropolitan paid every dema up to the usual hour of closing A bank meeting was held this afternoon, which it is understood the proposition of age