Article Text

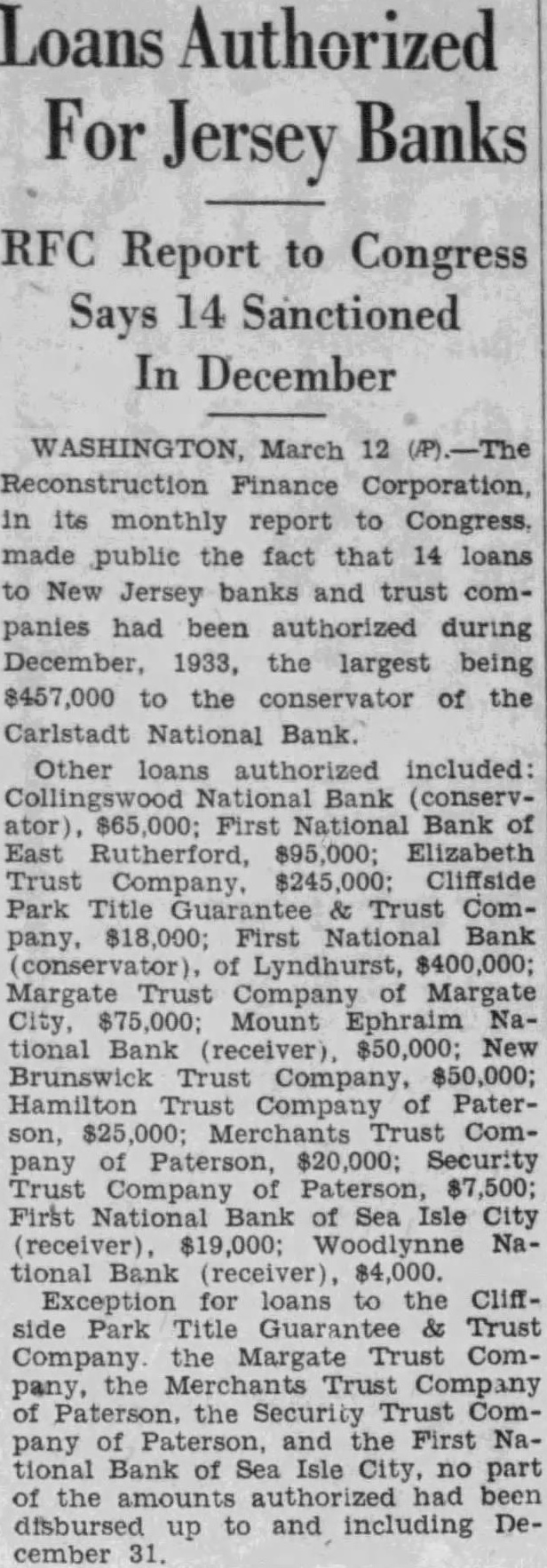

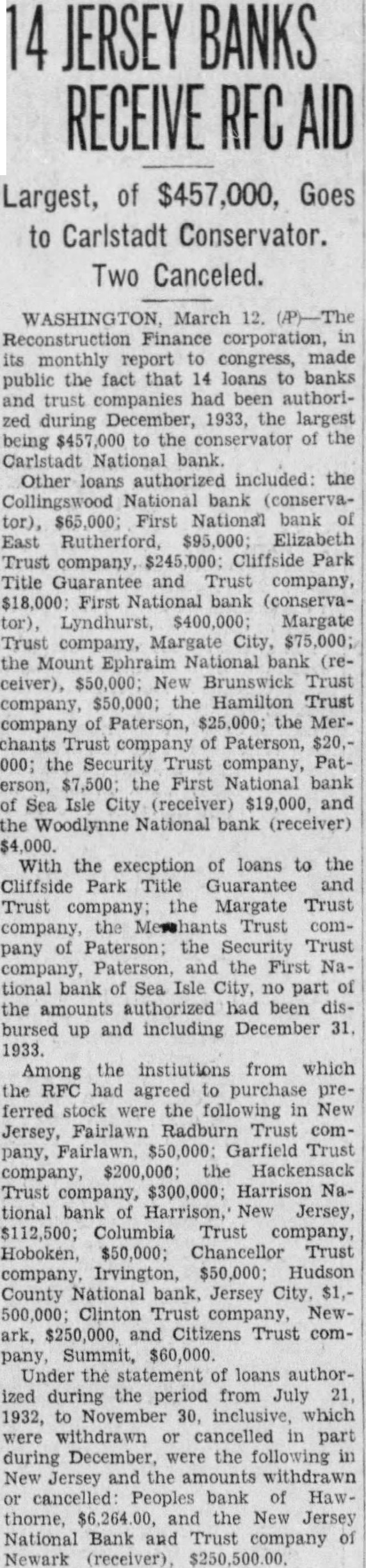

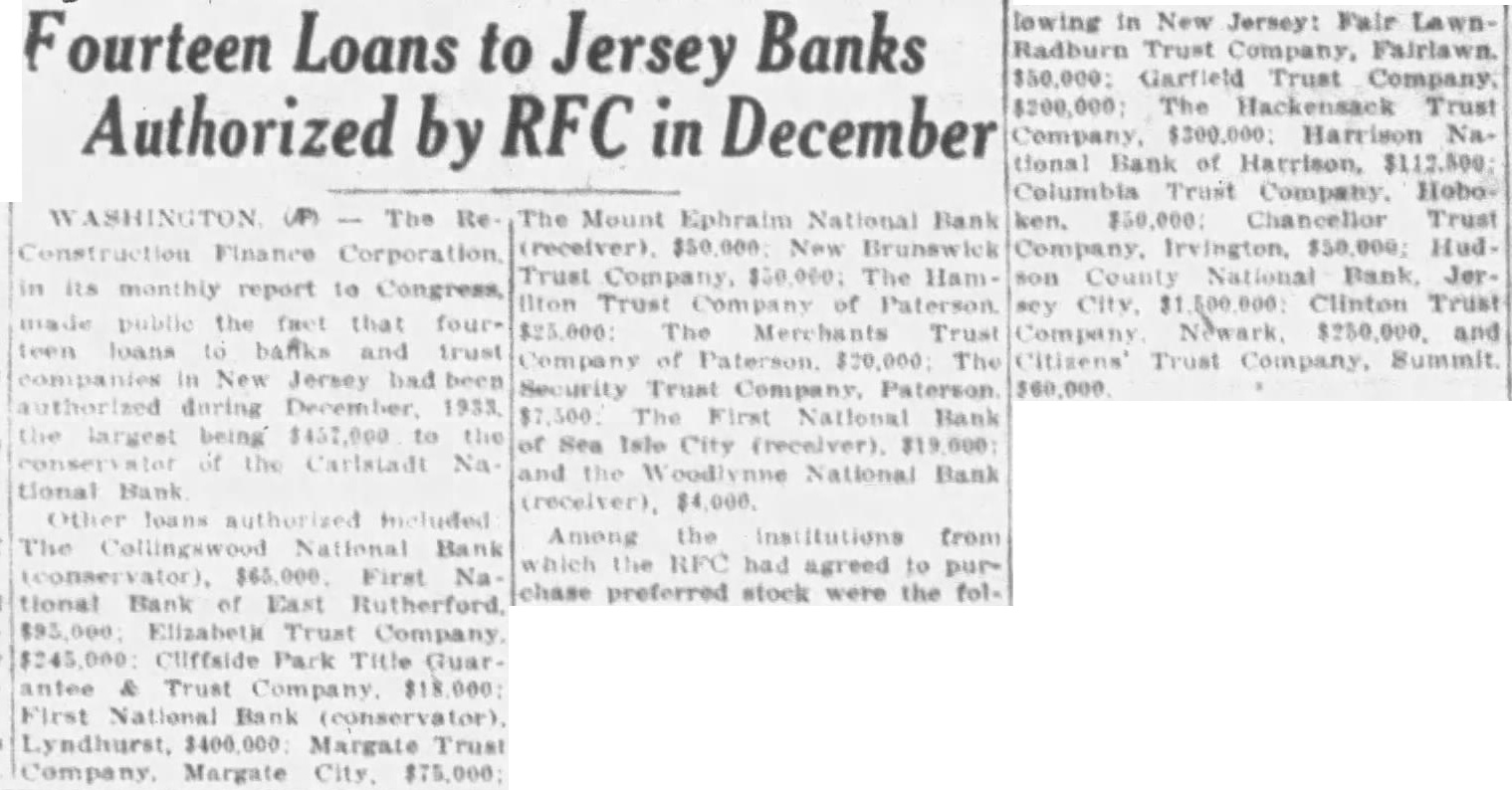

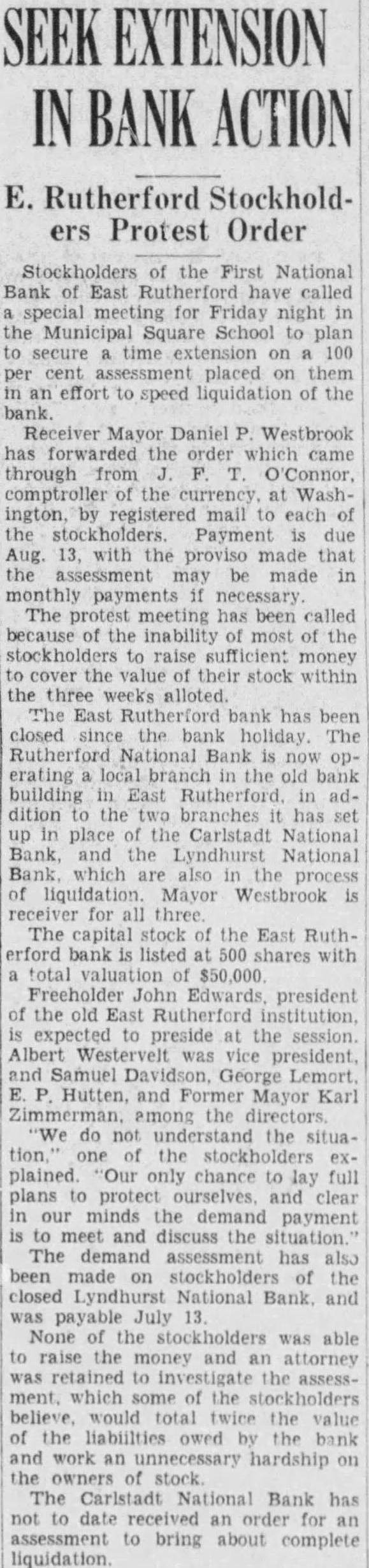

Loans Authorized For Jersey Banks RFC Report to Congress Says 14 Sanctioned In December WASHINGTON, March 12 (P).-The Reconstruction Finance Corporation, in its monthly report to Congress, made public the fact that 14 loans to New Jersey banks and trust companies had been authorized during December, 1933, the largest being $457,000 to the conservator of the Carlstadt National Bank. Other loans authorized included: Collingswood National Bank (conservator), $65,000; First National Bank of East Rutherford, $95,000; Elizabeth Trust Company, $245,000: Cliffside Park Title Guarantee Trust Company, $18,000; First National Bank (conservator), of Lyndhurst, $400,000; Margate Trust Company of Margate City, $75,000; Mount Ephraim National Bank (receiver), $50,000; New Brunswick Trust Company, $50,000; Hamilton Trust Company of Paterson, $25,000; Merchants Trust Company of Paterson, $20,000; Security Trust Company of Paterson, $7,500; First National Bank of Sea Isle City (receiver) $19,000; Woodlynne National Bank (receiver), $4,000. Exception for loans to the CliffPark Title Guarantee & Trust Company the Margate Trust Company, the Merchants Trust Company of Paterson. the Security Trust Company of Paterson, and the First National Bank of Sea Isle City, no part of the had been disbursed up to and including December 31.