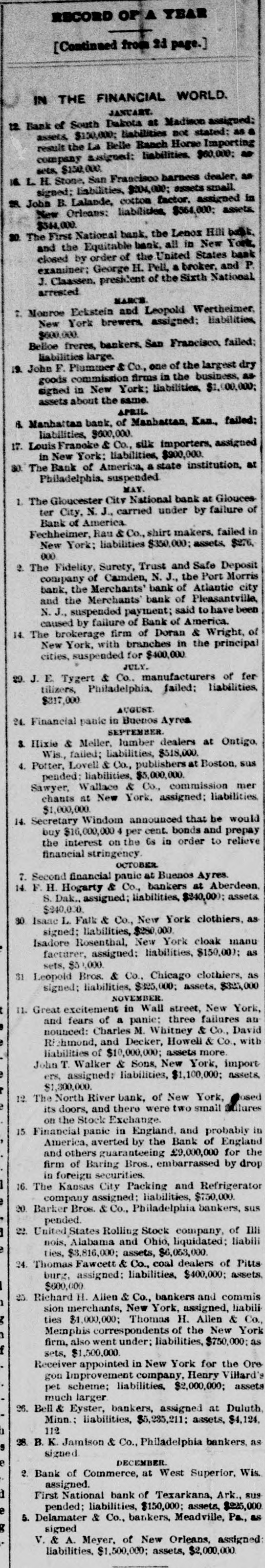

Article Text

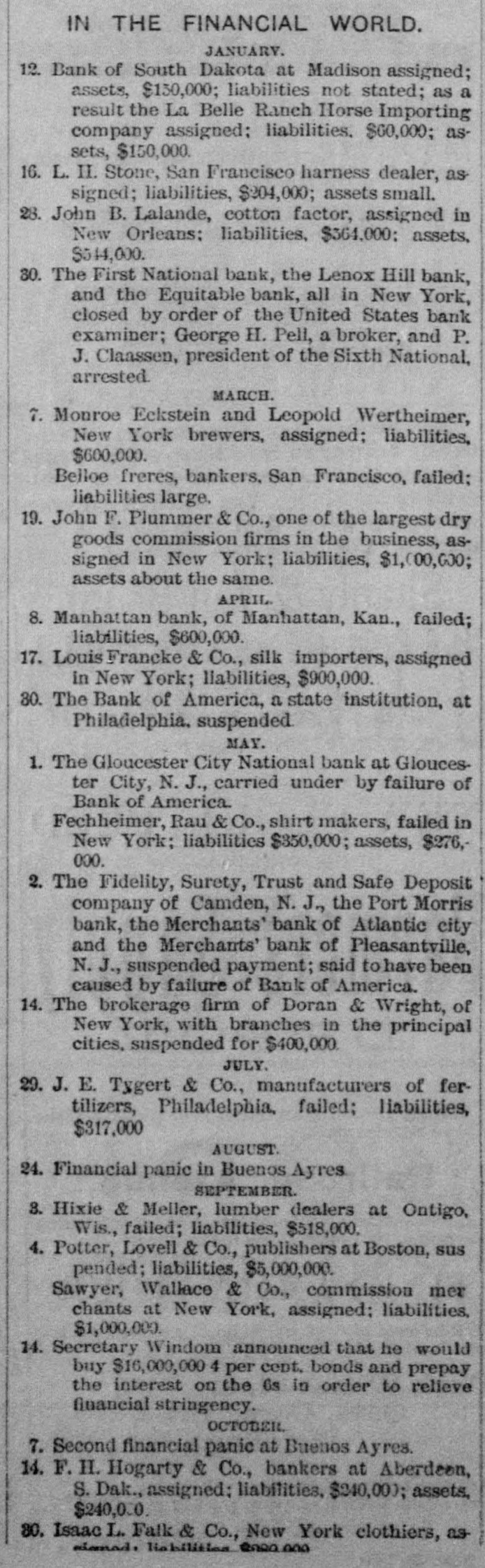

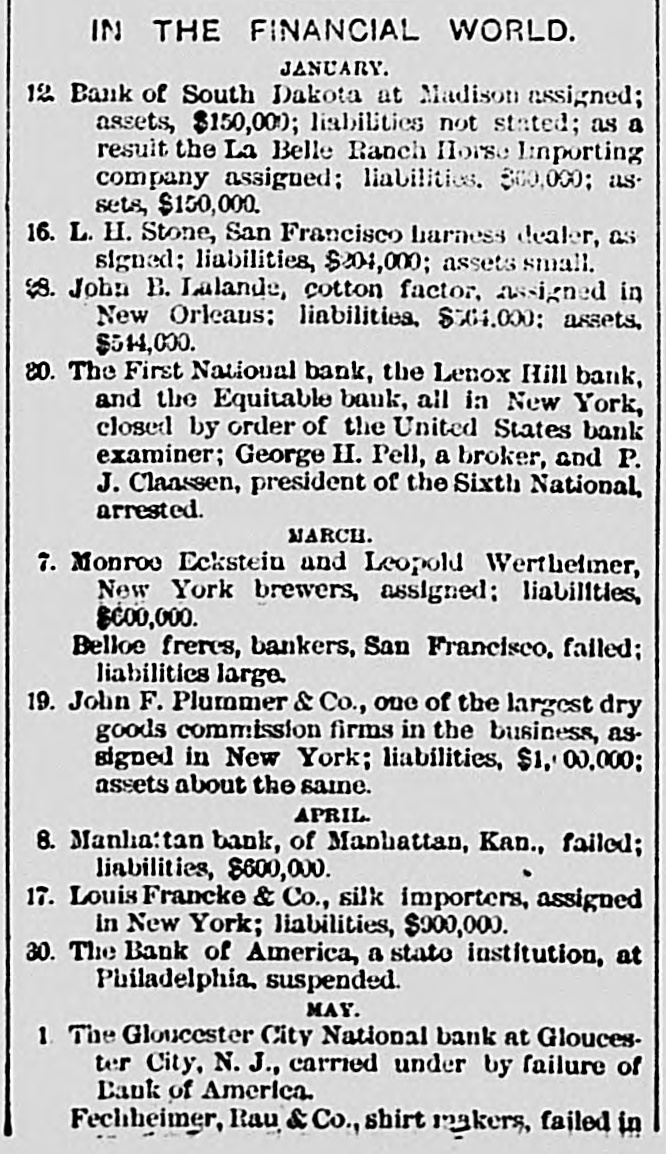

[Continued from 2d page.] IN THE FINANCIAL WORLD. JANUARY. 12. Bank of South Dakota at Madison assigned: assets, $100,000; liabilities not stated: as a result the La Belle Ranch Horse Importing company asigned: liabilities. $60,000; sets, $150,000. IS L. H. Stone, San Francisco harness dealer, an signed; liabilities, $204,000; essets small. S. John B. Lalande, cotton factor. assigned in New Orleans: liabilities, $564,000; assets. $544,000. 30. The First National bank. the Lenox Hill bask, and the Equitable bank. all in New York, closed by order of the United States bank examiner: George H. Pell, a broker. and P. J. Classen, president of the Sixth National arrested MARCH. 2. Monroe Eckstein and Leopold Wertheimer, New York brewers, assigned; liabilities, $600,000. Belloe freres, bankers. San Francisco, failed: liabilities large. 19. John F. Plummer & Co., one of the largest dry goods commission firms in the business, as signed in New York: liabilities, $1,000,000; assets about the same. APRIL & Manhattan bank, of Manhattan, Kan., failed: liabilities, $600,000. 17. Louis Franoke & Co., silk importers, assigned in New York: liabilities, $900,000. 80. The Bank of America, a state institution, at Philadelphia. suspended MAY. 1. The Gloucester City National bank at Glouces ter City, N. J., carried under by failure of Bank of America. Fechheimer, Rau & Co., shirt makers. failed in New York; liabilities $350,000; assets, $276, 000 2. The Fidelity, Surety, Trust and Safe Deposit company of Camden, N. J., the Port Morris bank, the Merchants' bank of Atlantic city and the Merchants bank of Pleasantville, N. J., suspended payment; said to have been caused by failure of Bank of America. 14. The brokerage firm of Doran & Wright, of New York, with branches in the principal cities, suspended for $400,000 JULY. 29. J. E. Tygert & Co., manufacturers of fer tilizers, Philadelphia, failed: liabilities, $817,000 AUGUST 24. Financial paule in Buenos Ayrea SEPTEMBER. 3. Hixie & Meller, lumber dealers at Ontigo, Wis, failed; liabilities, $518,000. 4. Potter, Lovell & Co., publishers at Boston, sus pended: liabilities, $5,000,000. Sawyer, Wallace & Co., commission mer chants at New York, assigned: liabilities $1,000,000 14. Secretary Windom announced that be would buy $16,000,000 4 per cent. bonds and prepay the interest on the Gs in order to relieve financial stringency. OCTOBER 7. Second financial panic at Buenos Ayres. 14. F. H. Hogarty & Co., bankers at Aberdeen. S. Dak., assigned; liabilities, $240,000; assets $840,000. 30 Isaac L. Falk & Co., New York clothiers, as signed; liabilities, $280,000. Isadore Rosenthal, New York cloak manu facturer, assigned: liabilities, $150,00): as sets, $51,000. 31 Leopold Bros. & Co., Chicago clothiers, as signed; liabilities, $825,000; assets, $325,000 NOVEMBER. 11. Great excitement in Wall street, New York, and fears of a panic: three failures an nounced: Charles M. Whitney & Co., David Ri chmond, and Decker, Howell & Co., with liabilities of $10,000,000; assets more. John T. Walker & Sons, New York, import ers, assigned: liabilities, $1,100,000; assets, $1,300,000. sed 12. The North River bank, of New York, its doors, and there were two small Bulures on the Stock Exchange. 15 Financial panic in England, and probably in America, averted by the Bank of England and others guaranteeing £9,000,000 for the firm of Baring Bros., embarrassed by drop in foreign securities. 16. The Kansas City Packing and Refrigerator company assigned; liabilities, $750,000. 20. Barker Bros. & Co., Philadelphia bankers, sus pended. 22. United States Rolling Stock company, of Illi nois, Alabama and Ohio, liquidated; liabili ties, $3,816,000; assets, $6,053,000. 24. Thomas Fawcett & Co., coal dealers of Pitts burg, assigned: liabilities, $400,000; assets. $600,000 25. Richard H. Allen & Co., bankers and commis sion merchants, New York, assigned, liabili ties $1,000,000; Thomas H. Allen & Co., Memphis correspondents of the New York firm, also went under: liabilities, $750,000: as sets, $1,500,000 Receiver appointed in New York for the Ore gon Improvement company, Henry Villard's pet scheme; liabilities, $2,000,000; assets much larger 26. Bell & Eyster, bankers, assigned at Duluth Minn.: liabilities, $5,235,211: assets, $4,124, 112 28. B. K. Jamison & Co., Philadelphia bankers, as signed DECEMBER. 2. Bank of Commerce, at West Superior, Wis. assigned. First National bank of Texarkana, Ark., sus pended; liabilities, $150,000; assets, $225,000 5. Delamater & Co., bankers, Meadville, Pa., as signed V. & A. Meyer, of New Orleans, assigned liabilities. $1,500,000; assets, $2,000,000