1.

December 24, 1931

The Jersey Journal

Jersey City, NJ

Click image to open full size in new tab

Article Text

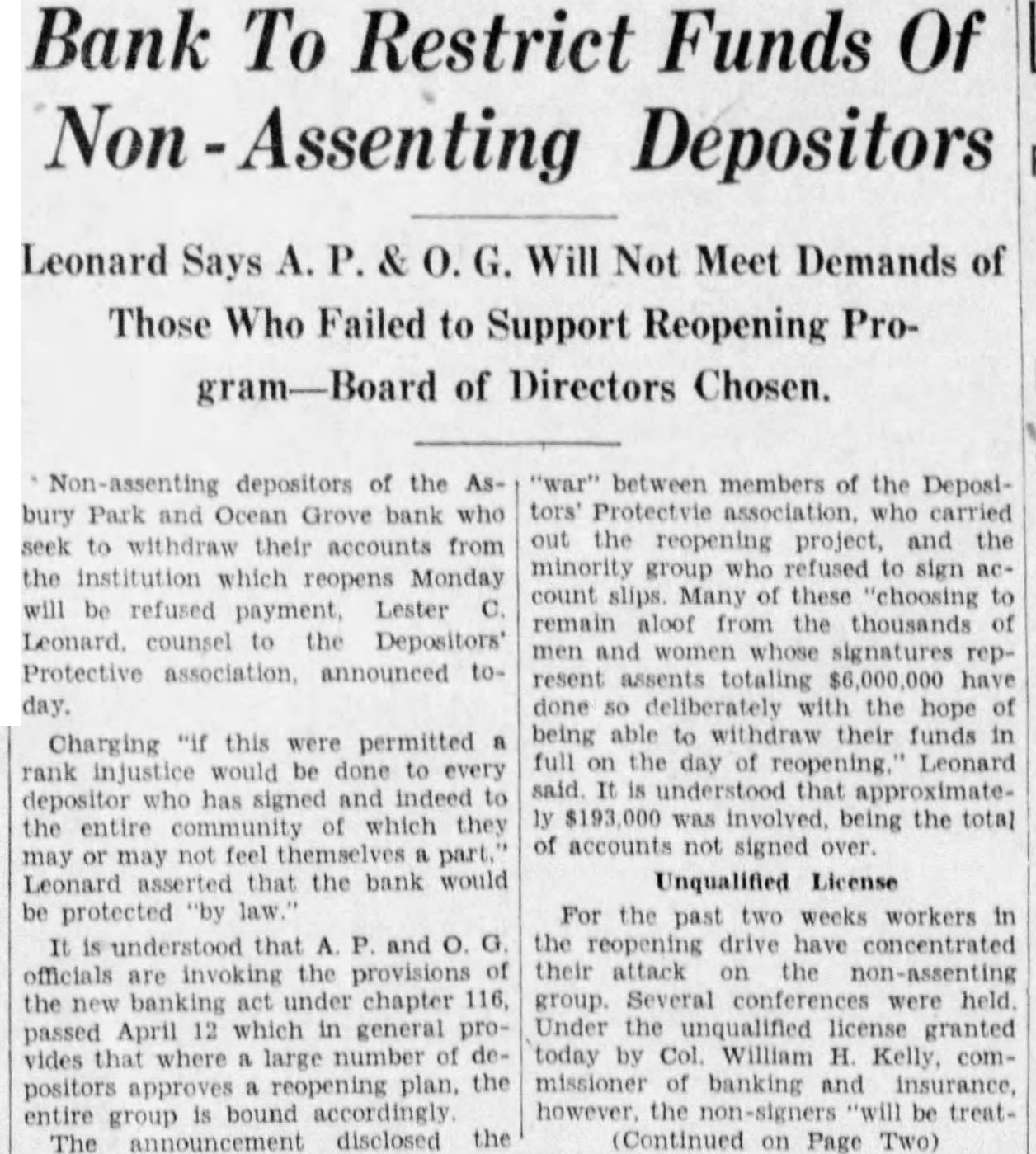

MAYOR HALTS RUN ON BANK

Leaves Sickbed to Stem Wave of Fright Among Depositors.

ASBURY PARK. (AP) Mayor Clarence E. Hetrick, who has been seriously ill for the past six months, left his sick bed to stop run on the Asbury Park and Ocean Grove Bank, the largest bank in Monmouth County, with resources of It was the mayor's first public appearance Summer. The effect of his presence and his halted the suddenly had begun. was deposhundreds more talked excitedly for the mayor unexappeared. Men and women stood aside to let him inside. Standing the pass midst the crowd indoors mayor held up his hands for silence. Then he spoke. heard this," he said, "and have you that down are You are unwise in own this spoke further He told the people confidence in the judg. ment the men whom they had their money He paused and voices began murThen someone muring cheered Almost instantly others began cheering The mayor's wan face relaxed and he smiled and the crowd. taking heed his words, Banking hours went the doors of the building closed.

NEW HAVEN Connecticut closed their officers expressed the belief positors would be paid full. The Merchants' Trust Company of Wawith deposits of nearly 000,000. did not open, statement by directors said, because of the depreThe bank of Sanditz Traurig at Merchants Trust positor closed during the morning because not obtain funds the other bank meet depositors' mands. said, however, the 100 percent solvent.' New Haven the Broadway Bank and Trust Company, with deposits about not open heavy withdrawals during the last week.

2.

December 24, 1931

The Morning News

Wilmington, DE

Click image to open full size in new tab

Article Text

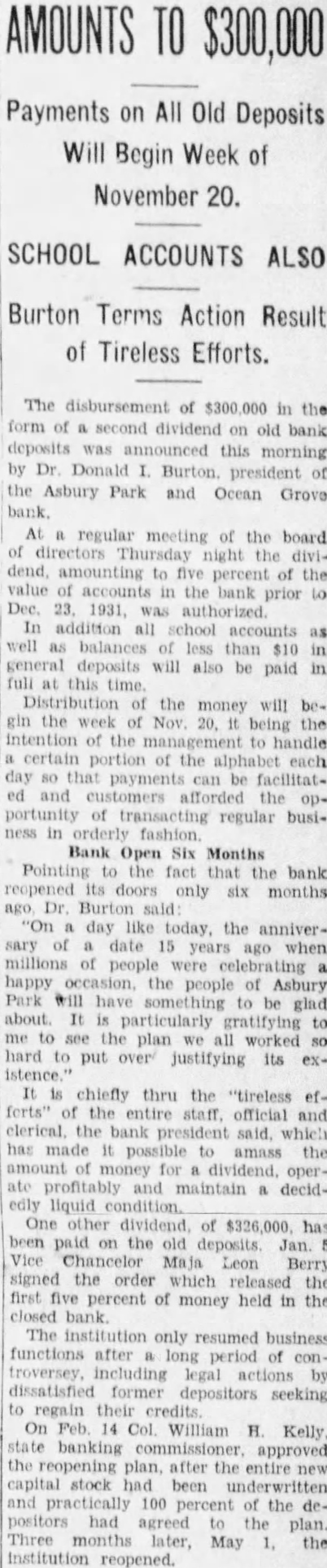

MAYOR LEAVES DEATHBED .TO HALT RUN ON BANK

Dissuades Asbury Park, J., Crowd To Touch Funds ASBURY PARK, Dec sick man appeared pectedly in crowd anxious bank depositors, dissuaded them from withdrawing their funds and sent them today. He was Mayor Clarence Hetrick, seriously for six months. Mayor Hetrick his bed for the first time he became ill, dressed and drove to the Asbury Park and Ocean Grove Bank largest in Monmouth County, will resources of $12,have come from my deathbed." he told the crowd, you you are about bring the house down on your heads. You are unwise in acting this He paused and voices murmured approval The throng took The Mayor's face into broad smile. He departed and so did the depositors Three Monmouth County banks were closed during the day and taken over by the banking authorities.

3.

December 24, 1931

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

THREATENED BANK RUN IS AVERTED BY MAYOR By the Associated Press. ASBURY PARK, N. J., December 24 -Mayor Clarence E. F. Hetrick left his bed yesterday for the first time since he became ill six months ago, dressed and drove to the Asbury Park and Ocean Grove Bank, where he dissuaded a crowd of anxious depositors from withdrawing their funds. "I have come," he told them, "to warn you you are about to bring the house down on your heads. You are unwise in acting this way." Somebody cheered, the throng took it up and soon departed. Three Monmouth County banks were closed during the day and taken over by the banking authorities.

4.

December 24, 1931

The Evening Sun

Baltimore, MD

Click image to open full size in new tab

Article Text

RESERVE BANK CREDIT OUT STILL DECLINES in the first half of December. After with deposits of about $2,700,000, rethe middle of however, the closed today. board found that bank in The institution combination of New England were followed by some Averaged $360,000,000 Less In increased withdrawals of currency the former West Haven Bank and Week Of December 12 Than part of which has begun to return. Trust Company and the Home Bank Loans and of member and Trust Company, which merged October Peak banks in leading cities continued to last April with capital of $100,000. Dec. 24-The Federal decline and on December were $370. Reserve Board reports that the volume 000,000 smaller than four weeks earlier. Bonded Wheat Futures Up of reserve bank credit outstanding de- The decrease was equally divided beNew York, Dec bonded clined during November and the first tween the banks' loans and their inwheat futures traded on the Produce half of December, averaging $360,000.- Deposits of these banks, 000 less in the ending December both demand and time, showed Exchange were firm today. Trading 12 than at its October peak seven decrease, with consequent reduction was quiet, owing to the holiday dullweeks earlier. It said the decrease in required reserves. ness. Cables steady and export was in large part in the banks' port- sales aggregated 300,000 bushels. New 3 BANKS STAY CLOSED folio of acceptances, as discounts for York cleared 218,000 bushels. December member banks and holdings of United Asbury Park, N. Dec. 24 (A)-The closed 50 bid. up 1/2; May 547/8 bid. 55% States showed little change asked, up % and for the Asbury Park and Ocean Grove Bank. July 56 period. the largest in Monmouth county, did asked. up 1/2. The decline in total volume of renot open for today. Officials serve credit outstanding during the period reflected growth of $100,000. said they hoped the closing would be only ELEC. NOTICES, MEETINGS, ETC. 000 in the stock of gold The First National Bank of Bradley largely through imports from Japan. Beach also failed to open for business and continued reduction in the reThe serve balances of member banks, re- Trust Deposits of the Asbury Park and flecting further liquidation of memmore Ocean Grove Bank. as listed the ber bank credit. Demand for currency September 29 statement, were $9,951,989 declined during the last three weeks of November and showed considerably properly less than the usual seasonal increase West Haven Bank and Trust Company,

5.

December 24, 1931

St. Louis Globe-Democrat

St. Louis, MO

Click image to open full size in new tab

Article Text

MAYOR'S CALM REMARKS STOP RUN ON BANK

By Associated Press. ASBURY PARK, N. J., December 23.-Mayor Clarence E. F. Hetrick left his bed today for the first time since he became in six months ago, dressed and drove to the Asbury Park and Ocean Grove Bank where he dissuaded crowd of anxious depositors from \withdrawing their funds. "I have come,' he told them, "to warn you you are about to bring the house down on your heads. You are unwise in acting in this way.' Somebody cheered, the throng took it up and soon departed. Three Monmouth County banks were closed the day and taken over by the banking authorities. to provide for the gradual completion of the By owning its system, Mayor Ruth pointed out, the city will be able to use more candle power at no increase in the lighting budget. Passage of the bond issue has been approved by officers and trustees of University City vement associations at recent meetings, Mayor Ruth announced.

6.

December 24, 1931

Omaha World-Herald

Omaha, NE

Click image to open full size in new tab

Article Text

Bank Suspensions.

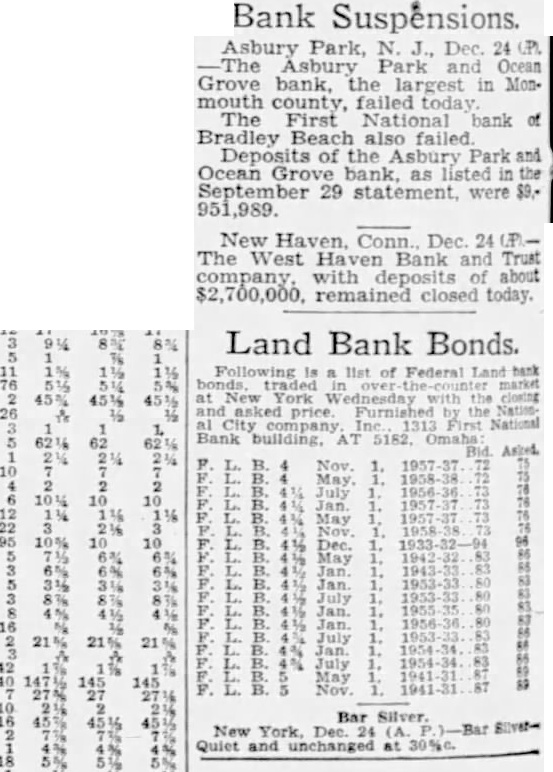

Asbury Park, N. J., Dec. 24 The Asbury Park and Ocean Grove bank, the largest in Monmouth county, failed today The First National bank Bradley Beach also failed Deposits of the Asbury Park Ocean Grove bank, as listed September 29 statement, were $9.951

New Haven, Conn. Dec 24 The West Haven Bank and Trust company, with deposits of about $2,700,000, remained closed today.

Land Bank Bonds. Federal

7.

January 1, 1932

The Keyport Weekly

Keyport, NJ

Click image to open full size in new tab

Article Text

STATE WOULD COMPEL PLANT

(Continued from first page)

Irom which a revenue could be derived and that the return would barely pay the interest on the cost of making the extension. He said that would be necessary to celve at least 10 per cent return on the principal invested. We are quite willing. said Mayor Wyckoff, "to water at a profit and if you can show us a guarantee that will warrant making the extension the proposition will be considered. It was suggested that the Matawan Township Committee submit to the Borough Council a statement of what would Councilman Smith chairman of the Water Committee, in reporting on the feasibility of rebuilding and extending water mains on a portion of Fulton and Eighth Streets sug. gested that the Council as whole look over the situation and It was decided that this would be done Councilman Van Pelt reported progress on the matter of introducing ordinances providing for merchantile licenses and prohibiting the distribution of circulars The introduction of such ordinances had been requested by the Keyport Chamber of Commerce Mayor Wye. koff suggested that the Council have a conference with the Cham ber of Commerce on the matter and that the merchants of Keyport be invited to attend a meeting of the Council and express their individual opinions of the needs of such ordinances

The matter of a compromise of tax liens on the George Crawford property was presented by Borough Attorney Howard W. Roberts The property was bid in at tax sale by Attorney Ezra W. Karkus for the benefit of the heirs to the estate Allen Poling represented the heirs at the meeting Monday night. The matter was referred to a committee consisting of Councilmen Camp. Smith and Van Pelt The financial statement of Collector Charles R. Davison showed that there was a balance of $8,896.71 in the general fund. $437.03 in the water account and $834.14 in the capital and trust account Bills to the aggregate sum of $7.977 45 were approved for payment. By resolution, an emergency appropriation of $284.20 was made for the care of the poor A water anticipation note for $1,300 was authorized. This note, given for three months. is payable at the Peoples National Bank An unexpended balance of the street appropriation of $843.62 the sum of $446.02 was transferred to the police appropriation and $397.60 to the sewer appropriation. accounts All excitement has entirely subsided. Many deposits were made to express confidence in the institution and a cial confidence was manifest in large private deposit made the first the Hon, Henry E. Ackerson, president of The Peoples National Bank when interviewed said, "We are deeply appreciative of the splendid confidence manifested at this time by the people of the community in the integrity and stability of the Borough's financial institutions The Matawan Bank is the eighth Lanking institution to close Monmouth County in less than week. The Seacoast Trust Company of Asbury Park was the first to close on Tuesday afternoon last week. The following day the Merchants Trust Company of Red Bank the New Jersey Trust Company and the Citizens National Bank both of Long Branch, were closed The fifth bank to suspend business was the Asbury Park and Ocean Grove Bank of Asbury Park and the following notice signed by George Compton a bank examiner was posted on the The of Banking and Insurance has taken of the business and property of the Asbury Park and Ocean Grove Bank The bank is state institution and is the largest in Monmouth County in the matter of resources which total more than $12,000,000 The combined resources of the other four banks according to the financial statements filed with the State Department of Banking and and Insurance on September 29 last amounted to $11,361,326 Bank depositors continuing their heavy withdrawals from Monmouth County banks forced two more of the institutions in the Asbury Park district to close immediately after the Asbury Park and Ocean Grove bank suspened business These were the First National Bank of Bradley Beach and the Ocean Grove National Bank The officers and directors of these banks said the institutions were sound. that the closings were necessary to conserve assets and that the banks would be reorganized at once and pay all demands in full They attributed the heavy withdrawals to the failure of the Seacoast Trust Company and the withdrawals from other banks that resulted. The general unrest was probably largely responsible for the closing of all the banks. along with the inability to realize on loans due to the depression and that business was suspended in the interest of depositors

8.

January 1, 1932

Matawan Journal

Matawan, NJ

Click image to open full size in new tab

Article Text

RUMORS CAUSE OF BANK'S SUSPENSION

(Continued from page one) phone calls from friends and strangers from all over the county expressing their confidence in his bank these times of stress and be was no small satisfaction to be able to look back upon the safe and conservative policy always followed with view of safeguarding the interests of the depositors happenings

"The bank. established over 102 years ago, has for that long period been under the management of three generations of the same family and for over hundred years has had the same correspondto The First National Bank of New York; unquestionably the strongest bank in the world During the last 25 or 30 years its policy has been largely guided by James L. former president of The First National Bank of Red Bank, pronounced by the late George G. Baker. president of the First National Bank of New York. as the ablest financier in New Jersey, also by John Terhune, president of the Long Branch Trust unquestionably the strongest and most successful banking institution in the county and by its present president. The closing of The Matawan Bank caused small flurry at The Farmers and Merchants National Bank Saturday and Monday. largely by women, many of whom drew from their savings account and called for their safety deposit boxes This timidity did not take hold of the business men, of whom it was said the bank, every merchant from Bailey's store to the station made their customary Monday morning deposits There were not half the number demands that were expected, and for which large preparation had been made were registered. Instead of the anticipated many new accounts were opened by people throughout the county some of whom lived at considerable distance. Tuesday's payments were made in gold but there were few takers

Keyport was not without some actions. but as in Matawan, these were not by the business men where was reported at both banks usual business deposits were made of very substantial nature. showing that the purchases must have had been largely made with the Keyport merchants No Keyport business man withdrew his account in either of their bankinstitutions Palmer Armstrong. president of the Keyport Banking Company. said the excitement in his bank was mainly among depositors who did not understand conditions and among some others who drew their savings accounts All excitement has entirely subsided. Many deposits were made to express confidence in the institution and sp # cial confidence was manifest in large private deposit made the first of the

Hon Henry E. Ackerson. president of The Peoples National Bank. when interviewed We are deeply appreciative of the splendid confidence manifested at this time by the people of the community the integrity and stability of the Borough's financial institutions

The Matawan Bank is the eighth banking institution to close Monmouth County in less than week. The Seacoast Trust Company of Asbury Park was the first close on Tuesday afternoon last week The following day the Merchants Trust Company of Red Bank, the New Jersey Trust Company and the Citizens National Bank both of Long were

The fifth bank to suspend business was the Asbury Park and Ocean Grove Bank of Asbury Park and the following notice signed by George bank was posted on the bank Commissioner of Banking and Insurance has taken of the business and property of the Asbury Park and Ocean Grove Bank The bank is state institution and the largest in Monmouth County the matter of which total more than $12,000,000 The combined resources of the other four banks according to the financial statements filed with the Department of Banking and and Insurance September amounted to Bank depositors continuing their heavy withdrawals from Monmouth banks forced more institutions in the Asbury Park district to close immediately after the Asbury Park and Ocean Grove suspened These the First National Bank of Beach and the Ocean Grove Bank

The officers and directors of these said the institutions were that the were necesassets and that and all demands full attributed with. the failure of the Trust Company and the from other banks that

The general unrest was probably largely responsible for the closing banks with the

9.

January 19, 1932

Asbury Park Press

Asbury Park, NJ

Click image to open full size in new tab

Article Text

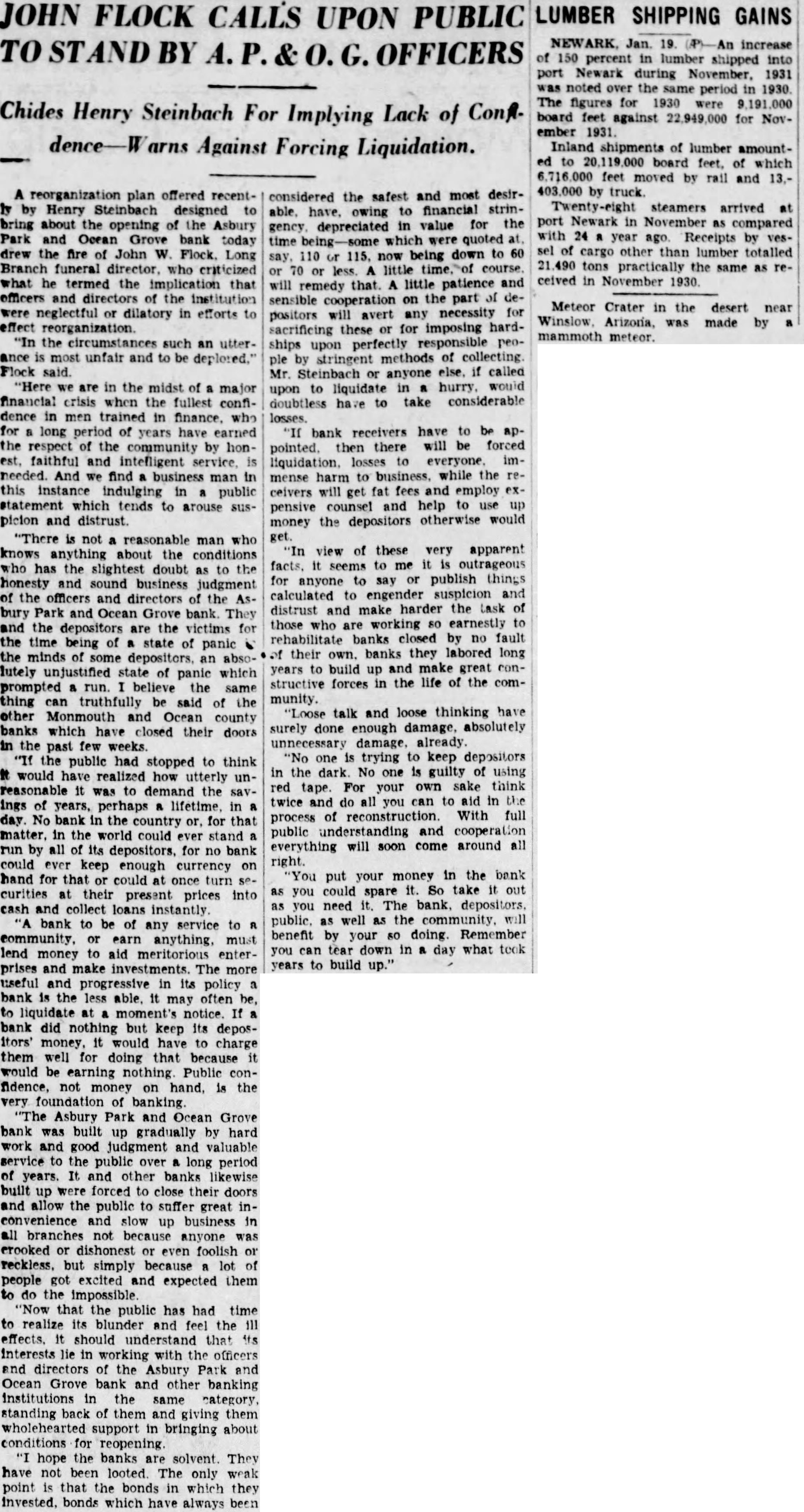

JOHN FLOCK CALLS UPON PUBLIC LUMBER SHIPPING GAINS NEWARK, Jan. 19. increase TO STAND BY A. & G. OFFICERS of 150 percent in lumber shipped into

Chides Henry Steinbach For Implying Lack of Confldence-Warns Against Forcing Liquidation.

A reorganization plan offered recentby by Henry Steinbach designed to bring about the opening of the Asbury Park and Ocean Grove bank today drew the fire of John W. Flock. Long Branch funeral director, who criticized what he termed the implication that officers and directors of the institution were neglectful or dilatory in efforts to effect reorganization. "In the circumstances such an utterance is most unfair and to be deplored, Flock said. "Here we are in the midst of major financial crisis when the fullest confidence in men trained in finance. who for long period of years have earned the respect of the community by honest. faithful and intefligent service, is needed. And we find business man in this instance indulging in public statement which tends to arouse suspicion and distrust. "There not reasonable man who knows anything about the conditions who has the slightest doubt as the honesty and sound business judgment of the officers and directors of the Asbury Park and Ocean Grove bank They and the depositors are the victims for the time being of a state of panic the minds of some depositors, an absolutely unjustified state of panic which prompted run. believe the same thing can truthfully be said of the other Monmouth and Ocean county banks which have closed their doors in the past few weeks. "If the public had stopped to think It would have realized how utterly unreasonable it was to demand the savings of years, perhaps a lifetime. in day. No bank in the country or, for that matter. in the world could ever stand run by all of its depositors, for no bank could ever keep enough currency on hand for that or could at once securities at their present prices into cash and collect loans instantly "A bank to be of any service to R community. or earn anything. must lend money to aid meritorious enterprises and make investments. The more useful and progressive in its policy bank is the less able. it may often be, to liquidate at notice. If a bank did nothing but keep its depositors' money, it would have to charge them well for doing that because it would be earning nothing Public confidence, not money on hand, is the very foundation of banking "The Asbury Park and Ocean Grove bank was built up gradually by hard work and good judgment and valuable service the public over long period of years. It. and other banks likewise built up were forced to close their doors and allow the public to suffer great inconvenience and slow up business in all branches not because anyone was crooked or dishonest or even foolish or reckless. but simply because lot of people got excited and expected them to do the impossible "Now that the public has had time to realize its blunder and feel the ill effects. it should understand that its interests lie in working with the officers and directors of the Asbury Park and Ocean Grove bank and other banking institutions in the same category. standing back of them and giving them wholehearted support in bringing about conditions for reopening "I hope the banks are solvent They have not been looted. The only weak point that the bonds in which they invested. bonds which have always been considered the safest and most desirable. have, owing to financial stringency depreciated in value for the time which were quoted being down to 60 110 or now or 70 or less. little time. course. will remedy that. A little patience and sensible cooperation on the part of depositors will avert any necessity for sacrificing these or for imposing hardships upon perfectly responsible people by stringent methods of collecting. Mr. Steinbach or anyone else. if called upon to liquidate in hurry. would doubtless have to take considerable losses. "If bank receivers have to be appointed. then there will be forced liquidation. losses to everyone. immense harm to business. while the receivers will get fat fees and employ expensive counsel and help up money the depositors otherwise would get.

"In view of these very apparent facts. it seems to it outrageous for anyone to say or publish things calculated to engender suspicion and distrust and make harder the task of those who are working 80 earnestly to rehabilitate banks closed by no fault of their own. banks they labored long years to build up and make great constructive forces in the life of the community. Loose talk and loose thinking have surely done enough damage, absolutely unnecessary damage. already "No one is trying to keep depositors in the dark No one is guilty of using red tape. For your own sake think twice and do all you can to aid in the process of reconstruction. With full public understanding and cooperation everything will soon come around all You put your money in the bank as you could spare it. So take it out as you need The bank. depositors. public. as well as the community. will benefit by your so doing. Remember you can tear down in day what took years to build up." port Newark during November, 1931 was noted over the same period in 1930. The figures for 1930 were 000 board feet against 22,949,000 for November 1931. Inland shipments of lumber amounted to 20,119,000 board feet. of which 6,716,000 feet moved by rail and 13,by truck. Twenty-eight steamers arrived at port Newark in November as compared with 24 year ago Receipts by vessel of cargo other than lumber totalled 490 tons practically the same as recelved in November 1930.

Meteor Crater in the desert near Winslow, Arizoria, was made by mammoth meteor.

10.

January 19, 1932

Asbury Park Press

Asbury Park, NJ

Click image to open full size in new tab

Article Text

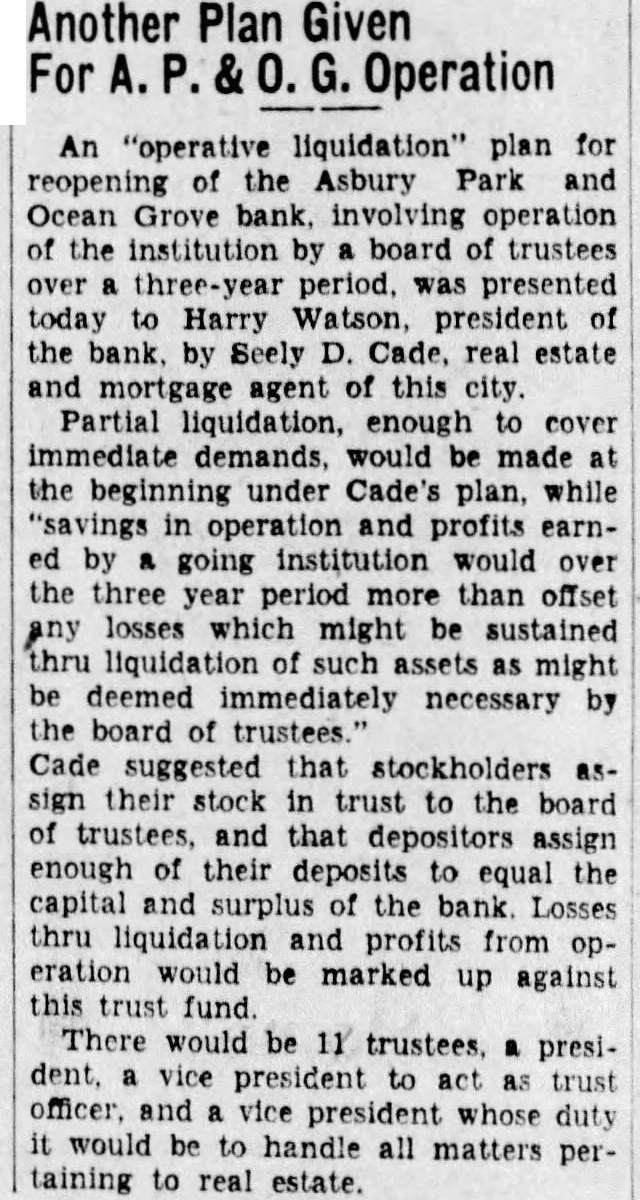

Another Plan Given For A. P. & 0. G. Operation

An "operative liquidation" plan for reopening of the Asbury Park and Ocean Grove bank. involving operation of the institution by board of trustees over three-year period. was presented today to Harry Watson, president of the bank. by Seely D. Cade, real estate and mortgage agent of this city. Partial liquidation, enough to cover immediate demands, would be made at the beginning under Cade's plan, while "savings in operation and profits earned by going institution would over the three year period more than offset any losses which might be sustained thru liquidation of such assets as might be deemed immediately necessary by the board of trustees." Cade suggested that stockholders assign their stock in trust to the board of trustees, and that depositors assign enough of their deposits to equal the capital and surplus of the bank. Losses thru liquidation and profits from operation would be marked up against this trust fund. There would be 11 trustees. president, vice president to act as trust officer, and vice president whose duty it would be to handle all matters pertaining to real estate.

11.

February 19, 1932

The Waterbury Democrat

Waterbury, CT

Click image to open full size in new tab

Article Text

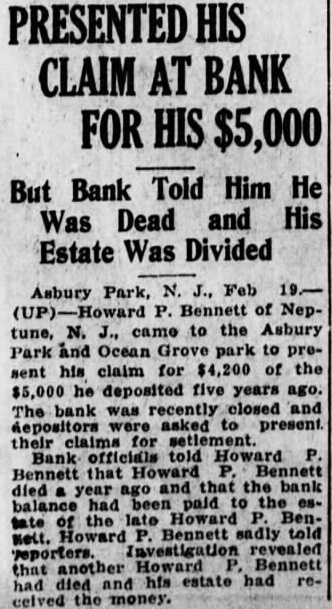

HIS CLAIM AT BANK FOR HIS $5,000

But Bank Told Him He Was Dead and His Estate Was Divided

Asbury Park, N. Feb 19P. Bennett of NepN. J., came to the Asbury tune, Park and Ocean Grove park to present his claim for $4,200 of the $5,000 he deposited five years ago. The bank was recently closed and depositors were asked to present. their claims for setiement. Bank officials told Howard P. Bennett that Howard that Bennett ago and the bank died balance had paid to the estate the late Howard BenMett. Howard P. Bennett sadly told reporters. Investigation revealed Bennett that another Howard had died his estate had rethe money.

12.

September 8, 1932

The Central New Jersey Home News

New Brunswick, NJ

Click image to open full size in new tab

Article Text

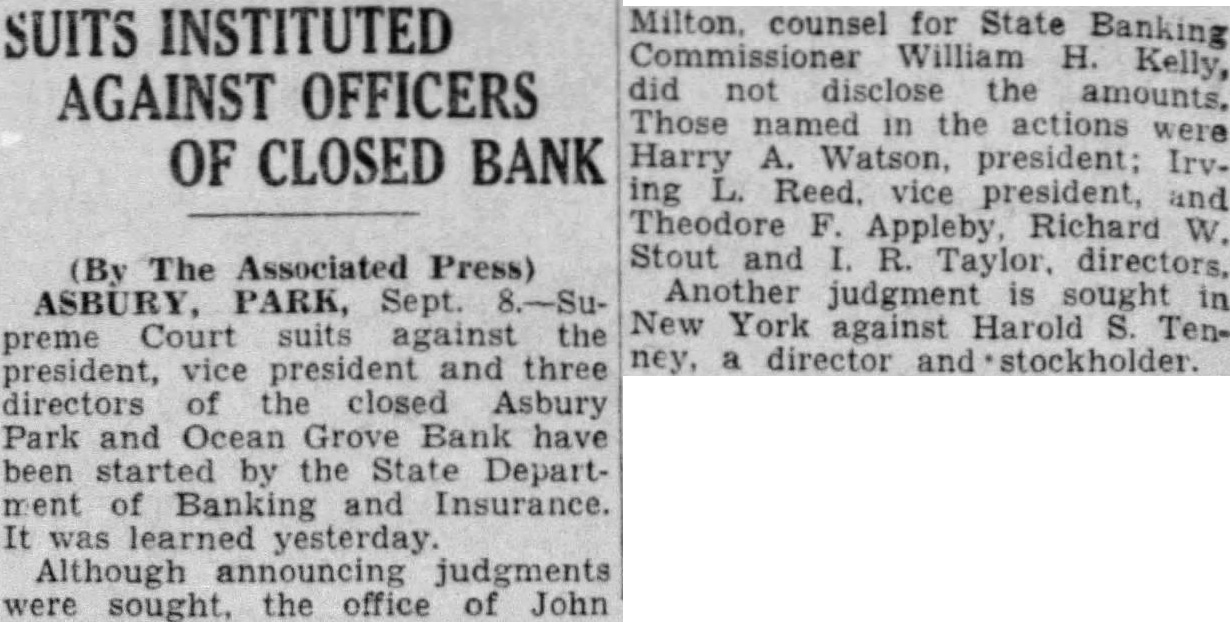

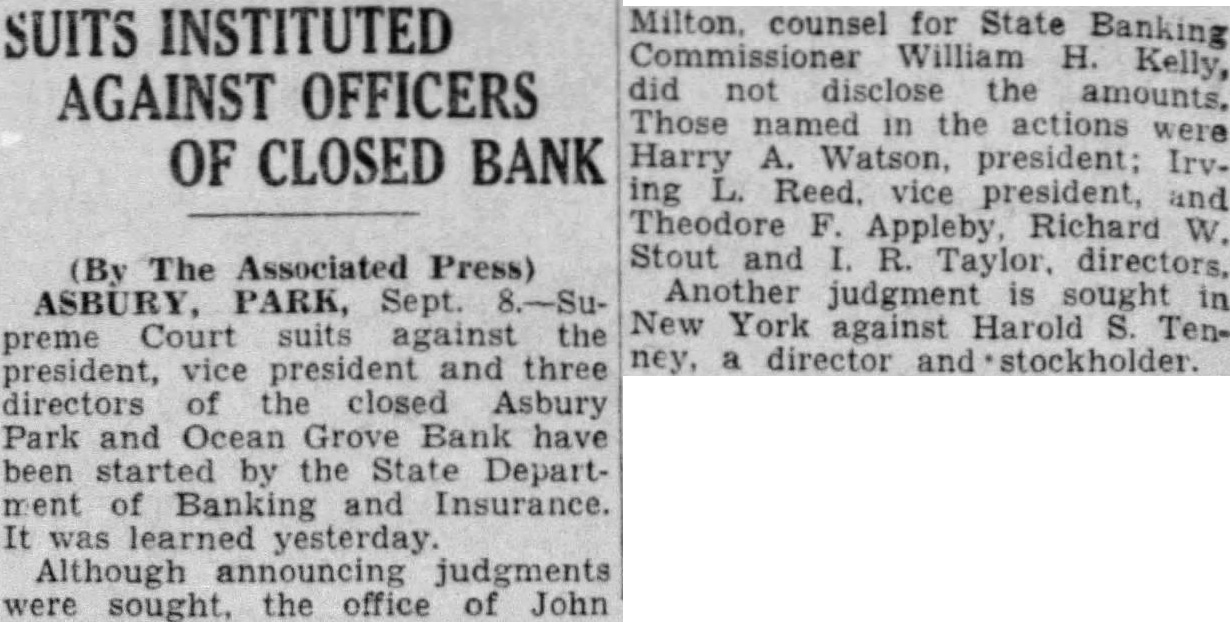

SUITS INSTITUTED AGAINST OFFICERS OF CLOSED BANK

(By The Associated Press) ASBURY, PARK, Sept. 8.-Supreme Court suits against the president, vice president and three directors of the closed Asbury Park and Ocean Grove Bank have been started by the State Depart ment of Banking and Insurance. It was learned yesterday.

Milton. counsel for State Banking William H. Kelly, did not disclose the amounts, Those named in the actions were Harry A. Watson, president; Irv. ing L. Reed. vice president, and Theodore F. Appleby Richard W. Stout and R. Taylor, directors, Another judgment is sought in New York against Harold S. Tenney, a director and stockholder

13.

December 17, 1932

The Jersey Journal

Jersey City, NJ

Click image to open full size in new tab

Article Text

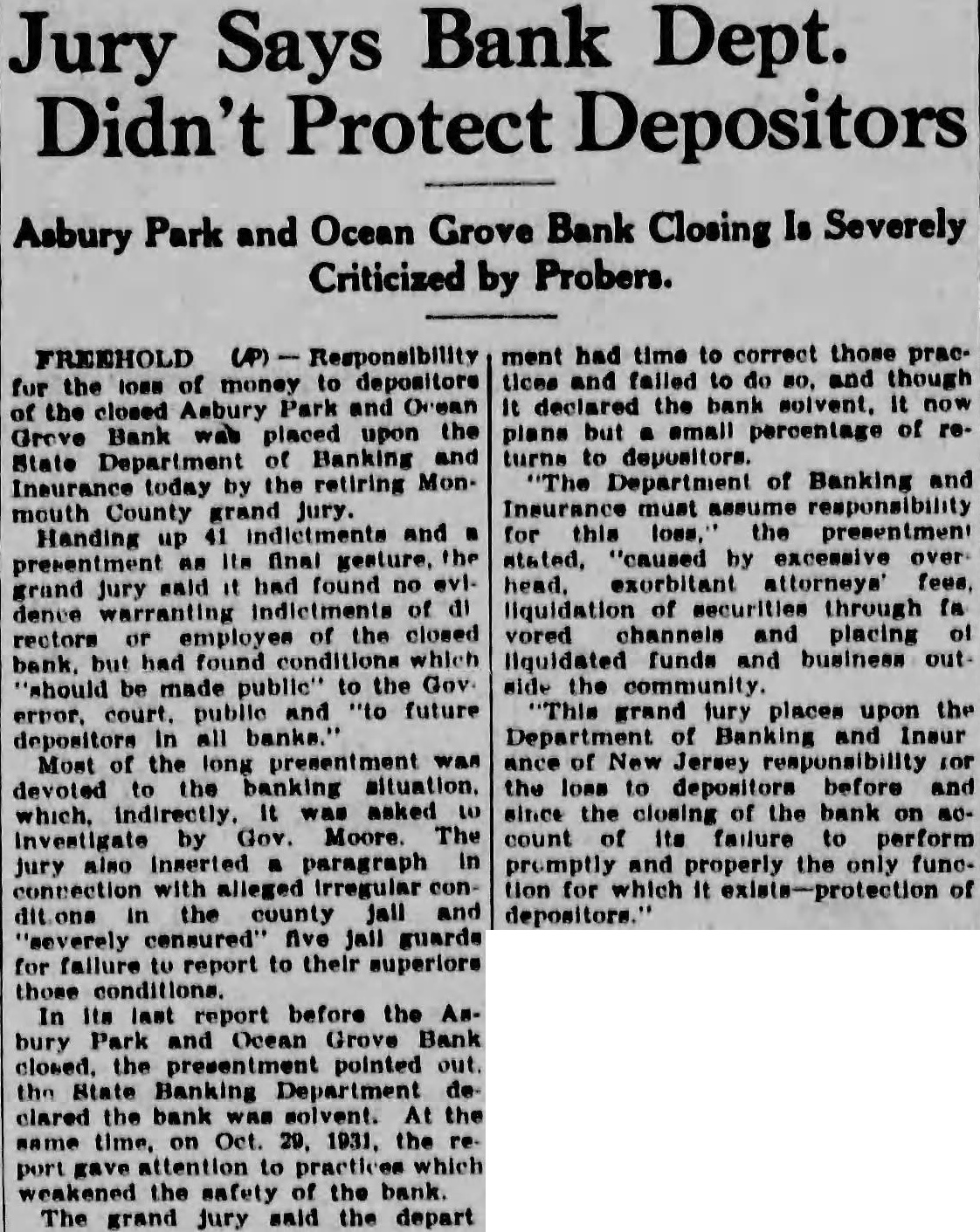

Jury Says Bank Dept. Didn't Protect Depositors

Asbury Park and Ocean Grove Bank Closing Is Severely Criticized by Probers.

FREEHOLD (AP) Responsibility the of money depositors for of the closed Asbury Park and Orean Grove Bank placed upon the State Department Banking Insurance today the retiring Monmouth grand Jury. and Handing up its final the grand Jury said it had found no evidence of di employee of the closed rectors had found which but "should made public" to the Gov court. public and "to future depositors all banks. Most the long presentment was devoted banking situation. which, indirectly. asked Investigate Gov. Moore. The jury also inserted paragraph in connection with alleged concounty and "severely consured' five jail guards for failure report to their superiors In its last report before the Anbury Park and Ocean Grove Bank closed. the presentment pointed out. the State Banking Department clared the bank solvent. At the same time, Oct. 29. 1931. the gave which weakened the safety of the bank. The grand jury said the depart ment had time to correct those pracand falled to do so, and though It declared the bank solvent, plane but email percentage of returns to "The Department of Banking and must responsibility for this the presentment stated. "caused by excessive over attorneys' liquidation of securities through in vored channels placing liquidated funds and business out side the community. "This grand jury places upon the Department of Banking Insur ance of New Jersey responsibility for the loss to depositors before and since the closing of the bank on account its failure to perform promptly and properly the only funetion for which It of depositors.

14.

February 3, 1933

Asbury Park Press

Asbury Park, NJ

Click image to open full size in new tab

Article Text

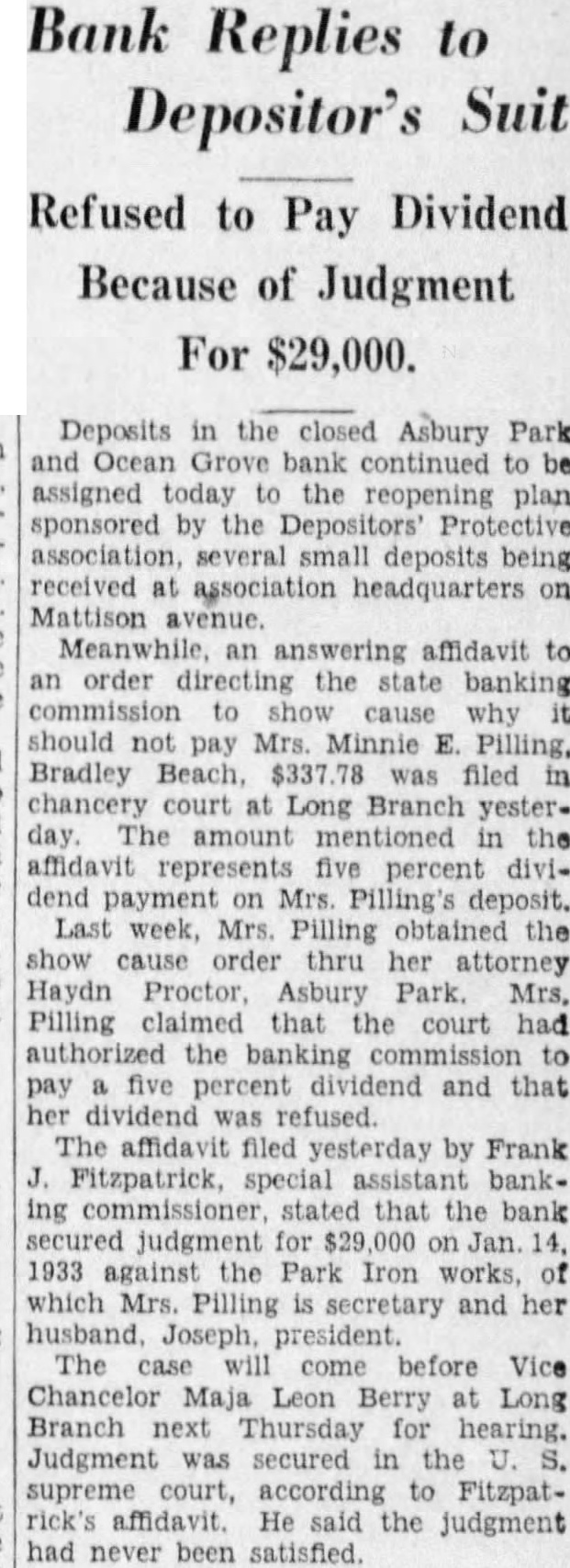

Bank Replies to Depositor's Suit

Refused to Pay Dividend Because of Judgment For $29,000.

Deposits the closed Asbury Park and Ocean Grove bank continued assigned today reopening plan sponsored the Depositors' Protective association several small deposits being received association headquarters on Mattison Meanwhile. affidavit to order the state banking should pay Mrs. Minnie Pilling, Bradley Beach, chancery court Long Branch yesterfive dividend Last week, Mrs. Pilling thru her attorney Haydn Proctor Asbury Park. Mrs. Pilling claimed court had authorized banking and that dividend affidavit filed yesterday by Frank Fitzpatrick, special commissioner stated that the secured judgment for 1933 against Park Iron works which Mrs. Pilling secretary and her Joseph, president. The case come before Vice Chancelor Maja Leon Berry Long Branch Thursday for Judgment secured supreme according Fitzpatthe judgment had never been satisfied.

15.

March 2, 1933

Asbury Park Press

Asbury Park, NJ

Click image to open full size in new tab

Article Text

Local Happenings

Mrs. Elizabeth Chandler Wanamassa, visited today in New York.

Mrs. John Day Deal Lake drive, the New Weston hotel, New York city.

Miss Eleanor Mears of the Mayfair Bradley Beach, suffering from severe cold.

Mrs. Charles Castofos, 514 Main street, Bradley Beach, been her home the grip. regular monthly meeting company Ocean Grove, will held tonight o'clock.

Commdr. Sands of the coast guard, Washington on official business.

Thomas Flanagan, 705 Seventh avenue, has left for Scranton where will remain for month on business.

Mrs. Ida Sherman 927 Bangs York the Clinton hotel.

Mr. Mrs. Caffery of this located the Park Central hotel during their stay in New York city.

Justice of the Peace Sigmund Eisewill the regular the County in the district court room here tonight.

Mrs. George Kemble of 121 Asbury avenue, Ocean Grove, patient the Fitkin hospital, where she was to operated on today.

About 50 men at work at the site Seaboard company's plant clearing and for the foundations.

Miss Peggy Yull of Spring Lake, New York city, while visiting in the metropolis.

Mrs. Bessie Banta Ross of 205 Edgemont drive, Arbour has returned home after an extended visit in Florida.

Mr. and Mrs. George Douglas of LawOcean Grove, are the parents of daughter yesterday Memorial hospital, Long Branch.

Thomas Errickson, injured dent, his home, 54 patient the Hazard hospital, Long Branch for

Mrs Mildred Stone, 141 Webb Ocean Grove, has been to her home the past three weeks broken ankle, able attend her duties the closed Asbury Park and Ocean Grove bank.

Ensign and George AnsPark Army, 611 have welGeorge The yesterday in the Gunther nursing home, this city.

Seven vaudvil, dancing feature benefit the and Odd Fellow lodges this district the American Legion Belmar tonight 8.30.

Mr. and Mrs. William Megill and daughter, Fourth and Miss Eleanor Burdge 308 Fourth Bradley Miami, where remain until

An increase business was cited today Pollack owner Golden Kidde Shop, 721 Cook. avenue, the for removal the store 608 The new shop being opened

16.

March 2, 1933

The Daily Record

Long Branch, NJ

Click image to open full size in new tab

Article Text

Injunction Alleges Bank Defeat Scheme

(Continued from First Page) bank. The conspiracy charged Hulick, Green, Preston, some addition to charging that the former the mittee removed in sents, the asserts that Hulick day two previous the closing the withdrew from $5,000, of $350. An the latter amount with those the of the partment, the complaint points Climax Long Dispute Today's action brings to the dispute between the Hulick committee Depositors' Association, headed Donald Burton. Hulick committee of five members and advisory committee early in reopen the Ambury Park and Grove bank. The four members named today's statement May "retired" from the campaign and "your committee that work has been completed possible this time." The Burtons are not relat- the association charged the will and the The campaign point carried by the by Dr. In Septemthe Hulick group turned banking the assents for checking. the the depositors returned the custody Hulick. The recites the wrapand sealed by banking placHulick's custody. On of this year after members the association State Banking Commissioner William H. Kelly the partment made upon DarBurton, acting the absence Hulick, for the return the agreements. Upon rechecking state department it was disclosthat the ments been In this connection today's bill complaint says: "Complainants are verbelieve charge that said fendants, some upon the pretense complying with the quest seveight months prior, subsequent official and recording by the partment after the approval of plan the and and when the said stitution certain, wilfully, assents the defeating preventing the reopening of stitution.

Other Charges Added addition returning said asthe Darius Burton, wilfully, unlawfully and maliciously, and with the same intent purpose, extracted and removed the sealed package previously filed and recorded his assent covering deposit his Burton, amounting the account daughter amounting which sents they now unlawfully retain withhold. William Preston similarly charged with removing assent for deposit and assent daughter's deposit amounting to The referring the financial interest reopening the charges that durthe run on the bank he drew the his deposit, The withdrawal, according the complaint, took day two before closing the bank posit approximately The for this amount, the has not removed. Hulick, Green, Preston and charged having "persistently condemned posed efforts of the reopen the opposition, charged, carried despite their assurances the trary other quarters. argued the association that the assents dividual committee, but obtained public spirited and selfish

Restraint Asked Counsel for the asked Hulick, Green, Preston and Burton restrained from the assents reopening assents the custody the banking department, Burton has requested the return the custody as property Hulick Today's designed secure return the allegedly four and place the custody of the banking The complainants in today's tion are the WilHoward den, Louis Croce, John Alfred Rushton and Wil-

17.

April 29, 1933

Asbury Park Press

Asbury Park, NJ

Click image to open full size in new tab

Article Text

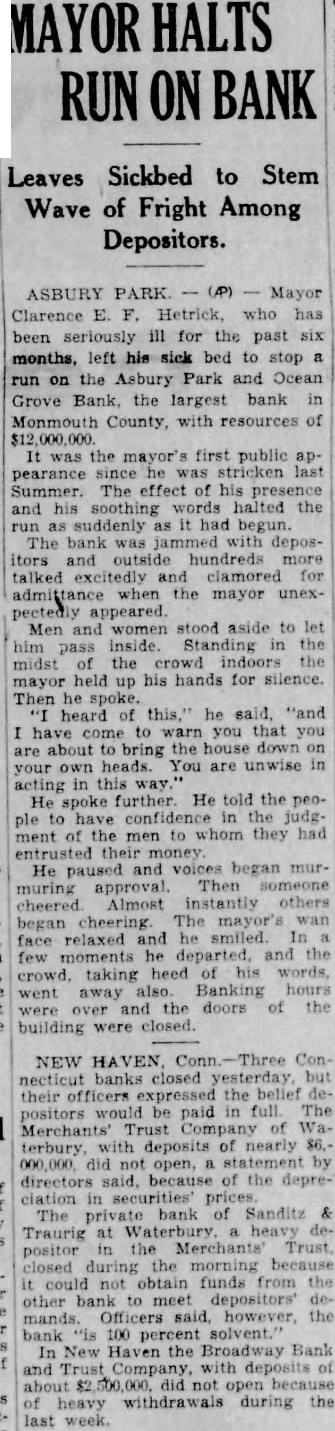

Bank To Restrict Funds Of Depositors

Leonard Says Will Not Meet Demands of Those Who Failed to Support Reopening Proof Directors Chosen. depositors of the bury Park and Ocean Grove bank who withdraw their accounts from the which reopens Monday will refused Lester counsel Depositors' Protective announced

Charging this permitted done every depositor indeed the entire which they may feel Leonard asserted that the bank would protected understood that and officials the chapter passed April which general where reopening the positors bound disclosed the The announcement between members of the DeposiProtectvie carried the reopening project, and the minority group refused sign count Many these "choosing remain aloof the thousands whose signatures resent assents totaling deliberately the being able withdraw their funds full the day Leonard understood approximatebeing the total accounts not signed

Unqualified License

For the past two workers the reopening drive concentrated attack Several were the license granted today by Col. William commissioner banking and insurance, however, the (Continued Page Two)

18.

November 11, 1933

Asbury Park Press

Asbury Park, NJ

Click image to open full size in new tab

Article Text

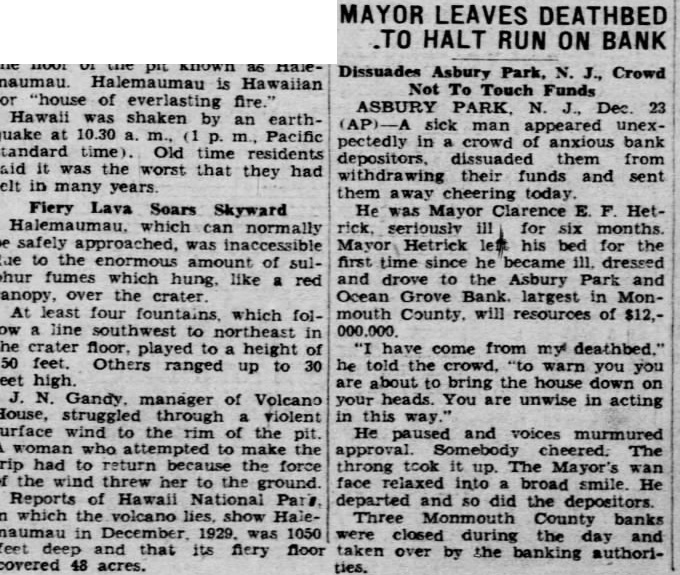

AMOUNTS TO $300,000

Payments on All Old Deposits

Will Begin Week of

November 20.

SCHOOL ACCOUNTS ALSO

Burton Terms Action Result of Tireless Efforts.

The disbursement of $300,000 in the form dividend bank old deposits announced this morning Dr. Donald president the Asbury Park and Ocean Grove bank. regular meeting the board percent the bank addition school accounts balances than $10 deposits also be paid the money will the being the intention the certain the be facilitatand portunity transacting regular busiin orderly Six Months Pointing fact bank six months Dr. Burton day today, the anniverpeople celebrating Asbury Park will glad gratifying the plan hard to put over justifying its chiefly thru the "tireless entire staff. official the bank president which has made possible amass the amount money dividend. profitably maintain decidliquid other dividend of $326,000. has on the old deposits. Chancelor Maja Leon Berry signed the order which released the first five percent of money held in the closed bank. The only resumed business functions after period of conincluding legal actions former depositors seeking regain On William H. banking approved the entire stock been 100 percent the dehad the plan. Three months later, May the reopened.