Click image to open full size in new tab

Article Text

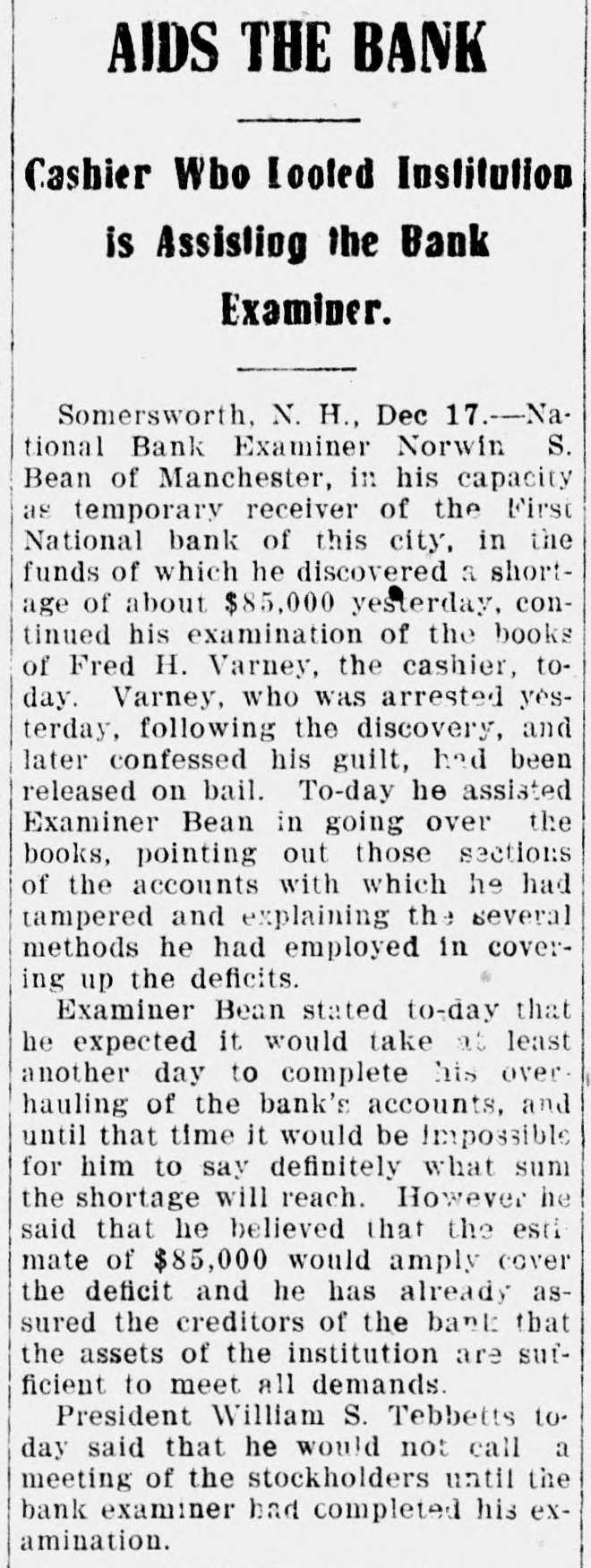

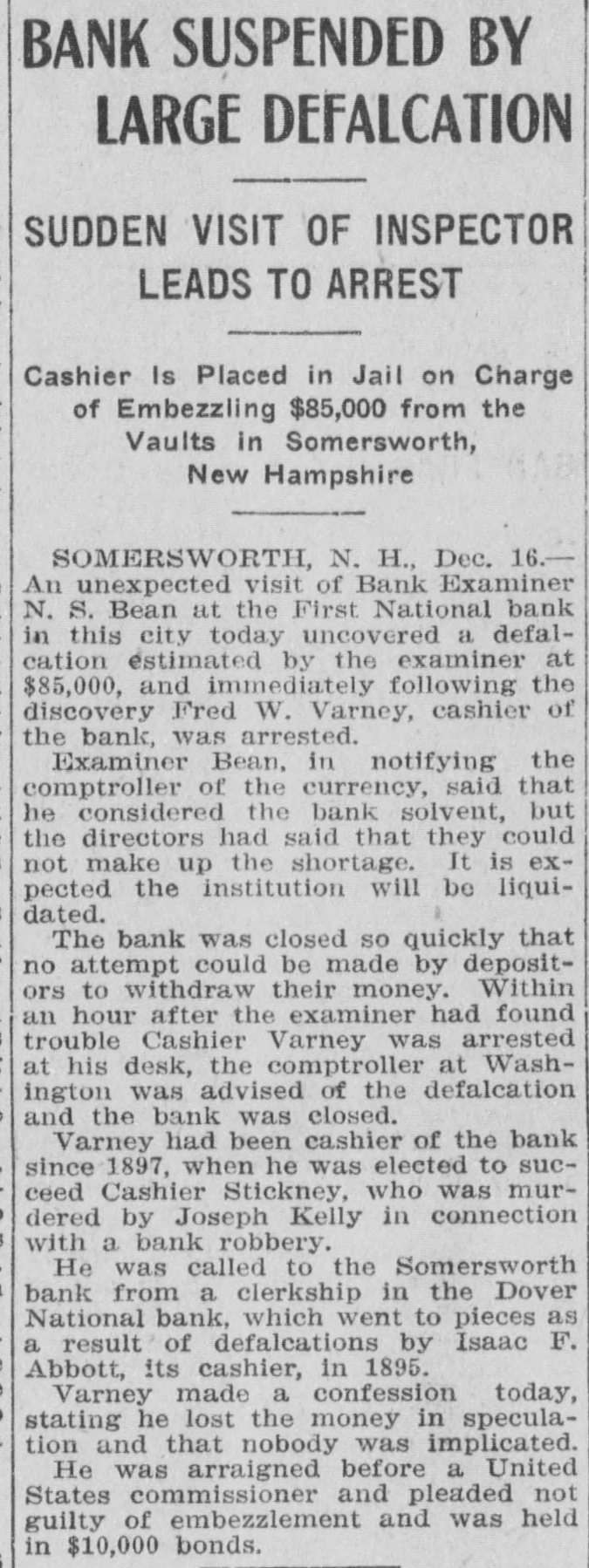

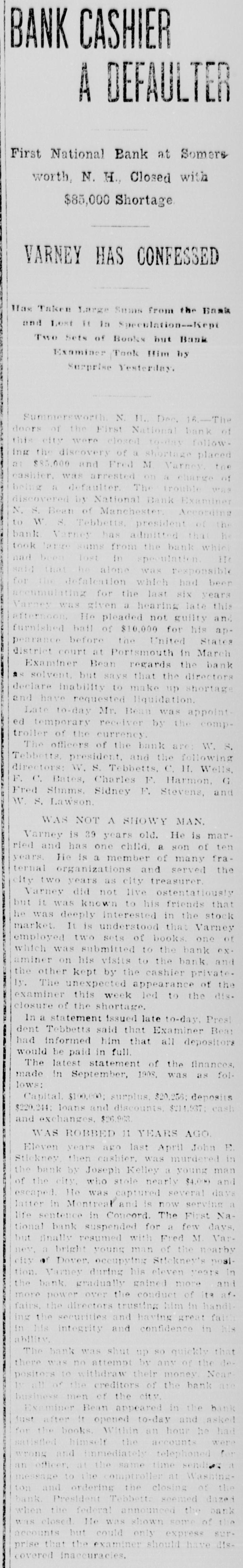

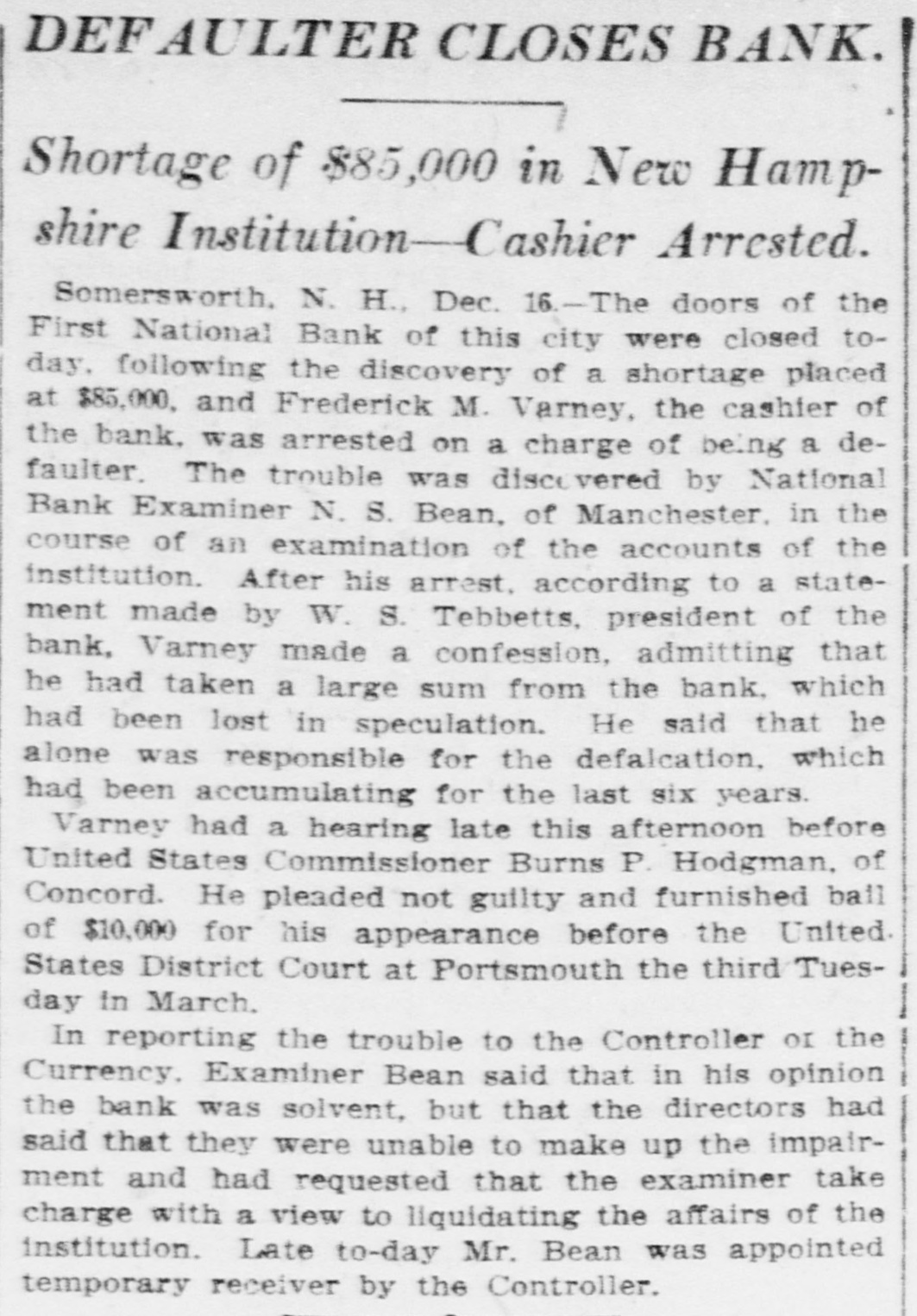

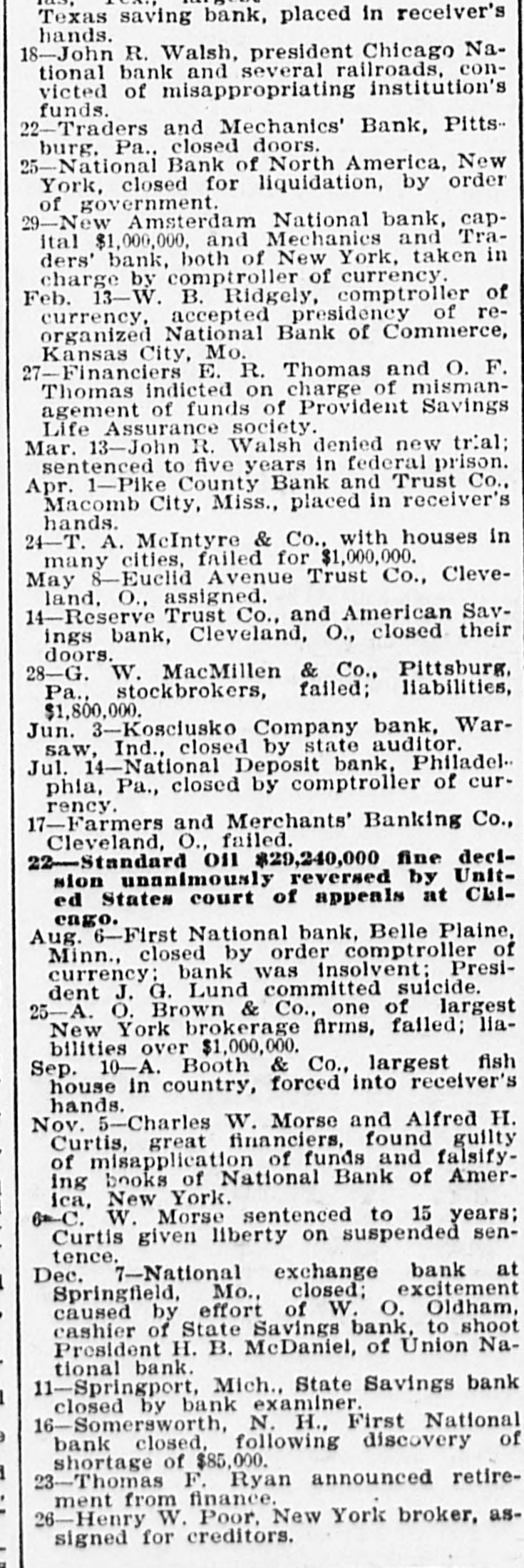

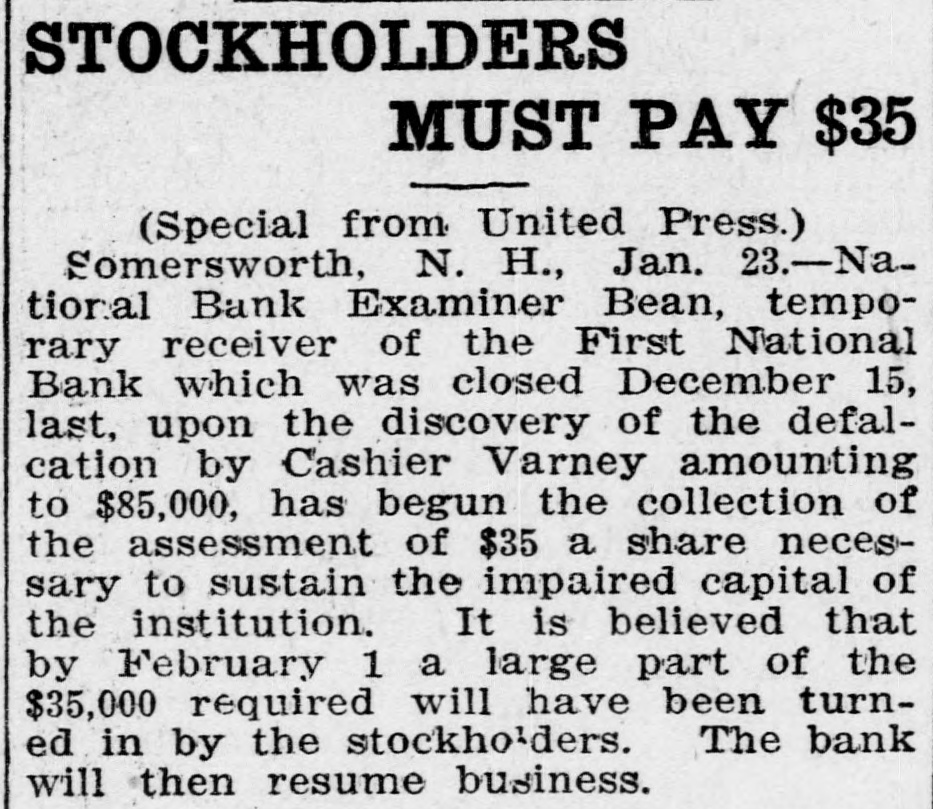

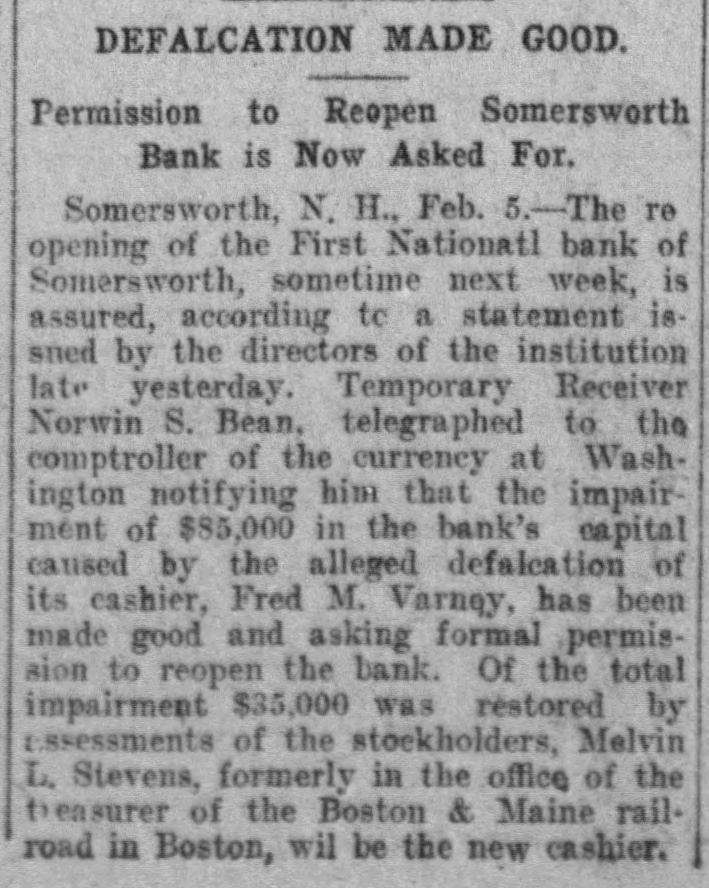

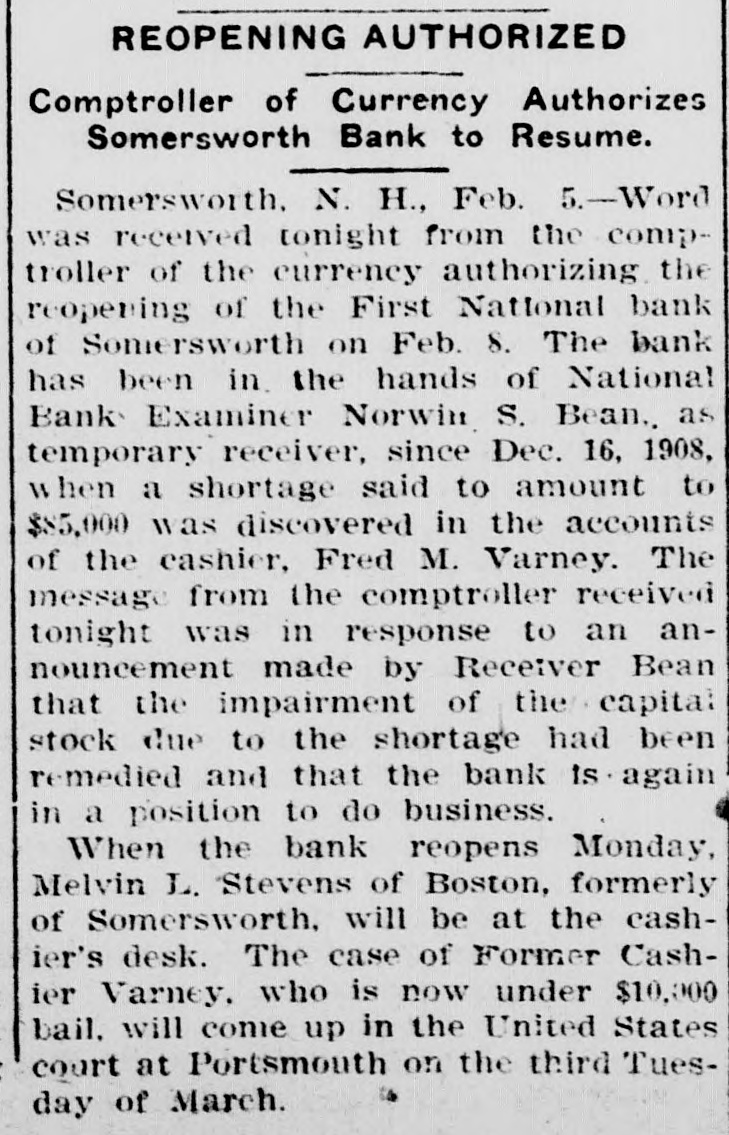

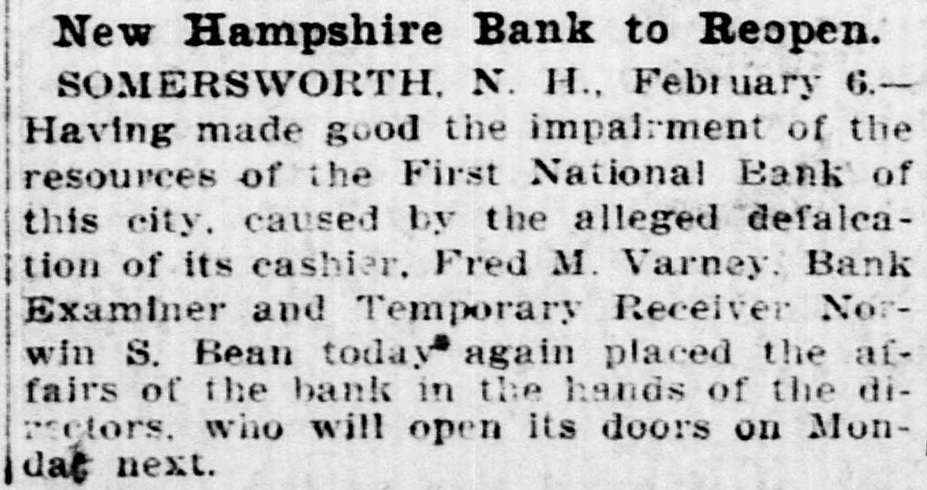

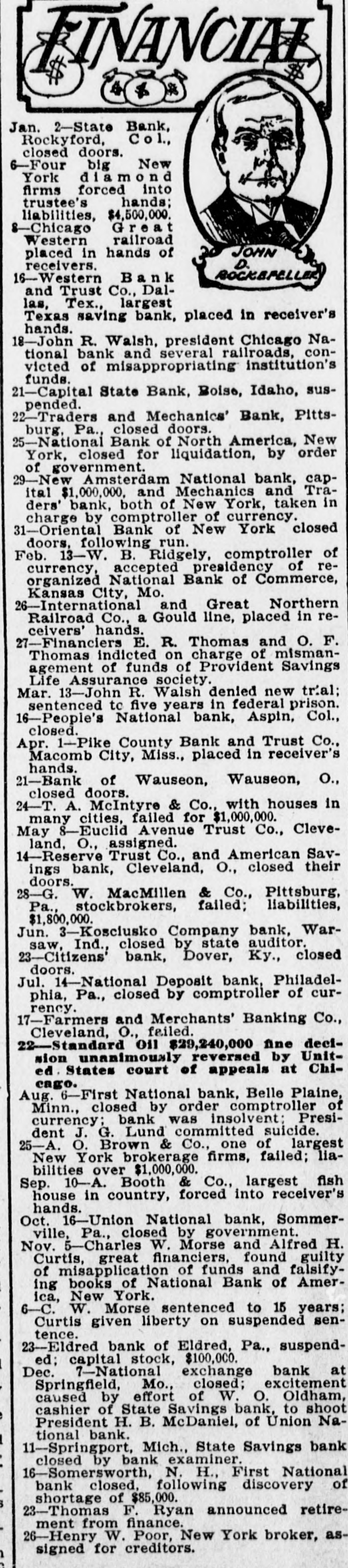

FINANCIAL Jan. 2-State Bank, Rockyford, Col., closed doors. 6-Four big New York diamond firms forced into trustee's hands; liabilities, $4,500,000. -Chicago Great Western railroad JOHN placed in hands of receivers. 16-Western Bank and Trust Co., Dallas, Tex., largest Texas saving bank, placed in receiver's hands. 18-John R. Walsh, president Chicago National bank and several railroads, convicted of misappropriating institution's funds. 21-Capital State Bank, Boise, Idaho, suspended. 22-Traders and Mechanics' Bank, Pittsburg, Pa., closed doors. 25-National Bank of North America, New York, closed for liquidation, by order of government. 29-New Amsterdam National bank, capital $1,000,000, and Mechanics and Traders' bank, both of New York, taken in charge by comptroller of currency. 31-Oriental Bank of New York closed doors, following run. Feb. 13-W. B. Ridgely, comptroller of currency, accepted presidency of reorganized National Bank of Commerce, Kansas City, Mo. 26-International and Great Northern Railroad Co., a Gould line, placed in receivers' hands. 27-Financiers E. R. Thomas and O. F. Thomas indicted on charge of mismanagement of funds of Provident Savings Life Assurance society. Mar. 13-John R. Walsh denied new trial; sentenced to five years in federal prison. 16-People's National bank, Aspin, Col., closed. Apr. 1-Pike County Bank and Trust Co., Macomb City, Miss., placed in receiver's hands. 21-Bank of Wauseon, Wauseon, O., closed doors. 24-T. A. McIntyre & Co., with houses in many cities, failed for $1,000,000. May 8-Euclid Avenue Trust Co., Cleveland, O., assigned. 14-Reserve Trust Co., and American Savings bank, Cleveland, O., closed their doors. 28-G. W. MacMillen & Co., Pittsburg, Pa., stockbrokers, failed; liabilities, $1,800,000. Jun. 3-Kosclusko Company bank, Warsaw, Ind., closed by state auditor. 23-Citizens' bank, Dover, Ky., closed doors. Jul. 14-National Deposit bank, Philadelphia, Pa., closed by comptroller of currency. 17-Farmers and Merchants' Banking Co., Cleveland, O., failed. 22-Standard on $29,240,000 fine decision unanimously reversed by United States court of appeals at ChiAug. cago. 6-First National bank, Belle Plaine, Minn., closed by order comptroller of currency; bank was insolvent: President J. G. Lund committed suicide. 25-A. O. Brown & Co., one of largest New York brokerage firms, failed; liabilities over $1,000,000. Sep. 10-A. Booth & Co., largest fish house in country, forced into receiver's hands. Oct. 16-Union National bank, Sommerville, Pa., closed by government. Nov. 5-Charles W. Morse and Alfred H. Curtis, great financiers, found guilty of misapplication of funds and falsifying books of National Bank of America, New York. 6-C. W. Morse sentenced to 15 years; Curtis given liberty on suspended sentence. 23-Eldred bank of Eldred, Pa., suspended; capital stock, $100,000. Dec. 7-National exchange bank at Springfield, Mo., closed; excitement caused by effort of W. O. Oldham, cashier of State Savings bank, to shoot President H. B. McDaniel, of Union National bank. 11-Springport, Mich., State Savings bank closed by bank examiner. 16-Somersworth, N. H., First National bank closed, following discovery of shortage of $85,000. 23-Thomas F. Ryan announced retirement from finance. 26-Henry W. Poor, New York broker, assigned for creditors.