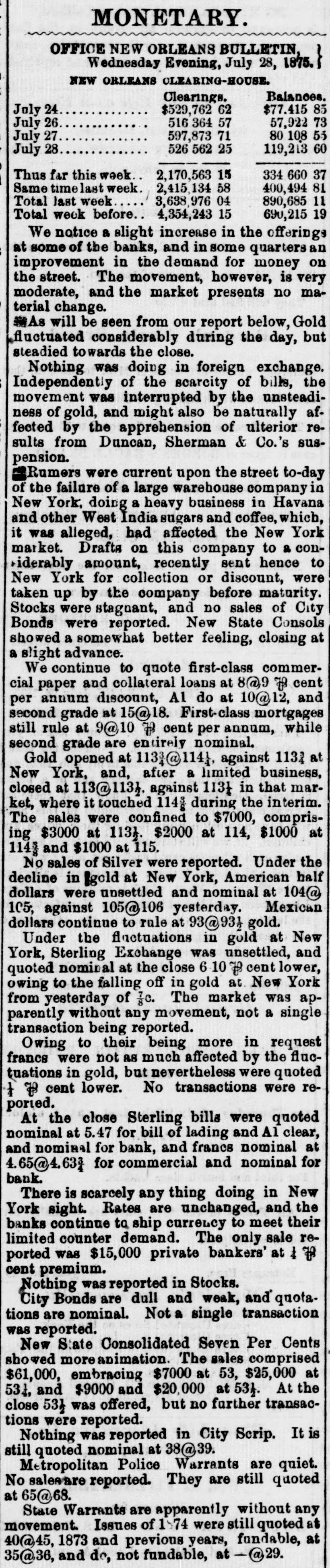

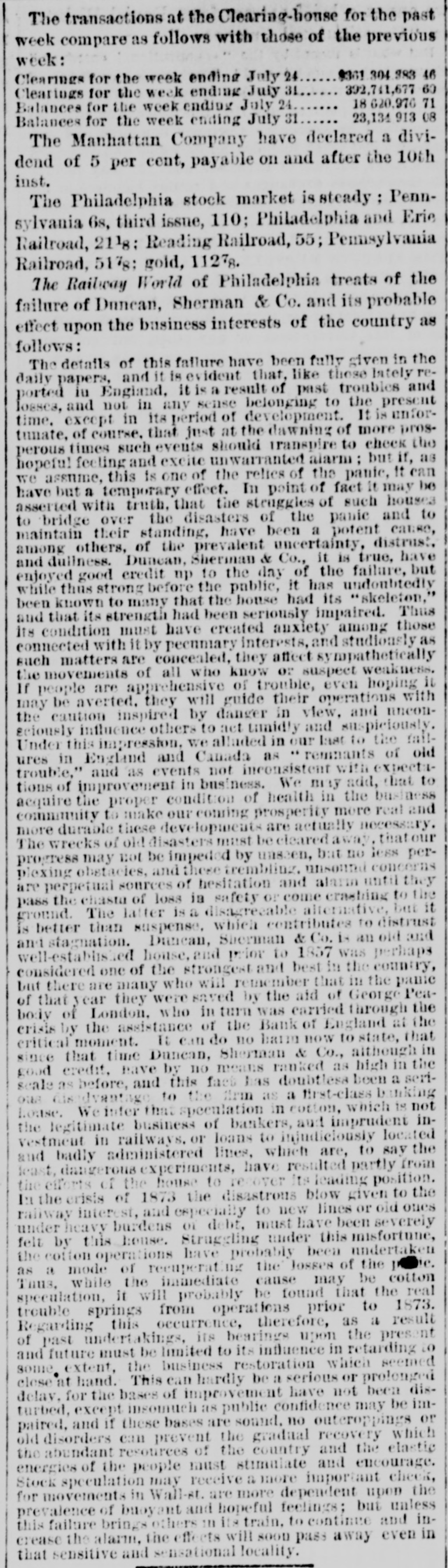

Article Text

NEW YORK. Heavy Failure- Fluctuations in Gold. NEW YORK, July 28.-Dunean, Sherman & Co. suspended this morning. There is great excitement in Wall street. Gold jumped to 116} upon the announcement of the suspension of Duncan, Sherman & Co. and the rumored embarrassment of other houses, but it soon fell to 114. The Evening Post has the following in the financial column: "The quietness of Wall street was broken in the second hour of business by the announcement that the banking house of Duncan, Sherman & Co. had closed their doors and suspended payment. A clap of thunder in a clear sky could not have caused more consternation, and at the Stock Exchange, Gold Exchange and Cotton Exchange there was great excitement. The liabilities of the house are given at inside of $6,000,000, and the assets far below this amount. The losses which weakened the house are not of recent making, but cover several years." The following statement to creditors was prepared by Mr. Duncan and read to the Stock Exchange: NEW YORK, July 27, 1875.-A careful examination of our business and affairs shows us, most unexpectedly, that through losses and misfortunes, our available assets are so reduced that we are compelled to go into liquidation. We reach this conclusion with the deepest regret, but the fact that up to the latest moment our most unexampled credit having remained unimpaired would have compelled us, if we continued business, to hazard new obligations and incur new confidences, which we were unwilling to assume. For the protection of all our ereditors, without distinction or preference, we have this day made a general assignment to the Hon. Wm. D. Shipman, of this city, whose address for all matters connected with our affairs will be at our late banking house, No. 11 Nassau street. DUNCAN, SHERMAN & Co. The greatest excitement prevailed in the lower part of the city as soon as the rumor of the suspension began to be circulated. It was at first hardly believed, as no suspicion of the weakness of the house had been entertained. The truth, however, was soon apparent by the closing of the iron doors of the great stone building on Nassau street. A large crowd of people soon collected, the majority of whom were attracted by motives of curiosity rather than interest. The suspension was everywhere the subject of conversation, and most contradictory and absurd rumors were in circulations. Many attempts were made to gain admission to the building, but the doors remained obstinately closed. Inside numerous clerks could be seen at their desks busily engaged with their books. Many absurd stories were set affoat to account for the general excitement. Among them was one to the effect that Commodore Vanderbilt was dead. It is admitted that the house has lost very largely on cotton; in fact, that is its principal loss. Investments with various railroad enterprises, old and new, also entailed losses on the house. The liabilities are understood to be between $5,000,000 and $6,000,000.