Click image to open full size in new tab

Article Text

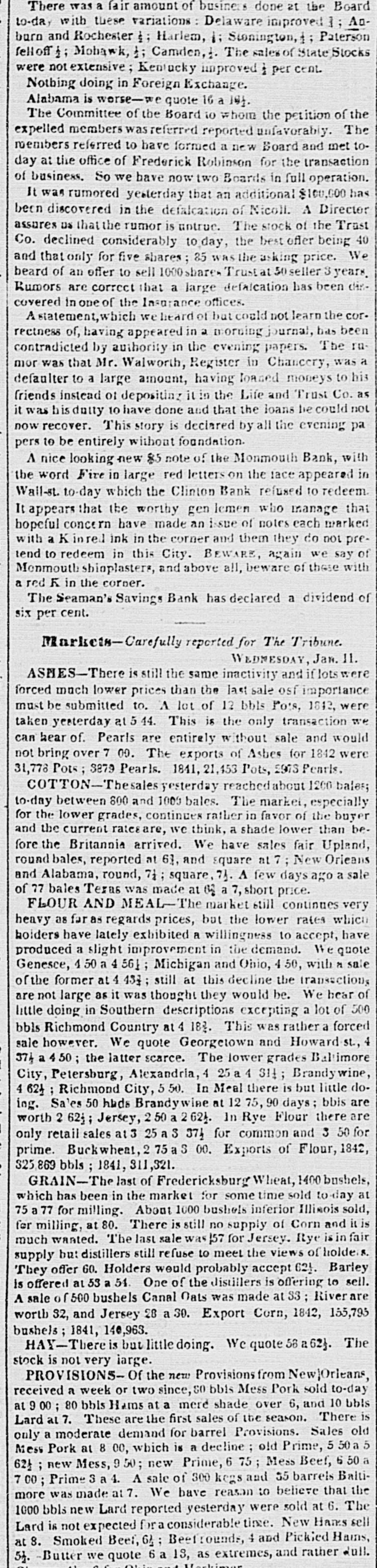

: n felloff ; Mohawk, 1; Camden, 1. The sales of State Stocks were not extensive; Kenjucky improved : per cent. Nothing doing in Foreign Exchange. Alabama is worse-we quote 16 a 194. The Committee of the Board to whom the petition of the expelled members was referred reported unfavorably. The members referred to have formed a new Board and met today at the office of Frederick Robinson for the transaction of business. So we have now two Boards in full operation. It was rumored yesterday that an additional $100,000 has been discovered in the defalcation of Nicoll. A Director assures us that the rumor is untrue. The stock of the Trust Co. declined considerably to day, the best offer being 40 and that only for five shares; 85 was the asking price. We beard of an offer to sell 1000 share. Trust at is seller 3 years. Kumors are correct that a large defalcation has been discovered in one of the Insurance offices. Astatement,whice welleard of but could not learn the correctness of, having appeared in a morning journal, has been contradicted by authority in the evening papers. The rumor was that Mr. Walworth, Register in Chancery, was a defaulter to a large amount, having loaned moneys to his friends instead of depositing it in the Life and Trust Co. as it was his dutty 10 have done and that the loans be could not now recover. This story is declared by all the evening pa pers to be entirely without foundation. A nice looking new 85 note of the Monmouth Bank, with the word Fire in large red letters on the lace appeared in Wall-st. o-day which the Clinton Bank refused to redeem. It appears that the worthy gen lemen who manage that hopeful concern have made an issue of notes each marked with a K inred ink in the corner and them they do not pretend to redeem in this City. BEWARE, again we say of Menmouth shinplasters, and above all, beware of these with a red K in the corner. The Seaman's Savings Bank has declared a dividend of six per cent. Markets-Carefully reported for The Tribune. WEDNESDAY, Jan. 11. ASHES-There is still the same inactivity and if lots were forced much lower prices than the last sale osf importance must be submitted to. A lot of 12 bbls Pots, 1842, were taken yesterday at 544. This is the only transaction we can hear of. Pearls are entirely without sale and would not bring over 7 00. The exports of Ashes for 1842 were 31,776 Pots 3879 Pearls. 1841, 21,453 Pots, 2978 Pearls. COTTON-Thesalesyesterday reached about 1200 baler; to-day between 800 and 1000 bales. The market, especially for the lower grades, continues rather in favor of the buyer and the current rates are, we think, a shade lower than before the Britannia arrived. We have sales fair Upland, round bales, reported at 61, and square at 7; New Orieans and Alabama, round, 71: square, 71. A few days ago a sale of 77 bales Teras was made at or a 7, short price. FLOUR AND MEAL-TH market still continues very heavy as far as regards prices, but the lower rates which holders have lately exhibited a willingness to accept, have produced a slight improvement in the demand. We quote Genesce, 450 a 4 561 ; Michigan and Ohio, 4 50, with M sale of the former at 4434 still at this decline the transaction, are not large as it was thought they would be. We hear of little doing in Southern descriptions excepting a lot of 500 bbls Richmond Country at 4 183. This was rather a forced sale however. We quote Georgetown and Howard st., 4 374 a 450; the latter scarce. The lower grades Baltimore City, Petersburg, Alexandria, 4 25 a 4 311; Brandywine, 4 621 : Richmond City, 5 50. In Meal there is but little doing. Sales 50 hads Brandywine at 12 75, 90 days; bbis are worth 2 62j; Jersey, 2 50 a 2624. In Rye Flour there are only retail sales at 25 a S 374 for common and 3 50 for prime. uckwheat, 25 a 3 00. Exports of Flour, 1842, 325,869 bbls; 1841, 311,321. GRAIN-The last of Fredericksburg Wheat, 1400 bushels, which has been in the market for some time sold to day at 75 a 77 for milling. About 1000 bushels inferior Illinois sold, for milling, at 80. There is still no supply of Corn and it is much wanted. The last sale was 157 for Jersey. Rye isin fair supply but distillers still refuse to meet the views of holder 8. They offer 60. Holders would probably accept 621. Barley is offered at 53 a 54. One of the distillers is offering to sell. A sale of 500 bushels Canal Oats was made at 33 ; River are worth 32, and Jersey 28 a 30. Export Corn, 1842, 155,795 bushels ; 1841, 140,963. HAY-There but little doing. We quote 58 a .62}. The stock is not very large. PROVISIONS- Of the new Provisions from New|Orleans, received a week or two since, SO bbis Mess Pork sold to-day at 9 00 ; 80 bbis Hams at a mere shade over 6, and 10 bbls Lard at 7. These are the first sales of the season. There is only a moderate demand for barrel Provisions. Sales old Mess Pork at 8 00, which is a decline ; old Prime, 5 50 a 5 62) ; new Mess, 9 50; new Prime, 75; Mess Beef, 6 50 a 700; Prime 3 4. A sale of 300 kegs and 35 barrels Baitimore was made at 7. We have reasan to believe that the 1000 bbls new Lard reported yesterday were sold at 6. The Lard is not expected fora considerable time. New Hams sell at 8. Smoked Beef, 64 ; Beefrounds 4 and Pickled Hains, 5 -Butter we quote 6 a 13, as extremes, and rather dull.