Click image to open full size in new tab

Article Text

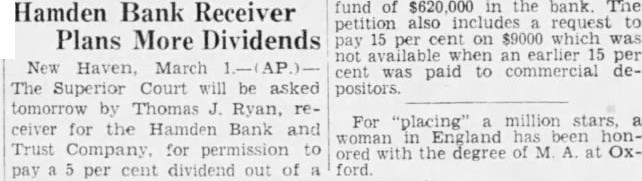

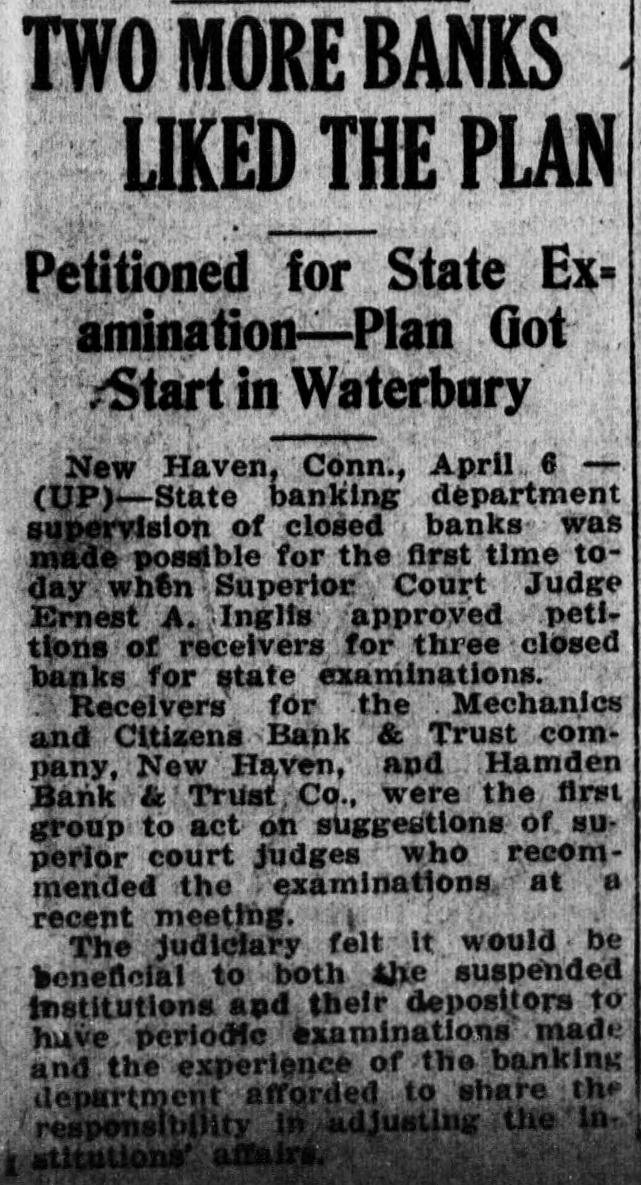

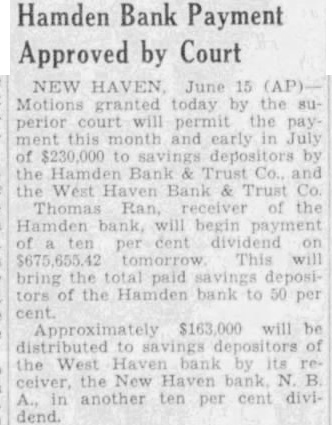

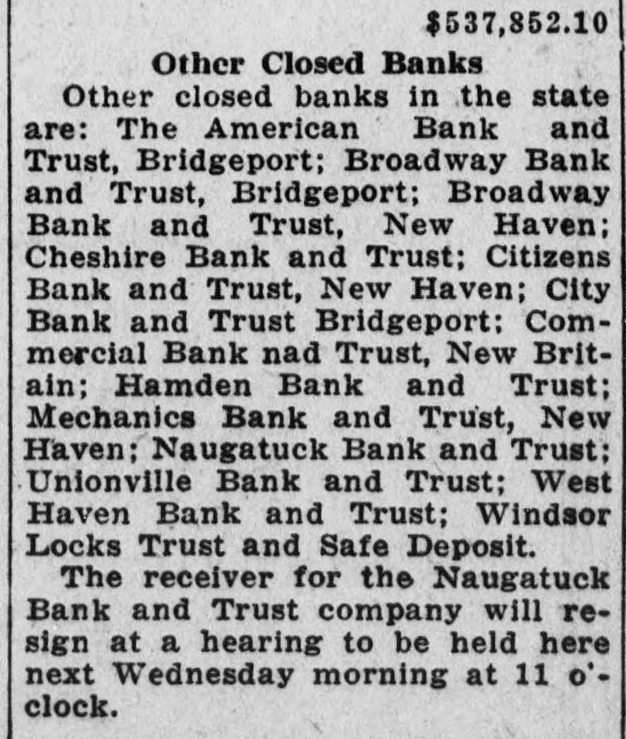

ASSETS SHRINK IN CLOSED BANKS Fourteen of Them Re= ported By Bank Receiv= er; Dividends Came / Hartford, Conn., April 21-(UP) -An approximate shrinkage of $9,500,000 in the assets of 14 closed banks was reported today by the state banking commission, a part of which probably will be borne by depositors with claims ranging from 15 to 80 per cent. Since the closings in various parts of the state, resulting from the bank moratorium of 1933, assets were estimated to have fallen off from 31 to 21 million dollars. However, dividends declared under private receivership scaled from 20 to 80 per cent on savings accounts and from 15 to 50 per cent on commercial deposits. Took Over Them All The state bank department, by authority of the last session of the legislature, took over all receiverships last June and no additional dividends have since been granted. However, officials of the department indicated that when conditions warranted, the superior court would be petitioned for permission to reimburse both commersavings depositors in proto the portion cial and amount of liquidation. An improvement of nearly $1,000,000 in the condition of all of the banks was noted by commissioner Walter Perry in his report I to superior court late yesterday. Principal losses, thus far, have bene in the securities and mortgage fields. Banks Involved I The banks involved are the American Bank & Trust Co. and Commercial Bank & Trust Co., Bridgeport; Citizens Bank & Trust Co. and Broadway Bank & Trust Co., New Haven; Hamden Bank & Trust 1 Co.; Manchester Bank & Trust So.; 1 West Haven Bank & Trurst Co.; 1 Naugatuck Bank & Trust Co.; 1 Pawcatuck Bank & Trust Co., Stonington; Merchants Trust Co., Waterbury; Commercial Trust Co., New Britain; Unionville Bank & Trust Co.; Windsor Locks Trust & Safe Deposit Co.; City Bank & 8 Trust Co., Hartford.