Click image to open full size in new tab

Article Text

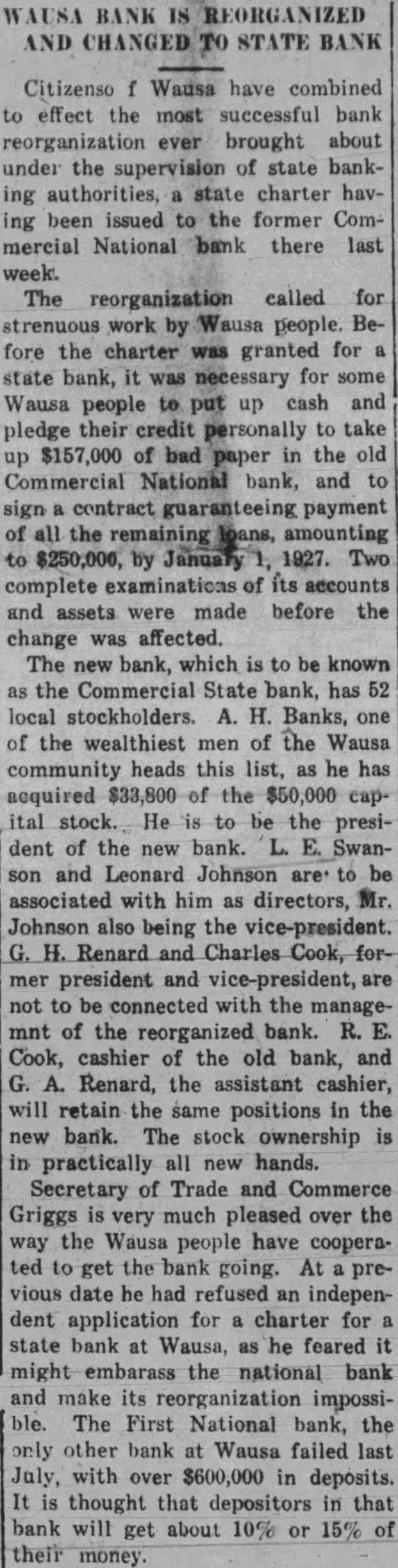

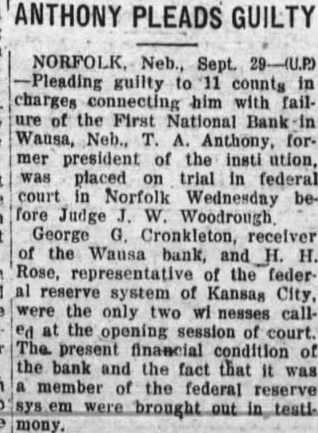

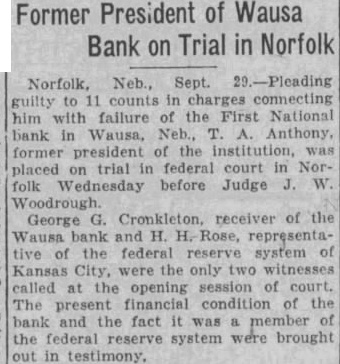

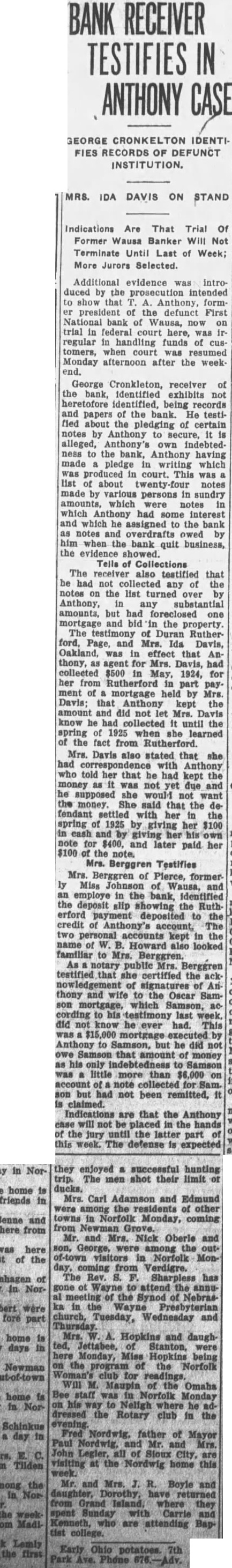

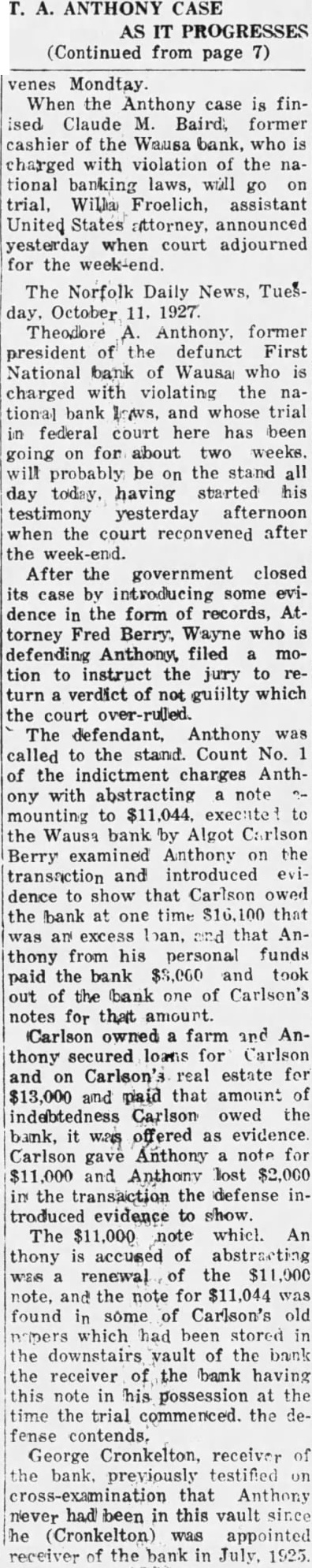

Thursday, November 28th, is not directly a legal statutory holiday by recital, but becomes such by proclamation of the Governor of the State, and by the President of the U. S. A. In Center, as elsewhere in the county, the day will be observed by cessation from labor to a large extent. Doctors Francis of the Federal, and Hays of the State Departments of Agriculture, were in Center during the week on business pertinent to the tuberculin testing of cattle and in conference with Dr. James Klopp, who is in charge of the campaign in Knox county. Congressman Edgar Howard was pictured in a metropolitan daily recently. He was shown in the atitude of inspecting a Nebraska ear of corn 24 inches in length. He is said to have had it displayed in his Washington, D. C. headquarters that easterners particularly might admire and view the sample of Nebraska's corn fields. The jury term of the District Court for Knox County is under way in Center this week and a considerable number of residents of the County were transacting business at the county seat at the same time. The campaign of the tuberculín testing of cattle in Knox County is expected to be completed in its initial form by January 1st, 1930. More than a dozen veterinarians are at work in alloted areas in the County. A very small percentage of the total number of cattle tested are reactors, according to reports. The greatest percentage of reactors for an individual occurred west of Niobrara where twothirds of a small herd showed tubereular reaction and in the vicinity of Bloomfield the greater percentage of numbers were found scattered in several sections. The 1929 legislature appropriated $60,000 for editing, compiling and publishing statutes for Nobraska, none of which have, as yet, been obtained at the county seat, excepting the session laws for 1929. Fees for registration of name for ranch or farm and for certificate of such are $1.00 in each ind stance. The registration record discloses the names of fifty-three farms or ranches to be registered in Knox county Members of the Knox County Board of Supervisors have been summoned to appear in Omaha on Dec. 9, 10 and 11 to attend the annual convention of County Supervisors, Commissioners, County Clerks and Registers of Deeds. John D. Forsyth, chairman of the Knox County Board of Supervisors, is an incumbent vice president of the mentioned state association. George G. Cronkleton of Plainview has been appointed as Receiver of the First National Bank of Wausa to fill the vacancy caused by the resignation of M. E. Jensen. Final dividend of this bank, which suspended several years ago, has not been anonunced. Knox County's share of the available gas tax for October, 1929 was $2,386.09, according to a receipt on file. Probably the greatest number of miles of gravel to have been placed on county roads in one year will been accomplished in Knox County by January 1, 1930 Tax lists for 1929 for both real estate and personal property have been turned to the Knox County Treasurer, with the exception of one interstate industrial organization which, through court action, has made it temporarily prohibitive for the state tax commissioner to certify the existant assessable valuation in Knox County. Much information is contained in a map of Knox County which may be had from the County Clerk's office for 25c. Schools, roads, streams, railways, towns, and highways are featured in splendid outline and townships are enumerated and named. Other and usual map features make it desirable. It is compactly enclosed in a pocket sized folder.

B. J. Huigens transacted business matters in Norfolk Friday. H. Guhlke was over from Bloomfield Tuesday afternoon attending to business matters. Miss Emma Veenker spent Sunday in Pierce with friends. She went down Saturday evening. G. Grabowski was a returning passenger from Omaha, where he had marketed two carloads of hogs. Misses Ethel and Julia Johnsen visited over the week end with friends in Omaha. They went down on Saturday morning. Mrs. Edwin Pavlik and children came down from Verdigre Saturday morning and visited over Sunday with Mrs. Pavlik's parents, Mr. and Mrs. Wm. Guenther, east of town.

LOCAL NEWS

Mrs. Mable Jasmer was a visitor in Norfolk Thursday. Miss Leona Johnson went to Stromsburg, Nebr., Friday to assist her aunt, who is ill. Nick Oberle was a returning passenger from Omaha Saturday morning, where he marketed stock. Miss Leafa Butterfield returned to Norfolk Friday after spending few days with her parents at Walnut. Dr. M Kile motored to Omaha Friday to attend an eye clinic. He was accompanied by Mrs. Kile, who visited friends. Mrs. Guy Wertz and son Billie returned to Omaha Thursday, after spending a week with her parents, Mr. and Mrs. J. H. Stoddard, and to care for her mother, who was ill for several days. Mrs. Albert Tinchert left for Dubuque, Iowa, Friday morning to attend the funeral of Mr Tinchert's niece, Mrs. Agnes Schubert. On account of illness Mr. Tinchert was unable to make the trip. Mrs. N. L. Raymond returned home on Friday morning from Butte, N. D., where she spent several months visiting with her daughter and law, Mr. and Mrs. Lutie Brown and family Mr. and Mrs. Grant See, who have been in the vicinity of Center for the past two months picking wild cucumber seeds for the Robinson Seed House of Waterloo, Nebr., returned to home in Fremont Thursday evening. Wilbert Pangburn. motored to Creighton from Dante, S. D., on Thursday evening to look after some business matters and he greeted many old acquaintances. Wilbert is located on a farm near Dante and he states that the farmers in that locality had a splendid crop of corn and small grain this year. Mrs. Mark Oster and son John Arnold, and her sister, Mrs. Struch arrived Thursday from Chicago, and spent several days visit with their aunt, Mrs. Henrietta Wieschendorf, and their cousin, Mrs. Molly Saunders. They came as far as Sioux City by auto. Mrs. Oster and her husband recently returned from a trip abroad, visiting the countries of Italy, France, Spain, Switzerland. and Germany. Miss Theodora Raab, a teacher in foreign lands, arrived in this city Friday to visit her friend, Miss Margaret Seeck. Miss Raab met Miss Seeck, at Columbus, O., during the National Convention of M. E. Foreign Missionaries, and following the convention Miss Raab has been visiting relatives in the east, and is now on her way home to Pasedena, Calif. As the distance was so close, she took this occasion to visit her coworker, before going home. These ladies are both home on a furlough at the present time, and are engaged in this line of work in the country of China.