Click image to open full size in new tab

Article Text

Nebraska Notes

They're Not So Dumb

BEATRICE William Pollock, steward at the Institution of Feeble Minded Youth, reported that 900 pounds of chicken, 300 pounds of turkey, 25 gallons of oysters, 240 bunches of celery, 200 pounds of cranberries, potatoes, gravy, jellies, vegetables, etc., were served at the Thanksgiving dinner. There were 900 wards and 60 staff members at the tables.

Wheat In Normal

SIDNEY Moisture from the recent snow storm was of great benefit to fall-sown grains in western Nebraska, crop observers believe. Winter wheat is normal, they report. Corn husking is at a standstill and may not be resumed for a week, but approximately 80 per cent of the corn has been cribbed.

Can't Smell, Sues for $25,000

LINCOLN What is the sense of smell worth? Bertha Dutton thinks $25,000 is about the right figure. She has filed suit in district court here for that amount, naming Thomas Dowd as defendant. The plaintiff alleges that as she stepped off a street car Oct. 20, she was struck by Dowd's automobile. She contends that her nerves were so badly shocked that since that time she has been unable to smell anything.

$40,000 in Club Checks

GRAND ISLAND - During the coming week Grand Island banks will pay out approximately $40,000 to the Christmas savings club members. The average amount to be paid each member is estimated at about $74. This amount, according to officials, is higher than during any previous year.

Named Nebraska's Sweetheart

LINCOLN - Miss Audrey Gregory, Hastings, was announced Thursday as "Nebraska's sweetheart." The young woman honored by the students of the University of Nebraska is a senior in the arts and science college, a freshman in the law school, and is a member of the Gamma Phi Beta sorority. Miss Gregory was elected by a general vote of all men students of the University of Nebraska, Nov. 20. Miss Lucille Carothers, Falls City, was "Nebraska's sweetheart" last year. The contest is conducted annually by the Kosmet klub.

Form Taxpayers League

BEATRICE - About 150 farmers from 11 precincts have organized the Gage County Taxpayers' Protective league. Fred Darrow, retired farmer, was named president; Dick Goble, vice president, and Edward McAllister, secretary. The league advocates abolition of the county highway commissioner, placing highway work under the district supervisor; reduction of the number of clerks in the courthouse and nullifying the 1 per cent fee paid to the city banks for collection taxes.

Claims Woman Stole Hogs

GRAND ISLAND Sheriff C.J. Palmer has recovered 10 Hampshire hogs stolen recently from Ben Cunningham, near Woodriver, and arrested Mrs. Floyd Brott in connection with the theft. The officer is seeking the woman's husband.

Train Cuts Leg Off NEBRASKA CITY S. G. Bigford, Nebraska City, was critically injured Sunday when he was struck by a Missouri Pacific train at a grade crossing. One leg was severed and the other broken.

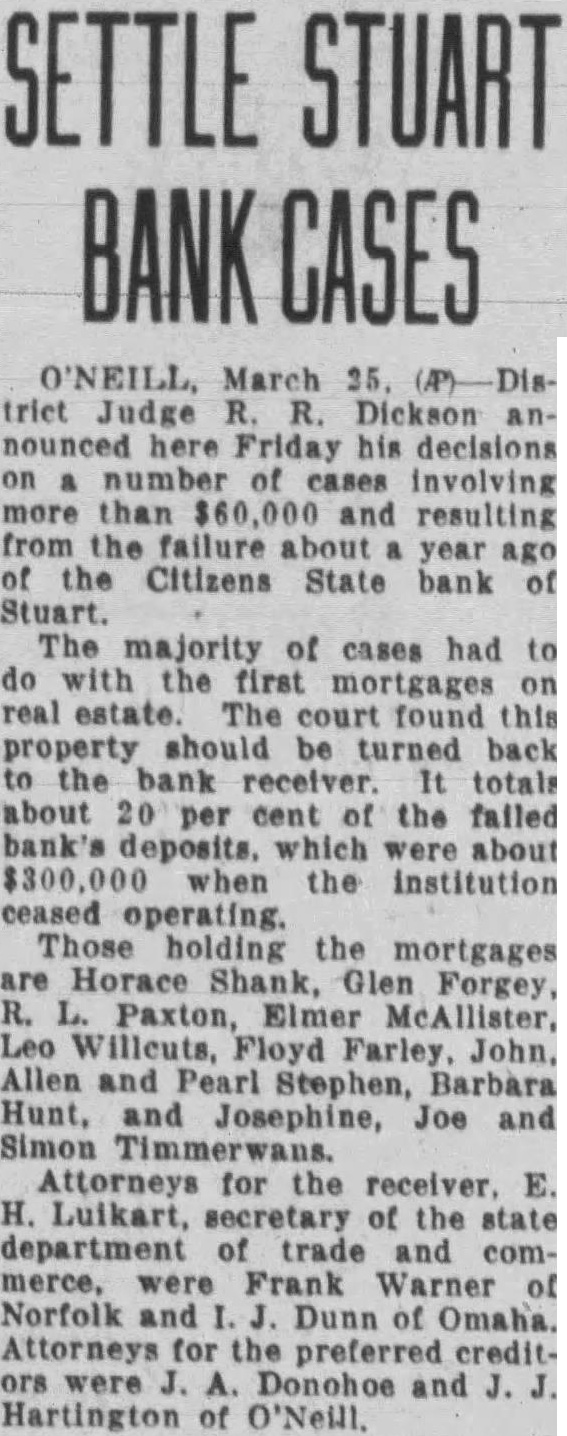

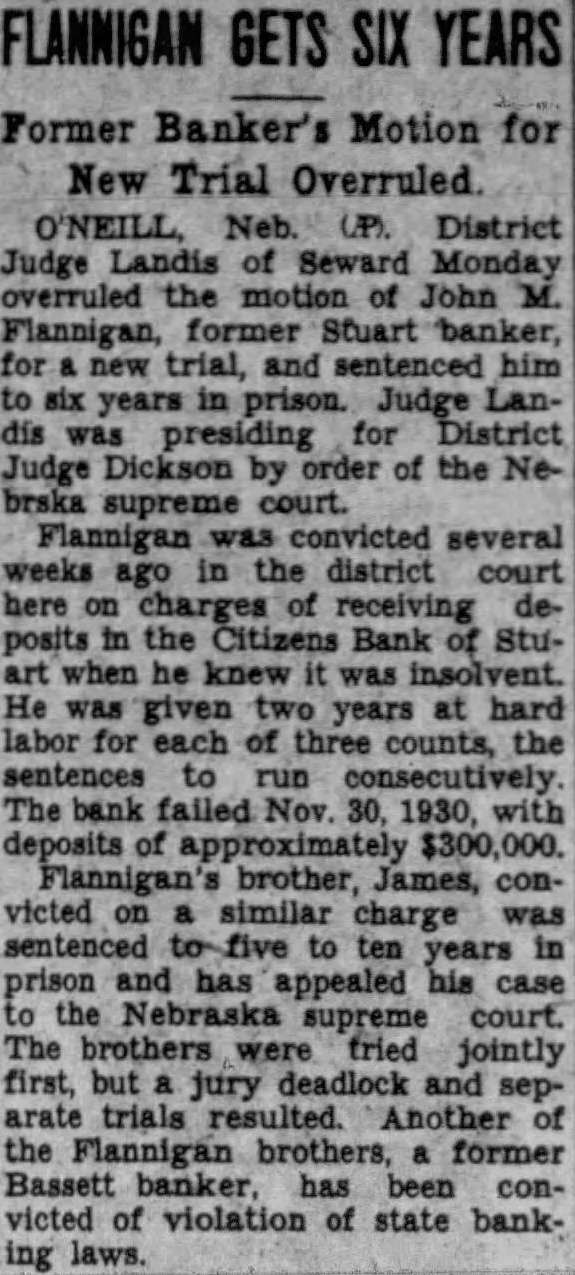

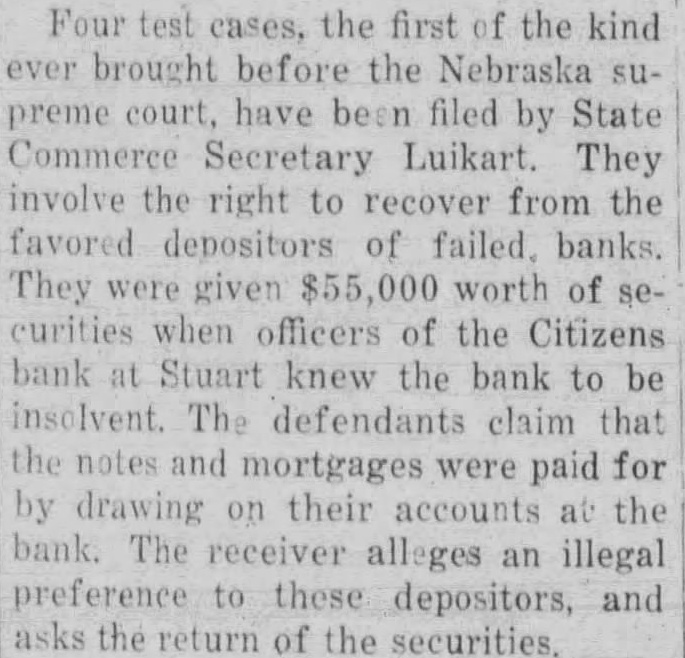

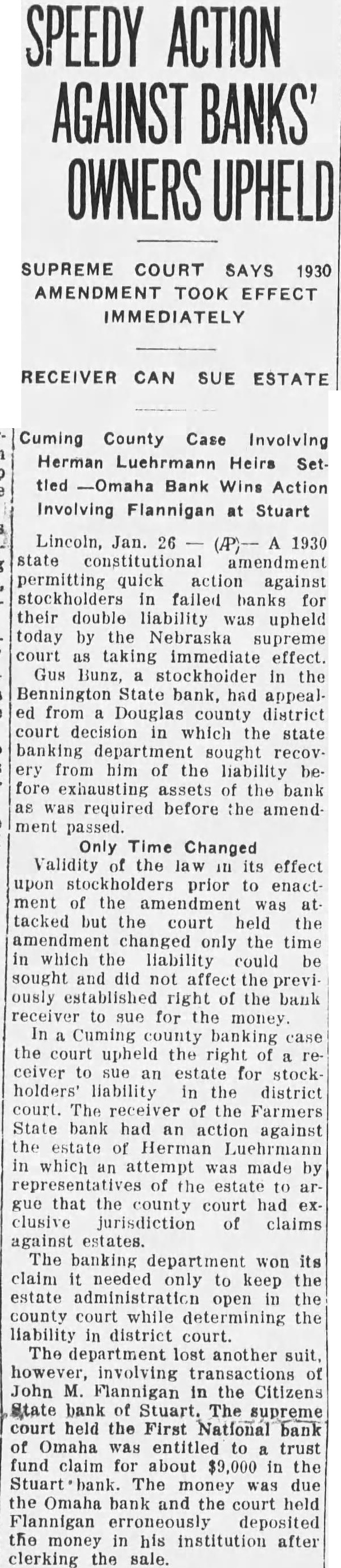

Stuart Bank Fails Suspension of the Citizens State bank at Stuart, of which John M. Flannigan, prominent Nebraska banker, is president, was announced Monday at Lincoln by George F. Woods, state bank commissioner. Virgil S. Lee, state bank examiner, was placed in charge of the bank. The bank had a capital of $50,000 a surplus of $12,000 and deposits of approximately $600,000, according to the last financial statement of the bank. Mr. Flannigan is vice president and Thomas S. Mains, cashier.