Article Text

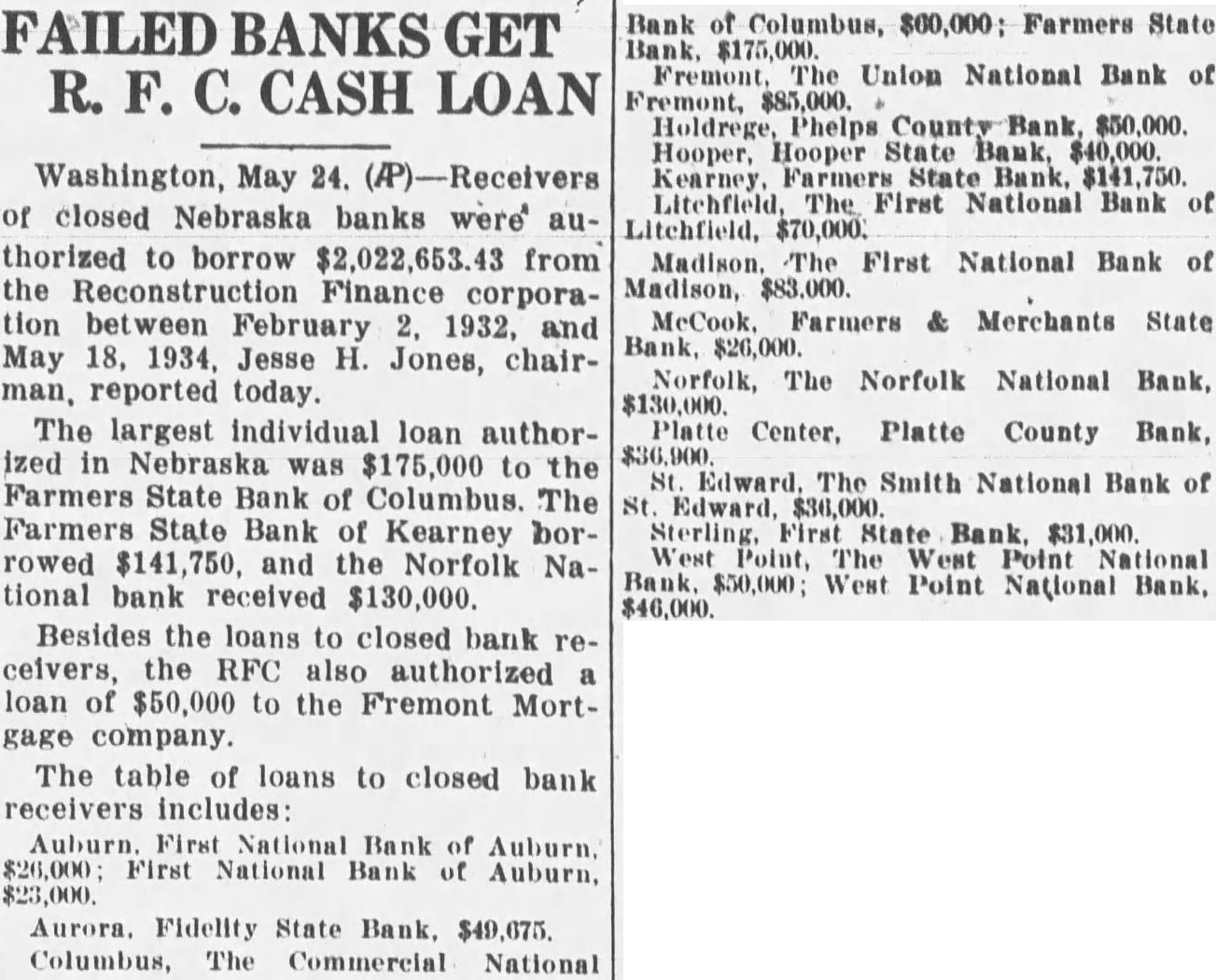

Bank Receiver John former Crofton banker, to Manny as of the First National bank of Madison, accordto word from Madison. Mr. Reifenrath. former member of state legislature, has already been appointed receiver the Smith National bank St. Edward. is not known whether the staff serving under Mr. Manny be affected. Tries to Kidnap Child Lincoln, Aug. Lincoln police today were searching for old man in light coach attempted to coax 5-year-old girl his near the University Nebraska stadium this morning. The man's motive known. the frightened little girl fused in the man Want Vote Beer Neb., Aug. petition bearing more than 600 natures has been filed here ing the beer licensing ordinance be submitted the election, April, 1934. Reports heard that another petition being circulated special election the Fairbury ordinance.