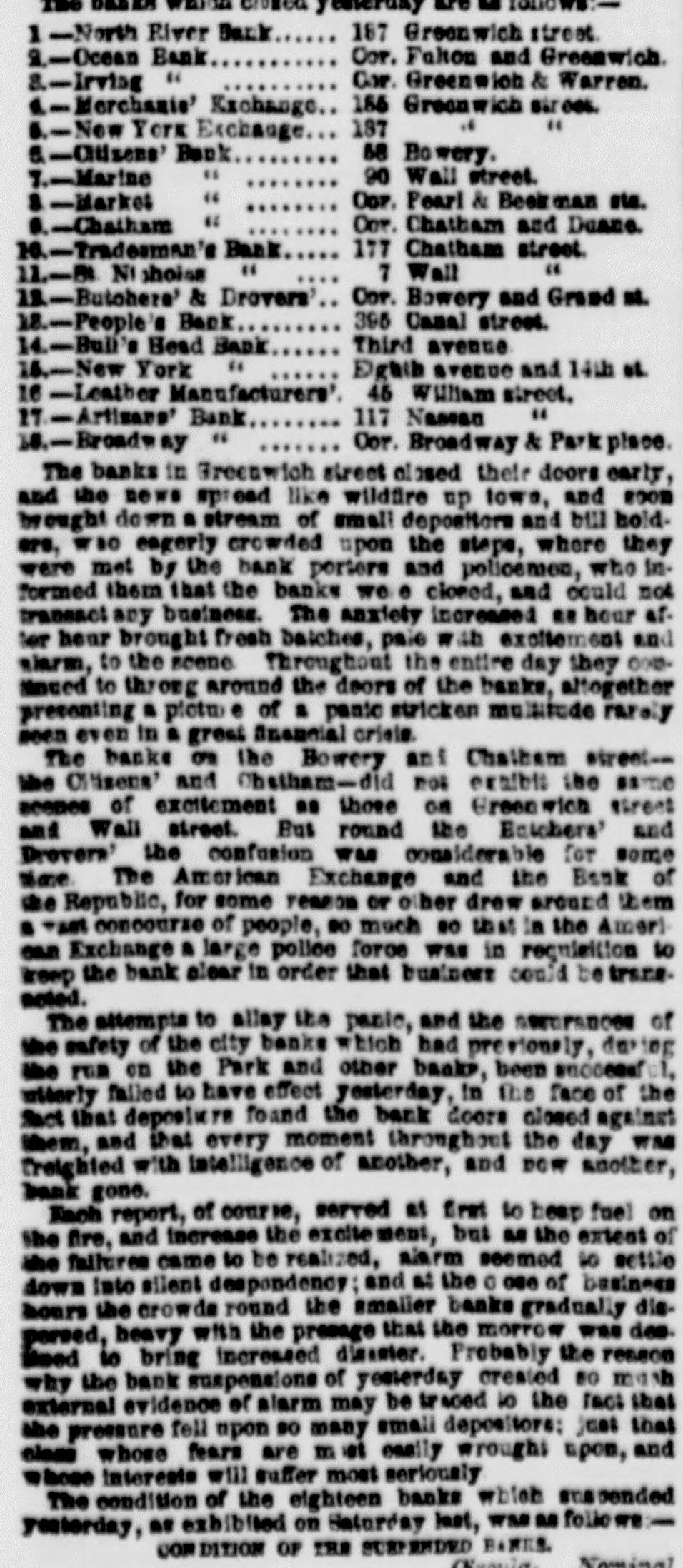

Click image to open full size in new tab

Article Text

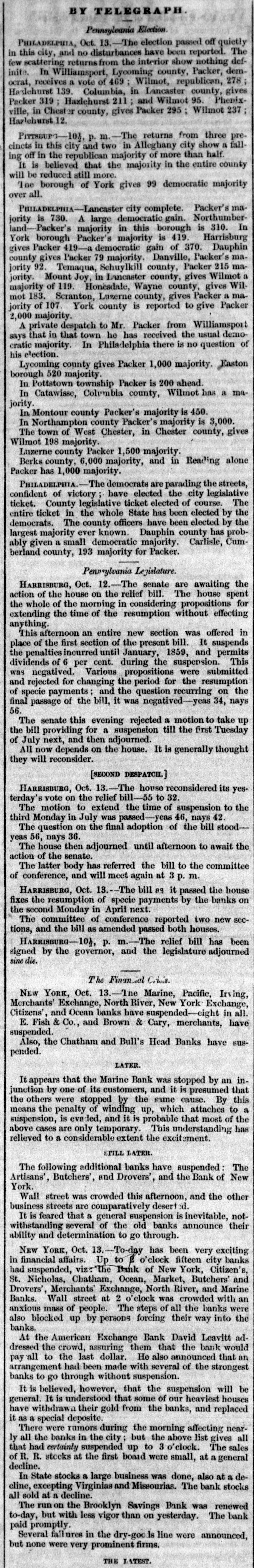

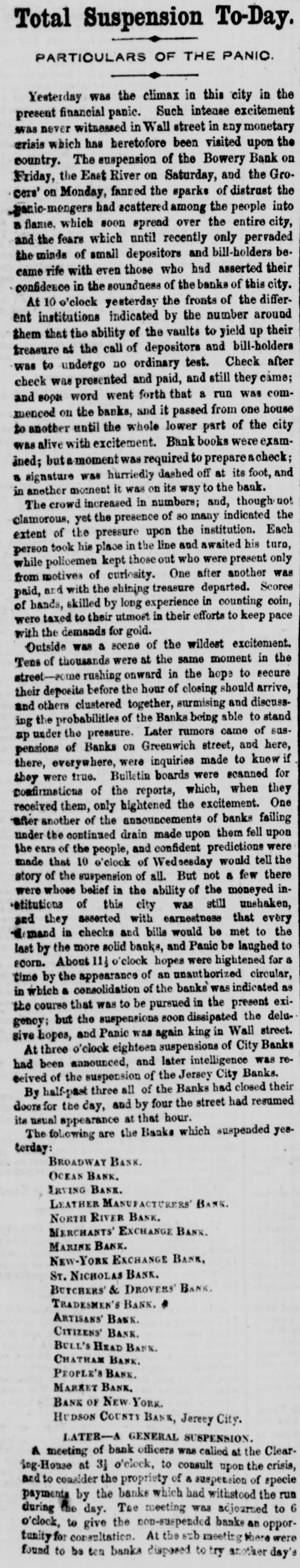

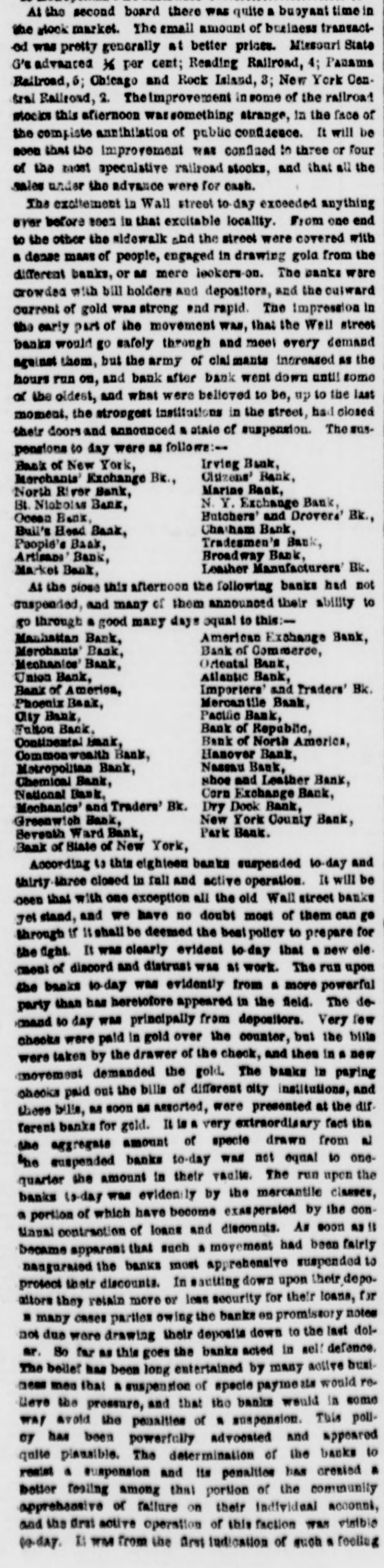

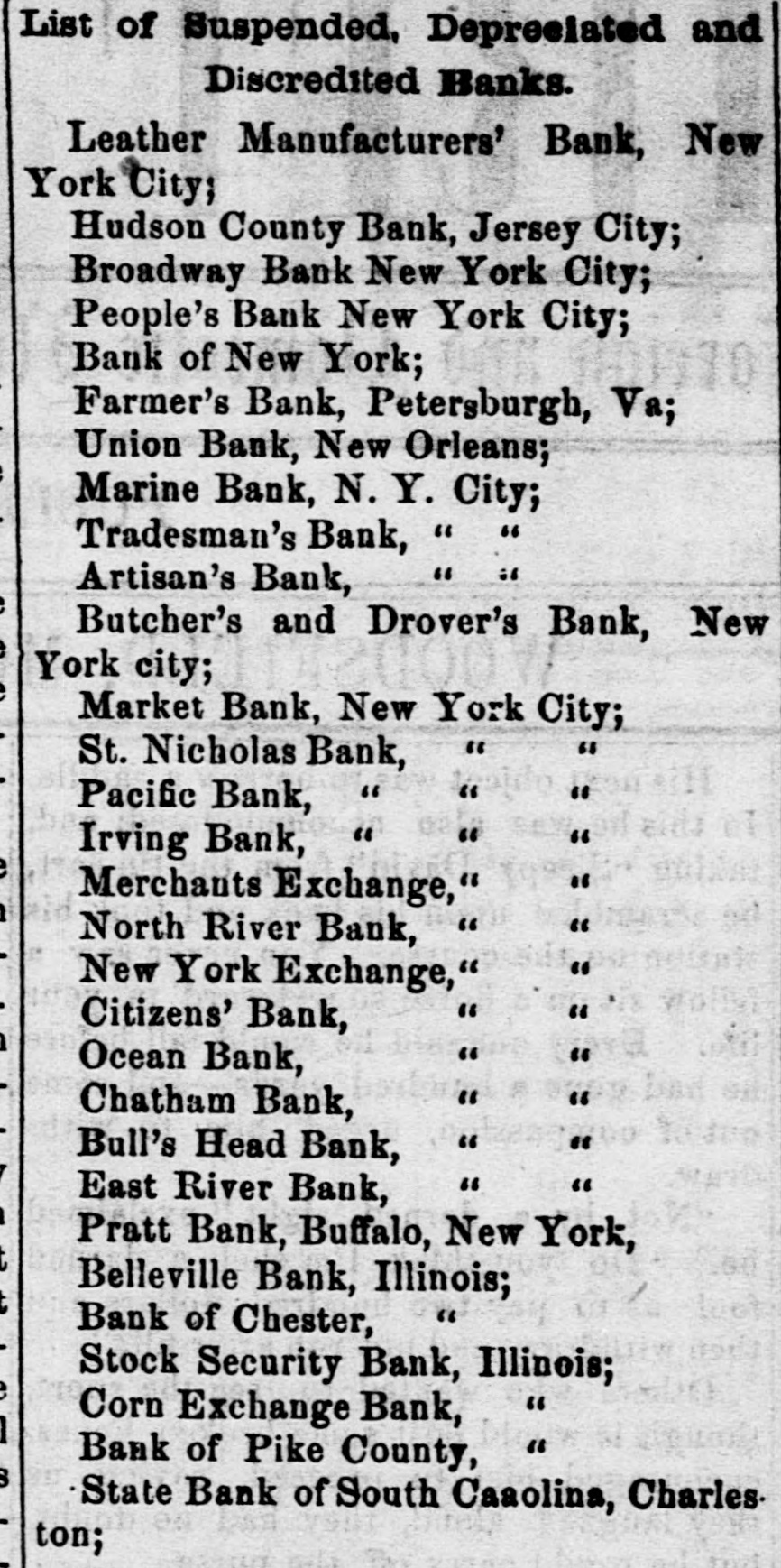

BY TELEGRAPH Pennsylvania Election. PHILADELPHIA, Oct. 13.-The election passed off quietly in this city, and no disturbances have been reported. The few scattering returns from the interior show nothing definite. In Williamsport, Lycoming county, Packer, democrat, receives a vote of 469 Wilmot, republican, 278 Hazlehurst 139. Columbia, in Lancaster county, gives Packer 319 Hazlehurst 211 and Wilmot 95. Phenixville, in Chest er county, gives Packer 295; Wilmot 237 Hazlehurst.12. PITTSBUPO-101, p. m.-The returns from three precincts in this city and two in Alleghany city show a falling off in the republican majority of more than half. It is believed that the majority in the entire county will be reduced still more. The borough of York gives 99 democratic majority over all. PHILADELPHIA-Lancaster city complete. Packer's majority is 730. A large democratic gain. Northumberland-Packer's majority in this borough is 310. In York borough Packer's majority is 419. Harrisburg gives Packer 419-a democratic gain of 370. Dauphin county gives Packer 79 majority. Danville, Packer's majority 92. Temaqua, Schuylkill county, Packer 215 majority. Mount Joy, in Lancaster county, gives Wilmot a majority of 119. Honesdale, Wayne county, gives Wilmot 183. Scranton, Luzerne county, gives Packer a majority of 107. York county is reported to give Packer 2,000 majority. A private despatch to Mr. Packer from Williamsport says that in that town he has received the usual democratic majority. In Philadelphia there is no question of his election. Lycoming county gives Packer 1,000 majority. Easton borough 520 majority. In Pottstown township Packer is 200 ahead. In Catawisse, Columbia county, Wilmot has a majority In Montour county Packer's majority is 450. In Northampton county Packer's majority is 3,000. The town of West Chester, in Chester county, gives Wilmot 198 majority. Luzerne county Packer 1,500 majority. Berks county, 6,000 majority, and in Reading alone Packer has 1,000 majority. PHILADELPHIA.-The democrats are parading the streets, confident of victory have elected the city legislative ticket. County legislative ticket elected of course. The entire ticket in the whole State has been elected by the democrats. The county officers have been elected by the largest majority ever known. Dauphin county has probably given a small democratic majority. Carlisle, Cumberland county, 193 majority for Packer. Pennylvania Legislature. HARRISBURG, Oct. 12.-The senate are awaiting the action of the house on the relief bill. The house spent the whole of the morning in considering propositions for extending the time of the resumption without effecting anything. This afternoon an entire new section was offered in place of the first section of the present bill. It suspends the penalties incurred until January, 1859, and permits dividends of 6 per cent. during the suspension. This was negatived. Various propositions were submitted and rejected for changing the period for the resumption of specie payments; and the question recurring on the final passage of the bill, it was negatived-yeas 34, nays 56. The senate this evening rejected a motion to take up the bill providing for a suspension till the first Tuesday of July next, and then adjourned. All now depends on the house. It is generally thought they will reconsider. [SECOND DESPATCH.] HARRISBURG, Oct. 13.-The house reconsidered its yesterday's vote on the relief bill-55 to 32. The motion to extend the time of suspension to the third Monday in July was passed-yeas 46, nays 42. The question on the final adoption of the bill stoodyeas 56, nays 36. The house then adjourned until afternoon to await the action of the senate. The latter body has referred the bill to the committee of conference, and will meet again at 3 p. m. HARRISBURG, Oct. 13.-The bill as it passed the house fixes the resumption of specie payments by the banks on the second Monday in April next. The committee of conference reported two new sections, and the bill as amended passed both houses. Harrisburg-10}, p. m.-The relief bill has been signed by the governor, and the legislature adjourned sine die. The Financial Crivis. NEW YORK, Oct. 13.-Tne Marine, Pacific, Irving, Merchants' Exchange, North River, New York Exchange, Citizens', and Ocean banks have suspended-cight in all. E. Fish & Co., and Brown & Cary, merchants, have suspended. Also, the Chatham and Bull's Head Banks have suspended. LATER. It appears that the Marine Bank was stopped by an injunction by one of its customers, and it is presumed that the others were stopped by the same cause. By this means the penalty of winding up, which attaches to a suspension, is evaded, and it is probable that most of the above cases are only temporary. This understanding has relieved to a considerable extent the excitement. ETILL LATER. The following additional banks have suspended The Artisans', Butchers', and Drovers', and the Bank of New York. Wall street was crowded this afternoon, and the other business streets are comparatively desert ed. It is feared that a general suspension is inevitable, notwithstanding several of the old banks announce their ability and determination to go through. NEW YORK, Oct. 13.-To-day has been very exciting in financial affairs. Up to g o'clock fifteen city banks had suspended, the Bank of New York, Citizen's St. Nicholas, Chatham, Ocean, Market, Butchers' and Drovers', Merchants' Exchange, North River, and Marine Banks. Wall street at 2 'clock was crowded with an anxious mass of people. The steps of all the banks were also blocked up by persons forcing their way into the banks. At the American Exchange Bank David Leavitt addressed the crowd, assuring them that the bank would pay all to the last dollar. He also announced that an arrangement had been made with several of the strongest banks to go through without suspension. It is believed, however, that the suspension will be general. It is understood that some of our heaviest houses have withdrawn their gold from the banks, and replaced it as a special deposite. There were rumors during the morning affecting nearly all the banks in the city; but the above list gives all that had certainly suspended up to 3 o'clock. The sales of R. R. stocks at the first board were small, at a general decline. In State stocks a large business was done, also at a decline, excepting Virginias and Missourias. The bank stocks all sold at a decline.