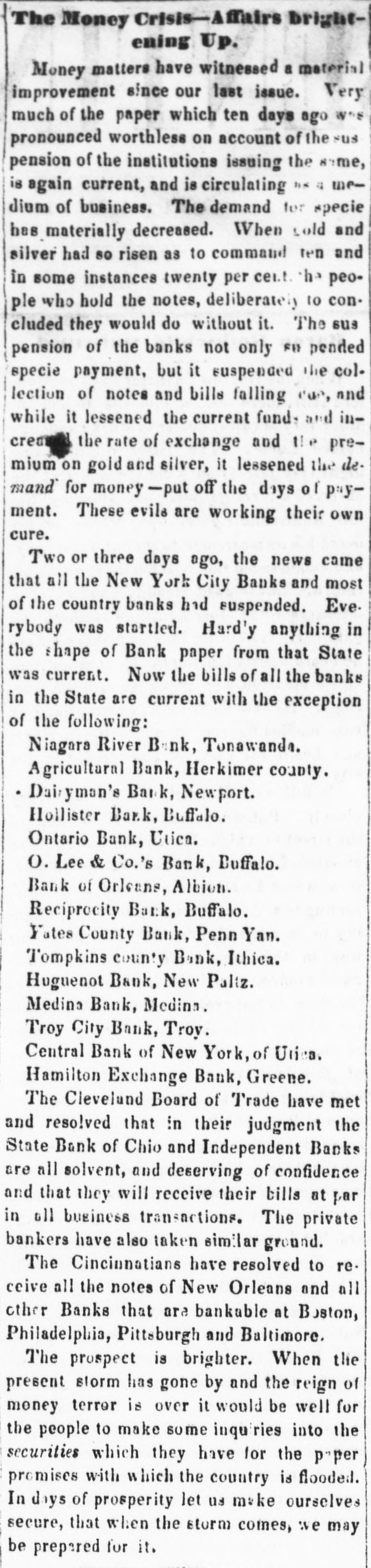

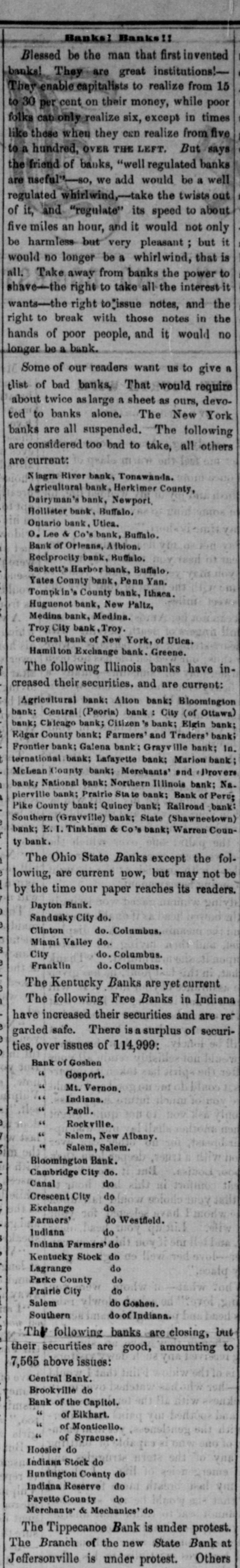

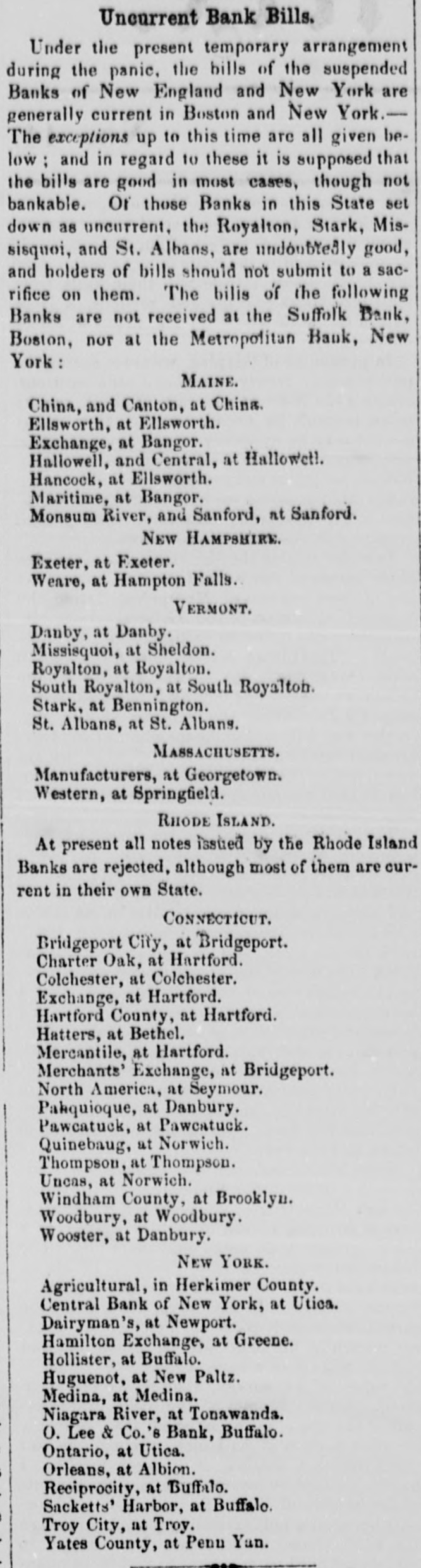

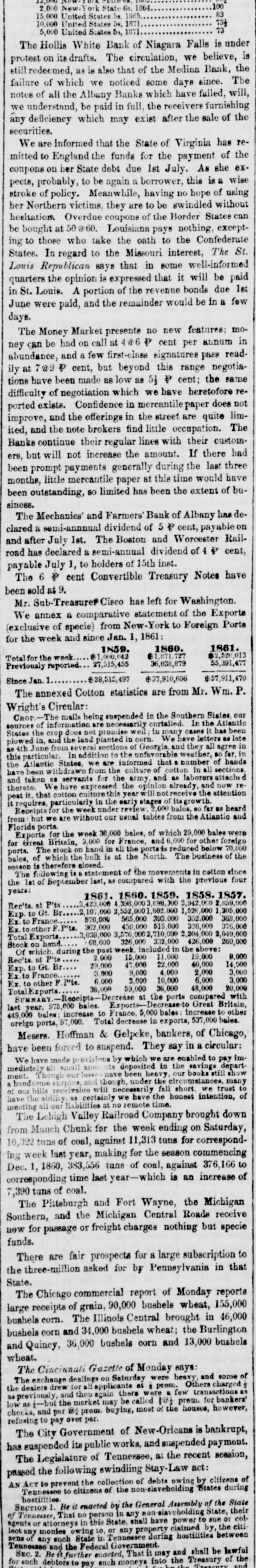

Article Text

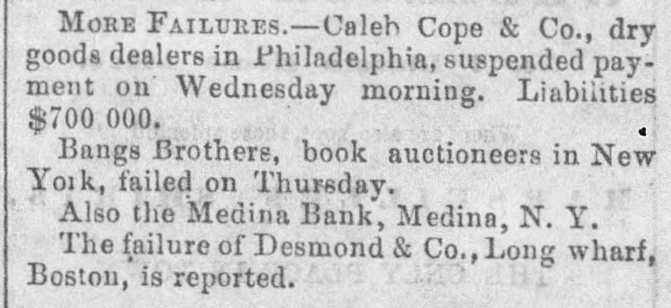

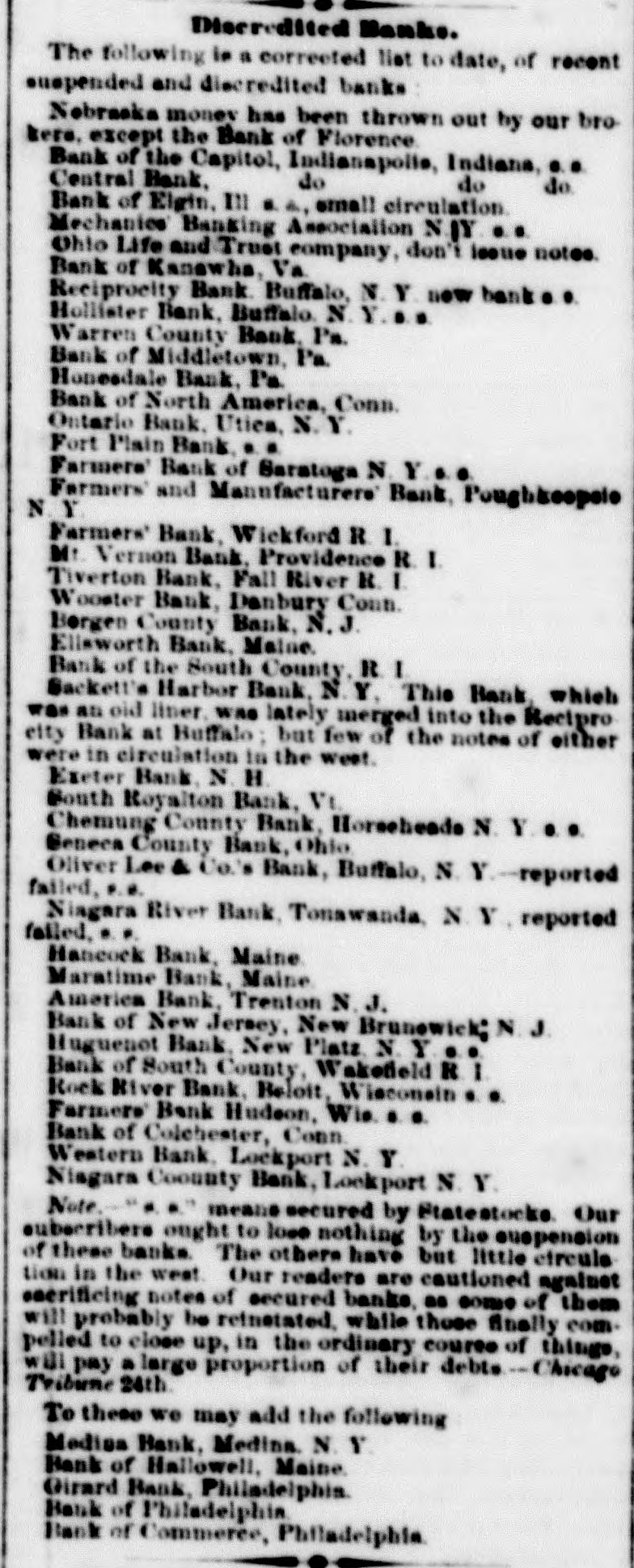

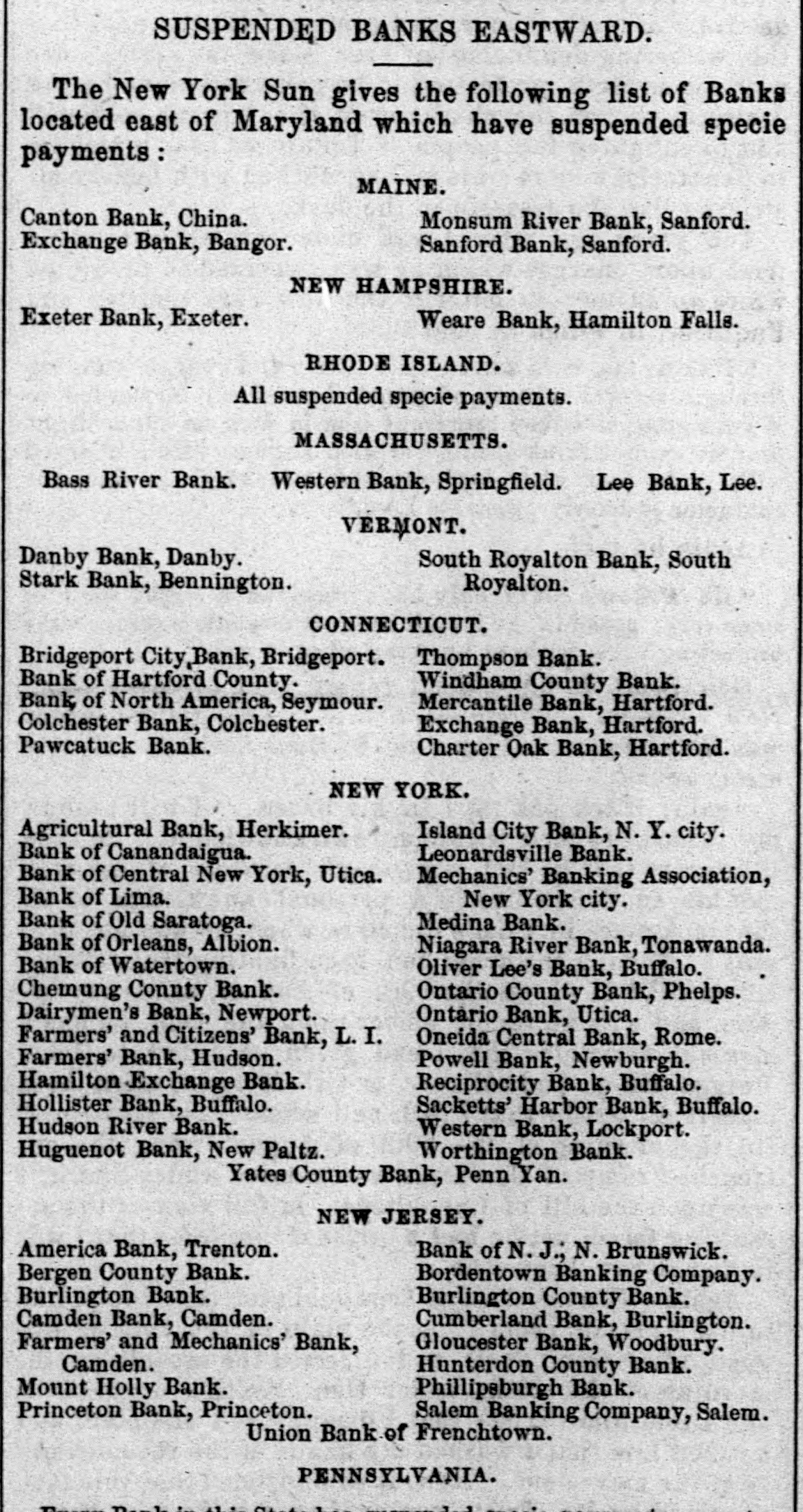

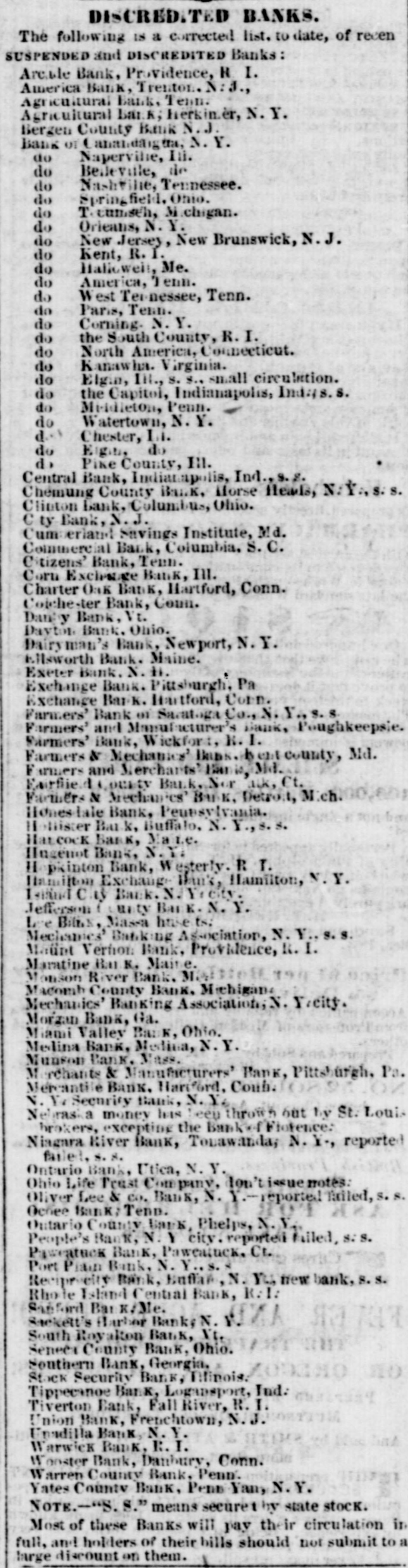

New TOTA 100 2.000 New. ork State 6s. 1364 83 15,000 United States 5a. 1865. 73 10,000 United States 5s, 1871 73 5,000 United States 53, 1871 The Hollis White Bank of Niagara Falls is under protest on its drafts. The circulation, we believe, is still redeemed, as is also that of the Medina Bank, the failure of which we noticed some days since. The notes of all the Albany Banks which have failed, will, we understand, be paid in full, the receivers furnishing any deficiency which may exist after the sale of the securities. We are informed that the State of Virginia has remitted to England the funds for the payment of the coupons on her State debt due 1st July. As she expects, probably, to be again a borrower, this is a wise stroke of policy. Meanwhile, having no hope of using her Northern victims, they are to be swindled without hesitation Overdue coupons of the Border States can be bought at 50@60. Louisiana pays nothing, excepting to those who take the oath to the Confederate States. In regard to the Missouri interest, The St. Louis Republican says that in some well-informed quarters the opinion is expressed that it will be paid in St. Louis. A portion of the revenue bonds due 1st June were paid, and the remainder would be in a few days. The Money Market presente no new features; mo- in can be had on call at 4@6 P cent per annum abundance, ney and a few first-class signatures pass readily at 7@9 P cent, but beyond this range negotiations have been made as low as 51 ₽ cent; the same difficulty of negotiation which we have heretofore reported exists. Confidence in mercantile paper does not improve, and the offerings in the street are quite limited, and the note brokers find little occupation. The Banks continue their regular lines with their customers, but will not increase the amount. If there had been prompt payments generally during the last three months, little mercantile paper at this time would have been outstanding, so limited has been the extent of business. The Mechanics' and Farmers' Bank of Albany bas declared a semi-annuual dividend of 5 & cent, payable on and after July 1st. The Boston and Worcester Railroad has declared a semi-annual dividend of 4 & cent, payable July 1, to holders of 15th inst. The 6 ₽ cent Convertible Treasury Notes have been sold at 9. Mr. Sub-Treasurer Cisco has left for Washington. We annex a comparative statement of the Exports (exclusive of specie) from New-York to Foreign Ports for the week and since Jan. 1, 1861 1861. 1860. 1859. $2,520,013 $ $1,000,042 Total for the week. 55,391,477 36,038,879 Previously reported 27,515,455 $57,911,470 $28,515,497 $37,910,606 Since Jan. 1 The annexed Cotton statistics are from Mr. Wm. P. Wright's Circular: CROP. The mails being suspended in the Southern In the States Atlantic our sources of information are necessarily curtailed. in many cases it has been States the crop does not planted promise in weil; corn. have letters late plowed in, and the several land sections of Georgia. and they all agree far, in in mt 4th June from addition to the unfavorable weather, so this particular. In we are informed that number of hands the Atlantic hdrawn States, from the culture of cotton in all sections, have been and taken as servants for the army and as laborers and attached now re We have expressed the opinion already thereto. that cotton culture this year will not receive the attention it peat requires, it. par particularly in under the early review stages 2,000 of bales. its growth. so far as heard from:but we Receipts for are the without week our usual tables from the Atlantic and Florida ports. for the week 38,000 bales, of which 29,000 bales were Exports Britain, 3,000 for France, and 6,000 for other foreign 70,000 for Great hand in all the ports to reduced below bales, ports. of The which stock the bulk on is at the North. The business of the SERSON is therefore is closed. statement of the movements in cotton since the The lat following of September last, as compared with the previous four years: 1861. 1860. 1859. 1858. 1857. Rec'ts. at P'ts 3,423,000 4.398.0003,698,X 2,942,000 2,107,000 2,552,0001,802.00 1,526 000 1,305,000 368,000 Exp. Gt. Br 570,000 565,000 393.000 352.000 Ex. to France. 515,000 326,000 459,000 376,000 362,000 Ex. to other Pita. 3,039,000 3,576,0002,710,000 2,204,000 2,049,000 Total Exports. 68,000 326.00 332,000 426,000 260,000 Stock on hand week included: the above: Rec'ts P'ts Of which during the past 2,000 15,000 11,000 19,000 9,000 40,000 47,000 22,000 14,000 Ex.to France Exp. to Gt. Br 29,000 3,000 9,000 4,000 2,000 3,000 6,000 3.000 3,000 10,000 6,000 Ex. to other F Pite. 38,000 59,000 36,000 48,000 20,000 TotalExports. Receipts-Decrease at the ports compared Britain, with SUMMARY Exporte- Decrease Great last year, 975,000 increase bales. to France, 5 000 bales increase to other 449,000 ports, bales 97,000. Total decrease in exports, 537,00 bales. oreign Messre. Hoffman & Gelpeke, bankers, of Chicago, have been forced to suspend. They say in a circular: have made provisions by which we are enabled to pay depart- imWe deposited in the books savings still show mediately Though all small have been heavy our many ment. and though under the cumstances, to handsome surplus. will earily fall short we trust of our bills ability receivable as certainly we have the honest intention, of have the all our liabilities no remote time. meeting The Lehigh Valley Railroad Company brought down Manch Chunk for the week ending on Saturday, 10,322 from tuns of coal, against 11,313 tuns for corresponding week last year, making for the season commencing Dec. 1, 1860, 383,556 tuns of coal, against 376,166 to corresponding time last year-which is an increase of 7,390 tuns of coal. The Pittsburgh and Fort Wayne, the Michigan Southern, and the Michigan Central Roads receive now for passage or freight charges nothing but specie funds. There are fair prospects for a large subscription to the three-million asked for by Pennsylvania in that State. The Chicago commercial report of Monday reports receipts of grain, 90,000 bushels wheat, 155,000 large bushels corn. The Illinois Central brought in 46,000 bushels corn and 34,000 bushels wheat; the Burlington and Quincy, 36,000 bushels corn and 13,000 bushels wheat. The Cincinnali Gazette of Monday says: of some The exchange dealings on Saturday at were prow heavy Others charged and the dealere drew for then all applicants again there were a few transactions backers' as as previously the and market may be called 101 prem. for however, checks, low as i-but and per @ prom. buying, most of the houses, refusing to pay over par. The City Government of New-Orleans is bankrupt, suspended its public works, and suspended payment. has The Legislature of Tennessee, at the recent session, the following swindling Stay-Law act: passed the collection of debts owing by States citizens during of AN Tennessee Act to prevent to citizens of the non-slaveholding non SECTION hostilities Be it enacted by the General Assembly veholding of State, the State their of agents Tennessee, or attorneys That no in person this State, in any shall property have claimed power to by. sue the or citi colzens of any such State in lect any monies owing to. or Tennessee any during hostilities between Tennessee and the Federal Government. That it may and shall be lawful into SEC.2. Be it further enacted, the Treasury of the for such debtora te pay such moneys Tennens and