Click image to open full size in new tab

Article Text

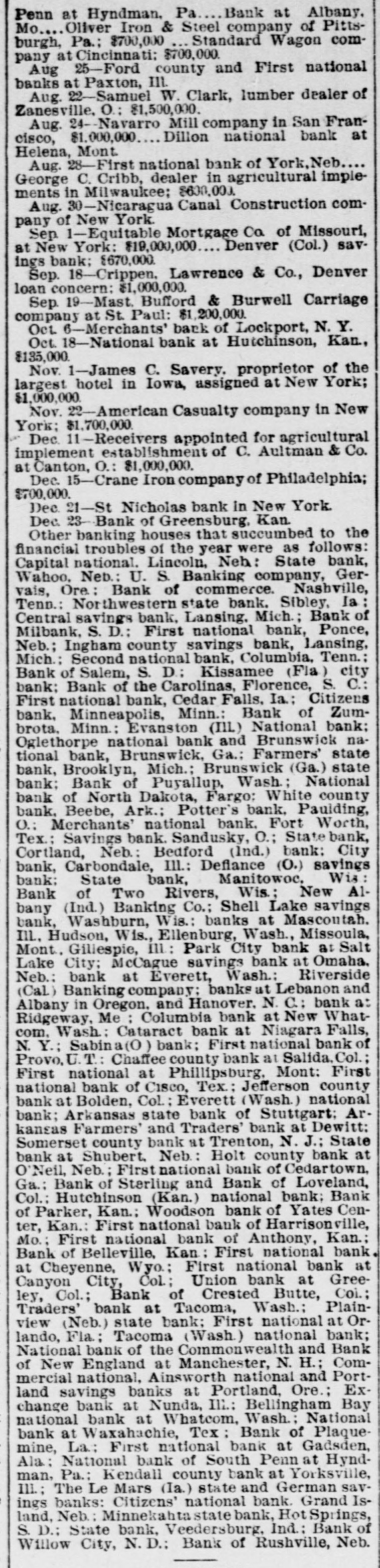

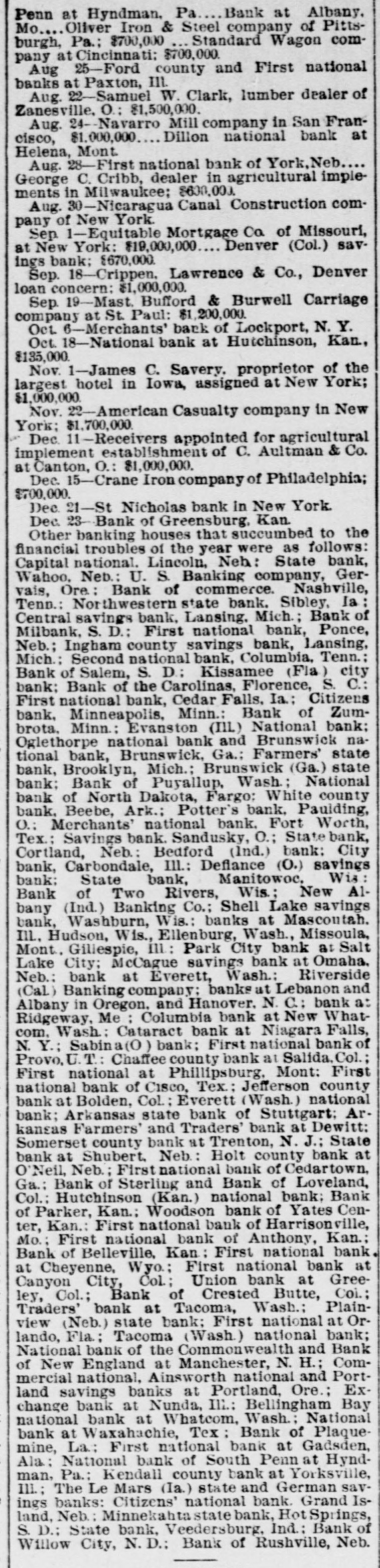

Penn at Hyndman, Pa Bank at Albany. Mo Oliver Iron & Steel company of Pittsburgh, Pa.; $700,000 Standard Wagon company at Cincinnati: $700,000. Aug 25-Ford county and First national banks at Paxton, III. Aug. 22-Samuel W. Clark, lumber dealer of Zanesville, O.: $1,500,000. Aug. 24-Navarro Mill company in San Francisco, $1,000,000 Dillon national bank at Helena, Mont Aug. 28-First national bank of York, Neb George C. Cribb, dealer in agricultural implements in Milwaukee; $600,000. Aug. 30-Nicaragua Canal Construction company of New York. Sep 1-Equitable Mortgage Ca of Missouri, at New York: $19,000,000 Denver (Col.) savings bank; $670,000. Sep. 18-Crippen. Lawrence & Co., Denver loan concern: $1,000,000. Sep. 19-Mast. Bufford & Burwell Carriage company at St. Paul: $1,200,000. Oct. 6-Merchants' bank of Lockport, N. Y. Oct. 18-National bank at Hutchinson, Kan., $135,000. Nov. 1-James C. Savery. proprietor of the largest hotel in Iowa, assigned at New York; $1,000,000. Nov. 22-American Casualty company in New York; $1,700,000. Dec. 11-Receivers appointed for agricultural implement establishment of C. Aultman & Co. at Canton, O.: $1,000,000. Dec. 15-Crane Iron company of Philadelphia; $700,000. Dec. 21-St Nicholas bank in New York. Dec. 23-Bank of Greensburg, Kan Other banking houses that succumbed to the financial troubles of the year were as follows: Capital national. Lincoln, Neh: State bank, Wahoo. Neb.: U. S. Banking company, Gervais, Ore: Bank of commerce. Nashville, Tenn.: Northwestern state bank. Sibley, la Central savings bank, Lansing, Mich.; Bank of Milbank, S. D.: First national bank, Ponce, Neb.; Ingham county savings bank, Lansing, Mich.: Second national bank, Columbia, Tenn.: Bank of Salem, S. D.; Kissamee (Fla) city bank: Bank of the Carolinas, Florence, S. C.: First national bank, Cedar Falls. Ia: Citizens bank, Minneapolis, Minn.: Bank of Zumbrota. Minn.: Evanston (III.) National bank: Oglethorpe national bank and Brunswick national bank, Brunswick, Ga.: Farmers' state bank, Brooklyn, Mich.; Brunswick (Ga.) state bank: Bank of Puyallup, Wash: National bank of North Dakota, Fargo: White county bank. Beebe, Ark.: Potter's bank. Paulding, O.; Merchants' national bank. Fort Worth, Tex.: Savings bank. Sandusky, 0.; State bank, Cortland, Neb.: Bedford (Ind.) bank: City bank, Carbondale, Ill.: Deflance (O.) savings bank: State bank, Manitowoc. Wis: Bank of Two Rivers, Wis.: New Albany (Ind.) Banking Co.; Shell Lake savings bank, Washburn, Wis.: banks at Mascoutah. Ill. Hudson, Wis., Ellenburg, Wash., Missoula, Mont. Gillespie, III: Park City bank at Salt Lake City; McCague savings bank at Omaha. Neb.: bank at Everett, Wash.: Riverside (Cal) Banking company; banks at Lebanon and Albany in Oregon, and Hanover. N. C: bank a: Ridgeway, Me Columbia bank at New Whatcom. Wash: Cataract bank at Niagara Falls, N. Y.; Sabina(O bank: First national bank of Provo. U.T.: Chaffee county bank at Salida. Col.; First national at Phillipsburg, Mont: First national bank of Cisco, Tex.: Jefferson county bank at Bolden, Col: Everett (Wash.) national bank; Arkansas state bank of Stuttgart; Arkansas Farmers' and Traders' bank at Dewitt: Somerset county bank at Trenton, N. J.; State bank at Shubert, Neb: Holt county bank at O'Neil, Neb.; First national bank of Cedartown. Ga.: Bank of Sterling and Bank of Loveland, Col.: Hutchinson (Kan.) national bank; Bank of Parker, Kan.: Woodson bank of Yates Center, Kan.: First national bank of Harrisonville, Mo.; First national bank of Anthony, Kan.: Bank of Belleville, Kan: First national bank. at Cheyenne, Wyo.: First national bank at Canyon City, Col: Union bank at Greeley, Col.; Bank of Crested Butte, Col.: Traders' bank at Tacoma, Wash.: Plainview (Neb.) state bank: First national at Orlando, Fla: Tacoma (Wash.) national bank; National bank of the Commonwealth and Bank of New England at Manchester, N. H.; Commercial national. Ainsworth national and Portland savings banks at Portland. Ore.: Ex-