Article Text

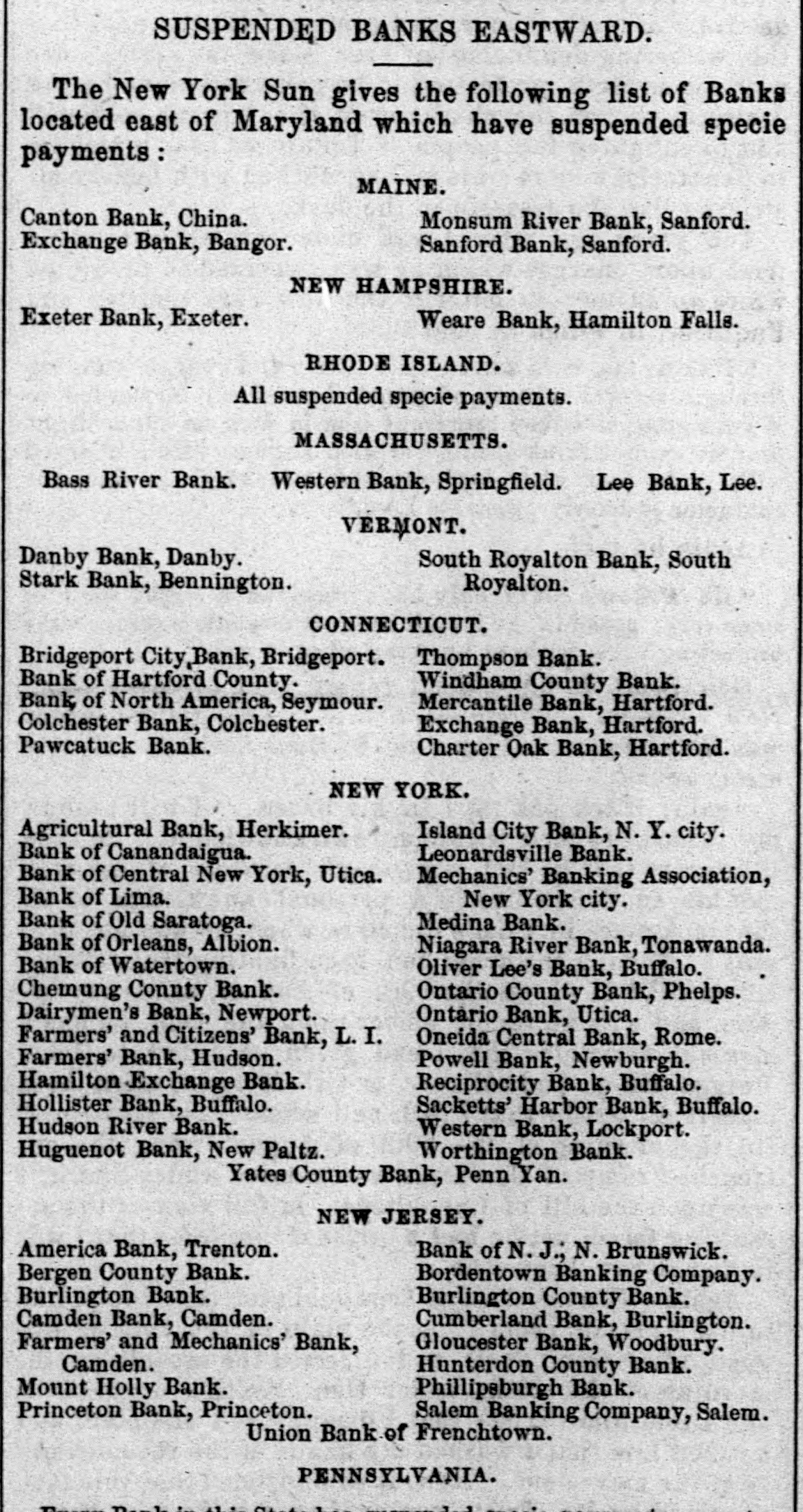

True unitted Mint, Philad The following banks have been thrown outsday The Bank of ima, Leonardsville Bank, and Hamilton Exchange Back of this State, and the Pawtucket Bask, Coon. From the Saffeik Back the advices are that the New England Banks are still firm. The most on'avorable advices day are from eriais has at last strack, and two banking houses have where of leading the Chicago, or three Baltimore and the West we are becoming quiet, and the are adapting themselves to the Philadelphia, monity motters suspended. mereantile hear From com- that The and more and liabilities of affairs. discounting Baltimore liberally, Philadelphia changed are Banks settled order are by the Banks have the resolve of to they could not meet all the and certified checks. although Here yesterday already expand, acted of materially assisted We hear of no new stal community. their dealers have important the demands commer- mereastile disasters, although rumore were sale of French Goods, $194,000, several. made A amounting current to of by Van Wyck, Townshend & yesterday, was met over 90,000-certainly & symptom. extent which fe of due The promptly very favorable Warren, to the promptness with which the are met is most circumstance. Trade, of under our the merchante certainly however, remarkable payments is quite among the jobbers and many are at a heavy loss. The stock carried dull will seiling probably descriptions of goods over be large, and the Spring a consummation most to are buying uncurrent Right, The the brokers devently money importations and be wished. domes. exchange very sparingly, and the in the street is not so as be former expected. offering Rates large amount might of the are too unsettled for quotation. warrants are entirely unsalable, and some time past. Our city banks the Land for eventenor of keep have on been their way, and feel abundantly able to Their in a short time by the the sautain themselves. largely increased California specie reserve arrival will of be steamer, by the disbursements &c. The specie to be $500,000, if at is Sub-Treasury, by the Vanderbilt, coming reported all, from coming prob- the for Havana; but the nothing of such an amount ship here The ably Arabia, in doubioons know it owners coming. of the is thought, has some gold out parties here for the of we haar that a sive ordered are. coal From house by Philadelphia purchase very on board, exten. prodhas suspended payment, which had - unfavorable effect upon Reading. The Illinois Central Railroad pays its coupons to and Road on Bonds, but defaults on morrow. Bonda its First and The Mortgage Milwaukee Mississippi its Income pays on its floating debt. The La Crosse and was served with an Peabody, to prevent the of granted the Milwaukee by Road Judge injunction payment to-day, coupons due to-morrow 0 what are bonds. The Fort will pay if the Treasurer and "eorruption" Chicago Road Pittsburgh, called at Wayne Pitts. the burgh has been able to obtain exchange on will pay as soon as be if not, obtained. the Company exchange New-York can The money is provided at Pittsburgh meet the interest, but the suspension of the Pittsburgh banks has embarrassed its transmission. Advices from Chicago speak of a crisis as failures had taken for a day or two the in there, and several We learn that, past, place. prevailing dealers and even some of the retail in this city, have refused dry goods houses of Washington the Jersey Market, City large the bills and Hoboken Banks-in fact, the ew Jersey Banks, This is the or suspension of the banks in of of bills the a of failure all question, result, but not general suspicion concerning all banks out of State. as Jersey City and Hoboken all others in the State research, As far and the Banks are Security a refusal of their bills under which dietates the General Law, doing the must suspicion business find its of the law under which as the provisions of that law are ate, would be almost birth in ignorance such they that oper- it impossible for the bill. holders to suf. Bank were to fail this law are required to the working Sermuch if every State Treasurer under to-day. deposit The Banks with stocks of the States of Virginia, Kentucky and Massachusetts, or (by special enact. ment) Jersey City water stock and Newark City Serip, to the full amount of their circulation. These stocks are taken by the State Treasurer at their market value, and if any time they should depreciate, the banks are compelled by the law to make such deprediation good by the return of their bills. These stocks are further require to produce 6 per cent per annum. We learn from reliable source the following facts relative to the se rities of the Jersey City Banks: The Hudson unty Bank has State Stocks and Newark and ey City Bonds, worth $135,000, to secure an outs ing circulation of $90,000. The Bank Jersey City has similar stocks and bonds, amou, to $99,500, to secure $66,000 circulation. The Mech and Traders' Bank has $118,000. principally ewark and Jersey City Bonds, against ion. $80,000 ein This she margin in favor of the banks respec. and $38,000, or an tively of in the hands of gate of $ a circulation of Treasure 00 00, guarantee in $32,500, securities, $236,000- the aggre- State more the per cent excess of securities over circulating lia ies, to offset possible depreciation, which, however extremely small, that portion of the sities 00 ting of City Bonds-a la mortgage portion-being on secuabsolute guaranteed by bond and the real eata of Jersey City and Newark. We append list of such of the banks of New-Jermy as are operating under this " General Banking Law, and, for the more ready detection of of we would say that under special charters, those such bill working banks, is they inasmuch differ the from bills as every countersigned by the State Treasurer. They are as follows: Hudson County Bank, Jersey City Mechanical and Traders' Jersey City. Bank of Jersey City, Jersey City. Hoboken City Bank, Jersey City Bergen County Bank, Hackensa Passaic Bank Paterson. Cataract Bank, Paterson. Freehold Banking Company, Freehold. through authentic sources the New State Bank of brasches We of Indiana will that the stand and continue to pay specie. of the Income Bonds of the Company and The Indianapolis Coupons Railroad falling due Madison on the let of October will be paid by Winslow, Lanier & Co. as and after that day. It is gratifying to learn that the old Madison Road is sustaining its credit in these try ing times.