Click image to open full size in new tab

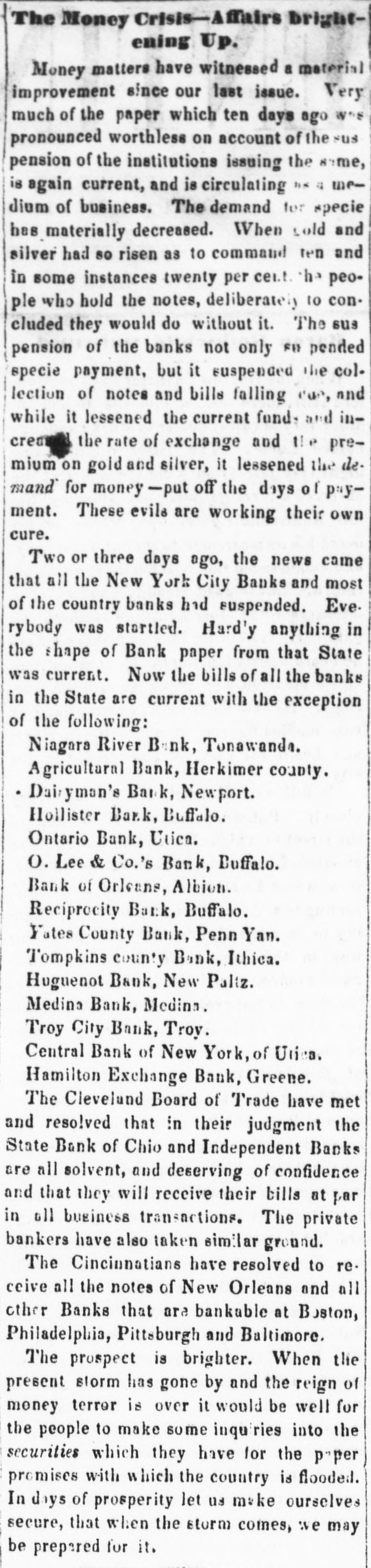

Article Text

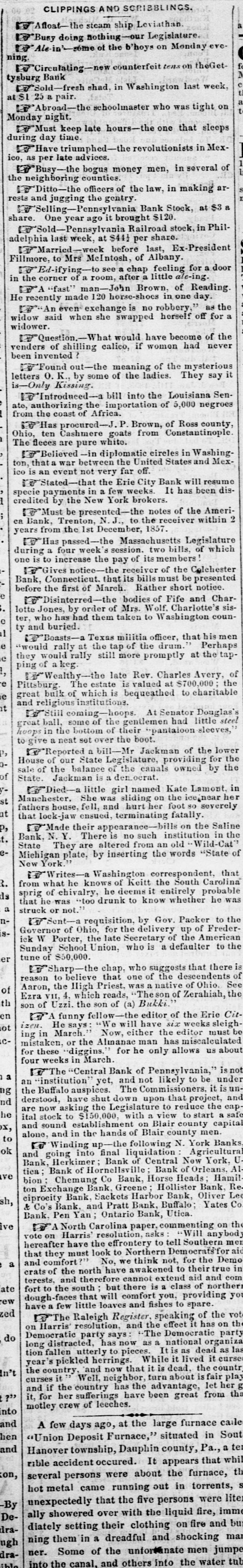

CLIPPINGS AND SCRIBBLINGS.

Afloat-the steam ship Leviathan.

Busy doing nothing-our Legislature.

Ale-in-some of the b'hoys on Monday eve-ning.

Circulating-new counterfeit tens on the Gettysburg Bank

Sold-fresh shad, in Washington last week, at $1 25 a pair.

Abroad-the schoolmaster who was tight on Monday night.

Must keep late hours-the one that sleeps during day time.

Have triumphed-the revolutionists in Mexico, as per late advices.

Busy--the bogus money men, in several of the neighboring counties.

Ditto-the officers of the law, in making arrests and jugging the gentry.

Selling-Pennsylvania Bank Stock, at $3 a share. One year ago it brought $120.

Sold-Pennsylvania Railroad stock, in Philadelphia last week, at $44½ per share.

Married-week before last, Ex-President Fillmore, to Mrs McIntosh, of Albany.

Ed-ifying to see a chap feeling for a door in the corner of a room, after a little ale-ing.

A "fast" man-John Brown, of Reading. He recently made 120 horse-shoes in one day.

"An even exchange is no robbery," as the widow said when she swapped herself off for a widower.

Question. What would have become of the venders of shilling calico, if women had never been invented?

Found out-the meaning of the mysterious letters O. K., by some of the ladies. They say it is-Only Kissing.

Introduced-a bill into the Louisiana Senate, authorizing the importation of 5,000 negroes from the coast of Africa.

Has procured-J. P. Brown, of Ross county, Ohio, ten Cashmere goats from Constantinople. The fleeces are pure whito.

Believed in diplomatic circles in Washington, that a war between the United States and Mexico is an event not very far off.

Stated-that the Erie City Bank will resume specie payments in a few weeks. It has been discredited by the New York brokers.

Must be presented-the notes of the America Bank, Trenton, N. J., to the receiver within 2 years from the 1st December, 1857.

Has passed-the Massachusetts Legislature during a four week's session, two bills, of which one is to increase the pay of its members!

Gives notice-the receiver of the Colchester Bank, Connecticut, that its bills must be presented before the first of March. Rather short notice.

Disinterred-the bodies of Fife and Charlotte Jones, by order of Mrs. Wolf. Charlotte's sister, who has had them taken to Washington county and buried.

Boasts-a Texas militia officer, that his men "would rally at the tap of the drum." Perhaps they would rally still more promptly at the tapping of a keg.

Wealthy-the late Rev. Charles Avery, of Pittsburg. The estate is valued at $700,000; the great bulk of which is bequeathed to charitable and religious institutions.

Still coming-hoops. At Senator Douglas's great ball, some of the gentlemen had little steel hoops in the bottom of their "pantaioon sleeves," to give a neat set over the boot.

Reported a bill-Mr Jackman of the lower House of our State Legislature, providing for the sale of the balance of the canals owned by the State. Jackman is a democrat.

Died-a little girl named Kate Lamont, in Manchester. She was sliding on the ice near her fathers house, fell, and hurt her foot so severely that lock-jaw ensued, terminating fatally.

Made their appearance-bills on the Saline Bank. N. Y. There is no such institution in the State They are altered from an old "Wild-Cat" Michigan plate, by inserting the words "State of New York."

Writes-a Washington correspondent, that from what he knows of Keitt the South Carolina sprig of chivalry, he deems it entirely probable that he was "too drunk to know whether he was struck or not."

Sent-a requisition, by Gov. Packer to the Governor of Ohio, for the delivery up of Frederick W Porter, the late Secretary of the American Sunday School Union, who is a defaulter to the tune of $50,000.

Sharp-the chap, who suggests that there is reason to believe that one of the descendents of Aaron, the Iligh Priest, was a native of Ohio. See Ezra VII, 4, which reads, "The son of Zerahiah, the son of Uzzi. the son of (a) Bukki."

A funny fellow-the editor of the Erie Citizen. He says: "We will have six weeks sleighing in March." Now, either the editor must be mistaken, or the Almanac man has miscalculated for these "diggins," for he only allows us about four weeks in March.

The "Central Bank of Pennsylvania," is not an "institution" yet, and not likely to be under the Buffalo auspices. The Commissioners, it is understood, have shut down upon that project, and are now asking the Legislature to reduce the capital stock to $150,000, with a view to start a safe and sound establishment on Blair county capital alone, and in the hands of Blair county men.

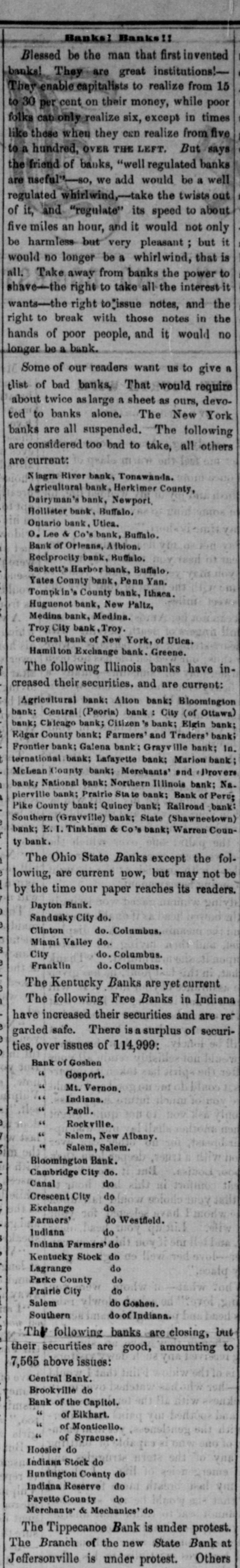

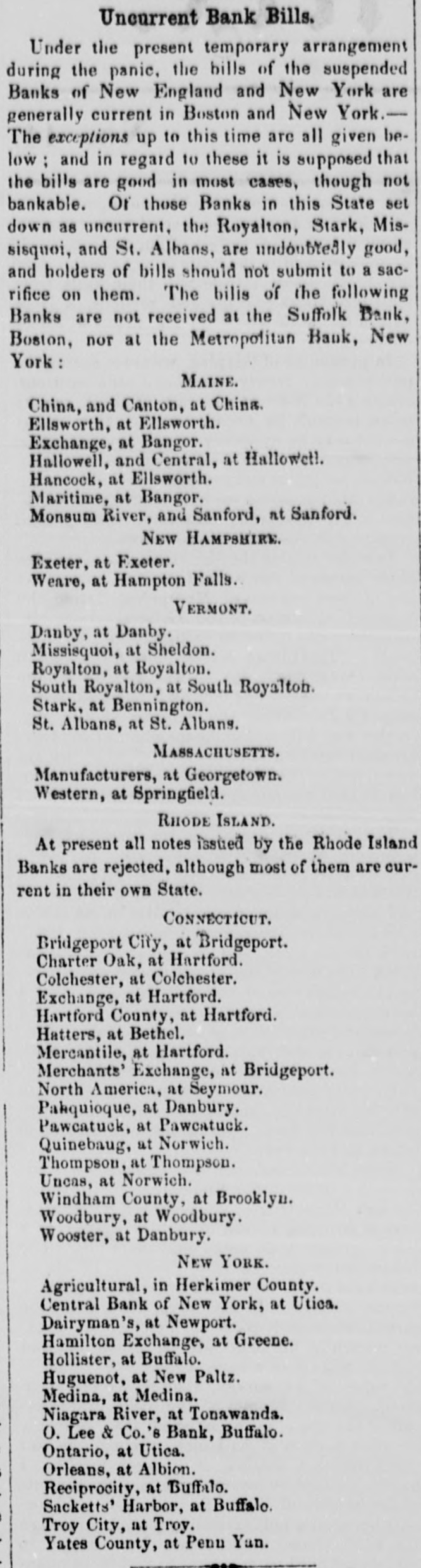

Winding up the following N. York Banks. and going into final liquidation: Agricultural Bank, Herkimer; Bank of Central New York, Utica; Bank of Hornellsville; Bank of Orleans, Albion; Chemung Co Bank, Horse Heads; Hamilton Exchange Bank, Greene; Hollister Bank, Reciprocity Bank, Sackets Harbor Bank, Oliver Lee & Co's Bank, and Pratt Bank, Buffalo; Yates Co. Bank, Pen Yan; Ontario Bank, Utica.

A North Carolina paper, commenting on the vote on Harris' resolution, asks: "Will anybody hereafter have the effrontery to tell Southern men that they must look to Northern Democrats for aid and comfort?" No, we think not, for the Democrats of the north have awakened to their true interests, and therefore cannot extend aid and comfort to the south; but there is a class of northern dough-faces that will comfort you, providing you have a few little loaves and fishes to spare.

The Raleigh Register, speaking of the vote on Harris' resolution, and the effect it has on the Democratic party says: "The Democratic party, long distracted, has now as a national organization fallen utterly to pieces. It is as dead as last year's pickled herrings. While it lived it cursed the country, and now that it is dead, the country curses it" Well, neighbor, turn about is fair play and if the country has the advantage, let her get it, for her sufferings have been great from that motley crew of leeches.

A few days ago, at the large furnace called "Union Deposit Furnace," situated in South Hanover township, Dauphin county, Pa., a terrible accident occured. It appears that while several persons were about the furnace, the hot metal came running out in torrents, so unexpectedly that the five persons were literally showered over with the liquid fire, immediately setting their clothing on fire and burning them in a dreadful and shocking manner. Some of the unfortunate men jumped into the canal, and others into the water tub.