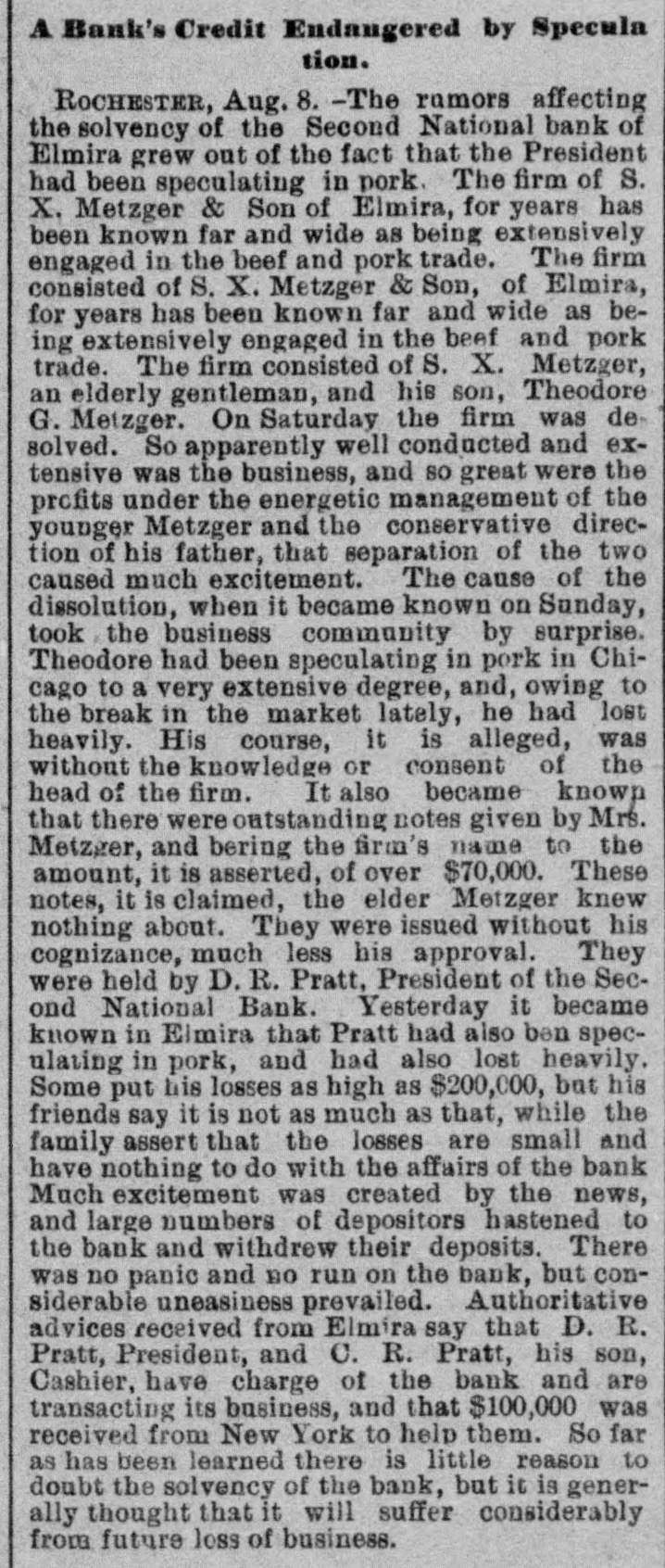

Article Text

NEW YORK. / Run on n Bank. NEW YORK, Aug. 7.-The Commercial says there is a run on the Second National Bank of Elmira, in consequence of its president, D.R. Pratt, having lost $150,000 in pork speculation. The bank is believed to be solvent. Will Not Attempt to Swim Up the Hudson. Norris Taylor Collinge, the English swimmer, who recently failed in his attempt to swim from Albany to New York in six days, announced that he would again attempt it, starting from New York and going up the Hudson with every flood tide. Forsome unexplained reason the programme was not carried out. Keno Players Interrupted. "Keno," followed by the cry of "Police," suddenly stopped a flourishing game of keno at the Iroquois House at Coney Island last night. About ten players were in when the police entered, seized all the instruments and arrested the dealers. Great excitnment was caused, and all the inmates broke for the doors and windows. A Panic on a Ferry Boat, A singular accident occurred last night to the ferryboat Darcy of Jersey. The packing of the engine blew out, and the engine-room became filled with steam. The engineer was driven out, and a panic ensued among the passengers. The boat ran against the bulkhead with a frightful shock, and one of the terrified passengers climbed up the bulkhead. Coated With Tar and Feathers. TROY, August 7.-About a year ago Albert Voss, a bright, well-mannered young German, who is believed to be well connected in Germany, took up his abode in Castleton, a Hudson river village, fourteen miles from here. He soon made friends with Henry Hoffman, a fellow-countryman, who possesses considerable property, a wife, and five children. It was not long before the villagers remarked that Voss and Mrs. Hoffman were very frequently in each other's company. The gossips talked to Hoffman, who recently scolded his wife and broke of his friendship for Voss. The couple, however, met as before, and a week ago Mrs Hoffman left her husband, and with Voss took a residence opposite the Hoffman dwelling. The villagers were incensed at the open immorality of the couple. A delegation on Thursday last waited upon Voss and ordered him to depart within six hours. Mrs. Hoffman by some means compromised with her husband, and not only induced him to take her back, bat secured his help in secreting Voss in the Hoffman residence. The Castleton people on Saturday night heard of Voss' whereabouts. One hundred men called at the Hoffman place and commanded the Hoffmans to produce him. Backed by his wife, Hoffman showed fight. Some of the party climbed to the roof, and, cutting their way through with axes, entered the garret, where they found Voss. He was covered with the contents of a pot of slack lime and then taken out. Escorted by the indignant populace, he was marched to a secluded spot, where he was stripped and tarred and feathered. Then he was marched through the village, and at its outskirts his clothes were returned to him and he was ordered never to return. The crowd went back to Hoffman's house and told him that if Voss was again harbored Hoffman and his wife would be tarred and feathered also. Mysterions Case of Drowning. Information of a mysterious cause of drowning was last evening given at the York-street Station in Brooklyn. Daniel J. Cunan stated that he was standing at the foot of Gold-street, when he saw a skiff in the water bottom upward, with a man clinging to it. Cunan threw off his clothes and plunged in. Before he could reach the boat the stranger lost his hold and sank.