Article Text

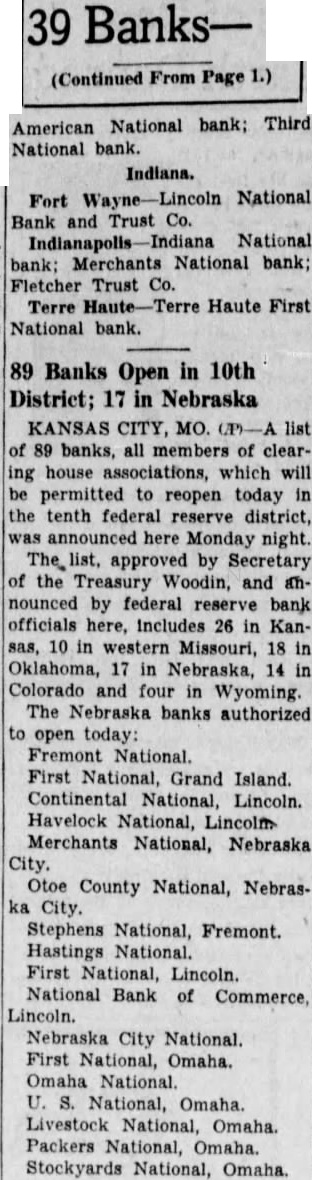

CASH BANK INTO SALARY CENTRALIZE ENVELOPES SUPPLY (Continued From Page bankers said. Most of the accounts are deposits of the cash received by large firms, they clared, although some individuals appear who may have had cash in deposit boxes. CHECK ON NEW FUNDS The First National bank had about $140,000 in this new count business Thursday, and was permitting checking against these accounts. These checks were identified with ber stamp reading, "This check drawn on funds deposited March subsequent thereto. Government checks and postal money orders received deposits. The Omaha National had about $90,000 the "new account business, 80 far had arrangements for The accounts strictly for the care cash, with all made by the depositor the counter Other banks had smaller sums in the ledgers. The state banks Nebraska not Woods rules and regulations under The difficulty with the banks' reopening many stances that their funds largely deposit in national banks Omaha "reserve center" and in other reserve and subreserve centers Unthe holiday state banks could deposit their reserves directly with the federal reserve state bank has account the payment would deplete its draw the federal reserve but would have draw national where its reserve deposited Mr. Earhart of federal reserve said he had ing whether the national bank could grant the pay roll withthrough the state bank but would be optional the officers of the national bank LINCOLN RATIONS PAY All Lincoln banks ing limited withdrawals cash their depositors Thursday for the payment salaries and wages, the purchase of food and medicine, special emergency needs permitted under the regulations laid down by Secretary of the Treasury Woodin Officers the pect to reopen for regular busisoon Congress enacts the legislation asked by President the Lincoln Clearing House association made customers of various banks found that they could obtain currency in limited amounts for their immediate needs. each establishment tell ers were receiving checks and paying out cash within specified conditions Regulations governing withwere altogether uniform the downtown banks The hope voiced by their officers that day would bring general "business as usual throughout the country First National, Vice President Maly said checks drawn upon that bank in payment salaries wages were being paid presentation up to $25 each. Individual depositors being permitted to out apiece for necessities.