Article Text

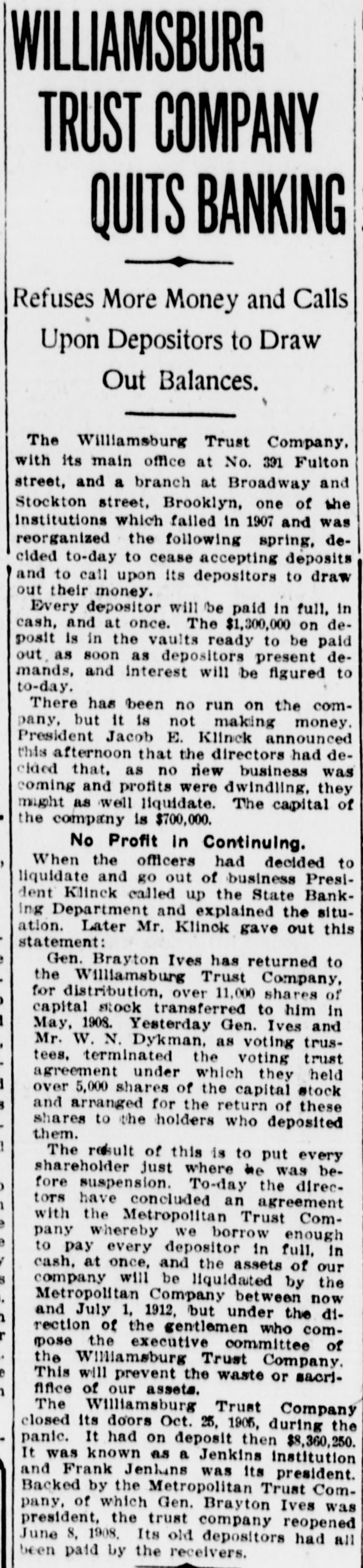

WILLIAMSBURG TRUST COMPANY QUITS BANKING Refuses More Money and Calls Upon Depositors to Draw Out Balances. The Williamsburg Trust Company, with its main office at No. 391 Fulton street, and a branch at Broadway and Stockton street, Brooklyn, one of the Institutions which failed in 1907 and was reorganized the following spring, decided to-day to cease accepting deposits and to call upon its depositors to draw out their money. Every depositor will be paid in full, in cash, and at once. The $1,300,000 on deposit is in the vaults ready to be paid out as soon as depositors present demands, and interest will be figured to to-day. There has been no run on the company, but it is not making money. President Jacob E. Klinck announced this afternoon that the directors had decided that, as no new business was coming and profits were dwindling, they mught as well liquidate. The capital of the company is $700,000. No Profit in Continuing. When the officers had decided to liquidate and go out of business President Klinck called up the State Banking Department and explained the situation. Later Mr. Klinck gave out this statement: Gen. Brayton Ives has returned to the Williamsburg Trust Company, for distribution, over 11,000 shares of capital stock transferred to him in May, 1908. Yesterday Gen. Ives and Mr. W. N. Dykman, as voting trustees, terminated the voting trust agreement under which they held over 5,000 shares of the capital stock and arranged for the return of these shares to the holders who deposited them. The result of this is to put every shareholder just where be was before suspension. To-day the directors have concluded an agreement with the Metropolitan Trust Company whereby we borrow enough to pay every depositor in full, in cash, at once, and the assets of our company will be liquidated by the Metropolitan Company between now and July 1, 1912, but under the direction of the gentlemen who compose the executive committee of the Williamsburg Trust Company. This will prevent the waste or sacrififice of our assets. The Williamsburg Trust Company closed its doors Oct. 25, 1905, during the panic. It had on deposit then $8,360,250. It was known as a Jenkins institution and Frank Jenhans was its president. Backed by the Metropolitan Trust Company, of which Gen. Brayton Ives was president, the trust company reopened June 8, 1908. Its old depositors had all been paid by the receivers.