Article Text

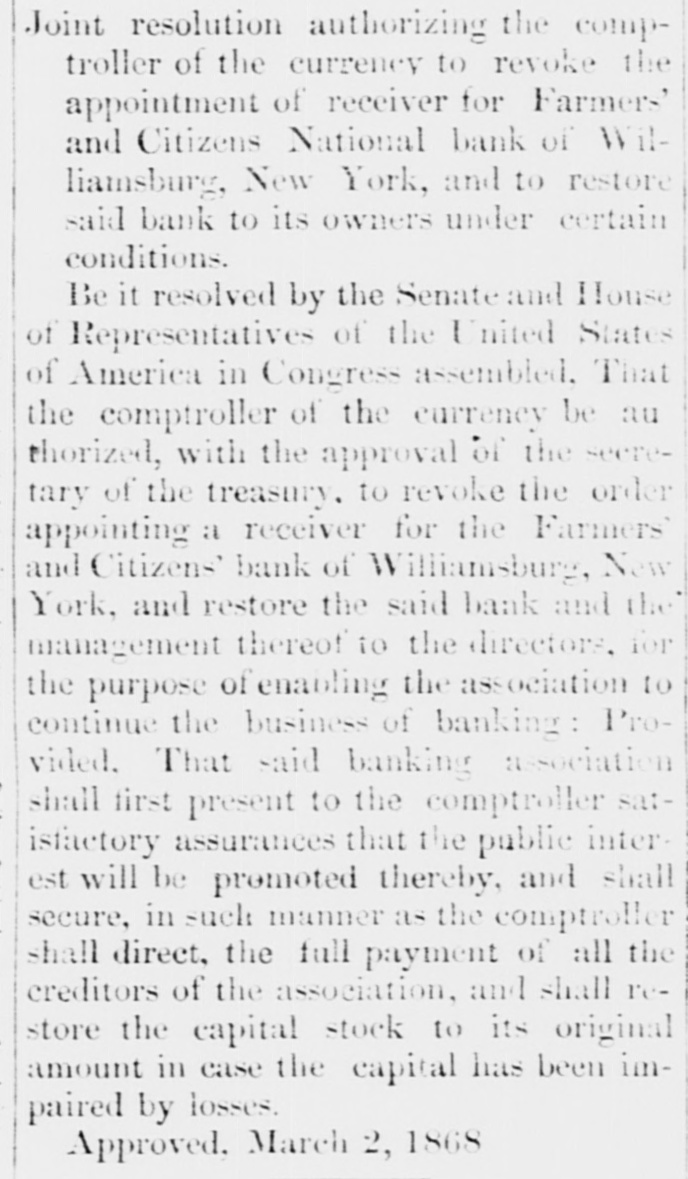

EUROPE The news report by the Atlantic cable is dated yesterday evening. September 7. The Prussian government issued a peace circular in which it 18 stated that the pacific declarations of the Marquis de Moustier, the French Foreign Minister, are "highly satisfactory." General Garibaldi dined with the Prussian Minister in Florence, by special invitation, when on his way to the Peace Congress of the revolutionists in Geneva The Austrian cabinet has been reconstructed. A number of Irish policemen have been dec. orated with English medals for action in the Fenian campaign. The little American schooner John T. Ford drifted to the coast of Ireland after being capsized. Valuable papers have been found on the wreck and se. cured. The Turkish naval authorities on the coast of Candia compelled an American vessel to desist from shipping insurrectionary refugees. Consols closed at 943. for money. in London. Five. twenties were at 73% and firmer in London, and at 77 in Frankfort. The Liverpool cotton market was easier, with middling uplands at 10d. Breadstuffs firm. Provisions and produce without material change. MISCELLANEOUS. Further particulars of the Naugatuck railroad accident disclose the fact that a passenger car was also precipitated from the bridge but without injury to the passengers. or the sixteen inmates of the baggage car which was swept with wonderful rapidity down the stream by the swollen current, eight lost their lives and four bodies have been recovered. A coroner's jury rendered a verdict stating that the bridge was an " insufficient struc. ture." Intense excitement prevailed among the depositors in the Farmers' and Citizens' National Bank, of Brooklyn, yesterday on receipt of the information that the institution bad been placed in the hands of a receiver. Heavy losses are experienced by this blow among the merchants of Williamsburg. The doors of the building were sealed yesterday, and no admittance was given to any of the numerous unfortunate ones who crowded about it demanding some redress. It is stated that the president of the bank kept his knowledge of the notification received from the Treasury Department for nearly a month from the directors. and the collapse was as adden to them as to the stockholders. No statement of the affairs of the bank has yet been put forth by the directors. The Merchants' and Traders' Bank, of Greenpoint, also suspended payment yesterday, as all its deposits were in the hands of the defunct institution. Several of the banks suffered slight losses by this double failure. An inquest was held on the body of John O'Flynn yesterday at Bellevue Hospital, and a verdict was ren. dered that he came to ha death from the effects of a fracture of the skull produced by a blow from the fist of William McKenzie, who has been arrested. General Griffin has assumed command at New Orleans, and in his initial order directs that all existing orders will remain is force. The Montreal riots have ceased and the town is again quiet. One man killed and thirty serious wounds from gunshots and stones are the sum total of casualties on rough estimation. Several of the alleged rineleaders were discharged from custody by the court yesterday. Middleton. an oil merchant, whose stores in Montreal were recently destroyed by fire, is reported to have absconded, leaving behind 3 deficiency of $43,000 on his books. General Sheridan arrived in Cairo yesterday, and started immediately by rail for St. Louis, no time being given for a demonstration in Cairo, beyond firing a salute. The population of San Francisco is now 130,000, an increase of 74,000 in seven years. A defaulting cashier in San Francisco recently ab. seconded for China with $100,000 worth of "misapproprinted" funds. The California election, it is claimed, was carried solely through the apathy of republicans. Some of the strong republican counties showed a heavy falling off in the vote polled, and even went strongly democratic. M. Alphonse Dano, the late French Minister in Mexico, sailed from this port yesterday for France. Frederick Horricks, the late Belgian Charge d'Affaires in Mexico, accompanied him. A Washington correspondent of a Boston paper states that the President's friends have telegraphed to General McClelian to come on to Washington, if he will attach himself to the President's cause. Abraham Myers, the conservative candidate for Mayor of Nashville, was killed by a fall from a staircase yes. serday. It was rumored in Washington yesterday that Secretary Seward had resigned. and that Reverdy Johnson was to be appointed Secretary of State. Secretary McCulloch is about preparing a revised and corrected statement of the public debt, in which he will show that the debt has been reduced nearly $265,000,000 within the last two years. Forty-three deaths from yellow fever occurred in New Orienas vesterday. Boats from that city are placed under quarantine at Vicksburg. The Newburg boat race was again postponed yesterday owing to the roughness of the water; this timel until Monday. The Fenian Congress at Cleveland yeaterday appolated . committee to confer with a committee from the Savage