Article Text

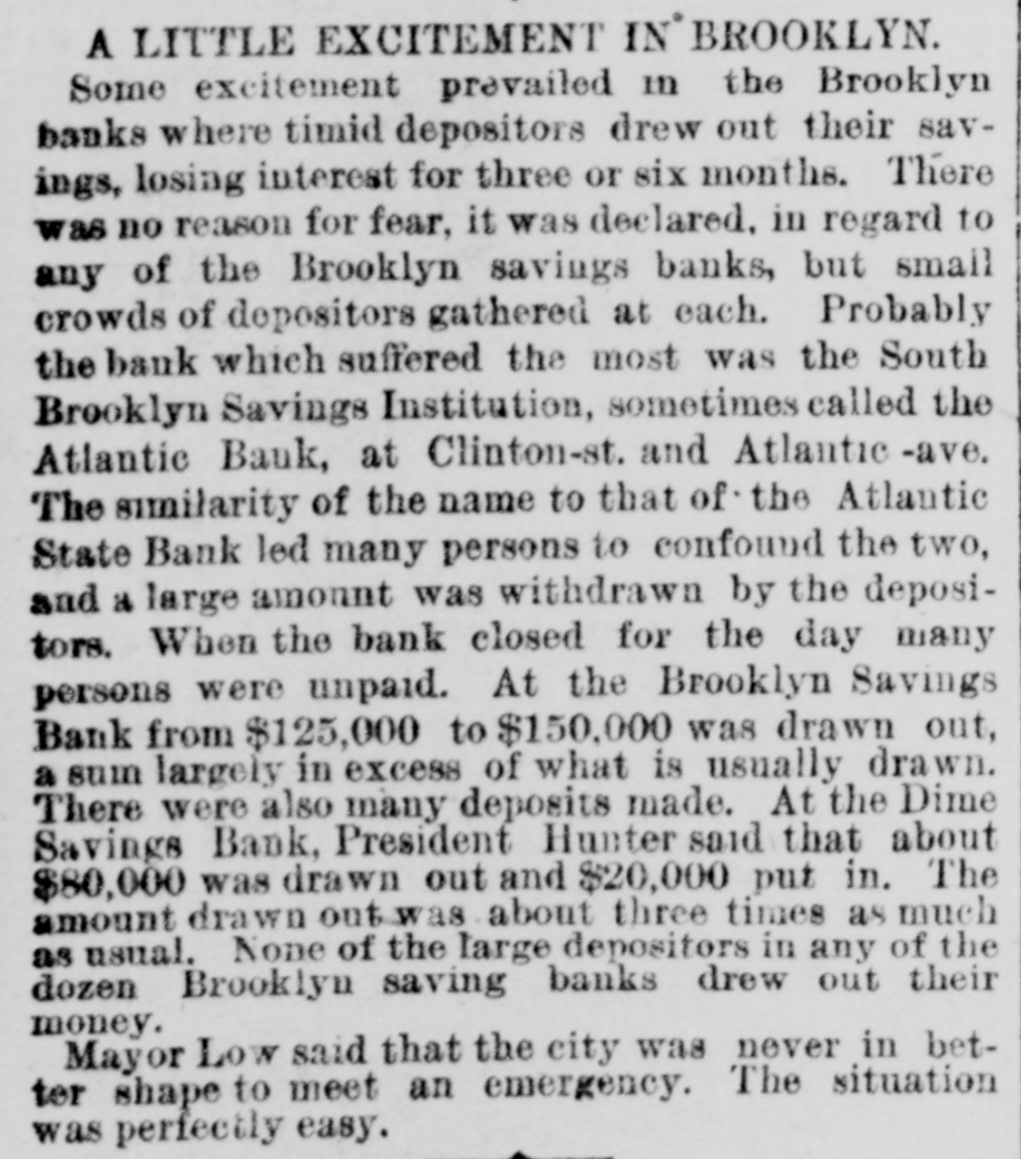

A LITTLE EXCITEMENT IN® BROOKLYN. Some excitement prevailed in the Brooklyn banks where timid depositors drew out their savings, losing interest for three or six months. There was no reason for fear, it was declared. in regard to any of the Brooklyn savings banks, but small crowds of depositors gathered at each. Probably the bank which suffered the most was the South Brooklyn Savings Institution, sometimes called the Atlantic Bank, at Clinton-st. and Atlantic -ave. The similarity of the name to that of the Atlantic State Bank led many persons to confound the two, and a large amount was withdrawn by the depositors. When the bank closed for the day many persons were unpaid. At the Brooklyn Savings Bank from $125,000 to $150,000 was drawn out, a sum largely in excess of what is usually drawn. There were also many deposits made. At the Dime Savings Bank, President Hunter said that about $80,000 was drawn out and $20,000 put in. The amount drawn out was about three times as much as usual. None of the large depositors in any of the dozen Brooklyn saving banks drew out their money. Mayor Low said that the city was never in better shape to meet an emergency. The situation was perfectly easy.