Article Text

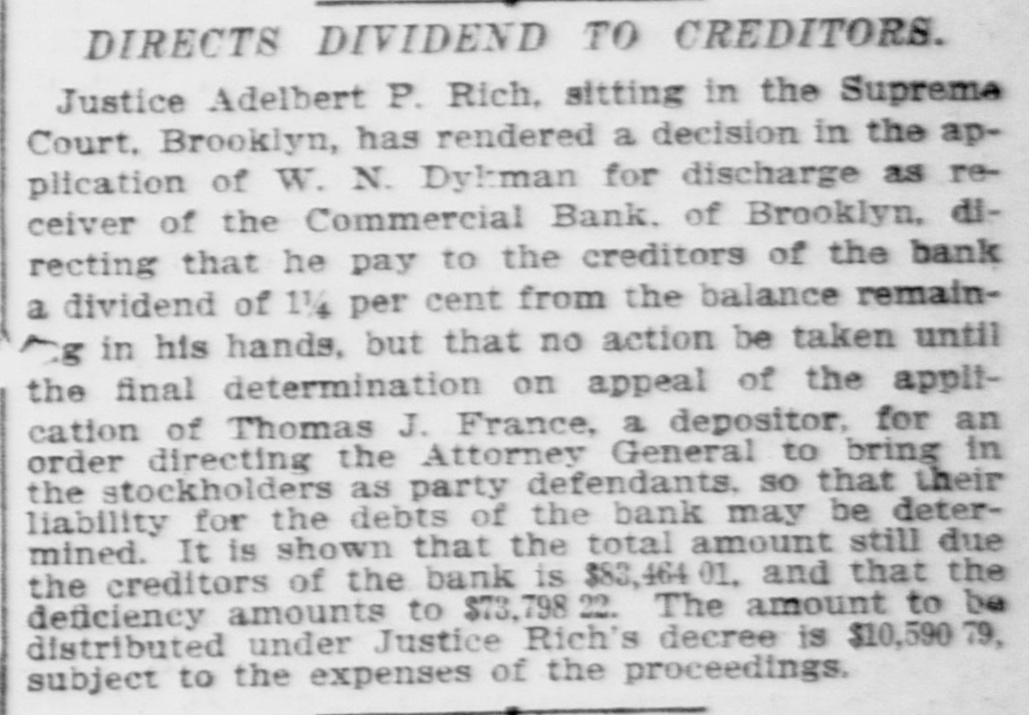

DIRECTS DIVIDEND TO CREDITORS. Justice Adelbert P. Rich, sitting in the Supreme Court. Brooklyn, has rendered a decision in the application of W. N. Dylman for discharge as receiver of the Commercial Bank. of Brooklyn, directing that he pay to the creditors of the bank a dividend of 1 1/4 per cent from the balance remain5.3 in his hands, but that no action be taken until the final determination on appeal of the application of Thomas J. France, a depositor, for an order directing the Attorney General to bring in the stockholders as party defendants. so that their liability for the debts of the bank may be determined. It is shown that the total amount still due the creditors of the bank is $83,464 01. and that the deficiency amounts to $73,798.23 The amount to be distributed under Justice Rich's decree is $10,590 79, subject to the expenses of the proceedings.