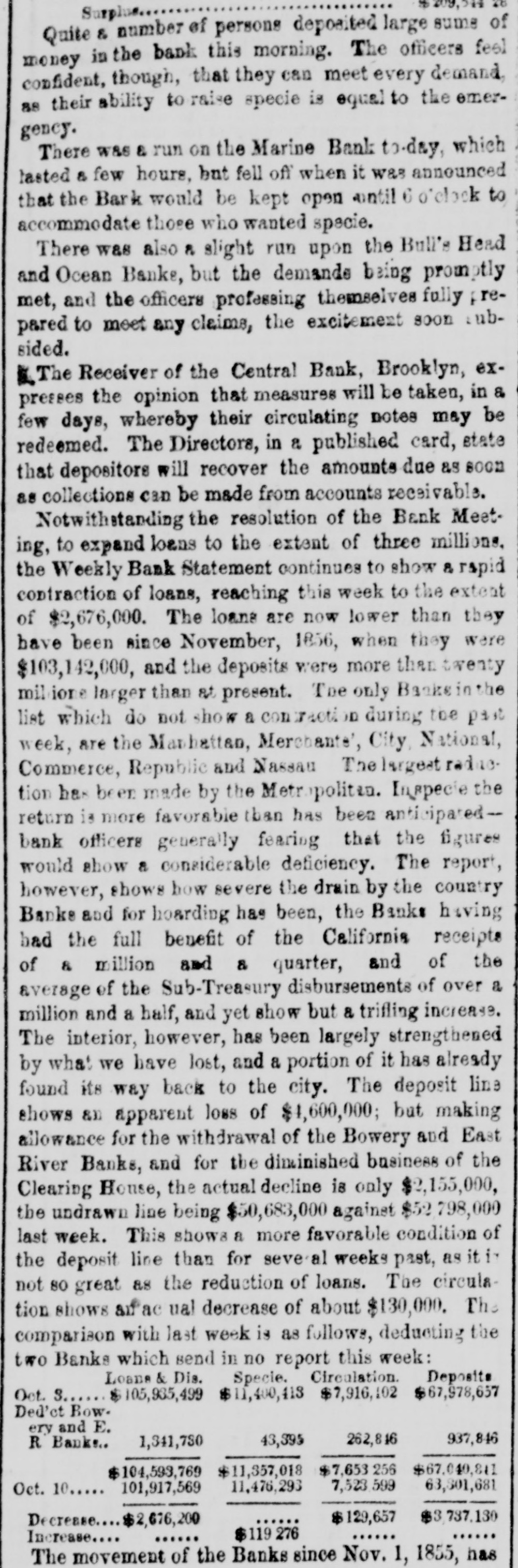

Article Text

TELEGRAPHIC NEWS. FROM THE ASSOCIATED PRESS. The Financial Crisis, &c. NEW YORK, Oct. -There is a gloomy and despondent feeling here. The Commercial, of this afternoon. regards this as the worst day yet. There is a strong pressure upon the banks to expand liberally, as the only means for preventing a general bankruptcy. There is a heavy decline in bank stocks under present circumstances. The Pine Plains Bank, of this State, was thrown out here to-day. The Central Bank. of Brooklyn, was also thrown out The total number of failures announced for the last week is one hundred and twenty-three. The well-known houses of Bowen & McNamee, and of Wm G Lane & Co., both dry goods, ask an extension. ton. The latter has connections in Charles. The amount of grain on board of vessels here ready for clearance to Liverpool is 380,000 bushels. The payments at the sub-treasury to-day were $282,000, and the receipts $156,000. The Albany bankers have been in consulta tion with the New York bankers to-day to induce them to expand sufficiently to bring forward the produce from the lake ports. Unanimity of action was, however, found impossible, and the project failed. Stocks, after second board, further declined. Bank stocks are excessively heavy. The Amerday. ican Exchange declined 10 per cent since yesterThere are numerous failures to-day, but the names are not made public. The Sheriff this morning seized the books and papers of the Milwaukie and Mississippi Railroad. at the instance of the President of the Milwaukie Bank. PHILADELPHIA, Oct. 8.-A numerously attended mass meeting was held here this afternoon by our business men relative to the financial difficulties. The call, which was signed by most of our prominent firms, was only issued during the morning; but, being posted in every prominent position throughout the city, attracted general attention, and, notwithstanding the short notice, a large number of persons had assembled at the appointed hour. A number of speeches were made, and various views expressed. It was believed that New York was the cause of all the present difficulties. The New York banks had expanded $7,000,000 in thirty-one days, while an expansion of $17,000,000 in five months broke the United States Bank. Becoming frightened they curtailed in two months $12,000,000-suflicient to produce a panie in the strongest community. The condition of laboring men was deplorably presented. Thousands would starve if there was not immediate relief. Extracts from letters from the largest manufacturers in the country were read. Men implored aid for the payment of wages or else they would have to discharge thousands of hands. Notwithstanding it was their own interest to stop altogether, they were determined to keep on if possible. The remedy was in the renewal of confidence in the banks. Thus renew confidence, and all would be brought about by a discontinuance of the run on these institutions and not depriving them of the ability to move. TORONTO, Can., Oct. 7.-Messrs. E.F. Whittemore & Co., brokers in this city, suspended today. Much sympathy is felt for them in consequence of their high character. NEW ORLEANS, Oct. 8.-First class paper here is worth 2½ per cent. per month. No failures of consequence are reported. No movement in business is possible until sterling exchange can bring cash in New York. The banks are extending every facility to factors and are cheerful. The excessive stringency in the money market has caused a further heavy decline in cotton, the reduction from the highest point being now 3% cents. The sales the past three davs amount to 6,000 bales, including middling at 13. Receipts continue to pour in rapidly, and the indications are that lower figures will be submitted to. All branches of business are more or less affected by the pressure, but the merchants are using their utmost endeavors to brave the storm. Sterling has still further declined, and sales of bankers' bills are made at 97. Money is more in dull demand naminally and rates daily hardening. Freights are