Article Text

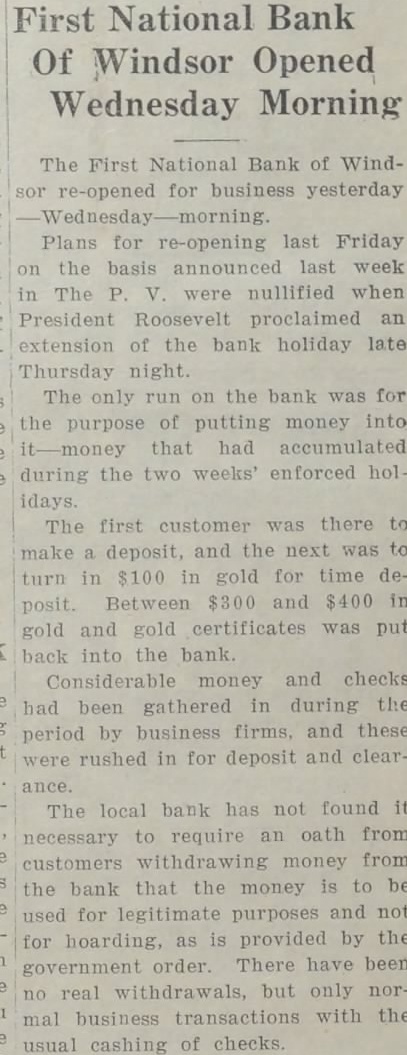

First National Bank Of Windsor Opened Wednesday Morning The First National Bank of Windsor re-opened for business yesterday Plans for re-opening last Friday on the basis announced last week in The P. V. were nullified when President Roosevelt proclaimed an extension of the bank holiday late Thursday night. The only run on the bank was for the purpose of putting money into it-money that had accumulated during the two weeks' enforced holidays. The first customer was there to make a deposit, and the next was to turn in $100 in gold for time deposit. Between $300 and $400 in gold and gold certificates was put back into the bank. Considerable money and checks had been gathered in during the period by business firms, and these were rushed in for deposit and clearance. The local bank has not found it necessary to require an oath from customers withdrawing money from the bank that the money is to be used for legitimate purposes and not for hoarding, as is provided by the government order. There have been no real withdrawals, but only normal business transactions with the usual cashing of checks.