Article Text

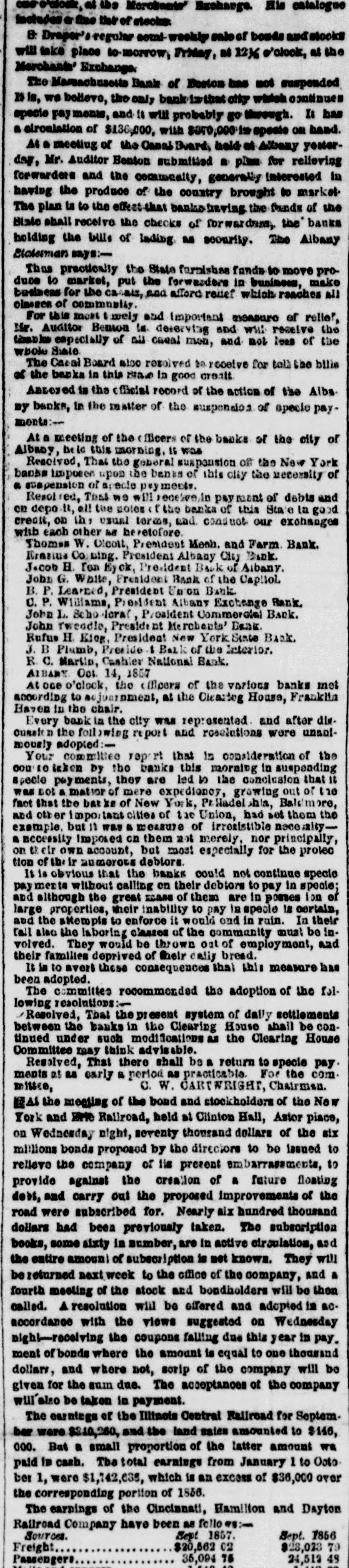

S. Draper's regular semi-weekly sale of bonds and stocks will take place to-morrow, Friday, at 12½ o'clock, at the Merchants' Exchange. The Massachusetts Bank of Boston has not suspended. It is, we believe, the only bank in that city which continues specie payments, and it will probably go through. It has a circulation of $136,000, with $370,000 in specie on hand. At a meeting of the Canal Board, held at Albany yesterday, Mr. Auditor Benton submitted a plan for relieving forwarders and the community, generally interested in having the produce of the country brought to market. The plan is to the effect that banks having the funds of the State shall receive the checks of forwarders, the banks holding the bills of lading as security. The Albany Statesman says:— Thus practically the State furnishes funds to move produce to market, put the forwarders in business, make business for the canals, and afford relief which reaches all classes of community. For this most timely and important measure of relief, Mr. Auditor Benton is deserving and will receive the thanks especially of all canal men, and not less of the whole State. The Canal Board also resolved to receive for tolls the bills of the banks in this State in good credit. Annexed is the official record of the action of the Albany banks, in the matter of the suspension of specie payments:— At a meeting of the officers of the banks of the city of Albany, held this morning, it was Resolved, That the general suspension of the New York banks imposes upon the banks of this city the necessity of a suspension of specie payments. Resolved, That we will receive, in payment of debts and on deposit, all the notes of the banks of this State in good credit, on the usual terms, and conduct our exchanges with each other as heretofore. Thomas W. Olcott, President Mech. and Farm. Bank. Erastus Corning, President Albany City Bank. Jacob H. Ten Eyck, President Bank of Albany. John G. White, President Bank of the Capitol. B. P. Learned, President Union Bank. U. P. Williams, President Albany Exchange Bank. John L. Schoolcraft, President Commercial Bank. John Tweddle, President Merchants' Bank. Rufus H. King, President New York State Bank. J. B. Plumb, President Bank of the Interior. R. C. Martin, Cashier National Bank. ALBANY, Oct. 14, 1857 At one o'clock, the officers of the various banks met according to adjournment, at the Clearing House, Franklin Haven in the chair. Every bank in the city was represented, and after discussion the following report and resolutions were unanimously adopted:— Your committee report that in consideration of the course taken by the banks this morning in suspending specie payments, they are led to the conclusion that it was not a matter of mere expediency, growing out of the fact that the banks of New York, Philadelphia, Baltimore, and other important cities of the Union, had set them the example, but it was a measure of irresistible necessity—a necessity imposed on them not merely, nor principally, on their own account, but most especially for the protection of their numerous debtors. It is obvious that the banks could not continue specie payments without calling on their debtors to pay in specie; and although the great mass of them are in possession of large properties, their inability to pay in specie is certain, and the attempts to enforce it would end in ruin. In their fall also the laboring classes of the community must be involved. They would be thrown out of employment, and their families deprived of their daily bread. It is to avert these consequences that this measure has been adopted. The committee recommended the adoption of the following resolutions:— Resolved, That the present system of daily settlements between the banks in the Clearing House shall be continued under such modifications as the Clearing House Committee may think advisable. Resolved, That there shall be a return to specie payments as early a period as practicable. For the committee, C. W. CARTWRIGHT, Chairman. At the meeting of the bond and stockholders of the New York and Erie Railroad, held at Clinton Hall, Astor place, on Wednesday night, seventy thousand dollars of the six millions bonds proposed by the directors to be issued to relieve the company of its present embarrassments, to provide against the creation of a future floating debt, and carry out the proposed improvements of the road were subscribed for. Nearly six hundred thousand dollars had been previously taken. The subscription books, some sixty in number, are in active circulation, and the entire amount of subscription is not known. They will be returned next week to the office of the company, and a fourth meeting of the stock and bondholders will be then called. A resolution will be offered and adopted in accordance with the views suggested on Wednesday night—receiving the coupons falling due this year in payment of bonds where the amount is equal to one thousand dollars, and where not, scrip of the company will be given for the sum due. The acceptances of the company will also be taken in payment. The earnings of the Illinois Central Railroad for September were $310,260, and the land sales amounted to $146,000. But a small proportion of the latter amount was paid in cash. The total earnings from January 1 to October 1, were $1,742,635, which is an excess of $36,000 over the corresponding portion of 1856. The earnings of the Cincinnati, Hamilton and Dayton Railroad Company have been as follows: Sources. Sept 1857. Sept. 1856 Freight $20,662 02 $28,023 79 Passengers. 35,094 76 24,513 49