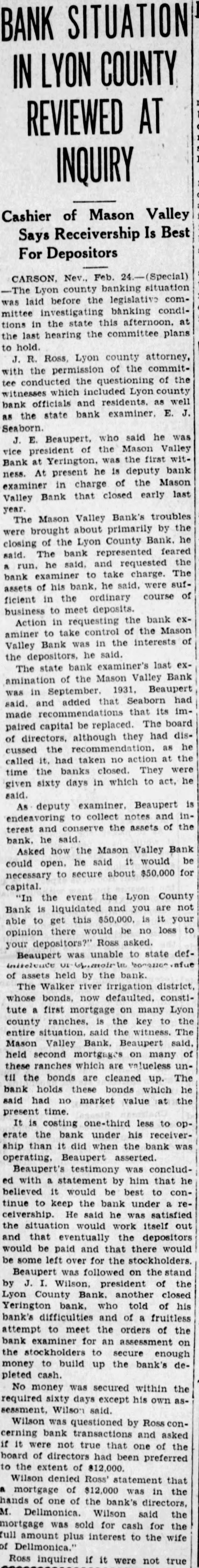

Article Text

SITUATION BANK LYON COUNTY IN REVIEWED AT INQUIRY Cashier of Mason Valley Says Receivership Is Best For Depositors CARSON, Nev., Feb. banking situation Lyon county before the legislative comlaid investigating banking condimittee tions in the state this afternoon. at last hearing the committee plans the to hold. Ross, Lyon county attorney, permission of the commitwith the tee conducted the questioning of the witnesses which included Lyon county bank officials and residents. as well the state bank examiner. Seaborn. who said he vice of the Mason Valley Bank Yerington. was the first witness. At present he deputy bank of the Mason examiner in charge that closed early last Valley Bank year. Valley Bank's troubles The Mason about primarily by the brought closing of the Lyon County Bank. he bank represented feared said. The and requested the he said. bank examiner to take charge. The bank. he said. were sufassets of his ordinary course of ficient in the to meet deposits. business the bank Action in requesting control of the Mason aminer to take in the interests of Valley Bank was he said. the examiner's last exThe state bank Mason Valley Bank amination of the Beaupert in September. added that Seaborn had said. and made that its impaired capital be replaced. The board of directors. although they had discussed the recommendation. he taken no action the called it. had time the banks closed. They were given sixty days in which to act. he said. deputy examiner. Beaupert endeavoring to collect notes and inconserve the assets of the terest and bank. he said. how the Mason Valley Bank Asked he said it would be could necessary to secure about $50,000 for capital. "In the event the Lyon County Bank is liquidated and you are not able to get this your opinion there would be no loss to your depositors?" Ross asked. Beaupert was unable to state defof assets held the bank. The Walker river irrigation district, whose bonds, now defaulted. constitute first mortgage on many Lyon county ranches. the key to the entire situation. said the witness. The Mason Valley Bank. Beaupert said, held second mortgages on many of these ranches which valueless until the bonds are cleaned up. The bank holds these bonds which he said had no market value the present time. It costing one-third less to operate the bank under his receivership than did when the bank was operating. Beaupert asserted. Beaupert's testimony was concludwith statement by him that he believed it would be best to continue to keep the bank under ceivership. He said he was satisfied the situation would work itself out and that eventually the depositors would be paid and that there would some left over for the stockholders. Beaupert was followed on the stand by Wilson, president of the Lyon County Bank another closed Yerington bank. who told of his bank's difficulties and of fruitless attempt to meet the orders of the bank examiner for an assessment on the stockholders to secure enough money to build up the bank's depleted cash. No money was secured within the required sixty days except his own asWilson said. Wilson was questioned by cerning bank transactions and asked it were not true that one of the board of directors had been preferred to the extent of $12,000. Wilson denied Ross' statement that mortgage of $12,000 was in the hands of one of the bank's directors, M. Dellmonica. Wilson said the mortgage was sold for cash for the full amount plus interest to the wife of Dellmonica. Ross inquired if it were not true