Article Text

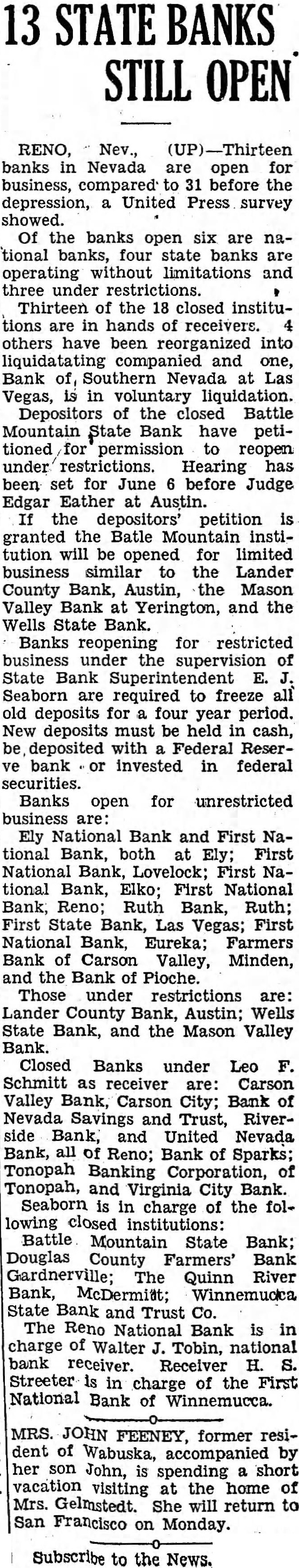

13 STATE BANKS STILL OPEN RENO, Nev., (UP)-Thirteen banks in Nevada are open for business, compared to 31 before the depression, a United Press survey showed. Of the banks open six are national banks, four state banks are operating without limitations and three under restrictions. Thirteen of the 18 closed institutions are in hands of receivers. 4 others have been reorganized into liquidatating companied and one, Bank of, Southern Nevada at Las Vegas, is in voluntary liquidation. Depositors of the closed Battle Mountain State Bank have petitioned for permission to reopen under restrictions. Hearing has been set for June 6 before Judge Edgar Eather at Austin. If the depositors' petition is granted the Batle Mountain institution will be opened for limited business similar to the Lander County Bank, Austin, the Mason Valley Bank at Yerington, and the Wells State Bank. Banks reopening for restricted business under the supervision of State Bank Superintendent E. J. Seaborn are required to freeze all old deposits for a four year period. New deposits must be held in cash, be, deposited with a Federal Reserve bank or invested in federal securities. Banks open for unrestricted business are: Ely National Bank and First National Bank, both at Ely; First National Bank, Lovelock; First National Bank, Elko; First National Bank, Reno: Ruth Bank, Ruth; First State Bank, Las Vegas; First National Bank, Eureka; Farmers Bank of Carson Valley, Minden, and the Bank of Pioche. Those under restrictions are: Lander County Bank, Austin; Wells State Bank, and the Mason Valley Bank. Closed Banks under Leo F. Schmitt as receiver are: Carson Valley Bank, Carson City; Bank of Nevada Savings and Trust, Riverside Bank, and United Nevada Bank, all of Reno; Bank of Sparks; Tonopah Banking Corporation, of Tonopah, and Virginia City Bank. Seaborn is in charge of the following closed institutions: Battle Mountain State Bank; Douglas County Farmers' Bank Gardnerville; The Quinn River Bank, McDermiat; Winnemucka State Bank and Trust Co. The Reno National Bank is in charge of Walter J. Tobin, national bank receiver. Receiver H. S. Streeter is in charge of the First National Bank of Winnemucca. MRS. JOHN FEENEY, former resident of Wabuska, accompanied by her son John, is spending a short vacation visiting at the home of Mrs. Gelmstedt. She will return to San Francisco on Monday. Subscribe to the News.