Article Text

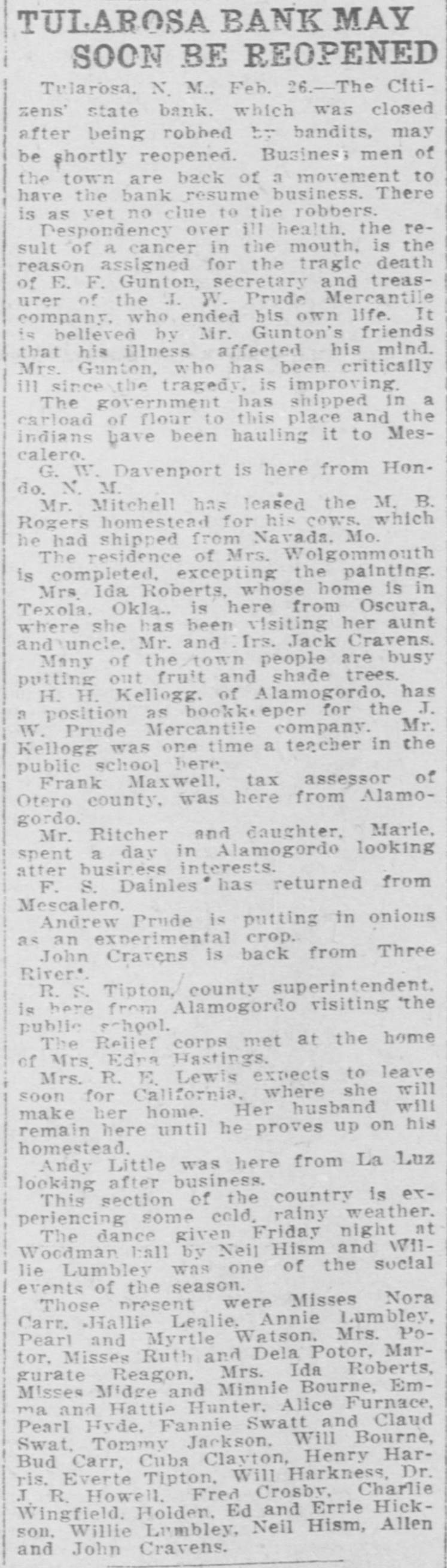

TULAROSA BANK MAY SOON BE REOPENED Tularosa, N. M., Feb. 26.-The Citizens' state bank. which was closed after being robbed by bandits, may be shortly reopened. Business men of the town are back of a movement to have the bank resume business. There is as yet no clue to the robbers. Despondency over ill health. the result of a cancer in the mouth, is the reason assigned for the tragic death of E. F. Gunton, secretary and treasurer of the J. W. Prude Mercantile company, who ended his own life. It is believed by Mr. Gunton's friends that his illness affected his mind. Mrs. Gunton, who has been critically ill since the tragedy, is improving. The government has shipped in a carload of flour to this place and the indians have been hauling it to Mescalero. G. W. Davenport is here from Hondo. N. M. Mr. Mitchell has leased the M. B. Rogers homestead for his cows. which he had shipped from Navada, Mo. The residence of Mrs. Wolgommouth is completed, excepting the painting. Mrs. Ida Roberts, whose home is in Texola. Okla.. is here from Oscura, where she has been visiting her aunt and uncle. Mr. and Irs. Jack Cravens. Many of the town people are busy putting out fruit and shade trees. H. H. Kellogg. of Alamogordo, has 3 position as bookkeeper for the J. W. Prude Mercantile company. Mr. Kellogg was one time a teacher in the public school here. Frank Maxwell, tax assessor of Otero county, was here from Alamogordo. Mr. Ritcher and daughter, Marie. spent a day in Alamogordo looking atter business interests. F. S. Dainles has returned from Mescalero. Andrew Prude is putting in onions as an experimental crop. John Cravens is back from Three River R. S. Tipton, county superintendent. is here from Alamogordo visiting "the public school. The Relief corps met at the home of Mrs. Edra Hastings. Mrs. R. E. Lewis expects to leave soon for California, where she will make her home. Her husband will remain here until he proves up on his homestead. Andy Little was here from La Luz looking after business. This section of the country is experiencing some cold, rainy weather. The dance given Friday night at Woodman hall by Neil Hism and Willie Lumbley was one of the social events of the season. Those present were Misses Nora Carr. Hallie Lealie. Annie Lumbley, Pearl and Myrtle Watson. Mrs. Potor, Misses Ruth and Dela Potor, Margurate Reagon. Mrs. Ida Roberts, Misses Midge and Minnie Bourne, Emma and Hattie Hunter. Alice Furnace, Pearl Hyde. Fannie Swatt and Claud Swat, Tommy Jackson. Will Bourne, Bud Carr, Cuba Clayton, Henry Harris. Everte Tipton, Will Harkness, Dr. J R. Howell. Fred Crosby, Charlie Wingfield. Holden. Ed and Errie Hickson. Willie Lumbley, Neil Hism, Allen and John Cravens.