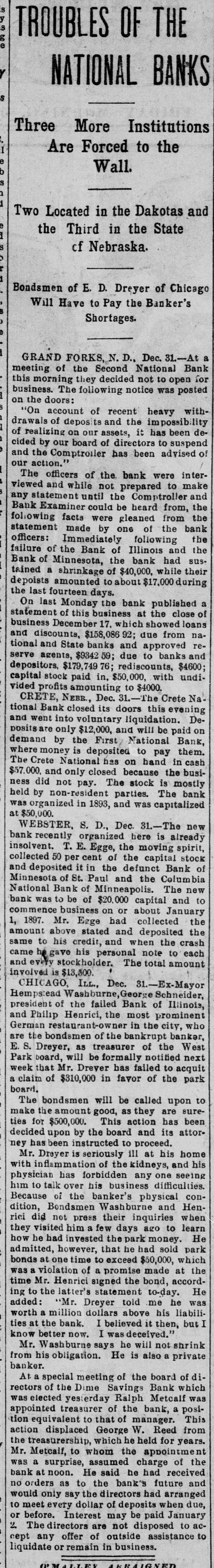

Article Text

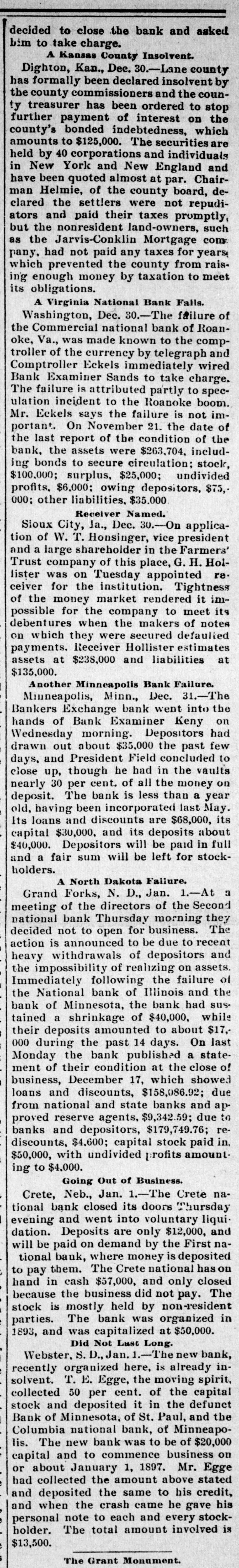

TROUBLES OF THE Y NATIONAL BANKS s Three More Institutions Are Forced to the Wall. b s 1 Two Located in the Dakotas and the Third in the State cf Nebraska. Bondsmen of E. D. Dreyer of Chicago si Will Have to Pay the Banker's Shortages. e 1 GRAND FORKS, N.D., Dec. 31.-At Bank a meeting of the Second National for this morning they decided not to open business. The following notice was posted on the doors: "On account of recent heavy withdrawais of deposits and the impossibility deof realizing on our assets, it has been cided by our board of directors to suspend and the Comptroiler has been advised of our action." The officers of the bank were interviewed and while not prepared to make and any statement until the Comptroller the Bank Examiner could be heard from, following facts were gleaned from the statement made by one of the bank the officers: Immediately following the the Bank of of the failure Bank of Minnesota, Illinois bank while had and their sustained a shrinkage of $40,000, depoists amounted to about $17,000 during the last fourteen days. On last Monday the bank published a statement of this business at the close of business December 17. which showed loans and discounts, $158,086 92; due from national and State banks and approved reserve agents, $9342 due to banks and depositors, $179,749 76; rediscounts, $4600; undicapital stock paid in, $50,000, with vided profits amounting to $4000. CRETE, NEBR, Dec. 31.-The Crete National Bank closed its doors this evening Deand went into voluntary liquidation. posits are only $12,000, and will be paid on demand by the First/ National Bank, where money is deposited to pay them. The Crete National has on hand in cash $57,000. and only closed because the business did not pay. The stock is mostly held by non-resident parties. The bank was organized in 1893, and was capitalized at $50,000. WEBSTER, S. D., Dec. 31.-The new bank recently organized here is already insolvent. T. E. Egge, the moving spirit, collected 50 per cent of the capital stock of and deposited it in the defunct Bank Minnesota of St. Paul and the Columbia National Bank of Minneapolis. The new bank was to be of $20,000 capital and to commence business on or about January 1897. Mr. Egge had collected the the amount 1, above stated and deposited same to his credit, and when the crash came hagave his personal note to each and every stockholder. The total amount involved is $13,500. CHICAGO, ILL., Dec. 31.-Ex-Mayor Hemps:ead Washburne, George Schneider, president of the failed Bank of Illinois, and Philip Henrici, the most prominent German restaurant-owner in the city, who are the bondsmen of the bankrupt banker, West E. S. Dreyer, as treasurer of the Park board, will be formally notified next week that Mr. Drever has failed to acquit a claim of $310,000 in favor of the park board. The bondsmen will be called upon to make the amount good, as they are sure- been for $500,000. This action has attorties decided upon by the board and its ney has been instructed to proceed. Mr. Dreyer is seriously ill at his home his with inflammation of the kidneys, and physician has forbidden any one seeing him to talk over his business difficulties. Because of the banker's physical condition, Bondsmen Washburne and Henrici did not press their inquiries when learn they visited him a few days ago to He how he had invested the park money. admitted, however, that he had sold which park bonds at one time to exceed $50,000, the violation of a promise made at time was a Mr. Henrici signed the bond, accord- He ing to the latter's statement to-day. added "Mr. Dreyer told me he liabili- was worth a million dollars above his ties at the bank. I believed it then, but know better now. I was deceived.' Mr. Washburne says he will not shrink from his obligation. He is also a private banker. At a special meeting of the board of directors of the Dime Savings Bank which elected yesterday Ralph Metcalf was appointed treasurer of the bank, a posi- This tion equivalent to that of manager. from action displaced George W. Reed the treasurership, which he held for years. Mr. Metcalf, to whom the appointment of the a surprise, assumed charge received bank was at noon. He said he had and orders as to the bank's future would no only say the directors had arranged due, meet every dollar of deposits when to before. Interest may be paid January ac2. or The directors are not disposed to to cept any offer of outside business. assistance liquidate or remain in 0 MALLEY KRAIGNED