Click image to open full size in new tab

Article Text

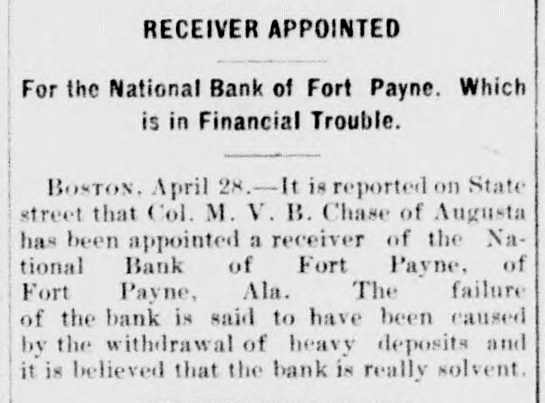

Commencement at Orono. BANGOR, May 26.-The 21st commencement of the Maine State College will be from June 25th to July 1st, with this programme: SATURDAY. 7.30 p. m.-Sophomore prize declamation. SUNDAY. 7.30 p. m.-Baccalaureate address by the President. MONDAY. 7.30 p. m.-Junior exhibition. TUESDAY. 9.00 a. m.-Meeting of the trustees. 1.00 to 4.00 p. m.-College halls open to visitors. 1.30 p. m.-Military exercises. 3.00 to 6.00 p. m.-President's reception. 8.00 p. m.-Alumni reunion. WEDNESDAY. 9.30 a. m.-Commencement exercises. 3.00 p. m.-Meeting of the alumni. 8.00 p. m.-Concert. THURSDAY. 2.00 p. m.-Class day exercises. FRIDAY. 8.30 a. m.-Examination of candidates for admission to the college. Receiver for Fort Payne Concerns. AUGUSTA, May 26.-The financial affairs of Fort Payne, Ala., continue to be of interest to Maine people. Colonel Martin V. B. Chase of this city has been appointed receiver of the Fort Payne National Bank, and also of the furnace company which had such a boom among investors not long ago. Two New Steamers. BATH, May 26. - Steamer Juliette, owned by George H. Storer of Jersey City, was launched this noon at the New England yard. She will run from Rockland to Ellsworth. BANGOR, May 26.-The new steamer Sedgwick, built by the Bangor and Bar Harbor Steamship Company, was launched today. Monhegan's Visitor. BOOTHBAY HARBOR, May 26.-A carrier pigeon landed on Monhegan Island Wednesday afternoon, at 2 o'clock, and was captured by the islanders. On one wing were painted the figures 7460. Each leg was encircled by a silver band, one bearing the figure 7 and the letters C.B. C., and the other the same figures as on the wing. Suicide by Hanging. ROCKLAND, May 26.-Nathan Stinson, a mail carrier between North Haven and Pulpit Harbor, committed suicide by hanging Wednesday night. No motive is known, and he is supposed to have been insane. Marcus Morton's Death. BETHEL, May 26. - Marcus Morton, aged 49, unmarried, was killed by a horse running away and dragging him under a land roller today. Burglary at Biddeford. BIDDEFORD, May 26. - Rosenbaum Brothers' store on Main street was burglarized last night. Furnishing goods and jewelry were taken. The thieves entered through a rear window. Hiram Smith's Injuries. ROCKLAND, May 26.-Hiram Smith, injured at Charles T. Spear's grist mill yesterday afternoon, died today.