Article Text

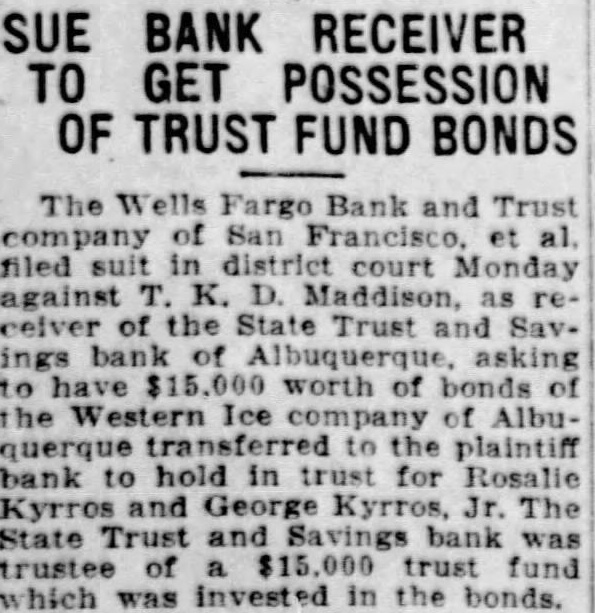

SUE BANK RECEIVER TO GET POSSESSION OF TRUST FUND BONDS The Wells Fargo Bank and Trust company of San Francisco, al. filed suit in district court Monday against K. D. Maddison, as receiver of the State Trust and Savings bank Albuquerque asking to worth of bonds the Western Ice company of Albuquerque transferred to the plaintiff bank to hold in trust for Rosalle Kyrros and George Kyrros, Jr. The State Trust and Savings bank was trustee of $15,000 trust fund which was invested in the bonds.