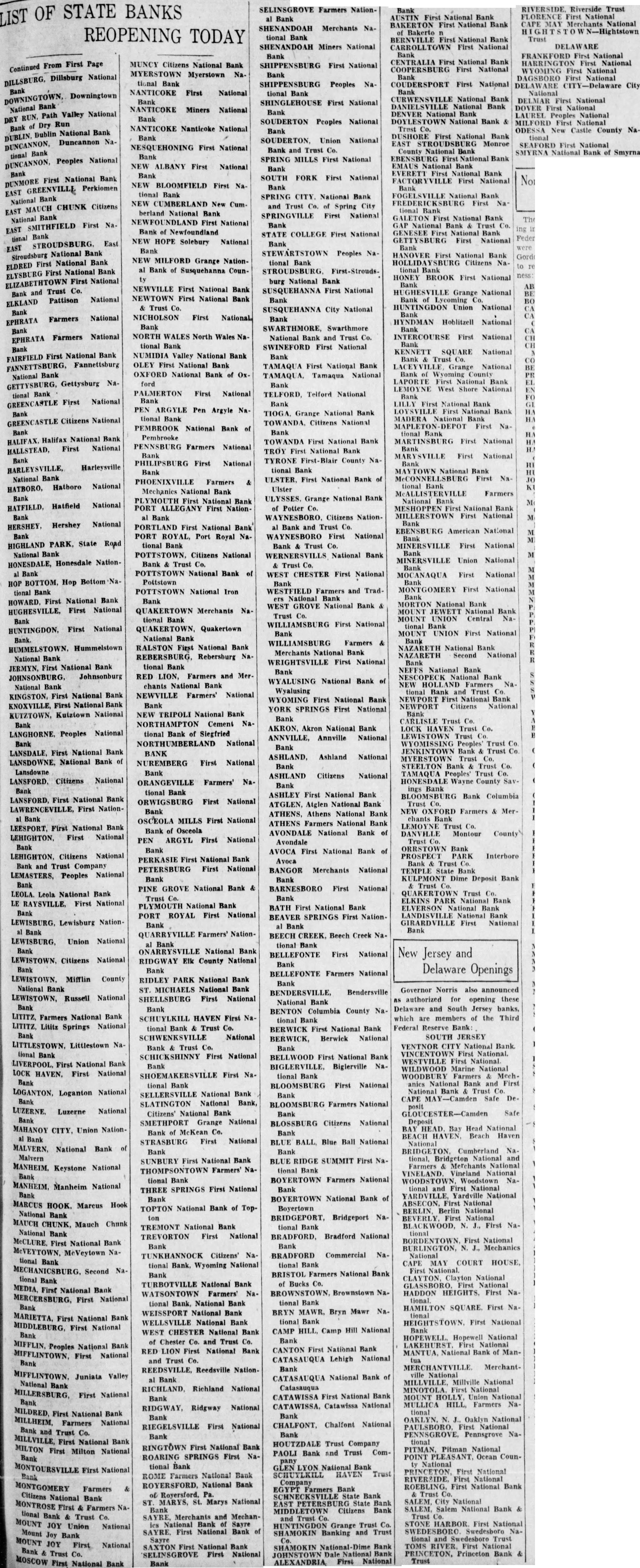

Article Text

OF STATE BANKS REOPENING TODAY From First Page Continued Dillsburg National DILLSBURG, Downingtown Bank National Valley National Path DRY Dry Run of Bank National Bank Dublin Duncannon NaDUNCANNON, Bank tional Peoples National DUNCANNON, Bank First National Bank DUNMORE Perkiomen GREENVILLE EAST Bank National CHUNK Citizens MAUCH EAST Bank National SMITHFIELD First NaEAST tional East EAST Stroudsburg National Bank First National Bank ELDRED First National Bank ELYSBURG First National ELIZABETHTOWN and Trust Co. Bank Pattison National ELKLAND Bank Farmers National EPHRATA Bank Farmers National EPHRATA Bank First National Bank FAIRFIELD Fannettsburg FANNETTSBURG, National Bank Gettysburg NaGETTYSBURG, tional Bank First National Bank Citizens National GREENCASTLE Bank Halifax National Bank First National HALLSTEAD, Bank Harleysville HARLEYSVILLE, National Bank Hatboro National HATBORO, Bank Hatfield National HATFIELD, Bank Hershey National HERSHEY, Bank PARK, State Road HIGHLAND National Bank Honesdale NationHONESDALE, Bank HOP BOTTOM, Hop Bottom Na- tional Bank HOWARD. First National Bank HUGHESVILLE, First National Bank First National HUNTINGDON, Bank. HUMMELSTOWN, Hummelstown National JERMYN, First National Bank JOHNSONBURG, Johnsonburg National Bank KINGSTON, First National Bank KNOXVILLE, First National Bank KUTZTOWN, Kutztown National Bank LANGHORNE, Peoples National Bank LANSDALE, First National Bank LANSDOWNE, National Bank of Lansdowne Citizens National Bank LANSFORD, First National Bank LAWRENCEVILLE, First NationBank LEESPORT, First National Bank LEHIGHTON, First National Bank LEHIGHTON. Citizens National Bank and Trust Company LEMASTERS, Peoples National Bank LEOLA. Leola National Bank LE RAYSVILLE, First National Bank LEWISBURG. Lewisburg NationBank LEWISBURG, Union National Bank LEWISTOWN. Citizens National Bank LEWISTOWN. Mifflin County National Bank LEWISTOWN, Russell National Bank LITITZ, Farmers National Bank LITITZ, Lititz Springs National Bank LITTLESTOWN, Littlestown National Bank LIVERPOOL. First National Bank LOCK HAVEN. First National Bank LOGANTON. Loganton National Bank Luzerne National Bank MAHANOY CITY, Union Nation- Bank MALVERN, National Bank of Malvern MANHEIM. Keystone National Bank MANHEIM. Manheim National Bank MARCUS HOOK. Marcus Hook National Bank MAUCH CHUNK, Mauch Chunk National Bank McCLURE. First National Bank McVEYTOWN, MoVeytown National Bank MECHANICSBURG. Second National Bank MEDIA. First National Bank MERCERSBURG, First National Bank MARIETTA, First National Bank MIDDLEBURG, First National Bank MIFFLIN, Peoples National Bank MIFFLINTOWN, First National Bank MIFFLINTOWN. Juniata Valley National Bank MILLERSBURG, First National Bank MILLHEIM, MILDRED, First National Bank Farmers National Bank and Trust Co. MILLVILLE, First National Bank MILTON First Milton National Bank First National Bank MONTGOMERY Farmers Citizens National Bank MONTROSE First & Farmers NaMOUNT tional Bank Trust Co. JOY Union National Mount Joy Bank MOUNT JOY First National Bank Trust Co. MOSCOW First National Bank MUNCY Citizens National Bank MYERSTOWN Myerstown Na. tional Bank NANTICOKE First National Bank NANTICOKE Miners National Bank NANTICOKE Nanticoke National Bank NESQUEHONING First National Bank NEW ALBANY First National Bank NEW BLOOMFIELD First Na- tional Bank NEW CUMBERLAND New Cumberland National Bank NEWFOUNDLAND First National Bank of Newfoundland NEW HOPE Solebury National Bank NEW MILFORD Grange National Bank of Susquehanna County NEWVILLE First National Bank NEWTOWN First National Bank Trust NICHOLSON First National Bank NORTH WALES North Wales National Bank NUMIDIA Valley National Bank OLEY First National Bank OXFORD National Bank of Ox. ford PALMERTON First National Bank PEN ARGYLE Pen Argyle Na. tional Bank PEMBROOK National Bank of Pembrooke PENNSBURG Farmers National Bank PHILIPSBURG First National Bank PHOENIXVILLE Farmers & Mechanics National Bank PLYMOUTH First National Bank PORT ALLEGANY First NationBank PORTLAND First National Bank PORT ROYAL, Port Royal National Bank POTTSTOWN, Citizens National Bank Trust Co. POTTSTOWN National Bank of Pottstown POTTSTOWN National Iron Bank QUAKERTOWN Merchants National Bank QUAKERTOWN, Quakertown National Bank RALSTON First National Bank REBERSBURG, Rebersburg Na- tional Bank RED LION, Farmers and Merchants National Bank NEWVILLE Farmers' National Bank TRIPOLI National Bank NORTHAMPTON Cement National Bank of Siegfried NORTHUMBERLAND National BANK NUREMBERG First National Bank ORANGEVILLE Farmers' Na. tional Bank ORWIGSBURG First National Bank OSCEOLA MILLS First National Bank of Osceola PEN ARGYL First National Bank PERKASIE First National Bank PETERSBURG First National Bank PINE GROVE National Bank & Trust PLYMOUTH National Bank PORT ROYAL First National Bank Farmers' NationBank National Bank RIDGWAY Elk County National Bank RIDLEY PARK National Bank ST. MICHAELS National Bank SHELLSBURG First National Bank SCHUYLKILL HAVEN First National Bank & Trust Co. SCHWENKSVILLE National Bank Trust Co. SCHICKSHINNY First National Bank First National Bank SELLERSVILLE National Bank SLATINGTON National Bank, Citizens' National Bank SMETHPORT Grange National Bank of McKean Co. STRASBURG First National Bank SUNBURY First National Bank THOMPSONTOWN Farmers' National Bank THREE SPRINGS First National Bank TOPTON National Bank of Top- TREMONT National Bank TREVORTON First National Bank TUNKHANNOCK Citizens' Na. tional Bank. Wyoming National Bank TURBOTVILLE National Bank WATSONTOWN Farmers' Na. tional Bank, National Bank WEISSPORT National Bank WELLSVILLE National Bank WEST CHESTER National Bank of Chester Co. and Trust Co. RED LION First National Bank and Trust Co. REEDSVILLE, Reedsville Nation. Bank RICHLAND, Richland National Bank RIDGWAY, Ridgway National Bank RIEGELSVILLE First National Bank RINGTOWN First National Bank ROARING SPRINGS First National Bank ROME Farmers National Bank ROYERSFORD, National Bank Pa. ST. MARYS, St. Marys National SAYRE, Merchants and MechanNational Bank Sayre SAYRE, First National Bank Sayre First National Bank SELINSGROVE First National Bank SELINSGROVE Farmers National Bank SHENANDOAH Merchants National Bank SHENANDOAH Miners National Bank SHIPPENSBURG First National SHIPPENSBURG Peoples National Bank SHINGLEHOUSE First National Bank SOUDERTON Peoples National Bank SOUDERTON, Union National Bank and Trust Co. SPRING MILLS First National Bank SOUTH FORK First National Bank SPRING CITY. National Bank and Trust Co. of Spring City SPRINGVILLE First National Bank STATE COLLEGE First National Bank STEWARTSTOWN Peoples National Bank STROUDSBURG, First-Strouds- burg National Bank SUSQUEHANNA First National Bank SUSQUEHANNA City National Bank SWARTHMORE, Swarthmore National Bank and Trust Co. SWINEFORD First National Bank TAMAQUA First National Bank TAMAQUA, Tamaqua National Bank TELFORD, Telford National Bank TIOGA. Grange National Bank Citizens National Bank TOWANDA First National Bank TROY First National Bank TYRONE County Na. tional Bank ULSTER, First National Bank of Ulster ULYSSES. Grange National Bank Potter WAYNESBORO, Citizens NationBank and Trust Co. WAYNESBORO First National Bank Trust Co. WERNERSVILLS National Bank Trust WEST CHESTER First National Bank WESTFIELD Farmers and TradNational Bank WEST GROVE National Bank Trust WILLIAMSBURG First National Bank WILLIAMSBURG Farmers Merchants National Bank WRIGHTSVILLE First National Bank WYALUSING National Bank Wyalusing WYOMING First National Bank YORK SPRINGS First National Bank AKRON, Akron National Bank ANNVILLE, Annville National Bank ASHLAND, Ashland National Bank ASHLAND Citizens National Bank ASHLEY First National Bank ATGLEN, Atglen National Bank ATHENS, Athens National Bank ATHENS Farmers National Bank AVONDALE National Bank of Avondale AVOCA First National Bank of Avoca BANGOR Merchants National Bank BARNESBORO First National Bank BATH First National Bank BEAVER SPRINGS First NationBank BEECH CREEK, Beech Creek National Bank BELLEFONTE First National Bank BELLEFONTE Farmers National Bank BENDERSVILLE, Bendersville National Bank BENTON Columbia County National Bank BERWICK First National Bank BERWICK, Berwick National Bank BELLWOOD First National Bank tional Bank BLOOMSBURG First National Bank BLOOMSBURG Farmers National Bank BLOSSBURG Citizens National Bank BLUE BALL Blue Ball National Bank BLUE RIDGE SUMMIT First Na- tional Bank BOYERTOWN Farmers National Bank BOYERTOWN National Bank of Boyertown BRIDGEPORT, Bridgeport Na. tional Bank BRADFORD, Bradford National Bank BRADFORD Commercial Na. tional Bank BRISTOL Farmers National Bank Bucks BROWNSTOWN, Brownstown Na. tional Bank BRYN MAWR. Bryn Mawr Na. tional Bank CAMP HILL, Camp Hill National Bank CANTON First National Bank CATASAUQUA Lehigh National CATASAUQUA National Bank of Catasauqua CATAWISSA First National Bank CATAWISSA, Catawissa National Bank CHALFONT, Chalfont National Bank HOUTZDALE Trust Company PAOLI Bank and Trust ComNational Bank SCHUYLKILL HAVEN Trust Company EGYPT Farmers Bank SCHNECKSVILLE State Bank EAST PETERSBURG State Bank MIDDLETOWN Citizens Bank and HUNTINGDON Grange Trust Co. SHAMOKIN Banking and Trust SHAMOKIN Bank JOHNSTOWN National Bank ALEXANDRIA First National Bank AUSTIN First National Bank BAKERTON First National Bank Bakerto BERNVILLE First National Bank CARROLLTOWN First National Bank CENTRALIA First National Bank COOPERSBURG First National COUDERSPORT First National National Bank DANIELSVILLE National Bank DENVER National Bank DOYLESTOWN National Bank Trust DUSHORE First National Bank EAST STROUDSBURG Monroe County National Bank National Bank EMAUS Bank EVERETT First National Bank First National FOGELSVILLE National Bank First National Bank GALETON First National Bank GAP National Bank Trust Co. GENESEE National Bank GETTYSBURG First National Bank HANOVER First National Bank Citizens National Bank HONEY BROOK First National Bank Grange National Bank Lycoming HUNTINGDON Union National Bank HYNDMAN Hoblitzell National INTERCOURSE First National Bank KENNETT SQUARE National Bank Trust Grange National Bank Wyoming County LAPORTE First National Bank West Shore National Bank LILLY First National Bank First National Bank MADERA National Bank First Na. tional Bank MARTINSBURG First National Bank MARYSVILLE First National Bank MAYTOWN National Bank First National Bank Farmers National MESHOPPEN First National Bank MILLERSTOWN First National Bank EBENSBURG American National Bank MINERSVILLE First National Bank MINERSVILLE Union National First National MONTGOMERY First National Bank MORTON National Bank MOUNT JEWETT National Bank MOUNT UNION Central National Bank MOUNT UNION First National NAZARETH National Bank NAZARETH Second National Bank NEFFS National Bank NESCOPECK National Bank NEW HOLLAND Farmers Na. tional Bank and Trust NEWPORT First National Bank NEWPORT Citizens National Bank CARLISLE Trust Co. LOCK HAVEN Trust Co. LEWISTOWN Trust WYOMISSING Peoples' Trust Co. JENKINTOWN Bank Trust MYERSTOWN Trust STEELTON Bank Trust Co. TAMAQUA Peoples' Trust Co. HONESDALE Wayne County Savings Bank BLOOMSBURG Bank Columbia Trust NEW OXFORD Farmers Merchants Bank LEMOYNE Trust Co. DANVILLE Montour County ORRSTOWN Bank PROSPECT PARK Interboro Bank Trust TEMPLE State Bank KULPMONT Dime Deposit Bank Trust Trust ELKINS PARK Bank ELVERSON National Bank LANDISVILLE National Bank GIRARDVILLE First National Bank Governor Norris also announced authorized for opening these Delaware and South Jersey banks, which are members of the Third Federal Reserve Bank: SOUTH JERSEY VENTNOR CITY National Bank. VINCENTOWN First National. WESTVILLE First National WILDWOOD Marine National WOODBURY Farmers Mechanics National Bank and First Bank Trust CAPE Safe DeSafe Deposit BAY HEAD. Bay Head National BEACH HAVEN, Beach Haven National BRIDGETON, Cumberland National, Bridgeton and Farmers Merchants National VINELAND. Vineland National Woodstown National First National YARDVILLE, Yardville National ABSECON, First National BERLIN, Berlin National BEVERLY, First National BLACKWOOD, N. J., First NaBORDENTOWN, First National BURLINGTON, N. Mechanics National CAPE MAY COURT HOUSE, National CLAYTON Clayton National GLASSBORO. First National HADDON HEIGHTS. First Na tional. HAMILTON SQUARE. First Na. tional HEIGHTSTOWN, First National Bank HOPEWELL Hopewell National First MANTUA. National Bank of ManMerchantville National MILLVILLE, Millville National MINOTOLA, First National MOUNT HOLLY Union National MULLICA HILL, Farmers Na. tional OAKLYN. N. Oaklyn National PAULSBORO, National PENNSGROVE, Pennsgrove National PITMAN. Pitman National POINT PLEASANT, Ocean CounNational First National RIVERSIDE. First National ROEBLING, First National Bank Trust Co. SALEM. City National SALEM, Salem National Bank Trust STONE HARBOR First National SWEDESBORO Swedesboro National and Trust TOMS RIVER. First National PRINCETON, Princeton Bank Trust RIVERSIDE Riverside Trust FLORENCE First National CAPE MAY National Trust FRANKFORD First National HARRINGTON First National WYOMING First National DAGSBORO National DELAWARE City National DELMAR First National DOVER First National LAUREL Peoples National MILFORD First National ODESSA New Castle County Na. tional SEAFORD First National SMYRNA National Bank of Smyrna